Last updated on February 29th, 2024 at 07:34 pm

In this post, you will get 31 printable monthly budget templates and tips on using them.

According to statistics 58% of Americans build a personal budget and 50% of Americans use different tools for creating this budget.

These tools include budgeting templates, apps, and other helpful tools. they not only make the budgeting process easy but also save you time.

But everyone cannot afford expensive budgeting apps, while also not being comfortable with pen and paper. That’s why monthly budget templates are a good way to start making your budget.

In this post, I will review 31 templates you can use for free.

Let’s dive in.

What is a budget?

A budget is an estimation of your monthly income and spending. It is a spending plan that helps you estimate how much you are going to earn in the whole month and how much you are going to spend over the month.

The process of estimating income and spending is called budgeting. It helps you to keep track of your expenses and save more money for your future investment needs. That’s why it is a helpful tool for achieving your financial goals.

As an individual, you can make different types of budgets based on your needs. For example monthly budget, weekly budget, family budget, household budget, and college budget.

What is a budgeting template?

A budget template is a tool that is pre-made and makes it easy for you to budget. It gives you an overview of your monthly finances including all types of income and expenses.

These templates help you save time. You can get them in weekly, bi-weekly, and monthly budget template formats. You can customize them according to your needs by adding and deleting categories as you want.

The good news is that they are free and available in Excel, Google Sheets, and PDF formats. You can download and print them as well.

Related Post: 30 Money-Saving Charts To Track Your Savings And Debt Pay-Off

Why should you use a monthly budgeting template?

Here are some reasons why you should use budgeting templates:

- easy to use and you need to enter your values and categories if needed

- allow customization as you want and add and delete categories

- free and you can downloadable online

- available in Excel spreadsheet and PDF formats and are printable

- multiple designs are available to choose from

- available for events like weddings, birthday parties, and holidays

- in some templates values are automatically calculated and no need to use formulas

- the accuracy of calculations is higher as compared with the pen-and-paper method

- you can export and import them and upload them into budgeting apps

- help you track finances and give a summary overview of all details

- last but not least they are free and you don’t need to pay a dime

You can see how beneficial these budgeting templates are.

Let’s jump to the next section.

Related Post: Cash Envelope System: 9-Simple Steps To Do Envelope Budgeting

31 Downloadable printable monthly budget template

Now let’s review the 31 templates one by one:

1. Subscribe page printable monthly budget template

A single-page monthly budgeting template anyone can use with ease. It starts with a title and the name of the month. Below are listed sections including income, savings, debt, and goals. The starting and ending balances are also available. It’s a downloadable printable monthly budget template and you need to use a pen for writing budget values. DOWNLOAD

2. Mint monthly budget template

Mint provides an Excel budget template in .xlsx format. Make sure you have pointed out the option of .xlsx files to open in Excel on your computer. The categories in this template are already listed and you only need to add amounts. The total and differences are automatically shown because formulas are already inserted. DOWNLOAD

3. 101Planner Monthly Budget template

101Planner provides a comprehensive personal monthly budget template with projected and actual amounts columns. Each category of expensive is listed separately to give a bird’s eye view of the monthly spending. The amazing thing about this template is that you can download it in Excel, Google Sheets, PDF, and Word document versions. DOWNLOAD

4. 101Planner printable monthly budget template

If your expenses and income sources are limited then this simple one-page budget sheet is the best option to choose. It lists six important expense category names under which you are required to write subcategories yourself. In the end, you get a single cell to write a most critical budgeting goal. DOWNLOAD

5. Savvy Ladies’ printable monthly budget template

Savvy Ladies provides a comprehensive all-in-one Excel monthly budget template. The good thing about the template which separates it from other templates is that it lists all the months in a single row and under each month you get amounts for specific expenses. All the expenses and subcategories are listed in the first column followed by amounts. The required total and difference are calculated automatically. DOWNLOAD

6. Printable Crush template

A colorful and beautiful single-page PDF monthly budgeting template. All the main expense categories and subcategories are listed in different colors. Below is another sheet for the expense trial balance with amounts and descriptions. DOWNLOAD

7. Mom’s Make Cents printable monthly budget template

Another downloadable printable monthly budget template with three sheets. First is a budget sheet with estimated, actual, and difference amount columns. All categories of expenses are listed and you don’t need to write down subcategories.

