Last updated on March 10th, 2024 at 04:28 am

In this post, you’ll learn, what is a money-saving challenge. Also, 23 challenge ideas to save big money fund.

Savings are the most important part of your personal finance.

We all face different money needs for emergencies, holidays, vacations, and buying assets like a car.

For all of that, you need money and if you don’t have anything saved separately then you may face problems or go into debt.

To fill up these ditches with saving funds, you can do a money-saving challenge.

So let’s jump into the step-by-step guide.

What Is A Money-Saving Challenge?

They are different types of activities to help you stash some money, change your monetary habit, cut back expenses or track the expenses.

A money-saving challenge either helps you save money throughout a certain period of time to meet a certain financial need. But some challenges don’t directly save you money instead help you avoid a bad habit or track expenses and cut back on useless items. So you save money indirectly.

The money-saving challenge is used for:

- Meeting certain financial goals like paying credit card debt, car payment, student loan payment, and building an emergency fund of $5000

- Saving money for a vacation to have fun and enjoyment with family

- Covering holidays expenses like Christmas and easter

- Tracking expenses and cutting back on useless items

- Stopping impulse purchasing and buying what you really need

- Avoiding a habit that is eating up your money like eating out, buying coffee, and wearing branded items, or online automatic renewable subscriptions

When you do a saving challenge then a clear decreasing effect is seen in your money outflow and increase in saving.

Related Posts:

Cheap Grocery List 150+ Items: 17 Tips to Save More Money

12 Quick & Easy Financial Tricks on How to Stop Wasting Money

23 Easy Ways to Save $20000 In a Year From Your Salary (2024)

Why Should You Do A Money-Saving Challenge?

There are certain benefits to why you do a saving challenge:

- Helps you develop good money habits and get financial motivation

- You become accountable for spending

- and develop financial intelligence

- You can pay off debt, build an emergency fund, and cover vacation expenses

- You can cope with retirement fund

- If enough funds are built you can put them into a mutual fund or a high-yield saving account to earn an extra stream of income.

- You learn how to achieve a certain financial goal

- Build a budget and analyze your expenses to cut back extra ones

- Improve your personal finances and create fun in your life

Related Post: What is a No-Spend Challenge? 7 Simple Tricks to Do It Yourself

How To Pick A Money-Saving Challenge?

There are five major personality types when it comes to money. That is big spenders, shoppers, debtors, savers, and investors.

Which saving challenge you are going to choose depends on the type of money personality and traits you have.

1. Big Spenders

The big spenders don’t care about debt and spend money blindly. They love new cars, branded products, and gadgets. And take big risks in investing.

2. Shoppers

Like spenders, shoppers also love to buy things and spend money but with one difference of buying bargains. They spend money when they see a bargain even if that item is not necessary that is impulse purchasing.

Related Post: 33 Tricks on How to Save Money on Groceries

3. Debtors

The third type is debtors whose spendings are more than their earnings and to satisfy their appetite they spend more with credit cards and consumer loans which creates a big debt mountain. They don’t concern about matching 401k as well.

Related Post: 133 Frugal Living Tips to Save Money and Build Your Financial Future

4. Savers

Savers are people who try to accumulate a lot of money by saving and minimizing expenses. They don’t spend much money on the latest products and branded products, turn off lights and look like cheap stakes which they usually aren’t.

They are basically frugal and love to secure investments and earn interest on savings accounts. Savers are totally the opposite of big spenders. They avoid impulse purchases and cut back on extra expenses which is a good habit.

Related Post: 59 Ways on How to Save Money Even If You Find it Difficult

5. Investors

The fifth and last are investors. They are financially literate and intelligent people who take calculated risks, buy assets, and always look to increase passive income while minimizing liabilities. One of the best examples is people like warren buffet and Robert Kiyosaki. Always try to achieve certain financial goals and know how money works as well as how to put it to work for covering their expenses.

You pick up the money-saving challenge based on this personality. Apply these five definitions to yourself and identify your money personality. The below money-saving challenges can be used by any of the above five money personalities.

So let’s jump to the next section…

What Are The Types Of Money-Saving Challenges?

Here are the 23 different Saving Challenge Ideas. You can try any one of these that best suits your personality type from the above five.

Let’s briefly explain each one of them.

