Last updated on January 22nd, 2024 at 01:15 pm

In this post, you’ll get 20 budget templates to help you keep track of your finances.

Money management is an important factor when it comes to achieving your financial goals.

Whether it’s an emergency fund, investment, purchasing a car, or controlling monthly spending, you need to keep track of your income and expenses.

And the first and foremost tool is budgeting.

But budgeting tools & apps are expensive as well as complicated. Everyone doesn’t have time to understand them or buy their plans.

So the second option is to use premade budget templates. You can get 20 templates here in this post.

Let’s dive into it.

What is a budget template?

It helps you create a budget to keep track of your income and spending. They’re manual and you need to enter every bit of information yourself. But very easy to change and provide enough picture of your finances.

You also love: 11 Downloadable Printable Monthly Budget Template (Excel + PDF)

Why do you use budget templates?

There are several benefits of using these templates. Here are some of them:

- Easy to make changes if any figure is wrong

- You can download and print them to keep a record

- Can be uploaded on several budgeting apps

- You can send them to any financial expert

- Free for analyzing your financial picture

Now let’s move on to the next section.

How to use these budget templates?

Using these templates is a breeze. You just need to enter the required financial data and give the formula to calculate the required figure.

Here is how to use it:

- First of all, enter data of your income sources

- Second, you list down your expenses and amounts

- Third, enter any miscellaneous expense like fun and gifts

- Now, most templates have pre-entered formulas, charts, and graphs. So they automatically calculate the totals and differences.

The only drawback is that you need to enter data yourself. The manual work of gathering different documents and entering all the data takes a lot of time and hard work. You need to enter figures carefully otherwise accuracy will hurt.

Related Post: How to Create a Personal Budget [6 Easy Steps] PLUS Template

20 Budget Templates To Confidently Budget Your Money

Below 20 templates are reviewed below and you can choose according to your likes and dislikes.

I picked up templates from different sites and listed them here with download links. You can easily download any of these if you like.

The majority of these templates are free while two or three come with little payment.

Note: I don’t get any affiliate commission for any template. I’m not affiliated with any of the programs or websites providing these templates.

So let’s jump straight to the first one.

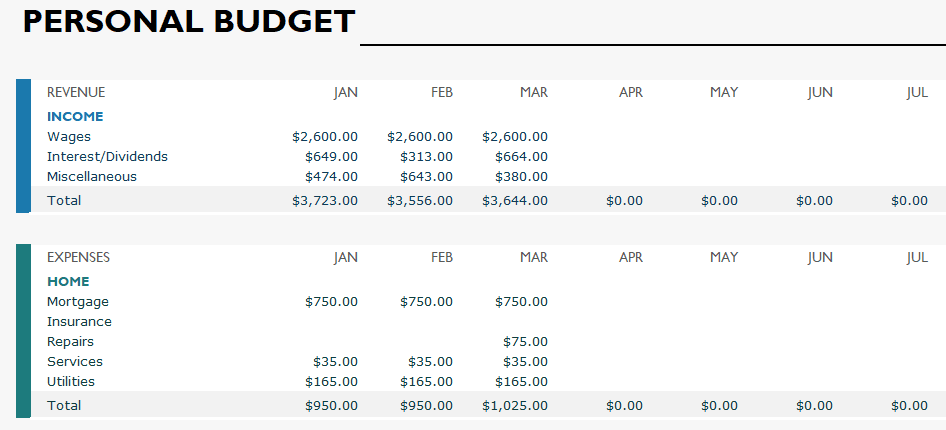

1. Simple budget excel template

Microsoft office comes with amazing excel budget templates including free and premium.

This template is a simple personal budget template with a light color design and provides a single screen view for several months of budgeting activity.

Why do I love the template?

Because it follows the zero-based budgeting method. It lists down the income and expenses in a single column for each month. And in the end, all the income minus expenses gives you zero dollars. Each dollar is given a certain job.

Here is a walkthrough of this budgeting template:

- There are a total of 14 columns one for income&expenses, the next 12 for months, and the last one for yearly calculations

- The first column lists different income sources, expenses (home, daily living, transportation, entertainment, health, vacations, recreation, dues/subscriptions, personal, financial obligations, and miscellaneous payments).

- The 2nd column to the 13th column lists January to December months with amounts. And at the end zero out because the zero-based budgeting method is followed.

