Last updated on February 16th, 2024 at 05:51 am

In this post, you’ll learn where is the account number on a debit card.

Along with that what is a sort code, CVC number, and expiry date?

You’ll get tips on protecting your debit card from getting stolen and misused.

This all helps you get a deep understanding of your debit card and credit card as well.

Other important FAQs are also answered.

So let’s get started.

What is a bank account number?

A bank account number is a unique identifier assigned to an individual or business account held at a particular bank. It consists of a series of digits that helps distinguish one account from another within the same financial institution. Bank account numbers vary in length, depending on the country and the bank.

A Bank account number is used for various purposes. the most common include:

- depositing funds,

- receiving payments,

- making withdrawals,

- and transferring money

- direct deposits,

- initiating electronic transfers,

- or provide account information

Where to find the account number on your debit card?

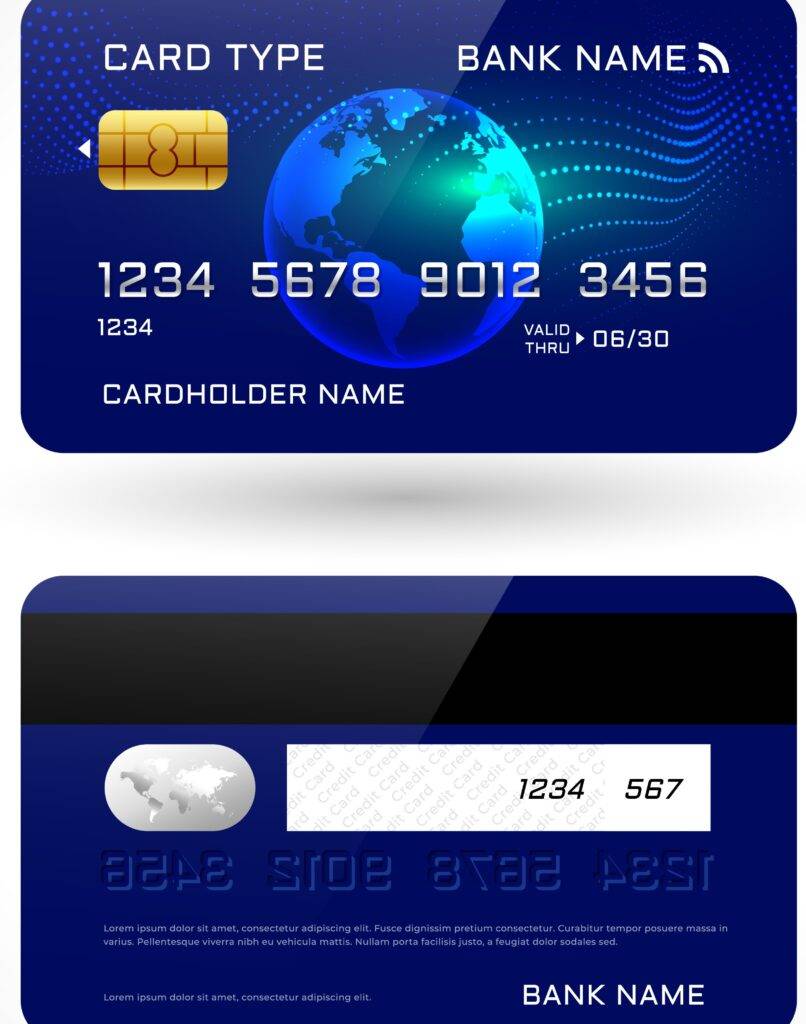

In the case of a debit card, the account number is typically located on the front or back of the card, depending on the card issuer. Here are the common places to find the account # on a debit card:

Front of the card: It is usually a long series of digits.

Back of the card: You may need to flip the card over to find it. It is often located either at the top or bottom of the card’s back side.

Embossed numbers: Can be embossed on the front, below, or above the cardholder’s name. These raised numbers are the account number.

Not present: Some debit cards do not display the account number on the card itself. So you have to find the account number by signing in to your online banking account or by referring to your bank statements.

