Last updated on February 16th, 2024 at 05:24 am

Are you curious to know $90000 a year is how much an hour?

Whether you’re considering a job offer or planning your budget, understanding the breakdown of your annual income is crucial.

In this article, we will explore the calculations and formulas to determine how much $90K a year translates to on an hourly basis.

You’ll know how to calculate the hourly rate for a $90K annual salary and break it down into different timeframes, such as semiannually, quarterly, and monthly.

Let’s dive in!

$90000 a year is how much an hour?

To determine how much $9000 a year is in terms of an hourly rate, we can use a simple formula. Divide the annual salary by the number of hours worked in a year. The standard assumption is that a full-time employee works around 2080 hours in a year, which is the equivalent of 40 hours per week for 52 weeks.

Now, let’s calculate the hourly rate for a $90000 annual salary:

Hourly Rate = Annual Salary / Number of Hours Worked in a Year

= $90000 / 2080

≈ $43.27

Therefore, if you earn $9000 a year, your hourly rate would be approximately $43.27.

How Much Is $90000 A Year After Taxes?

Before we calculate the hourly rate, it’s essential to understand the impact of taxes on your annual income. The amount you take home after taxes can vary depending on various factors, such as your filing status and deductions. To calculate the after-tax income, you can use the following formula:

After-tax income = annual income minus taxes

To determine the tax amount, consider using an online tax calculator or consulting a tax professional. Subtract the tax amount from your annual income of $90000 to determine your after-tax income.

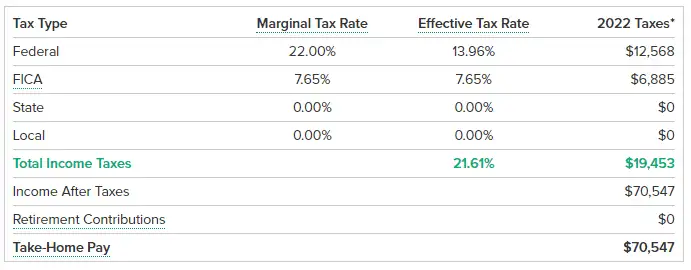

Now let’s assume that you live in Texas. Here, the state tax is zero, assuming that you’re not eligible for any additional deductions. So here is how much you pay 90,000 dollars a year, including federal tax and FICA tax.

Using the SmartAssets tax calculator, you pay 21.61% tax on your gross income. Here are your figures for the tax you pay and the take-home pay you receive:

Total income tax = $19,453

Income after tax = $70,547

See the screenshot:

$90000 a year is how much semiannually?

Now let’s break down your annual income into semiannual payments. To calculate the amount you would earn semiannually, you can use the following formula:

Semiannual income = annual income / 2.

By dividing your annual income of $90K by 2, you will earn $45000 every six months.

$90000 a year is how much quarterly?

If you prefer to look at your income every quarter, you can use the following formula:

Quarterly income = annual income / 4.

Applying the formula to your annual income of $90K, you will find that you earn $22500 every three months.

$90000 a year is how much monthly?

Now let’s explore how much you make every month. By dividing your annual income by twelve, you can calculate your monthly income:

Monthly income = annual income / 12

For an annual income of $90K, you would receive approximately $7500 per month.

$90000 a year is how much biweekly?

If you receive your paychecks every two weeks, you might be wondering how much you make biweekly. To calculate your biweekly income, you can use the following formula:

Bi-weekly income = annual income / 26

By dividing your annual income of $90000 by 26, you will earn approximately $3461.50 every two weeks.

$90000 a year is how much a week?

Now let’s break it down to a weekly income. By dividing your annual income by 52 weeks, you can calculate your weekly income as follows:

Weekly income = annual income / 52

For an annual income of $90K, you would be earning around $1730.77 per week.

$90000 a year is how much per day?

If you’re curious about your daily earnings, you can use the following formula:

Daily income = annual income / 246

By dividing your annual income of $90000 by 260 working days, you will earn approximately $346.15 per day.

Annual to Hourly Salary Calculator

To determine your hourly rate based on your annual income, you need to consider the number of hours you work per year. Let’s assume a standard workweek of 40 hours and 50 work weeks in a year. By dividing your annual income of $90000 by 2000 hours, you will find your hourly rate as follows:

Hourly rate = annual income/hours worked per year

= $90000 / 2000

Hourly rate = $45

Therefore, $90000 a year is equivalent to an hourly rate of $45.

Amount of $90K A Year Salary for Working 2,000 Hours Per Year

If you work a standard 40-hour workweek and 50 weeks per year, you would be working a total of 2000 hours. To calculate the amount of your $90000 annual salary for working these 2000 hours, you can use the following formula:

Amount per hour = annual salary/hours worked per year

= $90000 / 2000

Amount per hour = $45

Hence, for working 2000 hours per year, your $90000 annual salary amounts to $45 per hour.