The other two sheets include an expense tracker and a bill tracker. Bill tracker comes with bill name, due date, amount, and month option in which it is due. While the expense tracker comes with the date, company, notes, and amount. All the cells are highlighted with different colors which makes this template astonishing. DOWNLOAD

8. Moritz Fine Design zero-based budget template

Their downloadable printable monthly budget template follows a zero-based budgeting method. Using this method you make sure that every penny is spent somewhere in the expenses or savings category and nothing is left without work.

In this template months of a specific year are listed above under the title and you only need to tick mark the month you’re budgeting in. Under that is income and expense listed with all the subcategories followed by estimated and actual amounts. DOWNLOAD

9. World Label printable monthly budget template

This template is also downloadable and is the simplest. Just list down your budgeting items followed by estimated and actual amounts, and write the difference if you want. At the bottom, you can calculate the total difference to find whether the budget is in deficit or surplus. DOWNLOAD

10. Lightroom Presets template

This downloadable printable monthly budget template has three main sections checking, savings, goals, and income section in red color. It lists expenses under the checking section with just specific names. You may not find any necessary expenses that belong to you. But it is the best template for budgeting fewer expenses. DOWNLOAD

11. Pickmonkey printable monthly budget template

Pickmonkey has a downloadable printable monthly budget template with three columns. You can make a budget by writing down items, the category of that item in front of that, and then the amount. They also have other templates you can customize in Pick Monkey software. DOWNLOAD

12. OnPlanners template

Their budget templates are easy to personalize and have a simple structure. You can take their print and write down your name as well as budget values in the required fields. There are three types of monthly budget templates available:

- Goal-oriented monthly budget template where you’ve checking and savings fields with starting and ending balances. On the right is a field for writing your savings goals and below that are the actual values you get at the end of the month.

- Monthly budget planner with income columns to track expected and actual income. Expense fields to write and track down your household, utilities, food, and other expenses.

- The budget tracker is a simple worksheet with date, description, amount, and balance columns. You can use it to keep track of your credit card debt payments car payments and other expenses. DOWNLOAD

13. Addi Ganley’s printable monthly budget template

The template is so easy to use with five different columns including item, budgeted amount, actual amount, difference, and notes. In the items column, you get three things that are a list of income sources, expenses, and savings. While at the end is the total which is the difference between income and expenses.

You’ve to deduct total expected expenses from total income to find the difference. If it’s positive take a percentage of that difference to put into your savings account. DOWNLOAD

14. Pinterest monthly budget template

It’s the biggest source to find a budget template of your choice. Whether you want a simple structure template or more sophisticated budgeting worksheets with colorful designs. Just click the image and follow the link to a website. You need to have an account to view and visit the template’s websites. DOWNLOAD

15. Frugal Confessions monthly budget template

Has a post on a list of 11 different budget templates with links to their websites. You can visit the links and download these templates for free. To find other types of templates and binders just visit the budget link in the categories in the footer. DOWNLOAD

16. Savvy Budget Boss monthly budget template

An excellent paycheck monthly budgeting planner with the name of a month, and savings goals with starting and ending balances. Below are six different categories of expenses including housing, food, transportation, health, debt, and everything else. You can write amounts in front of each expenditure that belongs to you and leave unrelated ones. DOWNLOAD

17. Gathering Dreams monthly budget template

A simple but detailed template that includes income, savings & investments, and expenses with categories and subcategories. It covers common and uncommon expenses.

