Last updated on January 22nd, 2024 at 01:49 pm

In this article, you’re going to learn 13 tips on how to improve your credit score.

A credit score is one of the most important factors that lenders check to decide whether they give you a loan or not. It is also important if you want the lowest-interest loan that you can easily pay back.

But most people can’t maintain a credit score that falls under the very good or exceptional range.

According to statistics, only 46% of Americans have a credit score that is very good and exceptional, while the other 54% fall under good and below good.

That’s why having knowledge of tips and techniques to improve your credit score is crucial. It is important whether you’ve good, bad, or exceptional credit scores.

You can learn many tips online for improving credit scores but this article is comprehensive. Here you get tips on how to improve your credit score. Along with that, you get answers to many questions related to credit scores.

So let’s get started.

What is a credit score?

It is a numerical representation of a borrower’s creditworthiness.

The score determines how responsibly a borrower acted towards their debt obligation in the past and how much responsibility he is likely to show for existing debt obligation. On the basis of credit score lenders also decide whether to increase interest or not.

Lenders use it to decide if they approve a new loan or not.

A credit score is calculated for individuals and small businesses. But the factors used to calculate it vary depending on whether it is for individuals or businesses.

There are two big companies that determine credit scores. One is called FICO Score and the second is called VantageScore. Around 90% of top lenders use FICO Score. You’ll see detail on both in the next sections.

The credit score is very helpful in taking low-interest loans and getting approved for any type of loan. It is mostly used in determining the risk of unsecured loan borrowers like credit cards, student loans, personal loans, etc.

In the case of the mortgage loan and car loan, it doesn’t matter a lot. The reason is there is collateral and the lenders’ money is protected.

Having a bad credit score doesn’t mean that you can’t get any loans at all. But it becomes difficult to obtain good loans. On the other hand having a good, excellent, or exceptional credit score doesn’t guarantee that you get approved for any loan. The lender may reject you depending on the situation.

But maintaining a high credit score is important. And if you have a credit score in the worst, bad, fair, or good range and you want to improve it then knowing the real tips on how to improve your credit score are important.

RELATED POST:

So let’s jump on to the next section.

13 Tips on How to improve your credit score

There is no magic and fast way to improve credit scores. And companies who claim that are just boasting, you need to stay away from these bullies. A credit score takes time and patience to improve while following the tips and tactics.

The list below has 13 different tips which are proven and help you maximize your credit score if you implement them. So let’s explain each one by one.

1. Make your payments on time

There are different factors that affect your credit score. The major factor that affects is whether you make payments on time or are delinquent on them.

It doesn’t matter if you’re late on payment for one month, two months, or more. It impacts credit scores severely.

As you learned above 90% of lenders use the FICO score to determine the risk of the debtor.

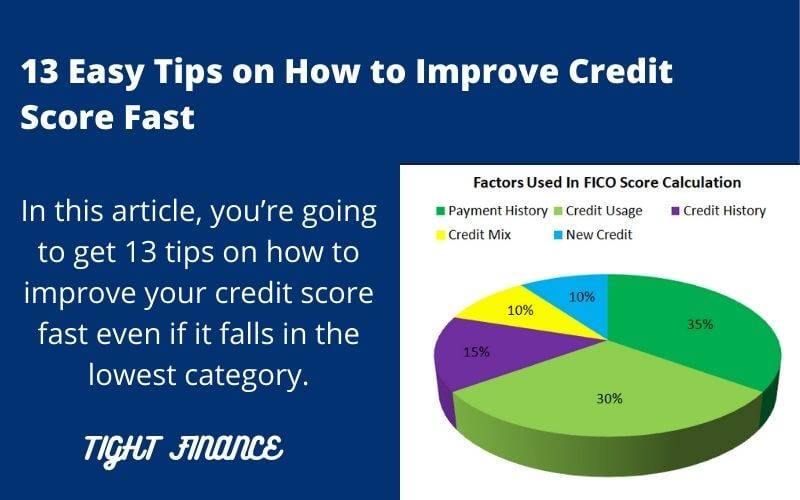

In calculating the FICO score 35% of the weightage goes to payment history. As you can see in the graph below.

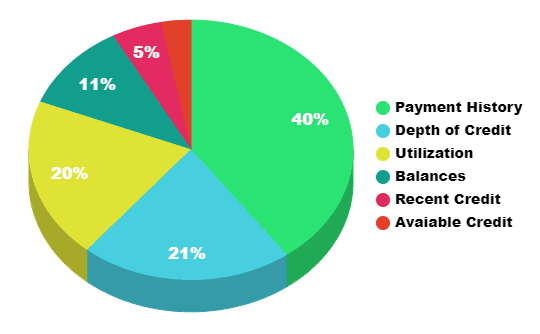

And this isn’t much different in the calculation of VantageScore. Here is the illustration of the Vantage Score calculation model:

You can see that payment history is a major factor and staying on top of it is the lifeblood of your credit score.