If all these tips don’t help you then contact your bank directly. They can provide you with the exact location or guide you on how to find it.

How can I find my bank account number without an ATM card?

If you don’t have your ATM card handy, there are alternative ways to find your bank account number. Here are a few methods you can try:

Online banking: Login to your bank’s online banking portal or mobile banking app. Once logged in, you can usually find your account number listed in your account information or account summary section. Look for a section that provides details about your specific accounts.

Bank statements: Retrieve your most recent bank statements. The account number is typically printed on the top or bottom of each statement page. It is often labeled as the “Account Number” or “Account Identifier.” Make sure to check both electronic and paper statements.

Checkbooks: your account number is printed on the bottom of each check. It is usually the series of numbers located to the right of the bank’s routing number and the left of the check number.

Contact your bank: Reach out to your bank’s customer service. provide the necessary details and they can help you find the number.

Where else can you find the account number?

In addition to the methods mentioned earlier, here are a few more places to find your bank account number:

Bank documents: Review any official documents provided by your bank, such as welcome letters, account opening confirmations, or account information sheets. These documents often contain your account number.

Direct deposit information: The account number may be mentioned on the direct deposit authorization form. or any correspondence related to the direct deposit setup.

Online banking profile: Access your online banking profile and navigate to the account details section. Some banks provide an option to view or retrieve your account number through their online banking platform.

Phone banking: Call your bank’s customer service or phone banking hotline. After verifying your identity, they should be able to provide you with your account number over the phone.

Account statements from other institutions: being linked to other services like PayPal, online payment platforms, or investment accounts, your bank account number may be visible in settings or transaction history.

Previous correspondence: Review any previous emails, letters, or messages exchanged with your bank. Sometimes, account numbers are mentioned in communication-related to your account.

RELATED POSTS:

8 Tips For Money Management To Achieve Financial Prosperity

12 Quick & Easy Financial Tricks on How to Stop Wasting Money

125+ Financial Affirmations to Stay Positive and Attract More Money

Rich vs Wealthy: 13 Tips On How to Become Wealthy

Money Can’t Buy Happiness But It Can Buy You What? 9 Ways to Find Happiness

15 Personal Finance Topics You Should Master In 2022

1389 Best Personal Finance Blogs To Sharpen Your Financial Wisdom

13 Best Places to Cash a Check (Low Fees and Free)

How Late Does Amazon Deliver? Amazon Shipping Hours (2023)

What’s the easiest way to find my bank account number through my debit card?

The easiest way to find your bank account number your bank’s mobile app or online banking portal. Here’s how you can typically find your account number using these methods:

Mobile banking app: Install your bank’s official mobile banking app on your smartphone or tablet. Log in to the app using your credentials. Once logged in, navigate to your account information or account details section. In this section, you should be able to view your account number along with other relevant account information.

Online banking portal: Access your bank’s official website using a web browser on your computer or mobile device. Log in to your online banking account using your username and password. Look for an account summary or account details section within the online banking portal. Your account number should be listed there.

With a mobile banking app, it’s a matter of seconds to find the account number associated with your debit card. These methods are secure and available 24/7 for your ease.

What are the benefits of an account number?

The account number associated with a bank account offers several benefits, including:

Unique identification: Each bank account has a unique account number, which distinguishes it from other accounts within the same bank. This uniqueness helps ensure that transactions are accurately processed and attributed to the correct account.

Efficient transactions: The account number facilitates smooth and efficient financial transactions. When you provide your account number for deposits, withdrawals, or transfers, it enables the bank or other parties to accurately route funds to the intended account.

Direct deposits: Many employers and government agencies use account numbers to set up direct deposits of salaries, benefits, or refunds. By providing your account number, you can conveniently receive funds directly into your account without the need for physical checks.

Electronic transfers: When you want to transfer money electronically to another bank account, the account number is essential. It ensures that the funds reach the correct recipient’s account, whether it’s for personal payments, bill payments, or online purchases.

Banking services: Banks use account numbers to provide various services to their customers. These include online and mobile banking, balance inquiries, transaction history, and account management. Your account number acts as a key identifier for accessing and managing your account securely.