- While the second last column name is “yearly”. Here all of the income and expenses of a particular category are total out and give a yearly picture of the movement of your finances.

- The last column presents a dot-line graphical representation of data.

- The bottom contains “totals” for expenses and total cash shortage/extra. It’s to see in which months you have a budget surplus, deficit, or balanced.

The light blue color for highlighting each second column of the budget template makes it look attractive. While the expense categories allow you to list down each type of expense under a specific main category. It’s only available in Excel format and you need to have Microsoft Excel to open it.

You can get this template for free. Just click the download button below.

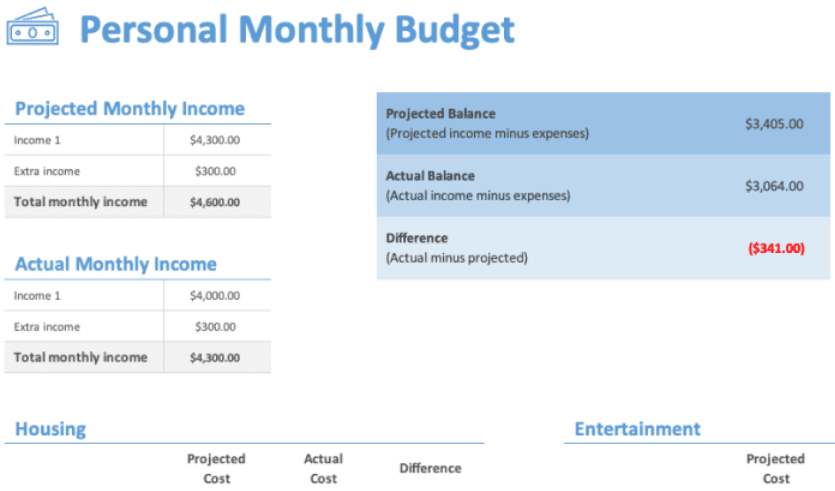

2. Monthly budgeting worksheet Excel

This template is also from Microsoft. It comes with their premium software called Microsoft Office 365 which costs around $7 a month. That means if you pay and download their product then you get this template.

The template provides a more informative view of your budgeting activity. Not only lists down projected monthly expenses, and income but also actual income and expenses and their difference as well. So you can easily analyze how much is expected expenses and how much are actual. The difference shows whether you’re overspending or within limits.

Here is what the budget template is going to look like:

- At the top, left corner list down the projected monthly income with the total, and below that is the actual monthly income and its total. On the right side, the two blocks are blue blocks of projected income minus expense, actual balance income minus expenses, and the difference between projected minus actual.

- Under these two blocks is a listing of expense categories side by side. Includes housing expenses, transportation, loans, legal, and others with projected cost, actual cost, and their difference.

- After that is a blue block of total projected cost, total actual cost, and their difference. This tells you whether you go overboard with your expense in a particular month or stayed inside your boundaries.

At the top, you can add the name of a particular budget month. For example, the personal monthly budget for January, February, or any other.

The downside is that it doesn’t have a graphical representation of data for the required payment each month. Only a single sheet is available in this template.

3. Family budget template

This family budget Excel template from Microsoft consists of three worksheets.

- The first is cash flow where you get a bar chart of projected and actual cash flows, total income, and total expenses. Aligned is a chart of total income, expenses, and total cash difference below the chart. The template automatically calculates all these values and variance of actual and projected numbers based on data entered.

- The second is a monthly income worksheet where you can list all your income sources. It automatically calculates total income and variance.

- The third worksheet is monthly expenses. Here you list down all your expenses with amounts actual and projected. For example, cable, pets, housing, food, utility, etc.

The plus point is that it’s free to use and gives a bar chart view of your income and expenses. But have no comparison available with the previous month’s budgets.

