Last updated on February 22nd, 2024 at 05:24 pm

In this post, you’ll learn how to make a budget binder yourself and organize your finances.

Budgeting for expenses and keeping them on track isn’t an easy process.

You’ve to stay organized and place the documents in one place so that you can analyze and review them on a regular basis.

Along with that, you should have a clear picture of how much of your specific goal is achieved.

It doesn’t matter whether you want to cut back expenses, build a savings fund, or pay off debt.

You need a budget binder to make a file of your financial documents and stay organized.

Let’s jump into the next section.

What is a budget binder?

It is a physical file used to keep track of personal or household finances. It typically includes a collection of documents and information about income, expenses, debt repayment, bills, and financial goals. You can also put a budgeting plan for managing and allocating funds.

The purpose of a budget binder is to provide a clear and organized picture of an individual or household’s financial condition. Which enables them to make informed decisions about spending and saving.

A budget binder is either a simple folder or a custom-designed planner, but the purpose remains the same: to help manage finances and reach financial goals.

So you can take any document whenever you want to help guide you about budgeting activities.

Why is a budget binder important?

The importance of using a budgeting binder to organize financial documents is inevitable.

Here is why:

- Helps manage finances: A budget binder allows you to track your income and expenses, so you can better manage your finances and make informed decisions about spending and saving.

- Increases awareness of spending habits: By tracking your spending, you become more aware of where your money is going and where you can cut back on unnecessary expenses.

- Assist in reaching financial goals: A budget binder helps you set financial goals and allocate funds towards those goals, so you can work towards achieving them.

- Promotes accountability: Keeping track of your finances in a budget binder makes it easier to hold yourself accountable for your spending and saving habits.

- Helps to avoid overspending: By creating a budget and sticking to it, you can avoid overspending and reduce the likelihood of going into debt.

- Provides a clear picture of financial status: Gives you a clear picture of your current financial situation, which can help you make informed decisions about future spending and savings.

- Easy to access: A budget binder is portable and easily accessible, making it convenient to review your finances and make adjustments as needed.

- Saves time: By having all of your financial information organized in one place, you save time and effort that would otherwise be spent searching for scattered documents.

RELATED POST: Budget by Paycheck Workbook: 6 Steps for Making a Paycheck Budget

What to keep in a budget binder?

Here are the documents you can keep inside a budget binder:

- Income tracker: any income source whether it’s salary, dividend, interest from savings or bonds, and a side business.

- Monthly budget: A comprehensive overview of your income and expenses for each month, including all bills and fixed expenses, as well as discretionary spending.

- Bill tracker: A record of all regular bills, including due dates and amounts owed.

- Income tracker: A record of all sources of income, including salary, bonuses, and any other regular sources of income.

- Savings tracker: A record of your progress towards your savings goals, including emergency funds, retirement funds, and other long-term savings.

- Receipts: Keep all receipts in your budget binder to track spending and ensure that all expenses are accurately accounted for in your monthly budget.

- Bank statements: Regular bank statements to monitor account balances and transactions.

- Investment information: Information about any investments, including stocks, bonds, or mutual funds.

- Financial goals: A list of your financial goals, including short-term and long-term goals, and a plan for how you will work towards achieving them.

- Debt repayment plan: A plan for paying off any outstanding debts, including credit cards, loans, and mortgages.

- Insurance information: Information about all insurance policies, including health, life, and property insurance.

- Retirement investments: Including 401k, IRA, Roth IRA, and any other.

RELATED POST: How to Create a Personal Budget [6 Easy Steps] PLUS Template

What supplies do you need to create a budget binder?

To create a budget binder, you’ll need the following supplies:

- Binder: Choose a sturdy binder with enough capacity to hold all your documents and materials.

- Dividers: Dividers with tabs help you organize your budget categories and keep everything in order.

- Loose-leaf paper: Use it to create your monthly budget worksheets, record expenses and take notes.

- Pen or pencil: For writing and tracking your budget.

- Highlighters: To highlight important information and make it easier to see what needs attention.

- Budget tracking software: A spreadsheet program such as Microsoft Excel, or an online budgeting tool like Mint or Personal Capital can help you track your budget and expenses.

- Envelopes: For holding and organizing receipts and bills.

- Stickers or labels: For labeling your envelopes and dividers.

- Cash: For paying bills and making purchases, as well as keeping some in an emergency fund.

- Calculator: For quick and easy calculations when making your budget and tracking your expenses.