Tracking transactions: With an account number, you can easily track and reconcile your transactions. It allows you to monitor deposits, withdrawals, and other activities associated with your account, helping you maintain accurate financial records.

Security and authentication: The account number, along with other security measures like passwords, PINs, and two-factor authentication, adds an extra layer of security to your account. It helps protect against unauthorized access and ensures that only authorized individuals can perform transactions or access account information.

How long is an account number?

The length of an account number can vary depending on the bank and country. Typically, account numbers can range from 6 to 18 digits. However, it’s important to note that the specific length of an account number is determined by the bank itself.

In some cases, account numbers may include a combination of letters and numbers, while others may consist solely of numbers. The structure and format of the account number can also differ among banks.

To obtain the precise length of your account number, it is best to refer to your bank’s official documentation, such as account statements, or online banking profile, or contact your bank’s customer service. They will be able to provide you with accurate information regarding the length and format of your specific account number.

What is written on a debit card?

A debit card typically contains the following information:

Issuing Bank: The name or logo of the bank or financial institution that issued the debit card is usually displayed prominently on the card.

Cardholder’s Name: The name of the cardholder to whom the debit card is issued is usually printed on the front of the card. It is often located near the embossed or printed bank logo.

Card Number: The unique 16-digit card number is printed on the front of the card. This number is used for identifying the card and conducting transactions.

Expiration Date: The expiration date indicates the month and year until which the card is valid. It is typically printed on the front of the card, below or near the card number.

Security Code: Also known as the Card Verification Value (CVV) or Card Verification Code (CVC), the security code is a three-digit or four-digit number printed on the back of the card. It provides an additional layer of security for online or phone transactions where the card is not physically present.

Signature Strip: The back of the debit card usually includes a designated area for the cardholder’s signature. This signature strip serves as a means of verifying the card’s authenticity when making purchases at locations that require a signature.

Additionally, some debit cards may have additional security features such as holograms, embedded chips (EMV), or contactless payment capabilities (e.g., Visa payWave or Mastercard PayPass). These features may vary depending on the card issuer and the type of debit card.

What’s a debit or credit card expiry date?

The expiry date on a debit or credit card refers to the month and year until which the card is considered valid. It is an important security feature that helps protect against unauthorized use of the card.

The expiry date is typically printed on the front of the card, below or near the card number. It consists of two digits for the month and two digits for the year. For example, if the expiry date is printed as “06/25,” it indicates that the card will expire in June 2025.

When a card reaches its expiry date, it means that the card is no longer valid for use. So the bank has to issue a new card. The purpose of the expiry date is to ensure that the cardholder regularly receives a new card with updated security features and to mitigate the risk of using an outdated or compromised card.

It is important to note that even if a card has expired, the associated bank account remains active, and the cardholder can continue to use the account. The expiry date only pertains to the physical card and its usability for transactions.

What is a sort code?

A sort code is a unique identification number used primarily in the United Kingdom and Ireland to identify banks and branches within a financial institution. It is a six-digit number that is used for routing and processing various types of financial transactions, such as domestic and international bank transfers, direct deposits, and bill payments.

What are the ways to find a debit card number?

Here are some common ways to locate your debit card number:

Physical card: The easiest and most common way to find your debit card number is by looking directly at the card itself. The card number is typically printed on the front of the card, embossed in raised numbers. It is usually a 16-digit number, divided into groups of four digits.

Online banking: If you have access to your bank’s online banking portal or mobile app, you can often view your debit card number there. Log in to your online banking account and navigate to the section that displays your account details or card information. Your debit card number should be listed along with other relevant card details.

Bank statements: Your bank statements usually include your debit card number, particularly if you have made transactions using the card within the statement period. Look for your most recent bank statement either online or in paper format, and the debit card number should be mentioned there.

Customer service: If you are unable to find your debit card or access your account details through the methods above, contacting your bank’s customer service is an option.

How do I find my 16-digit debit card number by contacting my bank?