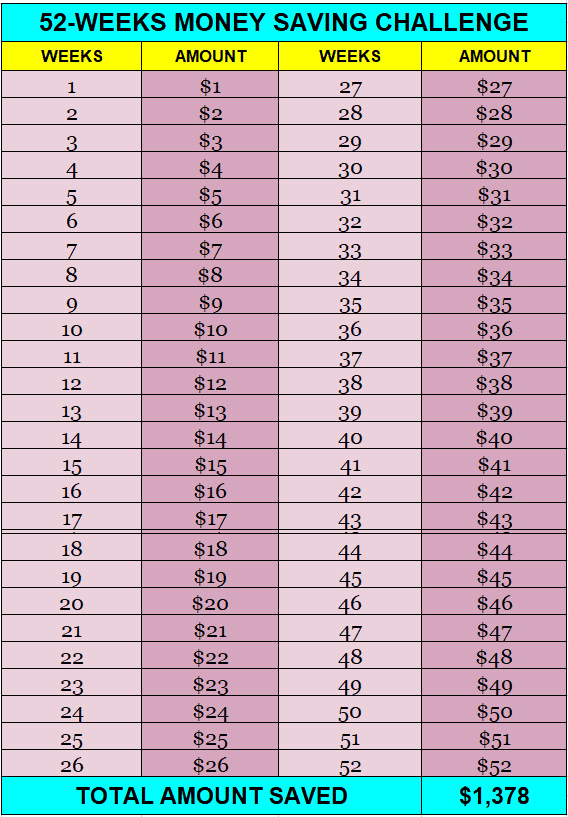

1. 52-Week Money-Saving Challenge

It’s one of the easiest challenges. Here you save an increasing amount of money each week for 52 weeks.

Why this challenge is easy because it doesn’t require much money.

Here you start by depositing $1 in the first week, $2 in the second week, $3 in the third week, and so on until 52 weeks. The arithmetic series of your deposits look like this: $1 + $2 +$3 +…….+ $52 = $1378.

In the last 52nd week you save $52. As a result, your total saving fund for the whole period becomes l$1,378 which is a good amount of income especially if your income is low.

Here is a complete table of how this process works:

Related Post:

$50000 A Year Is How Much An Hour? Can You Live On It?

How to Create a Personal Budget [6 Easy Steps] PLUS Template

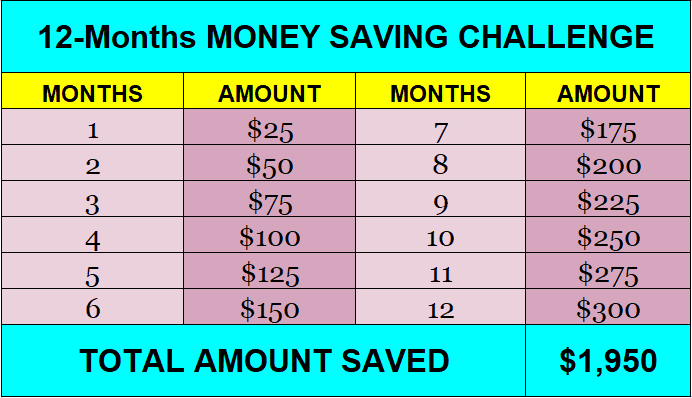

2. 12 Months Money-Saving Challenge

It sounds like the same as a 52-week challenge but with one difference which is you save money each month for the next 12 months.

You can start with as little as $25 and start saving with the increasing amount each month. For example, in January you saved $25, in February $50, in March $75, and so on. At the end of 12 months, you’ll have $1950 in your pocket. This strategy is best if you can’t afford to save more than that.

If your income is higher then you can increase the amount.

Here is the table of how it works:

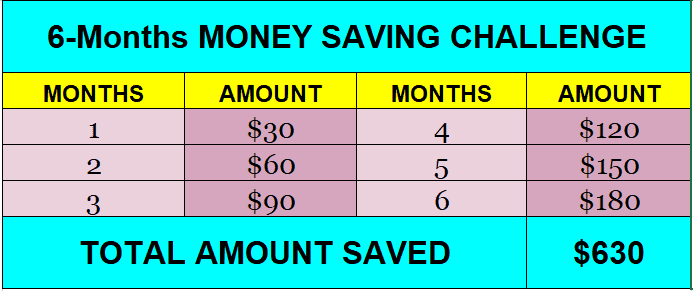

3. 6 Months Saving Challenge

This challenge is the same as you do the 12 monthly challenge but here you increase by $30 in each of the next months.

In the first month, you save $30, in the second $60, and in the third month $90 until 6th month. Here is the table:

4. 3 Months Money-Saving Challenge

This challenge is straightforward. Here you save $100 each month for 3 months and at the end, you have $300 in savings. Another way is to save $200 each month for 3 months and you have $600 at the end of the period.