The categories of expenses include home, entertainment, personal care, pet care, health/medical, transportation, debt payment, family expenses, and miscellaneous. Yellow color strips make the template look beautiful. DOWNLOAD

18. College Life Made Easy budget planner

A unique element of this template is that it includes a separate category of school expenses along with all other expense categories. In front of each category, you have a budgeted and actual amount. You can download it in light blue and pink colors. DOWNLOAD

19. Arts and Budgets monthly budget template

Arts and Budgets provides a multi-color template with three categories including housing expenses, monthly living expenses, and long-term expenses.

In housing expenses, the subcategories include the phone bill, mortgage, maintenance, etc and the monthly living expense category includes groceries, food, childcare, etc. In long-term expenses, you can budget for insurance, savings, and investment.

Along with that, you get a paycheck budget template and a money goals template. DOWNLOAD

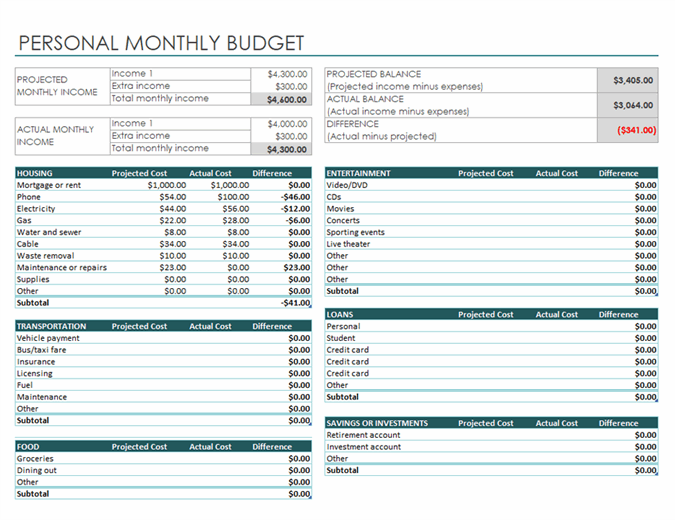

20. Templates Office monthly budget template

A comprehensive personal monthly budget tracker with a simple interface. At the top are projected monthly income and actual monthly income.

There are twelve different expense categories which include: dozens of subcategories. This helps you get all the expense categories in one place and no need to add or delete the columns. All categories columns are followed by projected cost, actual cost, and difference. Below is the subtotal of the category.

You can download this template in an Excel sheet to use it on computer or tablet devices. DOWNLOAD

21. Canva monthly budget template

Canva provides dozens of budget templates and expense trackers. They are so simple and include an income, fixed expenses, other expenses, and a recap of goals, actual value, and difference. You can customize these templates in Canvas as you require. DOWNLOAD

22. Life And A Budget monthly budget template

The simple budget worksheet with a list of expenses, amount, date, budgeted or estimated value, and the actual amount. Above are four columns of income sources. In the footer, there is a difference between the estimated and actual amounts. DOWNLOAD