If you need to find your 16-digit debit card number by contacting your bank, follow these general steps:

Prepare identification: Have your personal identification and account details ready. This may include your full name, date of birth, address, and any other information the bank may require to verify your identity and account ownership.

Call customer service: Dial the customer service number provided by your bank. This number can usually be found on the back of your debit card, on the bank’s website, or your account statements. Follow the prompts or speak to a customer service representative.

Verification process: Once connected with a customer service representative, explain that you need assistance in retrieving your 16-digit debit card number. The representative may ask you to verify your identity by providing personal information and answering security questions. This step ensures that they are providing sensitive account information to the authorized cardholder.

Follow instructions: The customer service representative will guide you through the process and provide you with your 16-digit debit card number. They may communicate it to you over the phone or provide it through a secure channel, such as email or a secure messaging service.

Can someone steal your debit card number?

Yes, someone can steal your debit card number. Debit card number theft can occur through various means, including:

Skimming: Criminals may use skimming devices to capture the information from your debit card when you use it at ATMs, gas pumps, or other payment terminals. These devices can be installed discreetly and are designed to collect your card number and other sensitive information.

Data breaches: When a company or institution experiences a data breach, hackers can gain unauthorized access to their databases and steal customer information, including debit card numbers. This can occur with online merchants, financial institutions, or even payment processors.

Phishing and scamming: Scammers often use deceptive techniques to trick individuals into providing their debit card information. They may pose as legitimate organizations, send phishing emails, make fraudulent phone calls, or create fake websites to collect your card details.

Card theft: If your physical debit card is stolen, the thief may have access to your card number along with other sensitive information, unless the card is quickly reported as lost or stolen.

How to protect your debit card?

To protect yourself from debit card number theft, it is important to take several precautions:

Keep your card secure: Ensure that your debit card is kept in a safe and secure place. Avoid leaving it unattended or sharing it with others.

Monitor your accounts: Regularly review your bank statements and transaction history. If you notice any unauthorized or suspicious transactions, report them to your bank immediately.

Use secure ATMs and payment terminals: When using ATMs or making payments, be cautious of any suspicious or tampered devices. Use ATMs located in well-lit areas and check for any signs of tampering before inserting your card.

Be cautious online: Only provide your debit card information on secure and trusted websites. Be wary of unsolicited requests for your card details and be cautious when clicking on links in emails or messages.

Report lost or stolen cards promptly: If your debit card is lost or stolen, report it to your bank immediately so they can block the card and prevent unauthorized use.

How do I find my 16-digit debit card number on the mobile app?

To find your 16-digit debit card number on a mobile banking app, follow these general steps:

Install and open the mobile banking app: Download and install your bank’s official mobile banking app from the respective app store (e.g., Google Play Store for Android or App Store for iOS). Launch the app on your mobile device.

Log in to your account: Enter your login credentials, such as username and password, to access your mobile banking account. If you haven’t registered for mobile banking, you may need to set up an account or enroll in the service first.

Navigate to card details: Once logged in, navigate to the section of the app that displays your account details or card information. Look for an option that specifically provides your debit card details.

View the card information: In the card details section, you should be able to view your debit card number along with other relevant card information, such as the expiration date and cardholder’s name.

Most banks follow this straightforward method but the exact process can vary in some institutions. So you can visit their online website for help documentation.

Where can I find my checking account number on my debit card?

The checking account number is a separate identification number specific to your bank account, and it may not be displayed on the debit card itself. However, you can find your checking account number through other means:

- Bank Statements

- Online Banking

- Checkbook

- Customer Service

How do I find my 16-digit debit card number without the card?

here are three ways to find your debit card number without the card:

- Bank Statements

- Online Banking

- Contact your Bank

Can anyone access a bank account if he knows the debit card number?

No, simply knowing the debit card number alone is not sufficient for someone to access your bank account. While the debit card number is a piece of the puzzle, it is not enough to carry out unauthorized transactions or gain access to your bank account.

To access a bank account, additional security measures are in place to protect your funds. These typically include:

Personal Identification Number (PIN): A PIN is a unique numeric code associated with your debit card. It acts as a password and is required to authorize transactions at ATMs and certain point-of-sale terminals. Without the PIN, it would be challenging for someone to withdraw cash or make purchases using a debit card.