5. 1-Month or 30 Days-Saving Challenge)

There are three main options you can try. You can either save each day for the next 30 days, save each week for the next 4 weeks, or save a certain amount one time out of the salary.

If you don’t like the first two options then save $100 to $500 in a single month out of the salary. Then continue the challenge next month. For example, you save $100 each month. So if you continue it for the next 6 months you’ll have $600 at the end of six months.

RELATED POST: How To Make a Budget Binder In 4-Simple Steps (Free Templates)

6. Biweekly Saving Challenge

This money-saving challenge is the best option if you are a beginner and a holiday is coming soon.

The best strategy here is that you start with a $10 ad of $5 each day. For example, you save $10 on the first day then 15 dollars on 2nd day 10 20 Dollars 25 until the 14th day.

Related Post: 30 Money-Saving Charts To Track Your Savings And Debt Pay-Off

7. 1 Week Saving Challenge

You can do this money-saving challenge for your practice as a beginner. Here you can start with $10 each day for the next 7 days. They help you develop the habit of saving money or avoiding a bad habit which is eating out your earnings. So you can easily do the long money by having colleges in the future and don’t get motivated.

8. 26-Week Saving Challenge Biweekly

This money-saving challenge is very interesting. Here you don’t have to save money each week instead you save money each of the next weeks for 26 weeks. For example, if you say $5 in the first week then you save $10 in the third week 10 15 in the 5th week so on and so forth until 52 weeks. So you saved money 26 weeks out of 52 weeks with an increasing amount each of the next week. Here is a table of 26-week money-saving challenges by weekly process

Related Post: Cash Envelope System: 9-Simple Steps To Do Envelope Budgeting

9. Daily Nickel Saving Challenge

There are two ways to do this challenge. The first is to save a nickel (which is equal to 5 cents) each day with increasing amounts. For example, if you save 5 cents the first day, then save 10 cents the next day, then 15 cents, and so on until 365 days when you save $18.40.

All of this adds up and the total amount becomes $3300 in a single year. It will be a big success. Here is how this process works:

