Last updated on February 16th, 2024 at 05:51 am

In this post, you’ll learn $50000 a year is how much an hour.

Along with that, you get calculations related to:

- Your after-tax income

- Monthly, biweekly, weekly, and daily wage

- Skills you need to make $50k a year

- Monthly budget example and tips to live

- And jobs that pay you $50k a year

With other relevant questions answered. So let’s get into the explanation…

$50000 A Year Is How Much An Hour?

For calculating the hourly wage rate from the yearly salary, first, you have to calculate the total working hours.

Normally there are 260 working days in a year.

Considering that you work full-time 8 hours per day for 5 days a week, the total yearly full-time working hours are as follows:

Total working hours in a year = total working days in a year × total working hours per day

Using this formula let’s calculate the total working hours:

Total working hours per year = 260 days × 8 hours per day = 2080

So there are 2080 total working hours in a year.

Now calculate that 50k a year is how much an hour you have to divide $50,000 with 2080. Here is the formula:

Hourly rate = Annual salary / Number of hours worked in a year

Here is the actual calculator:

$50,000/2080 = $24.038

Hourly rate ≈ $24.04 per hour

Hence if you earn $50,000 a year that means your hourly rate is $24.04 for each hour you work full-time. In short, you can approximate this rate to $24 an hour.

$50000 A Year Is How Much After Taxes?

Calculating the exact amount of take-home pay after taxes depends on various factors such as tax deductions, exemptions, filing status, and more.

Additionally, tax laws and rates may vary between different jurisdictions.

However, you can get a rough estimate based on some assumptions. But this is just an estimation and for actual calculations consult your tax professional.

Assuming you are a single filer in the United States and live in San Francisco California. To calculate the tax amount I used the SmartAsset tax calculator.

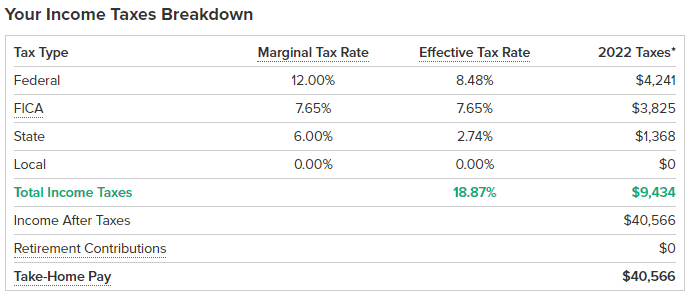

Here is the image showing you how much tax you pay including Federal, state, and FICA. Along with the take-home pay or disposable income.

- Your Federal tax bracket is 12.00% but the effective tax rate is 8.48% which amounts to $4,241.

- The FICA tax is 7.65% which amounts to $3,825 a year.

- The State income tax in California is 6.00% with an effective tax rate of 2.74% which amounts to $1,368.

The total income taxes are 18.87% which amounts to $9,434 a year. So deducting this tax amount from the $50,000 gross income you get a disposable ( income after taxes ) of $40,566.

$50000 A Year Is How Much Semiannually?

How much $50,000 per year is semiannual? You need to divide the annual salary by the number of semiannual periods in a year.

There are two semiannual periods 2 ( six-month + six-months = one year).

To calculate the semiannual amount, you can use the following formula:

Semiannum salary = Annual salary / Number of semiannual periods

Semiannual amount = $50,000 / 2

Semiannual amount = $25,000

Therefore, $50,000 per year is equivalent to $25,000 semiannually.

RELATED POSTS:

42000 a Year is How Much an Hour? Can Live on This Salary?

80000 A Year Is How Much An Hour? Is It A Good Salary?

How Many Weekends in a Year? [2023 & 2024] + Calculation Tips

$29 An Hour is How Much a Year After Taxes? Budget Example

25 Dollars An Hour Is How Much A Year? Is It Enough To Live?

23 Dollars An Hour Is How Much A Year? Is Enough To Live Easily?

How Much a Year is 15 Dollars an Hour? How to Easily Live on It?

21 An Hour Is How Much A Year? How To Live On This Salary?

20 Dollars an Hour is How Much a Year? Is it Enough to Live?

$50000 A Year Is How Much Quarterly?

There are 4 quarters of 3 months in a single year.