Therefore make sure you make payments on time and if you’ve missed payments or are late in any month then onwards stay regular to minimize the negative effect. If you’re late in any month or two then making payment on time there onwards will lower the previous impact and your credit score starts to improve.

Here is how to stay on top of monthly payments.

- Make multiple payments throughout the month. As many payments, you make this gives positive information and your score will boost. Try to make at least one payment after each week or two payments a month.

- Allow lenders to automatically deduct minimum payments from your bank account. This way you get out of worrying about late payments. But remember you should maintain enough balance in your bank account.

- Set auto-reminders for paying your monthly installments. This way you get notified of your outstanding payments before the payment date.

If you implement these techniques then you face no problem with your monthly payments. And if your credit score is bad then it will start gaining points.

2. Decrease credit utilization ratio

How much amount you owe to the lender is the second most important factor in determining your credit score. As you can see in the above graph of the FICO score the amount owed has a 30% weightage in calculating a credit score.

After monthly payments, it is the second most important tip on how to improve your credit score.

Basically, here involves the credit utilization ratio. It is referred to as how much amount of loan you owe to the lender as compared to your credit limit. The CUR is calculated as the amount of loan you used divided by the credit limit.

Credit Utilization Ratio = Amount Owed / Credit Limit

Let’s understand it with an example.

If you have a credit card with a $10,000 limit and you’ve used $4,500 out of it, then your credit utilization ratio is calculated by dividing $4,500 by $10,000. The respective answer is 0.45 and converting it into a percentage gives us 45%. This means you’ve used 45% of your available credit limit.

The higher the credit utilization ratio will be the more it will negatively impact your credit score. Because it shows more risk to your lender.

If you want to have an ideal utilization ratio then you shouldn’t spend more than 30% of your available credit limit. From the above example, if you have a $10,000 limit then don’t spend more than 3,000 out of it.

As you lower your ratio will be as much positive information adjusts to your credit score calculation and it improves.

How to maintain a lower credit utilization ratio?

- Don’t spend too much on your credit cards.

- Contact your lender and tell him to increase your credit limit on existing cards.

- If you’ve spent more than 30% of the available credit limit, then try to pay back as much amount as possible to keep in the range of 30%. Say you spend $4,500 out of $10,000 then pay back $2,000 and your ratio decreases to 25%.

- Don’t close old debt accounts. Because their credit limit counts in calculating a credit score and it will help you keep the utilization ratio minimum. If you close them then your ratio will suddenly increase.

- Open new accounts so the available credit limit increase and the overall ratio decreases. But remember don’t open too many new accounts because it leads to hard inquiries that lower your credit score.

If you keep these things in mind you can significantly decrease your credit utilization ratio. When it stays in a fair range then it improves your credit score.

RELATED POST: How to Avoid Debt to Make Yourself Financially Strong

3. Avoid opening new accounts

Without any necessary need, you don’t open new debt accounts.

The reason is if you suddenly open too many new credit cards or another loan account then it will result in an inquiry into your credit history. And this results in a decrease in your credit score.

This gives a signal of risk to the lender. In this situation, they do two types of inquiries in which one is called soft inquiry and the second is a hard inquiry.

Soft inquiry has no negative impact on credit scores but hard inquiries have because they stay on the report for two years.

Too many new accounts have another downside which is spending. If you spend using them the debt will rise and may become difficult to pay. As a result, you get late on payments and your credit score will eventually suffer.

4. Build a credit mixture

Credit mix refers to having different types of credit accounts. For example, mortgages, student loans, personal loans, credit cards, and car loans.

If you have only one type of credit account like a credit card, it negatively impacts your credit score.

In calculating the FICO score the credit mix has a 10% weightage. Which to some extent is not significant but beneficial if you have a very low credit score.

That’s why it is good to have a mixture of different types of debt accounts. But if for example you only need credit cards account and no need for any other type then avoid opening a new account in other categories.

5. Build up your credit file

If you’re new to the credit world then this is one of the tips on how to improve your credit score.

If you’re new to taking debt then usually your credit file is thin. A thin credit file means there is not enough credit record on your report to calculate your credit score.

In this situation, your lender cannot calculate the risk level or a picture of your creditworthiness. So you don’t get approved for credit.

It is just like having very low experience which makes it harder for you to get a good job.