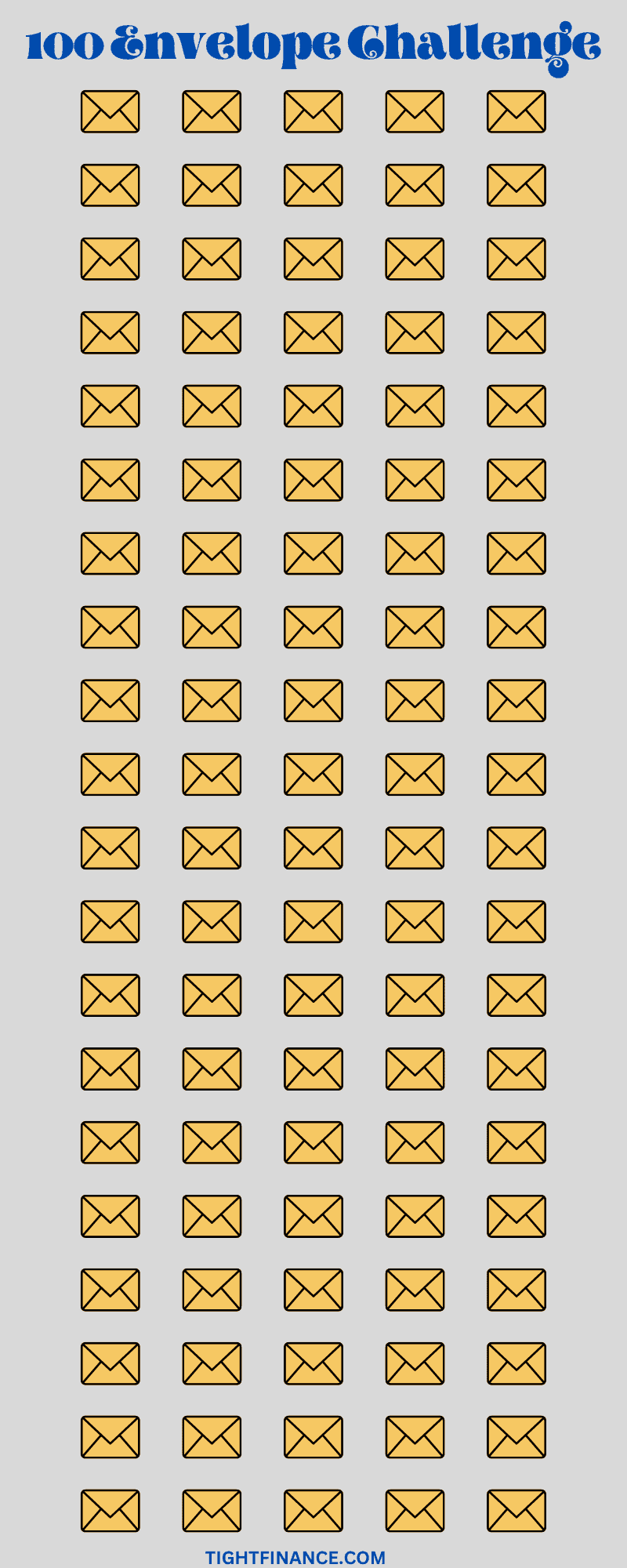

10. 100-Day Saving Challenge

This challenge is also called the 100 envelope challenge and 100-day money challenge.

In this challenge, you take 100 envelopes and number them from 1 to 100. After that, you randomly choose an envelope each day and see the number. After that, you put an equal amount of dollars in it according to his number.

For example, you randomly picked up envelope#30 and now put $30 in it. Continue this challenge for 100 days and at the end of 100 days you have saved more than $5050. That is a good amount of money.

11. $1000 Money-Saving Challenge

This challenge depends on the time in which you want to achieve $1000 in savings. Now there are different combinations. You can either achieve it in 30 days but that requires $1000 money out of your pocket which may be difficult if your income is low.

The second method that I think is easy is to achieve that amount in 90 days or 3 months. Here you save $11 each day throughout 89 days while on the last day, you save $21. When you count all of the money its sum equals $1000.

Here is a table of how the process works for 90 days:

| DAYS | AMOUNT | DAYS | AMOUNT |

| 1 | $11 | 46 | $11 |

| 2 | $11 | 47 | $11 |

| 3 | $11 | 48 | $11 |

| 4 | $11 | 49 | $11 |

| 5 | $11 | 50 | $11 |

| 6 | $11 | 51 | $11 |

| 7 | $11 | 52 | $11 |

| 8 | $11 | 53 | $11 |

| 9 | $11 | 54 | $11 |

| 10 | $11 | 55 | $11 |

| 11 | $11 | 56 | $11 |

| 12 | $11 | 57 | $11 |

| 13 | $11 | 58 | $11 |

| 14 | $11 | 59 | $11 |

| 15 | $11 | 60 | $11 |

| 16 | $11 | 61 | $11 |

| 17 | $11 | 62 | $11 |

| 18 | $11 | 63 | $11 |

| 19 | $11 | 64 | $11 |

| 20 | $11 | 65 | $11 |

| 21 | $11 | 66 | $11 |

| 22 | $11 | 67 | $11 |

| 23 | $11 | 68 | $11 |

| 24 | $11 | 69 | $11 |

| 25 | $11 | 70 | $11 |

| 26 | $11 | 71 | $11 |

| 27 | $11 | 72 | $11 |

| 28 | $11 | 73 | $11 |

| 29 | $11 | 74 | $11 |

| 30 | $11 | 75 | $11 |

| 31 | $11 | 76 | $11 |

| 32 | $11 | 77 | $11 |

| 33 | $11 | 78 | $11 |

| 34 | $11 | 79 | $11 |

| 35 | $11 | 80 | $11 |

| 36 | $11 | 81 | $11 |

| 37 | $11 | 82 | $11 |

| 38 | $11 | 83 | $11 |

| 39 | $11 | 84 | $11 |

| 40 | $11 | 85 | $11 |

| 41 | $11 | 86 | $11 |

| 42 | $11 | 87 | $11 |

| 43 | $11 | 88 | $11 |

| 44 | $11 | 89 | $11 |

| 45 | $11 | 90 | $21 |

12. $5k Saving Challenge

You can save $5000 in 100 days. Here you can either follow the 100 envelope money challenge which is discussed above. Here the total will be $5050 at the end.

But there is a downside to using the 100-envelope challenge. After 50 days the monthly saving requirement increases. If your income is higher and you don’t feel difficult then you can go with this method.

There are two solutions to this problem. The first is to save $50 for 100 straight days while the second way is to save $25 for 200 days.