RELATED POST: 31 Budgeting Tips for Beginners to Easily Grow Your Savings

How can you make a budget binder?

Here is how to make a budget binder in 5 simple:

First Step: Buy a three-ring binder

First of all, you need a binder with three rings. You can purchase it online or from a near book store in your local area. Before buying confirm that it has two pockets inside. This helps you place documents on both sides.

Second Step: Gather the necessary documents

In the second step, you have to gather all the financial documents that represent your finances.

The documents include:

- Income tracker

- Expense tracker

- Financial goals

- Savings fund tracker

- Money mindset document

- Retirement fund tracker

- Investments tracker

- Dividers

- Cash envelopes

- Receipts and invoices

- Debt repayment trackers

- Any other important financial document

After getting all these documents you can go to step: 3;

Third Step: Pint out budgeting templates

Budget templates are what you use to write down your expense estimates for the whole month. There are multiple budget templates available online. You can either download them for free or by paying money.

Budget templates come in Excel, Google Sheets, Google Docs, and pdf formats. So the spreadsheet templates may not give a clear print so go for a pdf or Google Docs template. You can download them for free by searching Google for free budget templates. You may have to signup for a newsletter actually to download the template.

If you prefer to budget every month then go for the monthly budget template. In case you receive a biweekly paycheck then download the biweekly budget template.

RELATED POST: 11 Downloadable Printable Monthly Budget Template (Excel + Pdf)

Fourth Step: Start organizing the templates

Now comes the most easiest and fun part of how to make a budget binder. Here you have to organize these documents one-by-one inside the binder. So let’s start with it:

1. Money mindset journaling page

A first and most important page in your budget binder.

It is a tool used in personal finance to reflect on and track your thoughts, feelings, and beliefs about money. It contains prompts and questions related to money, such as “Why do you want to budget your finances?” or “What is your goal for the month?”

Journaling can help you identify patterns in their spending habits and financial behavior, and develop healthier relationships with money. Reflecting on your experiences and emotions, you can gain insights into your relationship with money and make positive changes to your financial habits. So don’t skip it. Here is a money mindset journal from Free Money Mindset Journal:

RELATED POST: 59 Ways on How to Save Money Even If You Find it Difficult

2. Financial goals page

The financial goals page is part of a budget binder that outlines your long-term and short-term financial objectives. It includes details about goals like:

- Saving for emergencies

- Paying off debt

- Building a retirement fund

- Saving for a house down payment

- Investing in stocks or mutual funds

- Starting a side business or passive income stream

- Saving for education expenses

- Building wealth

- Creating a budget and sticking to it

- Building an emergency fund

- Purchasing your favorite car

- Buying a house

- Paying child fees

- Going on a vacation

The purpose of having a financial goals page is to help you stay focused and motivated toward reaching your financial objectives and to track your progress over time. Here is a financial goal template from MERS:

RELATED POST: Rich vs Wealthy: 13 Tips On How to Become Wealthy

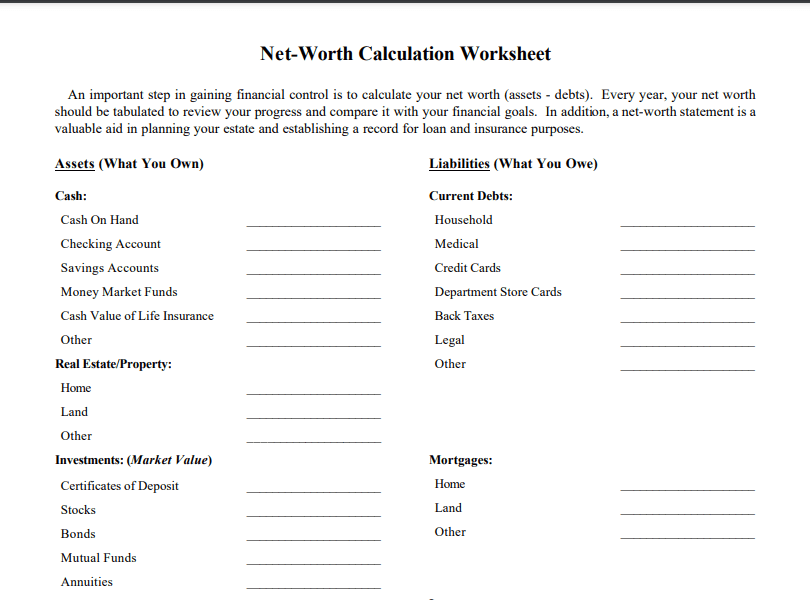

3. Total net worth tracker

A total net-worth tracker is a tool used to keep track of your personal financial position and progress over time. It calculates your overall net worth by taking into account the value of your assets (such as savings, investments, and property) and subtracting the total value of your liabilities (such as debts, loans, and mortgages).