23. Money Wise Steward monthly budget template

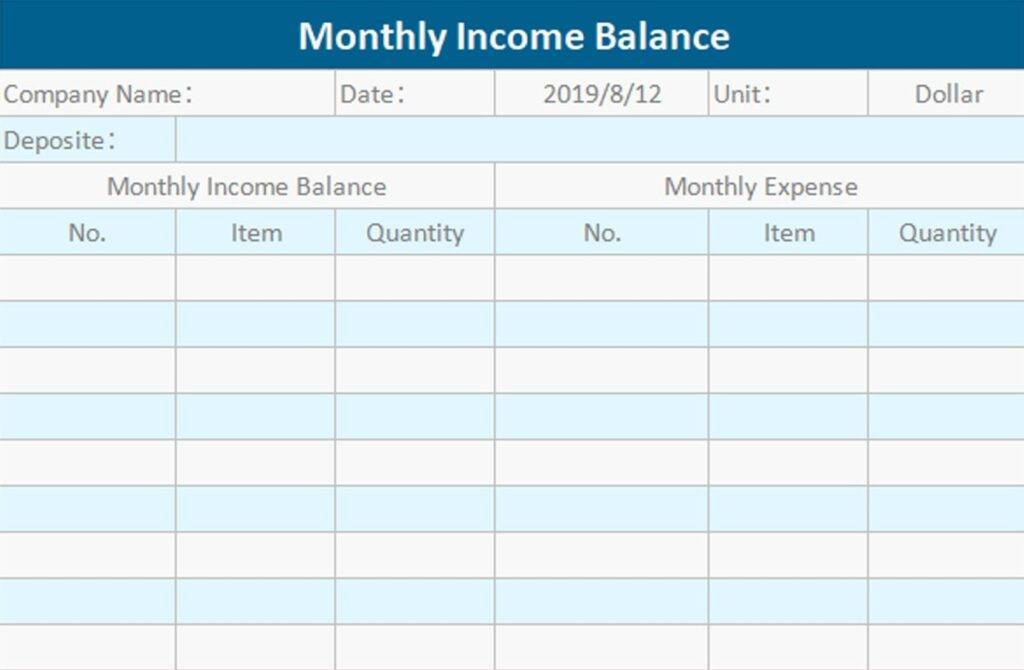

MoneyWiseStewards provides a free PDF budget template with names of 12 months on top and total income below it.

The expenses are divided into two main categories that are fixed and variable expenses followed by budgeted and actual values. Below are the debt and savings expenses columns that are long-term expenses. In front of that is total income, total fixed and variable expenses, debt/ savings, and last is leftover.

This helps you get a clear view of how much you’re spending in different expense categories, savings and debt, and how much is left. DOWNLOAD

24. Organize My House monthly budget template

A simple one-page template with two tables including an income table and an expensive table. You can write budgeted and actual amounts with due dates in front of these columns. But remember to print this template on 100 gsm or 120 gsm paper to get better results. You can subscribe to their templates library and access 100+ templates. DOWNLOAD

25. Develop a Good Habits monthly budget template

Provide free monthly budget tracker and monthly budget planner in PDF format. The monthly budget planner is a simple sheet with a date, description, category name, and amount while at the end is the total amount. It’s best for tracking expenses like bills and debt payments. Download here

The second template is a complete budgeting sheet with income sources and an expense box. But you’ve to write the total amount for every 5 major categories. You can’t add subcategories. It’s best if you don’t want to handle more than one page of budget templates in your budget binder. Download here

26. Everyday Chaos And Calm monthly budget template

Have six free PDF templates with a one-page printable setup. Here they’re:

- Simple income, expenses, and savings budget template

- Detailed expense tracker

- Monthly budget planner with income, fixed and other expenses, and debt/savings

- Monthly budget planner with income, debt, savings, and expenses tracking

- Monthly budget with expense tracking (a black and white sheet)

- Comprehensive one-page budget planner with columns (income, savings, household, daily living, debt/loans, miscellaneous, funds, totals, and notes at the end). DOWNLOAD

27. WPS monthly budget template

A range of budgeting templates is available on WPS. they not only have personal and household budget templates but also business budget templates. All of the templates are in simple .xlsx format with free and premium as well. Here are the different templates you can download:

- Expenditure budget worksheet

- Decoration budget worksheet

- Marriage budget plan

- Financial monthly budget plan

- Personal monthly budget template

- Monthly household budget Excel sheet

They’re customizable as needed and you can enter or remove values and columns. DOWNLOAD

28. The Balance Money budget templates

Have articles on best spreadsheet templates from software like Pearbudget and Tiller’s Money. This software is paid but you can try them for free with many budgeting templates as well. DOWNLOAD

29. The Savvy Couple monthly budget template

It’s a beautiful multi-color template with a simple one-page format. Includes income row, fixed + variable expenses columns, and debt/savings. At the end is a total of all these and different by subtracting them from income.