In the first money-saving challenge you have to take out $1500 per month from your monthly income. But if you feel difficulty with this challenge then extending it to 200 days only forces you to save $750 per month and $250 in the last 10 days.

13. 10k Saving Challenge

As the name suggests here you have to save $10000 in a specific period of time. There are many blueprints you can use if you search online. But the simplest method is to follow a 357 days blueprint to hit a $10000 saving challenge.

Here you save $28 each day for 356 days straight but on the 357th day, you save $32 to cover the extra 4 dollars requirement.

Follow the blueprint shown in the image:

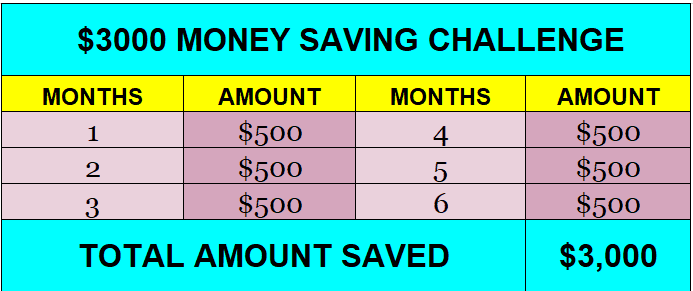

14. $3000 Saving Challenge

The Saving $3000 money challenge aims to save $3000 in a year, 6 months, 3 months, or in a single month. It’s your choice which option you want to go with depending on your monthly income and expenses.

If you go with 30 day $3000 saving challenge then you have to save $100 for 30 straight days. But it can be difficult because it becomes difficult to cover necessary expenses during the month. So the chances of failure increase.

While in the other three options, you can do it easily. In 3 months you have to save $1000 each month for 3 months. While 6 monthly challenge requires you to save $500 and with a 12-month challenge you only have to set aside $250 a month.

Here is how the process of all four options works:

15. $1 Bill Money-Saving Challenge

In this challenge, you have to save all the $1 bills throughout the year. Whether you go shopping or you find any $1 bill in your pocket put them into a piggy bank or a big jar.

After that when 52 weeks or 365 days are complete then count them. I guarantee you’ll have a big stash of cash.

16. $20 Saving Challenge

Another easy-to-do challenge in which you save $20 each week for 52 weeks. This helps you save a whopping $1040 if you stay successful.

If you have a higher income then you can choose to do it on a daily basis. That’s saving $20 each day for 365 days of the year. In the end, you’ll have $7300, a good stash of cash for emergencies or curing the retirement plan.

17. 2000 Money-Saving Challenge

You can complete this challenge in 30 days, 50 days, 100 days, and 200 days as well. It depends on your choice which option you are easy with.

If you follow the 30 days plan then you have to save $66 for 29 days and then $86 on the 30th day. In 50 days you save $40 per day, in 100 days $20 per day, and in 200 days $10 per day.

If your income is low then following 100 and 200 days blueprints is best.

18. Coin Saving Challenge

It’s a fun challenge to do. Here you save coins change you get from shopping, groceries markets, and supermarket. To do this money-saving challenge you can take a jar and start putting coins into it for a whole year.

When the 52 weeks or 365 days are complete you can put those coins into a Coinstar machine and take cash from a local retail store near the machine. You can also do shopping with that money.

The second option is to arrange those coins in plastic bags and take them to the local bank. The cashier or managers put them on a coin counter and give you the cash amount.

19. $5 Challenge

The $5 challenge is comprised of 52 weeks timeframe. You start by putting $5 on the first week, $10 on the second week, and so on with an increasing amount until 52 weeks. Here is how the series works:

If you’re not comfortable with the above timeframe and process then the second time frame is daily. Here you save $5 per day for 365 straight days. In the end, the total sum you save will be $1825. Here is a blueprint:

20. 20k Challenge

It means saving $20,000 in a year. Here you can either choose to save a variable amount per day or each week till 52. Another way is to save $55 per day for 364 days and enjoy success on the 365th day.

If you become successful in achieving the 20k saving goal then you can easily pay off debt payments and spend towards a retirement plan. You can also choose to invest that amount in a high-return opportunity. The high-yield saving account can also help you earn a yearly return.