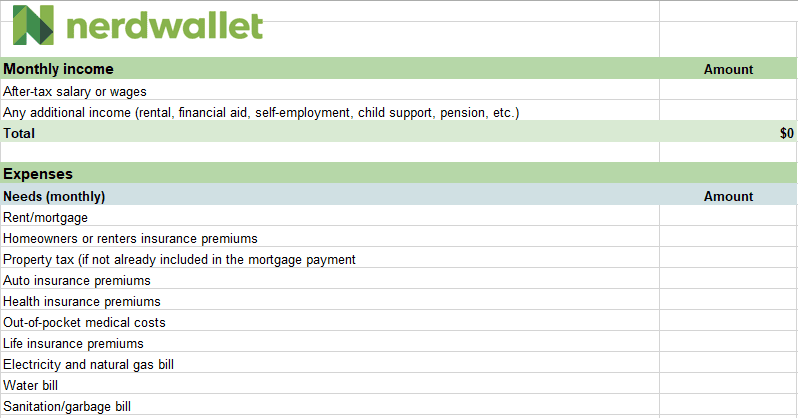

4. Nerdwallet monthly budget worksheet

A simple worksheet from the Nerdwallet website allows you to budget online and is downloadable in Excel format. Very simple formatting of income and expenses so you can easily enter them in required fields. It then automatically gives calculations below

It’s based on the 50-30-20 rule of budgeting that’s why you need to keep 50% for needs, 30% for wants, and 20% for savings and debt payments. Below the budget planner is the spending tracking tool for free.

5. Business budget template

If you’re running a business either small or medium you can download the Microsoft business budget worksheet template for free in Excel format.

With 4 sheets and an amazing design, it is best suited to build a business budget. These sheets include:

- Operating expenses sheet where you can list all of your operational expenses like advertising, raw material, taxes, and others. Along with estimated and actual amounts. The difference is calculated automatically when you enter amounts.

- Then comes personnel expenses where you list down all the wages and expenses of employees and workers. For example, salary, commission, and 401K.

- After that is the income worksheet. Here you list down all the income sources of the organization you’re running. It includes sales, interest on any loan or saving accounts or marketable securities, bonds, and asset gains. So you get the total income of the organization.

- The fourth worksheet is a summary of total expenses, income, and variance. Along with that, it lists down your top 5 biggest expenses and a bar chart on the right-hand side to see the budget overview.

It’s a simple and powerful template you can use and edit to suit your needs.

6. Personal budget template

Another premium template from Microsoft. This template is available in Office 365. The different thing about the template is that it contains due dates. So you don’t miss out on your monthly bills.

There are three sections one is income where you need to list down income. After that comes the expenses section where you list down names, amounts, and due dates.

At the end comes a summary that automatically displays your total monthly income, expenses, savings, and cash balance. Two graphs are also available. One is a donut chart and the second is a bar chart of total income and expenses.

Its simple design and format make it very easy to use.

7. College monthly budgeting template

Are you studying in college or university? If yes then it’s important to keep track of your financial activities under your eyes. You should have a clear-cut view of how much money you’re going to spend plus the actual money you spent.

It also helps you list down the sources of income and different expenses that you incur during college education. For example, hostel rent, vacations, food, utility, books, etc.

Vertex 42 provides an Excel template for making a college budget. Using this template you can either make a monthly budget, for the whole semester or a year.

Here is the breakdown of the college budgeting template:

- Funding or income sources can be a student loan, parents, job, or scholarship

- Then comes the expenses like tuition fees, hostel rent, loan payments, and other bills

- After that, you get the total income minus the total expenses difference

You can use this same template for more than one semester. Just add columns for other semesters. If you get confused about anything then click on the “Help” sheet to see details. You can download it for free.

8. Google Sheets budgeting template

Google Sheets provide a free template fur budgeting with simple and friendly features.

You can use it for budgeting on a monthly basis.

It’s just simple. You list down your all income sources and list expenses with amounts in their respective columns. Keep in mind that you don’t edit the cells other than highlighted ones.

It will automatically give you a summary of your budget. The beginning and ending balance graph is available to compare the financial picture at the beginning and end of the month.

9. Moneysmart simple budget planner template

The money smart template is easy to use with automatic value calculation.

Your first list down different types of income sources with amounts. Then go to each specific category of expenses and enter the expected amount for the specific subcategory of that expense.

The template shows you the amounts of total income, total expenses, and then net income after deduction.

The third column is frequency. Refers to how often your income or expenses occur. You can click on the specific cell to change that frequency to weekly, fortnightly, monthly, quarterly, and even annually.

The fourth column provides amounts based on the frequency setting in the third column. And you can also change that to weekly yearly or monthly, whatever you want.

Below the data is a bar chart that represents your data entered for the above expenses in a graphical view. So you can easily interpret how much money you’re spending on each specific expense.