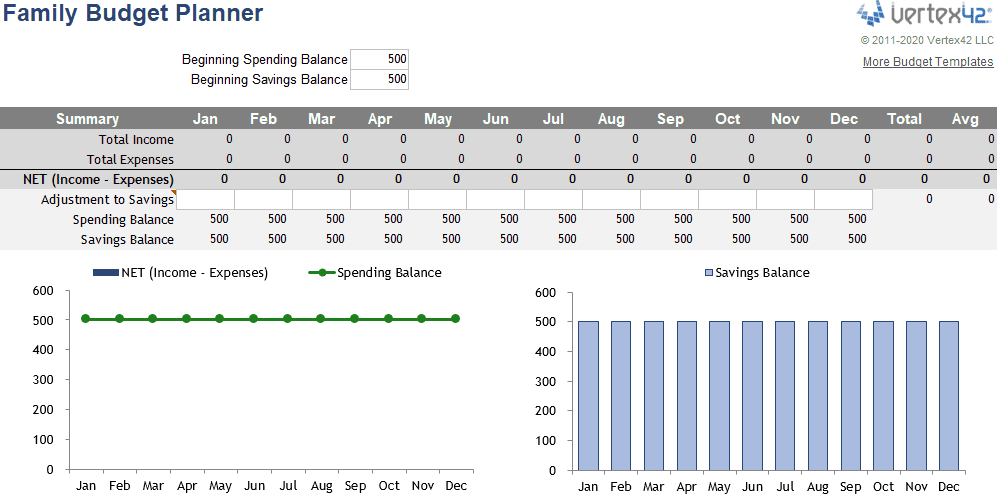

30. Vertex42 monthly budget template

Give free budget templates in all three formats which are pdf, excel, and google sheets. Along with that, the templates are in different varieties including household budget worksheets, monthly budget spreadsheets, event budget planners, wedding budget sheets, and zero-based budgeting templates as well. You can also download free templates for your business budget as well. DOWNLOAD

31. Spreadsheet 123 monthly budget templates

There are multiple different types of budget templates you can download for free. Whether you want it in Excel, Google Docs, or OpenOffice they’re easily downloadable and customizable. A total of 15 budget templates are present that are so comprehensive and cover all the categories of expenses. I recommend you download the personal and family budget templates in Excel format. DOWNLOAD

Other Helpful Posts:

$62000 a Year Is How Much an Hour? Is It Enough To Live?

$90000 a Year Is How Much an Hour After Taxes (US)? Is It Good?

$52000 A Year Is How Much An Hour? Is $52K Enough?

80000 A Year Is How Much An Hour? Is It A Good Salary?

70000 A Year Is How Much An Hour? Is $70K/Year A Good Salary?

40 an Hour is How Much a Year? Is $40 a Good Wage Rate?

18 An Hour Is How Much A Year? Can You Afford the Expenses?

33 An Hour Is How Much A Year? Is It Enough To Live?

What are the types of budgeting templates?

Budgeting templates fall into different types. Below are some types which help you decide which type of templates you need. Let’s explain them briefly.

General budget templates

These templates are commonly used for making personal, family, and college student budgets.

1. Personal budget template

It’s used for budgeting money for an individual’s expenses. Here you only budget your income and spending, not your family.

2. Family or household budget template

This budget takes into account all of your household income and spending including food, transportation, utility bills, mortgage, and family shopping. All the expenses of the entire family and house are listed in it.

These two templates are most commonly used in this category. The college budget is used by students to manage their educational finances.

Related Post: How to Do Zero-Based Budgeting Using 5 Simple Steps?

Budget templates based on time

These budget templates are also categorized based on the period. These templates help you budget according to your budgeting period. For example, weekly, bi-weekly, monthly, etc. And if you fall into those people who receive paychecks weekly, bi-weekly, or monthly basis then you can use these templates.

According to statistics, 36.5% of Americans receive a salary biweekly, 32.4% weekly, 19.8% semimonthly, and 11.3% every month.

1. Weekly budget template

If you receive income every week from your boss then your spending is also following the weekly time frame. In this situation, a weekly budget is a good option to choose. 32.4% of Americans receive a salary every week. But make sure you should set aside money for payments that occur at the end of the month.