The purpose of this document is to provide you with a comprehensive overview of your financial position. So you can see how your net worth changes over time and make informed decisions about your finances.

Here is a net worth tracker from NJAES:

RELATED POST: 40 Personal Finance Tips To Effectively Manage Your Money

4. Total income tracker

A tool that records and tracks all sources of income received each month. This can include salary or wages, bonuses, commissions, investments, rental income, and any other sources of income.

The purpose of an income tracker is to provide you with an accurate picture of your overall income. As a result, you can plan your spending, savings, and investments, and ensure you are living within your means. This information can also be used to create a budget and track progress toward your financial goals.

Here is a monthly income tracker from Sample Templates:

RELATED POST: 23 Money-Saving Challenge Ideas To Build A Big Saving Fund

5. Savings fund tracker

This tool is used to monitor your progress toward your savings goals. It keeps track of the amount saved each month and the total balance of your savings account(s).

It helps you stay motivated and on track with your savings goals, so you can reach your financial milestones, whether it is an emergency fund, a down payment on a home, or a vacation. A savings tracker can be as simple as a spreadsheet or a more complex financial software program.

Here is a savings fund tracker from LetsCraftInstead.com:

RELATED POST: 30 Money-Saving Charts To Track Your Savings And Debt Pay-Off

6. Expense tracker

A tool that helps you keep track of your spending and monitor your expenses. It records all your purchases, bills, and other costs, categorizing them by type (e.g. food, housing, transportation, etc.).

It gives you a clear picture of your spending habits and helps you identify areas where you can reduce expenses, allocate your resources more effectively, and stick to a budget. An expense tracker can be a physical or digital tool, such as a spreadsheet, app, or ledger, and can be used to track expenses daily, weekly, or monthly.

It includes fixed expenses and variable expenses.

Fixed expenses:

Fixed expenses are recurring expenses that do not vary from month to month and are required for basic living needs. These expenses need to be budgeted in advance to ensure that they are covered.

Examples of fixed expenses include rent or mortgage payments, car payments, insurance premiums, utility bills, and minimum debt payments.

Fixed expenses are often contrasted with variable expenses, which are more flexible and can vary depending on your spending habits. Fixed expenses are an important part of budgeting, as they form the foundation for determining your monthly spending limit and help you prioritize your financial goals.

Variable expenses:

Variable expenses are expenses that can fluctuate from month to month and are not considered essential living expenses. These expenses can be controlled and reduced, if necessary.

Examples of variable expenses include food, entertainment, clothing, travel, and personal care.

Unlike fixed expenses, which remain consistent, variable expenses can change based on an individual’s lifestyle and spending habits. Monitoring and tracking variable expenses are important for creating and sticking to a budget, as they can often be reduced to free up money for other financial goals.

Here is an expense tracker from Print A Bulls:

RELATED POST: How to do Zero-Based Budgeting Using 5 Simple Steps?