10. Evernote simple budget planner template

The simplest template. At the top, you write the particular month name you’re budgeting for. After that write your single goal with specific notes if any. Then expected starting balance and ending balance.

Last you move on to the income and expenses section and write the name and amounts. You’re required to give expected and actual amounts and write some notes if you want at the end of the column.

You can use this template by signing up to Evernote software with an email or your Google or Apple account. It’s free of cost.

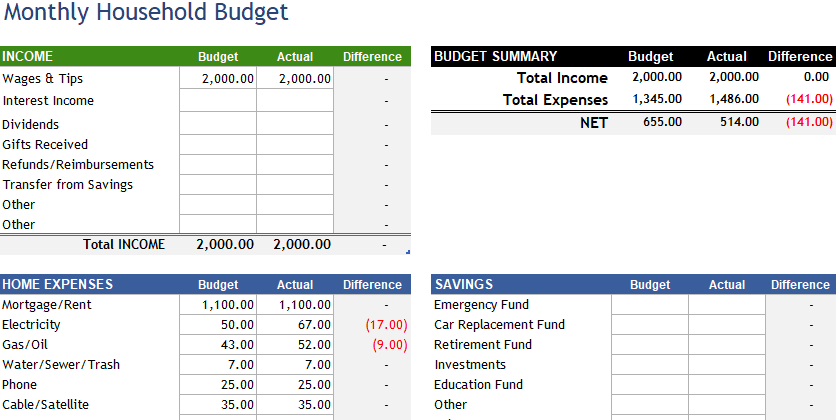

11. Vertex42 household budgeting template

A sophisticated and colorful spreadsheet template from vertex42 was created by Jon Wittwer. You can download this template for free in Excel format or spreadsheet. But remember that all vertex42 templates can’t be resale or distributed.

The template covers a lot of categories including income and expenses. You go through by listing down income sources. Then come types of expenses like:

- Home Expenses

- Savings

- Daily living

- Entertainment

- Transportation

- Health and more

You need to insert both expected and actual amounts. On the upper right side, the template automatically gives you the difference between expected and actual.

If you face any problem, they have a help section attached to the worksheet with relevant details and descriptions. It’s free of cost.

12. Smartsheet household budgeting template

If you like simple but mixed-color templates then go nowhere else. Smartsheet has this free spreadsheet household budget template with blue, orange, and green colors.

Here is what is inside this.

- Budget summary of total income, total necessary expenses, and their differences on a monthly and yearly basis with percentages

- Income summary of wage, investment earning, business, social security, and others. Amounts are mentioned in both monthly and yearly amounts.

- Necessary expenses like food, debt payments, transportation, laundry, etc. You don’t have to write or delete anyone. You just add amounts for ones that are relevant to you.

- Discretionary expenses section for dining out, sports, pet boarding, and more

- Investment expenses for retirement investments like 401k, IRA, stock options, and more

The template is available in both Google Spreadsheets and Microsoft Excel format.

13. Weekly budgeting template

If you like to budget weekly or biweekly then using this template is amazing for you. It’s created in smart sheets and you can use it in Excel format and Google Sheets by uploading it to Google Drive.

Here is what you get inside this template:

- Summary of total income, total expenses, and their difference for the current month in projections and in actual. It follows week 1, week 2, week 3, and week 4

- After that summary of income with sources names, current month projections amounts for each week, and their difference at the end

- Expenses list with projections, amounts for four weeks, and their difference. The expenses are categorized into main types and then subcategories.

It uses light blue color with white cells which makes it a stunning template.

14. Yearly budgeting template

An easy-to-use template in Google spreadsheets. Using this template you can create a budget for each month starting from January to December, a whole year.

The categories of income and expense can be changed based on your needs, and it automatically saves. Here is how to use this template:

- Enter your income source’s name or choose one from the list and enter the amount

- Add expense amounts for debt, children, education, entertainment, and others relevant to you

- When all of the above is done you can then check the summary section on the third worksheet. Here all your changes will be automatically displayed.

You also get totals and averages of all months along with income, spending, and ending balance. It’s free to use.

15. Event budgeting template

A one-page spreadsheet and Excel template for budgeting any event. You can use it for an event like a race and cycling.

Provides you with a budgeting summary for total income, expenses, and balance. Then a graphical view of estimated income, actual income earned, and expenses.