RELATED POST:

40 Personal Finance Tips To Effectively Manage Your Money

59 Ways on How to Save Money Even If You Find It Difficult

How to Create a Personal Budget [ 6 Easy Steps]

How to Stop Wasting Money Using 12 Simple Financial Tricks

8 Tips For Money Management To Achieve Financial Prosperity

Money Can’t Buy Happiness But It Can Buy You What? 9 Ways to Find Happiness

Why your credit profile is thin?

There are many reasons that you have a thin credit report:

- You’re new to the United States.

- If you closed down older accounts for a period of time and now retaking credit.

- You didn’t use any credit in the past and paid using a debit card or cash.

- You got credit but don’t use it enough and so information is not generated.

- If the credit bureau considered you as dead mistakenly.

- You don’t have a spouse and being single there is no credit history.

- The file is split into multiple ones which results in many thin files.

How to make your credit file fate?

Building a credit file is not difficult. You can take multiple steps to fatten it easily. Here are some of them:

- Get a secured credit card. This is backed with cash in your bank account and you can use it to build your credit history.

- Take a quick loan or credit-builder loan. This loan is of small amounts and anyone can take who wants to improve his credit history. Its amount is small enough between $250 to $1,000 and has fewer payments like $25 each month. You can easily pay it while building a credit report.

- Become a co-signer. If you become a cosigner with anyone else for his car loan or credit card, then it will appear on your credit report as well. Because you’re sharing responsibility with him. But keep in mind it is risky as well because if he didn’t pay his loan then you’re liable to pay.

- Become an authorized user on anyone else credit card. If you have a nice father, grandfather, sister, brother, or friend who responsibly uses his/her credit card, has a good credit score, and makes payments on time then you can become an authorized user for his credit card. Being an authorized user the original owner is liable for making payments. But it appears on your credit report as well and builds your credit history.

If you follow these tips then you may like to become successful in building your credit report. After that, it becomes easy for you to get approved for a loan.

6. Multiple debt payments

Are you making single loan payments each month? Then turn to multiple or frequent payments.

If you can afford then devote extra money to making biweekly or bi-monthly payments of outstanding debt. This will help you decrease your credit utilization ratio and frequent payment behavior will send a positive signal to improve your credit score.

Another thing to keep in mind is that you make payment before the due date. So that it is get reported to the credit bureaus. Otherwise, if you make a payment one day late then it is not considered in the current month’s evaluation.

You can contact the lender and find out the date when he gives you credit activity information for the month to the reporting agency. When you know that then make your payment before that date.

RELATED POST: How to Use Debt Avalanche Method to Quickly Pay Your Debt?

7. Utilize credit monitoring service

These are paid services that help you keep an eye on your credit report and any activity that influences your credit score.

This way you can analyze whether the possible change occurred due to any action you took or not. You can also depict any mistake or fraudulent action related to a credit report.

They provide you access to credit reports and credit score data. Also, make you secure from any identity theft using your name and personal information to open and run accounts.

More than that you get alerts regarding any hard inquiry, collection accounts, bankruptcies, changes in credit card or other debt accounts address, and new accounts.

Remember these monitoring services can’t track each type of fraud. But help you stay on top of your credit score and reporting activities.

8. Use debt consolidation

Debt consolidation is another best method that can improve your credit score very fast.

It is a method in which you take another loan to pay out existing ones. This is usually executed in the case that you’ve several high-interest debts like credit cards and you want to save money in interest. This way you take a low-interest loan from any other lender and use it to pay your high-interest debt, after that you make only a single payment on the new loan.

This is helpful in many ways. One is that it is easy to obtain so you can pay existing debt faster. It saves you money because of the low-interest rate. And last but not least it is easy to manage one payment as compared with multiple.

There are different ways you can consolidate your debt. Here are some common ones you can use:

Balance transfer

In this method, you take a new credit card with low interest or 0% introductory APR in the first 12 to 24 months. After that, you transfer your existing high-interest credit card balances to this new one by paying them with the new card.

Here if you make payments regularly and payout all or major portions in the 0% introductory APR period, then you can save enough money. But remember when the introductory period ends the interest rate rises very fast up to 29% a year.

Home equity loan (HEL)

Here you take a loan as a second mortgage. Here you put your homeownership as collateral and take a loan from a bank or any lending institution. The interest rate on this loan is usually low because it is secured.

Now you use it to pay existing debt and make installments thereafter. It is very easy to get because there is less concern with credit scores due to collateral.

Personal loan

You take a loan to consolidate your debt and then pay it in monthly installments. Here the lender pays the whole amount as cash and you use it for the need you want to satisfy, after that pay it back in monthly payments.