Related Posts:

$60 an Hour Is How Much a Year After Taxes (US)? Can You Live?

$36 an Hour Is How Much a Year? Before and After Tax In The US

$52000 A Year Is How Much An Hour? Is $52K Enough?

$34000 A Year Is How Much An Hour? Is It a Good Salary or Not?

48000 A Year Is How Much An Hour? Can You Live?

80000 A Year Is How Much An Hour? Is It A Good Salary?

$62000 a Year Is How Much an Hour? Is It Enough To Live?

$85000 a Year Is How Much an Hour? Is It a Good Salary or Not?

$43000 a Year Is How Much an Hour And After Tax In The US?

Is $90K a year a good salary?

Now that we have determined the hourly rate for an annual income of $90,000, you might be wondering if this is considered a good salary. The answer depends on various factors, such as your location, living expenses, and personal financial goals. In some areas, $90000 a year can provide a comfortable lifestyle, while in others, it might be considered average. It’s essential to consider your financial obligations and aspirations before determining if $90000 a year is suitable for you.

Can You Live Off Of 90000 Dollars A Year?

Living off an annual salary of $90,000 is undoubtedly possible, but it depends on your circumstances and lifestyle choices. Factors such as the cost of living in your area, housing expenses, debts, and personal spending habits will affect your ability to live comfortably within this budget. By creating a detailed monthly budget and prioritizing your expenses, you can make the most of your $90,000 annual income and ensure financial stability.

$90000 A Year Monthly Budget Example

Here’s an example of a monthly budget for someone earning $90,000 a year. The income used is after-tax monthly income, which is $5,878.916, or approximately $5,879 per month.

By allocating your income according to the above categories, you can effectively manage your expenses and save for the future.

Income:

- Monthly income: $5,879

Fixed Expenses:

- Housing:

- Rent/Mortgage: $1,200

- Utilities: $200

- Transportation:

- Car payment/loan: $300

- Insurance: $100

- Gas: $150

- Debt Payments:

- Student loans: $200

- Credit card payments: $100

- Insurance:

- Health insurance: $300

- Other insurance (e.g., life, disability): $50

Variable Expenses:

- Food:

- Groceries: $400

- Dining out: $150

- Work lunches: $50

- Personal Care:

- Toiletries and personal hygiene: $50

- Haircuts/salon: $30

- Entertainment:

- Hobbies and leisure activities: $100

- Entertainment: $50

Miscellaneous:

- Clothing: $100

- Gifts: $50

- Miscellaneous expenses: $50

Savings and Investments:

- Emergency fund: $1,249

- Retirement savings: $1000

How do I live on $90000 a year?

Living on a $90000 annual income requires careful financial planning and budgeting. Here are some tips to help you make the most of your salary:

- Create a budget. Track your expenses and allocate your income wisely.

- Prioritize savings: Set aside a portion of your income for emergencies and future goals.

- Minimize debt: Pay off high-interest debts to free up more of your income.

- Cut unnecessary expenses: Identify areas where you can reduce spending, such as dining out or entertainment.

- Take advantage of discounts and deals. Look for ways to save money on everyday expenses.

- Retirement plan: Contribute to a retirement account to secure your financial future.

- Seek financial advice. Consider consulting a financial advisor to help you make informed decisions.

By implementing these strategies, you can successfully live within your means and achieve your financial objectives.

Hourly Rate vs. Salaried Job: Which Is Better?

When considering job opportunities, it’s essential to understand the differences between an hourly rate and a salaried position. Hourly jobs typically pay a fixed rate per hour worked, while salaried positions offer a predetermined annual income. The choice between the two depends on your preferences and job requirements. Hourly jobs may provide more flexibility and overtime pay, while salaried positions often offer benefits and stability. Consider your lifestyle, financial goals, and career prospects when deciding which option is better suited for you.

Jobs That Pay $90K A Year

If you’re aiming for a $90000 annual income, various job opportunities can help you achieve this goal. Some professions that offer this level of income include:

- software developers

- financial managers

- marketing managers

- and civil engineers

However, it’s important to note that salaries can vary depending on factors such as experience, education, and location. Researching the job market and understanding the qualifications required for these positions can help you pursue a career path that aligns with your financial aspirations.

Helpful Websites To Find Jobs:

Conclusion

In conclusion, understanding how much $90000 a year amounts to on an hourly basis can provide valuable insights into your income and budget planning. By utilizing the formulas and calculations mentioned in this article, you can make informed financial decisions and effectively manage your earnings. Whether you’re evaluating a job offer or aiming to live within your means, having a clear understanding of your income breakdown is essential for your financial well-being.

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024