To calculate the quarterly amount, you can use the following formula:

Salary per quarter = Annual salary / Number of quarterly periods

Quarterly amount = $50,000 / 4

Quarterly amount = $12,500

Hence, $50,000 per year is equivalent to $12,500 quarterly.

$50000 A Year Is How Much Bi-Weekly?

Divide the annual salary by the number of bi-weekly periods in a year. There are 26 bi-weekly periods in a year since there are 52 weeks in a year, and a bi-weekly period occurs every two weeks.

To calculate the bi-weekly amount, you can use the following formula:

Two weeks’ salary = Annual salary / Number of bi-weekly periods

Bi-weekly amount = $50,000 / 26 = $1,923.08

Bi-weekly amount ≈ of $1,923

Therefore, $50,000 per year is approximately $1,923 bi-weekly.

$50000 A Year Is How Much A Week?

To find weekly earnings, you need to divide the annual salary by the number of weekly periods in a year. There are 52 weekly periods in a year since there are 52 weeks in a year.

To calculate the weekly amount, you can use the following formula:

Salary per week = Annual salary / Number of weekly periods

Weekly amount = $50,000 / 52 = $961.54

Weekly amount ≈ $9612

Therefore, $50,000 per year is approximately $962 per week.

$50000 A Year Is How Much Per Day?

To calculate the daily earnings at $50k per year income, you need to divide the annual salary by the number of days in a year. Typically, there are 365 days in a year.

To calculate the daily amount, you can use the following formula:

Per day earnings = Annual salary / Number of days in a year

Daily amount = $50,000 / 365 = $136.99

Daily amount ≈ $137

No one pays you for weekends. You worked for only 260 days so for the correct answer divide the $50,000 by 260.

Here is the calculation:

Daily-earnings = $50,000/260 = $192.30

Daily amount ≈ $192

Therefore, $50,000 per year is approximately $192 per day.

Annual to Hourly Salary Calculator

$50,000 Salary Working 2,000 Hours

If you are working 2,000 hours in a year and have a salary of $50,000, you can calculate your hourly rate using the following formula:

Salary for 2000 working hours = Annual salary / Number of hours worked

Hourly rate = $50,000 / 2,000

Hourly rate = $25

Hence, if you work 2,000 hours in a year and have a salary of $50,000, your hourly rate would be $25.

Is $50,000 a Year Good Salary?

Whether $50,000 is a good salary or not depends on different factors, including:

- the cost of living in your area,

- your personal financial situation,

- and your lifestyle preferences

In regions of the USA where the cost of living is lower, for example, Anniston and Conway you can easily live on a $50,000-a-year salary. The areas with a high cost of living such as New York and Los Angeles make it difficult to live on $50k a year income. Especially when you have a family, financial obligations, unpaid debt, and a mortgage, then life can be more challenging.

To determine the adequacy of a salary take into account factors:

- housing costs

- transportation expenses

- Healthcare and education

- and other essential expenses

Other related factors include personal preferences, career advancement opportunities, and long-term financial goals.

In the end, a good salary depends on your needs, preferences, and the type of lifestyle you want.

RELATED POST:

70000 A Year Is How Much An Hour? Is $70K/Year A Good Salary?

17 An Hour Is How Much A Year? Is It Enough To Live In The US?

60000 A Year Is How Much An Hour? Budget It With Example

$35 An Hour Is How Much A Year After Taxes Full And Part-Time

45 An Hour Is How Much A Year After Taxes In The US Full-Time

30 Dollars An Hour Is How Much A Year? Is It A Good Salary?

65000 A Year Is How Much An Hour? Is It A Good Salary?

55000 A Year Is How Much An Hour? Is It Enough?

$45000 A Year Is How Much An Hour? Is It Enough To Live?

How Much You Can Buy With A $50000 A Year Salary?

The purchasing power of a $50,000-a-year salary in terms of food quantity, including milk or other items, will depend on:

- your location

- cost of living

- personal spending habits

- and dietary preferences

To provide a general perspective, let’s consider the price of milk in the United States as an example. The cost of a gallon of milk can vary significantly depending on the region and store. On average, a gallon of milk in the US may range from $2 to $4.

Assuming you spend $3 on a gallon of milk, let’s calculate how many gallons of milk you can purchase with a $50,000 salary:

Total gallons of milk = Annual salary / Price per gallon of milk

Number of gallons of milk = $50,000 / $3

Number of gallons of milk ≈ 16,666.67

At $24 per hour, you can buy 5 to 7 gallons of milk per day.