Here is how the two blueprints work:

| DAYS | AMOUNT | DAYS | AMOUNT |

| 1 | $55 | 183 | $55 |

| 2 | $55 | 184 | $55 |

| 3 | $55 | 185 | $55 |

| 4 | $55 | 186 | $55 |

| 5 | $55 | 187 | $55 |

| 6 | $55 | 188 | $55 |

| 7 | $55 | 189 | $55 |

| 8 | $55 | 190 | $55 |

| 9 | $55 | 191 | $55 |

| 10 | $55 | 192 | $55 |

| 11 | $55 | 193 | $55 |

| 12 | $55 | 194 | $55 |

| 13 | $55 | 195 | $55 |

| 14 | $55 | 196 | $55 |

| 15 | $55 | 197 | $55 |

| 16 | $55 | 198 | $55 |

| 17 | $55 | 199 | $55 |

| 18 | $55 | 200 | $55 |

| 19 | $55 | 201 | $55 |

| 20 | $55 | 202 | $55 |

| 21 | $55 | 203 | $55 |

| 22 | $55 | 204 | $55 |

| 23 | $55 | 205 | $55 |

| 24 | $55 | 206 | $55 |

| 25 | $55 | 207 | $55 |

| 26 | $55 | 208 | $55 |

| 27 | $55 | 209 | $55 |

| 28 | $55 | 210 | $55 |

| 29 | $55 | 211 | $55 |

| 30 | $55 | 212 | $55 |

| 31 | $55 | 213 | $55 |

| 32 | $55 | 214 | $55 |

| 33 | $55 | 215 | $55 |

| 34 | $55 | 216 | $55 |

| 35 | $55 | 217 | $55 |

| 36 | $55 | 218 | $55 |

| 37 | $55 | 219 | $55 |

| 38 | $55 | 220 | $55 |

| 39 | $55 | 221 | $55 |

| 40 | $55 | 222 | $55 |

| 41 | $55 | 223 | $55 |

| 42 | $55 | 224 | $55 |

| 43 | $55 | 225 | $55 |

| 44 | $55 | 226 | $55 |

| 45 | $55 | 227 | $55 |

| 46 | $55 | 228 | $55 |

| 47 | $55 | 229 | $55 |

| 48 | $55 | 230 | $55 |

| 49 | $55 | 231 | $55 |

| 50 | $55 | 232 | $55 |

| 51 | $55 | 233 | $55 |

| 52 | $55 | 234 | $55 |

| 53 | $55 | 235 | $55 |

| 54 | $55 | 236 | $55 |

| 55 | $55 | 237 | $55 |

| 56 | $55 | 238 | $55 |

| 57 | $55 | 239 | $55 |

| 58 | $55 | 240 | $55 |

| 59 | $55 | 241 | $55 |

| 60 | $55 | 242 | $55 |

| 61 | $55 | 243 | $55 |

| 62 | $55 | 244 | $55 |

| 63 | $55 | 245 | $55 |

| 64 | $55 | 246 | $55 |

| 65 | $55 | 247 | $55 |

| 66 | $55 | 248 | $55 |

| 67 | $55 | 249 | $55 |

| 68 | $55 | 250 | $55 |

| 69 | $55 | 251 | $55 |

| 70 | $55 | 252 | $55 |

| 71 | $55 | 253 | $55 |

| 72 | $55 | 254 | $55 |

| 73 | $55 | 255 | $55 |

| 74 | $55 | 256 | $55 |

| 75 | $55 | 257 | $55 |

| 76 | $55 | 258 | $55 |

| 77 | $55 | 259 | $55 |

| 78 | $55 | 260 | $55 |

| 79 | $55 | 261 | $55 |

| 80 | $55 | 262 | $55 |

| 81 | $55 | 263 | $55 |

| 82 | $55 | 264 | $55 |

| 83 | $55 | 265 | $55 |

| 84 | $55 | 266 | $55 |

| 85 | $55 | 267 | $55 |

| 86 | $55 | 268 | $55 |

| 87 | $55 | 269 | $55 |

| 88 | $55 | 270 | $55 |

| 89 | $55 | 271 | $55 |

| 90 | $55 | 272 | $55 |

| 91 | $55 | 273 | $55 |

| 92 | $55 | 274 | $55 |

| 93 | $55 | 275 | $55 |

| 94 | $55 | 276 | $55 |

| 95 | $55 | 277 | $55 |

| 96 | $55 | 278 | $55 |

| 97 | $55 | 279 | $55 |

| 98 | $55 | 280 | $55 |

| 99 | $55 | 281 | $55 |

| 100 | $55 | 282 | $55 |

| 101 | $55 | 283 | $55 |

| 102 | $55 | 284 | $55 |

| 103 | $55 | 285 | $55 |

| 104 | $55 | 286 | $55 |

| 105 | $55 | 287 | $55 |

| 106 | $55 | 288 | $55 |

| 107 | $55 | 289 | $55 |

| 108 | $55 | 290 | $55 |

| 109 | $55 | 291 | $55 |

| 110 | $55 | 292 | $55 |

| 111 | $55 | 293 | $55 |

| 112 | $55 | 294 | $55 |

| 113 | $55 | 295 | $55 |

| 114 | $55 | 296 | $55 |

| 115 | $55 | 297 | $55 |