This is an unsecured loan and lenders strictly check your credit score and past payment history. So it is important for you to have an excellent history in both variables.

For getting more information on other types of debt consolidation options you can visit this article.

RELATED POST: How Does Debt Consolidation Work? Is It a Good Idea?

9. Get a secured credit card

Secured credit cards are like normal credit cards but with one difference and that is you put some cash as collateral in your bank account. All other functions are the same. If you aren’t able to pay the amount then the lender uses your collateral to recover it.

These cards are used in case you’ve poor credit history or are a thin-file borrower. These borrowers do have not enough information on credit reports that’s why most lenders don’t approve loans for them.

With a secured credit card, you can take a loan with a credit limit depending on your collateral. All the activity is reported on the basis of standard rules.

The credit limit starts from 200 and goes up to 1,000 dollars while in some cases up to 2,000.

Now if you make regular payments after using this card this increases data on your credit report as well as gives positive information. This way your actual credit score starts improving.

10. Check your credit report

This is another important tip. It is not only compulsory for people with bad credit scores but also for good credit score borrowers.

Here you need to get your credit report and check it out to see whether the information is correct or not. It is possible that there is a major mistake that is hurting your credit score. So you can report that to see an increase in your credit score.

There are other mistakes like name and address but they don’t improve credit scores.

You can get a credit report from major USA credit reporting agencies including Equifax, Experian, and TransUnion through the Annual Credit Report website.

In case you find any mistake you can file a dispute online or through a letter. The credit bureau normally takes up to 45 days to respond. Remember if you didn’t submit complete information regarding the error and were not given any proof then it is possible that they reject your dispute.

You also like: How to dispute an error on your credit report

11. Don’t close old accounts

If you’re old credit accounts then it is best to keep them open. If you’ve credit card accounts then make small spendings after some time to keep them open.

The reason is that old accounts with long credit histories and account age have a positive effect on credit scores. In FICO score estimation it is the third most weighted factor.

These accounts also help you keep your credit limit higher as a result the credit utilization ratio decreases which is another positive thing. As lowers, your utilization ratio will be a much more positive effect it put on your credit score.

Another thing to keep in mind is that if there is any delinquent account then you should start making payments. Make at least the minimum payment regularly because it after all increases your credit score and decreases the delinquent effect.

If you’ve any old account in the collection and it has got too old then don’t make any payment. Otherwise, it reactivates and hurts your credit score if you don’t pay the amount.

12. Understand credit score calculation

This step is one of the most significant tips that if you understand, you can take the necessary steps to build a credit score. It is simple you need to understand how your credit score is calculated.

So you then take steps to improve factors that have the most impact on credit score.

If you take into account the FICO score then it has five factors that are mostly used to calculate the overall credit score. They include:

- Payment history

- Credit utilization ratio

- Length of credit history

- Credit mix

- New credit accounts

Here the payment history has (35%) weightage, the amount owed (30%), length of credit history (15%), credit mix (10%), and new accounts (10%).

Here you can see that if you start improving payment history and credit utilization ratio (amount owed divided by credit limit) then having a bad credit score suddenly gains points. Not opening too many new accounts and closing old accounts can also put a positive impact.

13. Eliminate negative entries from the credit report

Out of all tips on how to improve your credit score, another best trick is to remove negative entries from your credit report.

This also makes your credit report clean which is vital for getting approved for a loan in the future.

But how do you remove these errors and negative entries?

Here are some simple steps that you can take:

- File a dispute for errors in your credit report. The credit bureau then reviews your submission and responds in 30 to 45 days. If they are successfully removed then excellent. Otherwise, resubmit your dispute with more proof and information.

- Offer money to your lender for deleting those entries. If you’ve debt in collection, delinquent accounts, or charge offs then you can make an arrangement with the lender to remove negative entries.

- Wait for the time limit to end for which the negative entries stay on your credit report. Usually, these entries do not stay on your credit report for more than 7 years except for bankruptcy which stays for 7 to 10 years.

For more tips on removing negative entries, you can visit this article below.

Final thoughts

You learned all the tips on how to improve your credit score faster. Now let’s jump to some conclusions.

Improving credit scores is not a magic bullet, but a time-consuming process. You need to act according to the proven ways that actually help you increase your credit score.

If your credit score is too low and you suddenly start acting on the terms and conditions of the credit, then it is likely that you see a greater increase in your points. It is possible that you gain 100+ points in a month. But if your credit score is already very good then you didn’t see much change.

Just follow one or more of the tips above and show consistency and patience.

I hope you understand the tips on how to improve your credit score fast in a real way. Now tell me in your comments which technique you like the most.

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024