Can You Live Off Of $50000 A Year?

As I early mentioned that for living in lower-cost-of-living areas $50k a year is a good salary. While in higher cost-of-living areas it can difficult.

But here are the factors that measure your ability to live on $50k a year:

- Cost of living: The cost of housing, transportation, groceries, healthcare, and other essential expenses.

- Lifestyle choices: Your personal lifestyle choices and spending habits on dining out, entertainment, travel, and other non-essential purchases.

- Financial obligations: If you have additional financial obligations such as debt payments, childcare expenses, or supporting a family.

- Savings and financial goals: Your long-term financial goals, such as saving for retirement, building an emergency fund, or purchasing a home.

With proper money management and budgeting, you can easily live off of a $50,000 per year income. But it may be required to adjust your lifestyle and expenses.

How To Live On $50000 A Year?

Here are some tips to effectively utilize most of your income:

- Create a budget: Categorize your expenses into fixed and variables. Set spending limits to make sure you don’t go overboard.

- Prioritize essential expenses: Ensure that your basic needs are covered first, such as housing, utilities, food, transportation, and healthcare.

- Minimize discretionary spending: Identify areas where you can cut back on non-essential expenses. This might involve reducing dining out, entertainment costs, and unnecessary subscriptions.

- Save and invest wisely: Even with a limited income, it’s important to save for emergencies and future goals. Set aside a portion of your income for savings and establish an emergency fund to cover unexpected expenses.

- Cut down on housing costs: Consider downsizing to a smaller living space or exploring more affordable neighborhoods. If feasible, finding a roommate to split rent and utilities can also help reduce housing costs.

- Shop smart: Compare prices, look for sales, and consider buying generic brands instead of premium ones. Plan your meals and grocery shopping in advance to avoid impulse purchases and minimize food waste.

- Reduce transportation costs: Consider alternatives to owning a car, such as using public transportation, carpooling, biking, or walking if feasible.

- Seek out discounts and deals: Take advantage of discounts, coupons, and loyalty programs. Look for deals when purchasing clothes, electronics, or other items.

- Explore additional income streams: If your schedule allows, consider taking on a part-time job or freelance work to supplement your income.

- Stay financially informed: Educate yourself on personal finance topics, follow financial blogs, and stay up to date on money management strategies.

RELATED POSTS:

How To Make a Budget Binder In 4-Simple Steps (Free Templates)

Cash Envelope System: 9-Simple Steps To Do Envelope Budgeting

31 Downloadable Printable Monthly Budget Template (Excel + Pdf)

31 Budgeting Tips for Beginners to Easily Grow Your Savings

How to Create a Personal Budget [6 Easy Steps] PLUS Template

How Should I Budget A $50000 Per Year Salary? -Budget Example

Here’s an example budget for a $50,000 annual salary. It’s a general example, and you should adjust the categories and amounts based on your own requirements:

- Monthly Income: $4,166.67

- Essential Expenses:

- Rent/Mortgage: $1,000

- Utilities (electricity, water, internet): $200

- Transportation (car payment, insurance, fuel): $300

- Groceries: $300

- Healthcare (insurance, prescriptions): $150

- Insurance (home/renters, auto, life): $100

- Debt Payments (student loans, credit cards): $400

- Savings and Investments:

- Emergency Fund: $300

- Retirement Savings (401(k) or IRA): $400

- Discretionary Expenses:

- Dining Out/Entertainment: $200

- Personal Care (grooming, clothing): $100

- Travel/Vacation: $100

- Subscriptions (Netflix, gym membership): $50

- Miscellaneous: $100

- Debt Repayment:

- Allocate any additional funds towards paying off debts, focusing on high-interest debts first.

In this example, the total expenses come to $3,500, leaving approximately $666.67 remaining each month. You can choose to allocate this surplus towards additional savings, debt repayment, or other financial goals.

RELATED POSTS:

59 Ways on How to Save Money Even If You Find It Difficult

133 Frugal Living Tips to Save Money and Build Your Financial Future

What is a No-Spend Challenge? 7 Simple Tricks to Do It Yourself

12 Best Money-Saving Apps for 2022

33 Tricks on How to Save Money on Groceries

$40000 A Year Is How Much An Hour After Taxes? Can You Live?