Below that is the expenses section with description, category, quantity, unit cost, and amount of money. Which gives you the total expenses of the event.

In the end, is income or funding sources for the event. Its calculator is the same as expenses.

You can make tweaks and changes in categories and colors to suit your needs. It’s available in Google spreadsheet as well as Excel format.

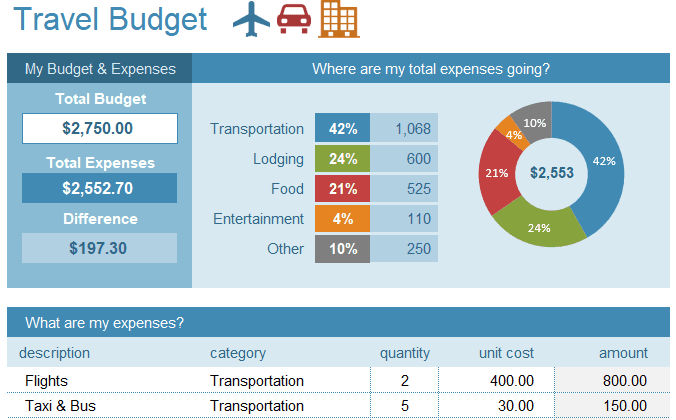

16. Travel budgeting template

If you love to travel to different places inside the county or internationally, travel budgeting is a must. It helps you travel in a financially planned manner and know how much you’ve and how much cost can occur.

The best method is to create a budget for traveling. And for this purpose, there comes the use of the travel budget template.

Vertex42 created a simple travel budgeting template for Excel and spreadsheet. Here you can list down your expenses with description, type, quantity, unit cost, and amount. At the top is a summary of total estimated expenses, actual expenses, and their difference.

The graphic chart represents the major expenses with percentages. So you can easily visualize the picture.

17. Christmas budgeting template

Christmas and other holiday events are a part of our life. We need to celebrate them properly with gifts and surprises for our relevant and friends. But all these items create are an expense.

That’s why you should budget the Christmas spending in advance.

For this purpose, Spreadsheet123 has an amazing template. A single-sheet template with a simple but attractive design.

It lists down different expense categories for the Christmas holiday. You need to choose the required category and enter the estimated amounts and then the actual amounts.

Here is an exact breakdown of categories:

- Gifts section where you list down names of all people you planned to give gifts to with gift name in the second column. After that, you write the expected budget amounts and then the actual after purchasing.

- Gift wrapping supplies include material for packing and handling gifts like ribbons, paper, bags, and scotch tape.

- Postcards for printing, postage stamps, and envelopes.

- Decoration category for Christmas trees, ornaments, indoor decoration lights, outdoor decoration lights, and ornaments.

- Christmas food and drinks section for listing down amounts of party food, drinks, and dining outside of restaurants and hotels.

The above header section gives you a summary of the estimated, actual, and variance of these amounts. The totals and difference is calculated automatically when you add values.

But remember to not make changes like the deletion of categories and rows. Because the template contains pre-ordered formulas it may impact your accuracy.

18. The 50/30/20 budgeting template

The 50/30/20 budgeting rule is a famous one. Here you divide your after-tax income into three percentages. You devote 50% to needs, 30% to wants, and 20% to savings and paying off debt if any.

The Financialstrees has created a simple Google Docs budgeting template using this rule. Here you enter the amounts in each category and results will be automatically calculated.

Let’s have a look at the sections of this template:

- Monthly income table showing you net income#1, net income#2, and other incomes summary with percentages

- Budget vs actual amounts difference for total income and expenses and then remaining income

- 50/30/20 budget three sections comparison with percentages. It shows you how much of your expenses are covering these percentages. It can be less than or more than the standard percentage numbers of the formula

- Below are three sections of the rule including needs, wants, and savings

- The needs section lists down important expenses you can’t live without. For example housing, food, healthcare, utilities, transportation, etc. Following the amounts in dollars and percentages out of 50%

- Wants section with expenses like eating outside, shopping for clothes, cell phone, wi-fi, entertainment, etc. With amounts and percentages out of 30%

- Savings and debt payment section with a listing of emergency funds, retirement savings account list, and debt repayment accounts list. Including amounts and percentages out of 20%

- At the end of each three sections are totals of the expenses

When you enter all the data you get a donut chart graph for all your expenses data. It shows you how much you’re spending in each category as compared with the 50/30/20 budgeting rule.