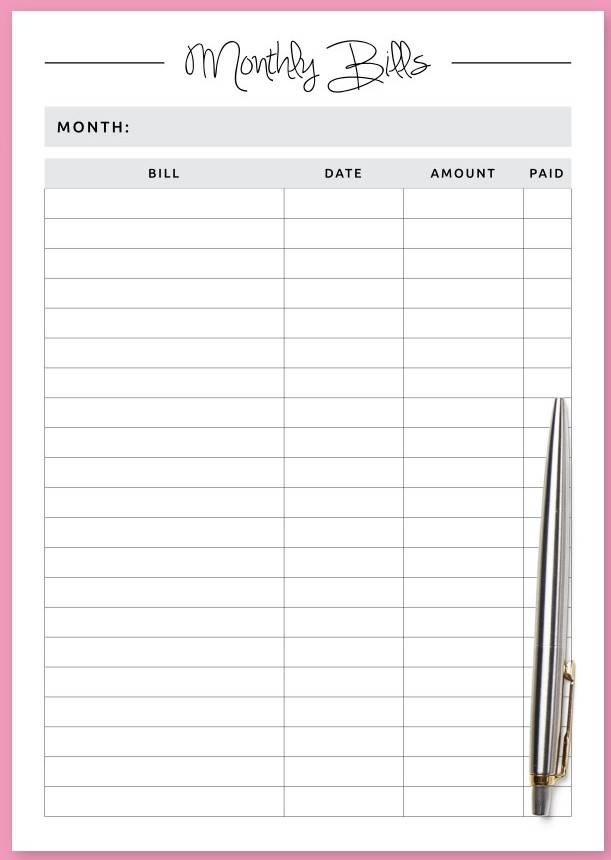

7. Monthly bill tracker

A bill tracker is a tool used in personal finance to keep track of all monthly bills and payments that are due. It lists the name of each bill, the due date, the amount due, and any other relevant information.

The purpose of a bill tracker is to ensure that all bills are paid on time, avoid late fees and penalties, and keep track of expenses. A bill tracker can be as simple as a paper list or a spreadsheet, or it can be a more sophisticated digital tool that automatically updates when a payment is made or a bill is received.

By keeping track of monthly bills and payments, you can avoid missed payments and stay on top of your finances.

Here is a bill payments tracker from PrintsBery:

RELATED POST: 15 Ways To Lower Your Energy Bills

8. Debt pay-off tracker

It’s used to track and monitor progress toward paying off debt. It typically includes details such as the type of debt, the interest rate, the minimum payment, and the remaining balance. This helps you focus your efforts on paying off debt, prioritize which debt to pay off first, and track progress over time.

It can also help you identify areas where you can reduce spending and allocate more resources toward debt repayment. A debt payoff tracker can be a simple spreadsheet or a more complex financial software program. It’s a component of a budget binder for those looking to get out of debt and improve their financial situation.

Here is a debt payment tracker from AMomsTake.com:

RELATED POST: How to Pay Off Credit Card Debt Fast (17 Quick Tips)

9. Account log page

It helps you keep track of important login information for all your accounts, such as bank accounts, online shopping and payment accounts, social media accounts, and any other accounts that require a username and password.

Account logs provide a centralized and secure location for storing login information, so you can easily access all your accounts without having to remember multiple usernames and passwords.

An account log can be a physical or digital document and should be protected with a strong password or encryption to ensure the security of your information.

10. Budget Template

A budget template is a pre-designed spreadsheet or document that can be used to create a personal or household budget. A budget template is a useful tool for tracking income, expenses, and savings, and helps individuals and families to manage their money effectively and reach their financial goals.

- Free vs Paid Budget Templates: There are free budget templates available online, as well as paid budget templates offered by financial blogs, software, or app providers. Free budget templates may have limited features, while paid templates often offer more in-depth analysis and tracking tools.

- Bi-Weekly vs Monthly Budget Templates: Budget templates can be designed for bi-weekly or monthly tracking. If you receive a salary on a monthly basis then the monthly template is useful and if you receive it on a biweekly basis then choose a biweekly template.

- Excel, Google Sheets, and PDF Budget Templates: Budget Templates can be found in different formats, including Microsoft Excel, Google Sheets, and PDF. Each format has its own pros and cons, so you should choose the one that best fits your needs. Excel is a more robust tool with more advanced features, while Google Sheets is more accessible and easier to use. PDF templates are typically the most basic and can be printed or saved as a record.

RELATED POST: 20 Budget Templates To Confidently Track Your Money

11. Monthly Calendar

You can take out 12 prints of a calendar for every month of the year. Using a monthly calendar to highlight bills and special events can be a helpful way to keep track of your expenses and ensure that you have enough money set aside for each obligation.

Here are some steps to get started:

- List all your monthly bills, including the due date and amount.

- Transfer this information to your monthly calendar, marking the due dates in red to make them stand out.

- Mark any special events or significant expenses, such as birthdays or anniversaries, on the calendar. Make note of the estimated cost and plan for how you will pay for it.

- Review the calendar regularly, checking for any bills that are coming up soon and making sure that you have enough money set aside to cover them.

- Make adjustments to your budget as needed, taking into account any changes in your expenses or income.

Use a monthly calendar to keep track of your bill’s due dates and special events, and holidays. It also helps you stay organized, avoid missed payments, and have a better sense of your overall financial situation.