What Factors Affect Your Take-Home Pay?

Several factors can affect your take-home pay, including

1. Gross Salary

Your gross salary, which is the amount you earn before any deductions, directly impacts your take-home pay.

2. Income Tax

The amount of income tax you owe is determined by your salary and the tax rates applicable in your jurisdiction. Income tax is typically withheld from your paycheck by your employer.

3. Social Security and Medicare Taxes

In the United States, employees are subject to Social Security and Medicare taxes, also known as FICA taxes. These taxes are withheld from your paycheck at a specific rate set by the government.

4. Pre-tax Deductions

Certain deductions, such as contributions to a retirement plan (e.g., 401(k)) or health insurance premiums, may be taken out of your paycheck before taxes are applied. These deductions can lower your taxable income and, in turn, increase your take-home pay.

5. Post-tax Deductions

Other deductions, such as health savings account (HSA) contributions, after-tax insurance premiums, or contributions to charitable organizations, are deducted from your paycheck after taxes have been applied. These deductions do not directly impact your take-home pay but can affect your overall financial situation.

6. State and Local Taxes

In addition to federal income tax, you may be subject to state and local taxes, depending on where you live and work. These taxes vary by jurisdiction and can further impact your take-home pay.

7. Benefits and Perks

Some employers offer benefits and perks that can affect your take-home pay indirectly. For example, if your employer provides a subsidized health insurance plan or offers paid time off (PTO), it can reduce your out-of-pocket expenses and increase your overall compensation package.

8. Paid Time Off (PTO)

PTO refers to the time off that you are entitled to take, such as vacation days, sick leave, or personal days. Taking PTO may temporarily reduce your take-home pay if you are not paid for those days off.

9. Overtime and Bonuses

If you work overtime hours or receive bonuses, they can impact your take-home pay as they are typically subject to different tax withholding rates.

What Skills Do I Need To Make $50k A Year?

The skills required to make $50,000 a year can vary depending on the industry, job role, and location. However, here are some skills that are generally valued across various professions to earn $50k:

- Communication Skills: Strong communication skills help in conveying ideas, collaborating with colleagues, and interacting with clients or customers.

- Technical Skills: Examples include proficiency in programming languages, data analysis tools, design software, or industry-specific software.

- Problem-Solving Skills: Developing critical thinking, analytical reasoning, and problem-solving skills can make you a valuable asset to employers.

- Adaptability and Learning Agility: The ability to adapt to new situations, learn quickly, and embrace change is important in today’s dynamic work environment.

- Time Management and Organization: Being able to prioritize tasks, meet deadlines, and stay organized.

- Teamwork and Collaboration: Having the ability to collaborate, listen to others, and contribute to group projects is essential.

- Customer Service Skills: These skills include empathy, problem-solving, patience, and the ability to handle challenging situations.

- Financial Literacy: Having a grasp on basic financial concepts, such as budgeting, managing personal finances, and financial planning.

- Industry-Specific Knowledge: Depending on your field, having industry-specific knowledge and staying updated on industry trends can set you apart.

It’s important to note that skills alone may not guarantee a specific salary level. Other factors such as experience, education, job market conditions, and negotiation skills can also influence your earning potential.

What Types Of Jobs Pay $50,000 A Year?

Here are some examples of jobs that commonly pay around $50,000 per year:

- Administrative Assistant: Providing administrative support to an organization or executive.

- Customer Service Representative: Assisting customers with inquiries, complaints, or requests.

- Paralegal: Assisting lawyers with legal research, drafting documents, and case management.

- Graphic Designer: Creating visual designs for digital or print media.

- Web Developer: Building and maintaining websites and web applications.

- Social Media Manager: Managing and executing social media strategies for businesses.

- Registered Nurse: Providing patient care, administering medications, and supporting healthcare teams.

- Financial Analyst: Analyzing financial data, preparing reports, and providing insights for decision-making.

- Sales Representative: Selling products or services to clients and meeting sales targets.

- Human Resources Coordinator: Assisting with HR processes, employee onboarding, and maintaining personnel records.

These are just a few examples, and there are many other job roles that can offer a salary of around $50,000.

Median Yearly Salary By U.S. State

Here is a list of the median annual wages by the state as of 2022 data:

How much is $24 an hour annually working part-time?