It has a simple design using blue and white colors. You can get it for absolutely free in your Google spreadsheet.

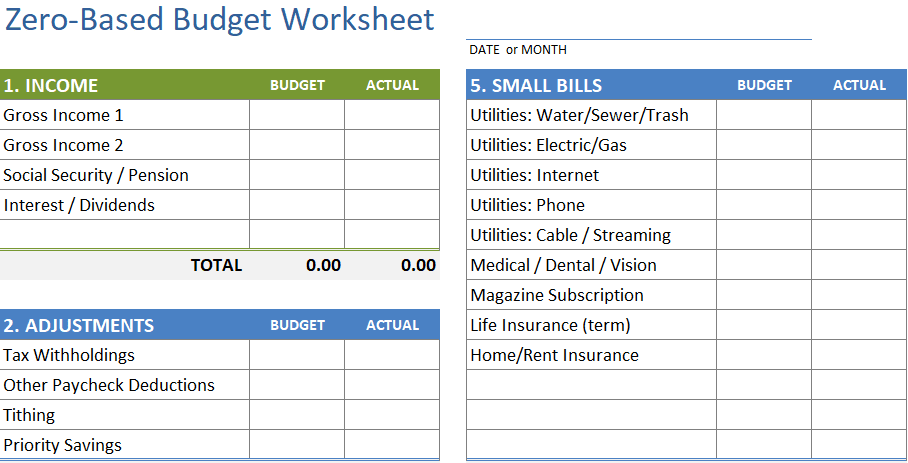

19. Zero-based budget template

It’s a budgeting method where you give a certain job to each dollar of your income. So in the end nothing is left behind without work.

The beginning and ending budget in this method is zero. You need to start a new budget each month.

The Vertex42 worksheet is simple with a single page. It’s available in Excel, Google spreadsheet, and pdf for printing if you like to.

Here is how to budget in this worksheet:

- First, you mention the month or year you’re budgeting for in the title

- Write your expected and actual amount figures in the income column

- Make adjustments to income with tax withholdings, tithing, and others

- List down your big bills in expenses like mortgage, health insurance, property tax, and home repairs

- Mention debt like car lease payments, credit cards, personal loans, student loans, and emergency loan

- Mention your small bills like internet, phone, cable, medical, and phone

- Write your daily living expenses like groceries, clothing, fun, children, and miscellaneous

- Last list down your savings like an emergency fund, debt snowball, retirement, college fund, and vacation. Here remaining income will be distributed among different categories or savings section

In the end, zero dollars will be left. Each dollar works for you in this budget.

20. Wedding budget template

This template is from Wedinspire with comprehensive details. It’s only a single-page worksheet in Excel format.

Here is how you can budget using this template:

- At the top, you mention the wedding ceremony date

- Below are different types of specific information columns

- The first column is for the categorization of wedding expenses. For example ceremony fees, music, venue cost, food and drinks, and entertainment. You can delete or change any name you like.

- In the second column, you write down the forecasted cost in front of each expense. While in the third column, you write the actual costs of expenses.

- The fourth column is for prepaid expenses in advance and you mention their dates in the fifth column

- After that is the balance due column where the difference between the actual cost and advance deposit will show automatically

- Then comes the due amount column where you mention any left deposits, then mention the supplier name in front of it. At last, you can write down some notes if you like.

At the bottom, you get an overview of the total budget, actual cost, deposits, and balance due.

Frequently Asked Questions

Do Google Sheets have budget templates?

Yes, Google Sheets have their free templates. They’re customizable and you can make tweaks to your needs. You just need a Google Gmail account to log in to Google Sheets and explore all of their other templates as well.

The main benefit of these templates is that automatically save each change or figure you enter. You can download them in Excel format or share them with others.

Related Post: What Is Financial Planning? How to Do It In 12 Easy Steps?

What is a budgeting app?

Budgeting apps are online software that helps you budget income and expenses. They provide you with more control and management efficiency over money. They come for all devices including mobile, Mac, iPhone, and desktop apps.

These versions are either free or charge a monthly fee with annual packages as well.