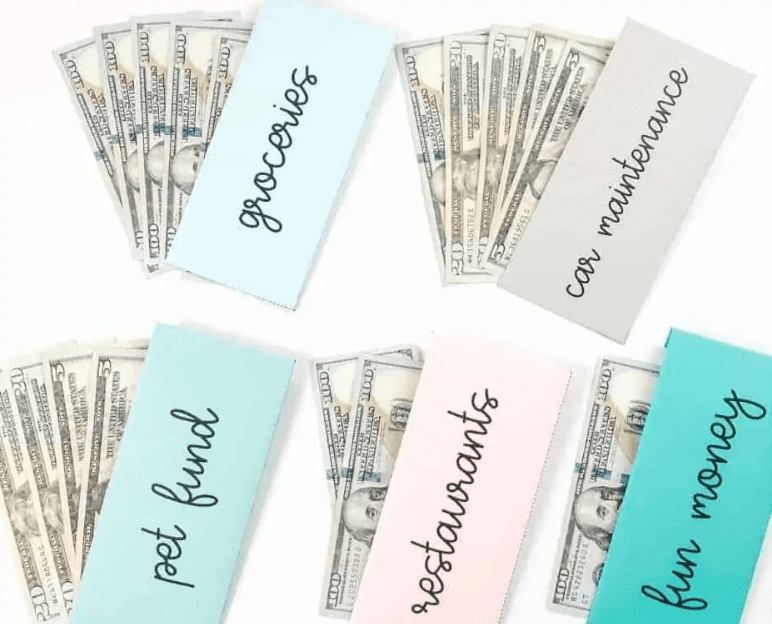

12. Cash envelopes

If you’re using envelope system budgeting then having cash envelopes can be a useful tool for managing expenses. Here’s how to use cash envelopes in your budgeting system:

- Get cash envelopes according to budget categories including expense and savings or investment.

- Allocate a certain amount of cash for each category of expenses, such as groceries, entertainment, and personal care.

- Label each envelope with the category of expense and the allocated amount.

- Use the cash in each envelope to pay for expenses in that category and track your spending throughout the month.

- When the cash in an envelope is gone, refrain from spending any more money in that category until the next budget cycle.

- Reevaluate your budget regularly and adjust the amount of cash in each envelope as needed to reflect changes in your expenses.

Using cash envelopes helps you manage your spending and stick to your budget, as it helps you stay within your set limits and avoid overspending. Additionally, using cash instead of a debit or credit card can make it easier to see exactly how much you have spent and how much you have left to spend.

Here are free cash envelope templates from Inspired Budget:

RELATED POST: Cash Envelope System: 9-Simple Steps To Do Envelope Budgeting

13. Labels

Create a label for each cash envelope and write the name of that specific category. If you’ve 15 budget categories then create 15 labels and stick the envelopes using the gum. This helps you identify the envelopes according to category. The common labels include groceries, utility bills, credit card payments, vacation funds, dining out, and rent.

The four steps on how to make a budget binder are completed. Let’s jump to the next section.

How to use a budget binder?

So your budget binder is ready. Here are some tips for using a budget binder:

- Start by creating a monthly budget: List all your income and expenses and determine how much you can afford to spend in each category.

- Track your spending: Keep receipts and record your expenses regularly to see where your money is going.

- Prioritize expenses: Decide what expenses are essential and allocate funds accordingly. Cut back on non-essential expenses to stay within your budget.

- Automate your savings: Consider setting up automatic transfers to a savings account to ensure you are saving a portion of your income each month.

- Regularly review your budget: Revisit your budget regularly to see if there are areas where you can improve or if you need to adjust your spending.

- Be flexible: Always make adjustments to your budget as needed based on changes in your income or expenses.

- Stay motivated and consistent: Reward yourself for staying within your budget, and remind yourself of your financial goals to keep yourself motivated and consistent.

RELATED POST: How To Make Money Without A Job (55 Lucrative Ways)

Conclusion

I wish you were clear on how to make a budget binder.

Now it’s your turn to bring all the supplies and order them inside the binder to use for your monthly budgeting needs.

A budget binder is your long-term friend so you can organize your financial documents and make informed decisions.

So invest in a quality budget binder and you can find them on local stationary, Amazon, and Etsy as well.

If you find this post helpful then share it on social media.

RELATED POSTS:

52 Ways How to Make Money as a Teenager Working (Online and Offline)

Example Of A Monthly Budget? How To Cut Back Extra Expenses

How to Sell Feet Pics Online and Make Passive Income: 20 Best Platforms

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024