| 116 | $55 | 298 | $55 |

| 117 | $55 | 299 | $55 |

| 118 | $55 | 300 | $55 |

| 119 | $55 | 301 | $55 |

| 120 | $55 | 302 | $55 |

| 121 | $55 | 303 | $55 |

| 122 | $55 | 304 | $55 |

| 123 | $55 | 305 | $55 |

| 124 | $55 | 306 | $55 |

| 125 | $55 | 307 | $55 |

| 126 | $55 | 308 | $55 |

| 127 | $55 | 309 | $55 |

| 128 | $55 | 310 | $55 |

| 129 | $55 | 311 | $55 |

| 130 | $55 | 312 | $55 |

| 131 | $55 | 313 | $55 |

| 132 | $55 | 314 | $55 |

| 133 | $55 | 315 | $55 |

| 134 | $55 | 316 | $55 |

| 135 | $55 | 317 | $55 |

| 136 | $55 | 318 | $55 |

| 137 | $55 | 319 | $55 |

| 138 | $55 | 320 | $55 |

| 139 | $55 | 321 | $55 |

| 140 | $55 | 322 | $55 |

| 141 | $55 | 323 | $55 |

| 142 | $55 | 324 | $55 |

| 143 | $55 | 325 | $55 |

| 144 | $55 | 326 | $55 |

| 145 | $55 | 327 | $55 |

| 146 | $55 | 328 | $55 |

| 147 | $55 | 329 | $55 |

| 148 | $55 | 330 | $55 |

| 149 | $55 | 331 | $55 |

| 150 | $55 | 332 | $55 |

| 151 | $55 | 333 | $55 |

| 152 | $55 | 334 | $55 |

| 153 | $55 | 335 | $55 |

| 154 | $55 | 336 | $55 |

| 155 | $55 | 337 | $55 |

| 156 | $55 | 338 | $55 |

| 157 | $55 | 339 | $55 |

| 158 | $55 | 340 | $55 |

| 159 | $55 | 341 | $55 |

| 160 | $55 | 342 | $55 |

| 161 | $55 | 343 | $55 |

| 162 | $55 | 344 | $55 |

| 163 | $55 | 345 | $55 |

| 164 | $55 | 346 | $55 |

| 165 | $55 | 347 | $55 |

| 166 | $55 | 348 | $55 |

| 167 | $55 | 349 | $55 |

| 168 | $55 | 350 | $55 |

| 169 | $55 | 351 | $55 |

| 170 | $55 | 352 | $55 |

| 171 | $55 | 353 | $55 |

| 172 | $55 | 354 | $55 |

| 173 | $55 | 355 | $55 |

| 174 | $55 | 356 | $55 |

| 175 | $55 | 357 | $55 |

| 176 | $55 | 358 | $55 |

| 177 | $55 | 359 | $55 |

| 178 | $55 | 360 | $55 |

| 179 | $55 | 361 | $55 |

| 180 | $55 | 362 | $55 |

| 181 | $55 | 363 | $55 |

| 182 | $55 | 364 | $55 |

| TOTAL AMOUNT SAVED | – | – | $20,020 |

21. Christmas Saving Challenge

Also called the holiday saving challenge. Here you start saving money each week starting from the first week of the year until the last week.

You can start saving $20 each week for 51 weeks. In the end, you’ll have $1020 in your saving account which you can use for spending on the Christmas holiday and new year celebrations.

22. Using cash for a month saving challenge

To some extent difficult challenge for those who are debtors and have a habit of using credit cards to pay for purchases.

But the main purpose of this challenge is to crack down on swiping credit cards everywhere. Because using you spend more money with credit cards as compared with cash. When you’ve cash money in your wallet then you don’t incur any interest rate, fees, or penalty. When cash is finished your shopping ends that day.

In this challenge, you use cash for a month for every purchase you make during the month. And you see how much money you save that otherwise may go to the bank for using their credit card.

23. Weather-saving challenge

The challenge idea is taken from the Arizona blogger who saves money based on the average of the highest temperature. And it’s really a fund activity.