You can easily sync them with your bank accounts to download transaction data. This makes a lot of manual work offloaded from your shoulders. Using reminders features you can pay bills on time without getting late. There are a lot of other amazing features with full security.

Related Post: 40 Personal Finance Tips To Effectively Manage Your Money

Should you use budget templates or apps? Which is a better option?

The budgeting apps have more features and functionality. They do most of your budget work automatically and manual work is very little. They import hundreds of transactions into budgeting. The accuracy is more than manual budgeting. But you need to learn their features and stay comfortable with them. Sometimes the simplicity of functionality is less.

Budgeting templates come in Excel, Google Spreadsheets, and Smartsheet. They’re mostly free and paid in some cases like Office 365. Here you need to do manual budgeting and entering of figures. The accuracy is low and takes much time to do budgeting.

So in my opinion budgeting apps are the best options for any type of budgeting. Whether it’s business budgeting, project budgeting, or personal budgeting. Even better is to go with a paid budgeting app. If not affordable then free is good.

In case your budgeting is not much large and you have a small number of expenses and fewer categories then the template is also good. Here it takes minimum time to do your job.

What are some popular budgeting apps?

The most popular budgeting apps are YNAB, Mint, Good Budget, and Personal Capital. For more popular apps visit the article here: 10 Best Budgeting Apps of 2022 (Free + Paid)

How do I make a budget sheet in Google Sheets?

There are two ways. One is to make it yourself from scratch and the other is to use a Google sheet budgeting template.

For making it yourself you need to first have a Google account to sign in to a spreadsheet. Then give the title, write down the names of different columns, and enter values. For this purpose, you can watch a YouTube video here.

The second way is to choose any budget template for the Google sheet from the above list. And then enter your required values which automatically calculate figures for income and expenses. In the end, your budget will be ready.

What’s the 50/30/20 budget rule?

According to this rule, you spend 50% of your income on needs, 30% on wants, and 20% on savings and paying off debt. This method is widely used and famous in personal finance budgeting. The template for using this method is available in the above list.

Related Post: How to Stop Wasting Money Using 12 Simple Financial Tricks

How do you create a simple budget spreadsheet?

You write a title like “Budget for January” and then create one section below with the name of “income” and then below that “expenses”. In front of these columns will be “expected amounts” and then another column with “actual amounts”.

List down all your income sources with amounts and then expenses with their amounts. After that calculate the total of incomes under the income column and expenses under the expense column. When you’re done with that subcontract income from expenses.

If the result is positive then you have a budget surplus otherwise deficit. In case of surplus devote the remaining money towards savings or paying down debt. While in deficit either cut down expenses or increase your income. If the balance is zero then it means your budget is zero-based.

You also like: How to do Zero-Based Budgeting Using 5 Simple Steps?

What is the best free budget app?

The best free budget app is “Mint” by “Intuit”. It has all the functionality that is usually present in premium budget apps. There are multiple layers of security for your accounts, financial, personal, and bank details.

You also like: 33 Tricks on How to Save Money on Groceries

How do I turn my notebook into a budget planner?

If your personal and household income and expense are limited and you’ve enough time to create a budget then you can use your notebook to make a budget.

Take a pen and list down your income sources and expense with the estimated amount for the whole month or week. Then find the total of your income and the total of your expense. In the end, subtract your expenses from your income.

What is the 70/20/10 rule of money?

This rule refers to dividing your income into three categories based on a certain percentage. The three stages are spending, saving, and giving. Following this rule, you’re required to devote 70% of your after-tax income to spending, 20% to saving, and 10% to giving to charity.

Related Post: 8 Tips For Money Management To Achieve Financial Prosperity

What is the 70/30 rule?

According to this rule, you’re required to divide your after-tax income into two portions. You spend 70% on needs and wants while 30% on your savings, investing, or giving away to charity.

Conclusion

I have reviewed 20 budget templates including Excel and spreadsheets. And you can choose according to your choice and start making budgets the easy way.

In the future, more templates for a variety of other purposes will be included in this post.

Now you’re free to choose any template. Whether you want to budget for personal expenses, household expenses, or weddings. It all depends on your choice.

If you find this post amazing and helpful please share it on social media. And tell me in your comments which budgeting template you like the most.

Related Post:

40 Ways on How to Save Money Even If You Find It Difficult

31 Budgeting Tips for Beginners to Easily Grow Your Savings

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024