2. Bi-weekly budget template

A bi-weekly budget is best to choose if you receive paychecks after 2 weeks. You can estimate income and spending every two weeks. According to the BLS, 43% of Americans receive a salary on a bi-weekly basis. If you fall into this category then using a bi-weekly budget template is the right option.

3. Monthly budget template

in the USA 11.3% of Americans receive paycheques every month. And for the monthly income, you need to do budgeting every month. So you need to have a monthly budget template.

4. Yearly budget template

A budget template is used to budget for the whole year. It gives you an estimation of income and spending over 12 months.

Budget templates based on methods

The third major category of budgeting templates follows methods of budgeting. The famous budgeting methods include zero-based budgeting and the 50-30-20 rule.

1. Zero-based budgeting template

The zero-based budgeting method helps you put every penny into work. When you subtract expenses from income then $0 remains at the end. This means all of your income and expenses are justified and nothing is left idle.

2. 50/30/20 budget template

This rule purports that you spend 50% of your income on needs, 30% on wants, and 20% on paying off and saving. There is also $0 left at the end, and your income is used up.

Related Post: 1389 Best Personal Finance Blogs To Sharpen Your Financial Wisdom

Budgeting template for occasions

Your life is full of locations and events and for these events, you need to spend money. To make sure you don’t overspend your money it is best to budget for them early. The common events are weddings, holidays, traveling, and birthday parties. You are lucky that budgeting templates are available for these kinds of events.

1. Wedding budget template

A wedding budget template helps you categorize and list all of your wedding expenses and estimate the cost in advance. Using this template you can prepare for wedding expenses in advance and ensure you don’t go overboard. The common costs include wedding dresses, dinner, gifts, makeup, music, and drinks.

2. Holidays budget template

Holidays are also part of our life and you can’t avoid them. For example, Christmas, Easter, and New Year celebrations. You can estimate the expenses in advance like gifts, holiday parties, and going out with friends.

Related Post: How to Get Student Loan Forgiveness? Who Will Qualify?

Budgeting templates based on the format

The fourth major category of budgeting templates is based on the formats. The formats are very important because they help you categorize, list, export, import, and print out the budget. Here are the common formats available:

1. Microsoft Excel budget template

MS Excel budgeting is mainly used because this software is available on all types of computers. But here you need to save the data yourself by pressing Control + S. You can also draw graphs and charts to better analyze your financial performance.

2. Google Sheets budget template

Google Sheets are online and it doesn’t work without the internet. It exhibits the majority of functionalities of Microsoft Excel but with one addition it saves your data automatically. A pre-made budgeting template is also available in Google Sheets. You can download the file and upload an Excel file through Google Drive to open it in Google Sheets.

3. PDF budget template

PDF budgets are easily printable but you need to write down the budget using a pen. Unfortunately, PDF templates are not easily editable.

Related Post: How to Pay Off Credit Card Debt Fast (17 Quick Tips)

What are the features of budgeting templates?

Choosing an effective budgeting template is important with all the necessary features. Here is what to look for in the budgeting template:

- it should have all the necessary income and expense categories pre-listed so you have time to customize them

- the calculation should be accurate so that your budget helps in achieving the end goal

- formulas should be proper and give accurate answers

- it automatically calculates differences between actual and estimated values to help you better understand the budgeting picture

- the calculation should be automatic so you don’t need to enter formulas and calculate them on your own

- there should be a category for irregular expenses that occur infrequently other than normal course

- graphic visualization is also important to understand the performance of your budget

If these features are present in a template then you can use that. And remember don’t frequently change budgeting templates and only stick to a single one.

Related Post: 15 Personal Finance Topics You Should Master In 2022

What should you include in the budget template?