To calculate the annual income for a part-time job with an hourly wage of $24, working 5 days a week for 5 hours per day, you can follow these steps:

- Determine the number of weeks worked in a year: Multiply the number of weeks you work in a month by the number of months you work in a year. For example, if you work 48 weeks in a year (assuming you take 4 weeks off for vacation or other reasons), you would use that figure.

- Calculate the number of hours worked in a year: Multiply the number of hours worked per day by the number of days worked per week and then by the number of weeks worked in a year. In this case, it would be 5 hours per day * 5 days per week * 48 weeks per year = 1,200 hours per year.

- Calculate the annual income: Multiply the number of hours worked in a year by the hourly wage. In this case, it would be $24 per hour * 1,200 hours per year = $28,800.

Therefore, working part-time at a rate of $24 per hour for 5 days a week, 5 hours per day, would result in an annual income of $28,800.

How To Know Your Real Hourly Wage?

For calculating the real hourly wage, you need to consider factors beyond just your base hourly rate. Here’s a step-by-step process to calculate your real hourly wage:

1. Calculate your gross income

Start by calculating your total gross income for a specific period. This includes all the income you earn from your job before any deductions or taxes.

2. Subtract taxes and deductions

Subtract the amount deducted from your gross income for taxes, Social Security, Medicare, and any other deductions required by law. This will give you your net income.

3. Determine the total hours worked

Calculate the total number of hours you worked during the same period for which you calculated your gross income. This includes regular working hours as well as any overtime or additional hours worked.

Consider any non-paid time you spend on work-related activities outside of your regular working hours, such as commuting, preparing for work, or responding to work-related emails or calls.

5. Calculate your real hourly wage

Divide your net income (after taxes and deductions) by the total number of hours worked (including non-paid work-related time). This will give you your real hourly wage.

For example, let’s say your gross income for a month is $4,167, after deducting taxes and other deductions, your net income is $3,381. During that month, you worked a total of 168 hours.

Real hourly wage = Net income / Total hours worked Real hourly wage = $3,381 / 168 hours

Real hourly wage = $20.125 per hour

In this example, your real hourly wage would be $20.125 per hour, taking into account taxes, deductions, and non-paid work-related time.

The real hourly wage helps you understand the true value of your time and income after accounting for taxes and other factors. It provides a more accurate measure of your earnings and allows you to make better comparisons and financial decisions.

$55,000 A Year Is How Much An Hour?

Divide the annual salary by the total number of hours worked in a year. Here it’s:

$55,000 / 2,080 hours = $26.44 per hour.

Therefore, with an annual salary of $55,000, the equivalent hourly wage is approximately $26.44 per hour.

What Is A Salaried Job?

A salaried job is a type of employment where an employee receives a fixed and regular salary for their work. It is typically expressed as an annual or monthly amount.

What Is An Hourly Job?

A type of employment where an employee is paid an hourly wage for the number of hours worked. In this arrangement, the employee’s compensation is calculated based on the actual hours worked during a given pay period. Hourly employees are generally entitled to overtime pay at a higher rate when they work more than a certain number of hours per week.

How Much Tax Do I Pay If You Make $50000 A Year?

If you live in San Francisco California and you’re a single person then you can expect to pay around $9,434 a year. This includes the Federal and FICA tax. But the actual figures can vary depending on several other related factors.

How Much Rent Can I Afford On $50000 A Year?

It depends on factors, such as your other expenses, debt obligations, and savings goals. As a general guideline, financial experts often recommend that you spend no more than 30% of your monthly gross income on housing expenses, including rent and utilities.

To estimate an affordable rent range, you can follow these steps:

- Calculate your monthly gross income: Divide your annual income by 12 to determine your monthly gross income. In this case, it would be $50,000 / 12 = $4,166.67.

- Determine your housing budget: Multiply your monthly gross income by 30% (0.3) to get an estimate of your housing budget. In this case, it would be $4,166.67 * 0.3 = $1,250.

Based on this calculation, a general guideline suggests that you could consider spending up to $1,250 per month on rent and utilities. However, it’s essential to consider your entire financial picture and make adjustments based on your individual conditions and priorities.

Keep in mind that rental costs can vary significantly based on factors such as location, property type, size, amenities, and market conditions.