You take the highest temperature every single week throughout the month. So there are four weeks that’s why you’ll have the four highest temperature values in your area weather. Now add these values and divide them by 4 to get an average. Save that much amount at the end of the month.

For example, the highest temperature values in 4 weeks are 85, 90, 95, and 100. Their average becomes 370/4 which equals 92.5. That means you save $92 and 50 cents that month. At the end of a year, you see big cash saved inside the bank account.

Free Saving Challenge Printable

The printables are premade templates that list down all the targeted amounts you’re required to save throughout a certain period of time. This makes it easy for you to save money on a daily, weekly, biweekly, and monthly basis for a specific time frame.

The printables are used for challenges where you save money based on time. Other fun challenges like coin saving, using cash for shopping, and cutting off subscriptions don’t require templates. Here you follow the guidelines for a specific time to analyze results at the end of avoiding a bad money habit.

The free money-saving challenge printables are available for different timeframes. Here I’m mentioning links to the websites with these free printables:

Free Printables by HassleFreeSavings.com

They also have a resource library where you can access all types of printables by signing up for their newsletter.

Free Printables by MoneyBliss.org

Here you have to get the password for accessing the resource library. So you have to subscribe by email and receive the password in their welcome email. After that enter the email and password to enjoy free stuff.

BONUS: Search Google

Search Google using different search strings with names of the challenge and free printables. It gives you all the results and you can download printables of your choice. You can also go to the images section and pick up any templates you like. Here Pinterest is also available to help you find different types of challenges and printable as well.

Related Post: 11 Downloadable Printable Monthly Budget Template (Excel + Pdf)

How to be successful with a money-saving challenge?

So you’ve identified your money personality type and picked up a challenge to save money. Now you want to succeed with the challenge. Yes, that motivational spark is amazing.

Here are three tips

- Challenge picking

Choose the challenge you feel comfortable with depending on its timeframe and money-saving requirement. For example, if you are a beginner then a short challenge will be the best choice. If your income is low then choosing a challenge with less saving requirement, per day, per week, or per month will be great.

Usually, for beginners, long challenges like 52 weeks or 12 months, and 6 months can be failures. You have to first develop a saving habit to feel easy to take on longer challenges.

- Create a budget

Budgeting is the second important tool to know how much you’re earning and where it’s going. This helps you manage your income during the challenge period and monthly expenses. You have a knowledge of how much money is spent and how much is left for transferring into the saving challenge.

- Cut out extra expenses

Track any extra or impulse expense in your budget and through it off. This helps you save more money and easily go through money-saving challenges without any money deficiency. The common expenses to cut out includes eating out, branded clothes and shoes, unnecessary items, and credit cards interest.

- Consistency is key

Stay consistent during the challenge and don’t get motivated. Feel happy about how much of a challenge you’ve achieved. Keep attention towards the end money-saving target. Write it on paper and stick to the wall in front of your sleeping bed and watch it daily to get motivated.

Related Post: 40 Personal Finance Tips To Effectively Manage Your Money

What to do with the money saved?

There are many ways to effectively utilize the money you’ve saved from the challenge.

- A few of the options include:

- Paying down credit card debt

- Student loan payment

- Child school fees

- Keeping some amount in an emergency fund

- Transferring into a high-yield saving account

- Doing an excellent vacation

- Buying any expensive household item like a washer

- Auto loan payments

These are some productive ways to spend that amount and generate maximum benefit.

Related Post: Rich vs Wealthy: 13 Tips On How to Become Wealthy

Conclusion

So you got an overview of 23 money-saving challenges for moving towards your saving goal and building up some money stash.

They include shorter and longer challenges depending to help you choose the right one for yourself.

Don’t go with a longer challenge if you’ve never ever taken on any saving activity. Otherwise, you may fail a get demotivated.

Along with that save the smaller amount of money because the larger amount can affect your spending requirement which you can’t cope with. As a result, your sequence will break and you’ll not be able to save enough money.

So pick a challenge, build a budget, cut out extra expenses, and consistently save money towards the challenge.

Other Helpful Posts:

What is Six Figure Salary? 25 Jobs That Pay You Six Figure

How To Make Money Without A Job (55 Lucrative Ways)

62 Best Jobs For Stay-At-Home Moms (Online And Offline)

30 Dollars An Hour Is How Much A Year? Is It A Good Salary?

Find the Best, Cheap, 24-Hour, And Coin Laundromat Near Me

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024