Here is what you should include in your budget template:

- include all of your income sources which can be salary, paychecks, dividends, return on investment, small business, and side hustle

- have a food category with subcategories like groceries, meat, rice, drinks, and cooking oil

- housing category with expenses like decoration, mortgage, furniture, and cleaning

- utility expenses like electricity, gas, water, and garbage bill

- debt and loans, for example, a student loan, personal loan, credit card, or HELOC

- transportation expenses including fuel, car maintenance, car loan payments, and tunning

- health care expenses like medical bills, doctor fees, child treatment, or any other

- personal care products expenses like shampoo, makeup, skincare products, soaps, and hair care

- Savings whether it’s retirement savings of 401k or IRA, emergency savings, any investment in bonds, stocks, mutual funds, or a savings account

- Miscellaneous category for any unusual expense that may occur unexpectedly like birthday gifts, wedding gifts, and traveling out of the city

- A sinking fund is used for saving money for big purchases in the future like refrigerators, deep freezers, washing machines, or even holiday gifts

Related Post: 33 Tricks on How to Save Money on Groceries

How to use a budget template?

Budgeting templates make your job easier but this doesn’t mean that work is done. There are some tips you need to follow to take more benefits from a budget template. Let’s take a brief look at them:

- choose a template with already listed categories and you don’t need to write them yourself

- customize the budget categories by adding and deleting some of them

- don’t edit or change formulas because it may lead to inaccurate calculations just enter your values

- avoid using the same copy of the template for making multiple budgets instead a use separate copy for next month

- make sure that the template has a different column to analyze in which category you spent more or less in a given month

- download the budget and save it somewhere on your desktop to review and compare it later on

If you follow these tips and tricks then your budget will stay accurate and help you achieve your financial goals. You also don’t face any problems while making the budget.

Related Post: 20 Budget Templates To Confidently Track Your Money

How to create a monthly budget template?

Creating a simple monthly budgeting template is easy. There are some simple steps you need to follow which are below:

- choose a software either Microsoft Excel or Google Sheets

- give a title like “budget for April” and save it somewhere on the laptop if you’re using Excel while for Google Sheets no need to save.

- choose three columns below the title category name, estimated, and the actual amount

- after that in the first column list all your income sources

- and list down expenses in two to three cells below in the same income column

- if you want you can add any graphics after inserting the estimated amounts of figures

And that is it. Your budget template is ready and now make sure to have several copies to help you budget each month from scratch.

What are the budgeting methods?

There are some well-known budgeting methods to make your budgeting process easy. Let’s have a look at their names:

- Cash Envelope system

- Zero-based budgeting

- 50/30/20 budgeting

- Pay yourself first budgeting

- 60% budgeting method

- The no-budget budgeting

- The barebone budgeting

The majority of people prefer to use the 50-30-20 rule also called a balanced budgeting system. It’s not only easy to implement but reliable.

How to stick to a monthly budget?

Making a monthly budget isn’t difficult. You take a template and write down your values and the monthly budget is ready. The difficult part is following that budget throughout the month. This is where people can’t cope with and fail.

I think the key to following the budget is to follow frugal living tips. Here I’m sharing some important frugal living tips and for others, you need to read the article on our website:

- make a shopping list before going shopping

- unsubscribe from online stores like Amazon, eBay, Aliexpress, and others to avoid impulse buying

- limit eating outside and fun activities within your budget amount

- cut down multiple credit cards and go for low-interest credit cards

- follow tips to save money on electricity, water, and gas bills

Conclusion

I have reviewed downloadable monthly budget templates including personal and family budget templates.

These templates make a lot of your job easier because they provide a premade format. You don’t need to structure lines from scratch.

By following the links you can download them from their respective websites.

Now it’s your turn to how you make your budget and stick to it to achieve your desired financial goals.

I hope you enjoyed this post and got a lot of value. You can now share your opinion on which monthly budgeting template you download for next month’s budget.

Other Helpful Posts:

23 Money-Saving Challenge Ideas To Build A Big Saving Fund

Rich vs Wealthy: 13 Tips On How to Become Wealthy

40 Personal Finance Tips To Effectively Manage Your Money

How to Create a Personal Budget [6 Easy Steps] PLUS Template

31 Budgeting Tips for Beginners to Easily Grow Your Savings

Budget by Paycheck Workbook: 6 Steps for Making a Paycheck Budget

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024