How Do You Calculate The Hourly Rate From The Annual Salary?

It’s so simple just divide the annual salary by the number of working hours in a year. For example, in this post, we divided $50 per year with 2080 working hours. As a result, we go an hourly rate of $24.04.

$50000 A Year Is How Much Every Two Weeks?

For a single week, it’s $961.53 if you divide the yearly income of $50k by 52. But for getting the biweekly income you have to multiply this figure by 2. As a result, you get a biweekly income of $1923 at $50,000 a year.

$50000 A Year Is How Much A Week?

Divide the annual salary by the number of weeks in a year. In this case, we’ll assume 52 weeks in a year since it’s the most common:

$50,000 / 52 = $961.54 (rounded to the nearest cent)

Hence at $50,000 a year salary, you would earn approximately $961.54 per week.

How Much Money Would I Make In A Day $50000 A Year?

Divide the annual salary by the number of days in a year.

In this case, we’ll assume 365 days in a year:

$50,000 / 365 = $136.99 (rounded to the nearest cent)

But weekends are off so you don’t get paid for those days. The accurate calculator is by dividing $50,000 by 260 working days. So here it’s

$50,000 / 260 = $192.30

Hence at a $50000 a year salary, you would make approximately $192.30 per day.

$50000 A Year Is How Much Monthly?

To calculate the monthly amount from a $50,000 annual salary, you can divide the annual salary by 12 (the number of months in a year):

$50,000 / 12 = $4,166.67 (rounded to the nearest cent)

Therefore, a $50,000-a-year salary is approximately $4,166.67 per month.

What If You Get 2 Weeks Of Unpaid Vacation?

If you take 2 weeks of unpaid vacation then your total working days decrease.

How?

There are 10 full-time working days in 2 weeks and if you subtract them from 260 working days in a year you get left with 250 days. There are 40 full-time working hours in a week and 80 in 2 weeks. Subtracting them from 2080 you get left with 2000 working hours.

Now at $50,000 a year, you earn approximately $24 per hour. So multiplying this by 2000 working hours in a year after deducting 80 unpaid working hours.

Here it’s:

Annual salary with unpaid vacation = 2000 hours X 24 = $48,000

Therefore, with two weeks of unpaid vacation, your adjusted annual salary would be $48,000.

What If You Get 2 Weeks Of Paid Vacation Or No Vacation?

If you receive two weeks of paid vacation, it means you will still receive your regular salary for that period, as if you were working. In this case, the annual salary remains the same, regardless of the vacation days taken.

So, if you take no vacation or get 2 weeks of paid vacation your annual salary still remains the same as $50000 a year.

What About The Holidays?

Holidays can vary in terms of how they are treated in terms of paid time off and compensation. Some employers provide paid holidays as part of their benefits package, while others do not.

If your employer provides paid holidays, it means that you will receive your regular salary for those designated holiday days, even though you are not working. In this case, the annual salary remains the same, regardless of the paid holidays.

However, if your employer does not provide paid holidays or you are required to work on holidays without receiving additional compensation, the annual salary would remain the same. In such cases, there may be other arrangements or policies in place, such as offering holiday pay or compensatory time off for working on holidays.

It’s important to review your employment contract, and company policies, or consult with your employer or HR department to understand how holidays are handled and whether you are entitled to paid time off or additional compensation for holidays.

Total Number Of Working Days In 2023?

To calculate the total number of working days in 2023, we need to consider weekends and public holidays.

In 2023, there are 365 days in total. Let’s break it down:

- Total weekends (Saturdays and Sundays): There are 52 Saturdays and 53 Sundays in the year 2023. That means 105 weekends.

- Public holidays: The number of public holidays can vary depending on the country and region. The specific public holidays for 2023 will depend on your location. In the United States, for example, there are typically 10 federal holidays, such as New Year’s Day, Independence Day, Thanksgiving, etc. However, state-specific holidays and additional holidays can vary.

To calculate the total number of working days, subtract the weekends and public holidays from the total number of days in the year:

Total working days = Total days in the year – Weekend days – Public holidays

Total working days = 365 – 105 – 10 = 250 working days

Multiplying these 250 days with 8 full-time hours per day gives you 2000 working hours. And multiplying these 2000 hours with a $24 hourly rate gives you an annual salary of $48,000.

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024