Online Banking Credentials: Accessing your bank account online usually requires a separate set of login credentials, such as a username and password. These credentials provide an additional layer of security to prevent unauthorized access to your account information and transactions.

Two-Factor Authentication (2FA): Many banks offer two-factor authentication as an additional security measure. This requires an extra verification step, such as a one-time password sent to your mobile device or a biometric scan, to ensure that only authorized individuals can access the account.

Security Monitoring: Banks employ sophisticated security measures to monitor and detect suspicious activities on accounts. They use fraud detection systems that analyze patterns and behaviors to identify potential unauthorized access or fraudulent transactions. If any suspicious activity is detected, the bank can take immediate action to protect your account.

However, it is still crucial to keep your debit card number confidential and take precautions to prevent unauthorized access.

RELATED POSTS:

40 Personal Finance Tips To Effectively Manage Your Money

What is a No-Spend Challenge? 7 Simple Tricks to Do It Yourself

109 Cheap Foods To Buy When Broke or On a Tight Budget

How to Create a Personal Budget [6 Easy Steps] PLUS Template

31 Downloadable Printable Monthly Budget Template (Excel + Pdf)

How do I find the routing number on a debit card?

Typically, debit cards do not contain the routing number. The routing number is a nine-digit number that identifies the financial institution responsible for processing a transaction. It is used for various types of transactions, including direct deposits, electronic funds transfers, and bill payments.

While the routing number is essential for certain transactions, it is not printed on debit cards themselves. Instead, there are other ways to find your routing number:

- Bank Statement

- Online Banking

- Bank’s Website

- Contact Customer Service

Is your bank account number your 7th – 15th digit on your credit/debit card?

No, your bank account number is not typically the 7th to 15th digit on your credit or debit card. The digits on a credit or debit card serve different purposes and represent different pieces of information. Here is a breakdown of the common digits on a credit or debit card:

First 6 Digits: The first six digits on a credit or debit card are known as the Issuer Identification Number (IIN) or Bank Identification Number (BIN). These digits identify the card issuer or the financial institution that issued the card.

Last 4 Digits: The last four digits on a credit or debit card are often referred to as the card’s “end digits” or “personal account number.” They are unique to your card and serve as a form of identification.

Expiry Date: The expiry date on a credit or debit card indicates the month and year the card is valid until. It is used as a security measure to ensure the card is not used beyond its expiration date.

CVV/CVC/CVV2: The Card Verification Value (CVV), Card Verification Code (CVC), or CVV2 is a three- or four-digit security code printed on the back or front of the card. It provides an additional layer of security for card-not-present transactions, such as online or over-the-phone purchases.

Is a debit card number and account number the same?

No, a debit card number and an account number are not the same.

A debit card number is a unique 16-digit number assigned to your debit card. It is printed on the front of the card and typically consists of four sets of four digits.

The debit card number is used primarily for making card-based transactions, such as purchases at point-of-sale terminals or online payments. It is associated with your specific debit card and acts as a reference to access funds from your linked bank account when you make transactions.

On the other hand, an account number refers to the unique identification number assigned to your bank account. It is used to identify your specific bank account within the financial institution. The account number is typically a series of digits that can vary in length depending on the bank and the specific type of account. In the US its length varies from 8 digits upto 16 and 17 digits.

What will be the account number if the old debit card is blocked and you receive a new debit card?

If your old debit card is blocked or deactivated, and you receive a new debit card from your bank, your bank account number remains the same. The account number is associated with your bank account, not the physical debit card. When you receive a new debit card, it is typically linked to the same underlying bank account.

The primary purpose of replacing a debit card is to issue a new card with updated security features or to replace a lost, stolen, or expired card. The replacement card will have a new card number, expiration date, and CVV (Card Verification Value) code for security reasons, but it does not affect your bank account number.

Yds have a slightly different format. The card number is a 15-digit numeric code and is printed on the front of the card, typically above the cardholder’s name. It is also embossed on the card surface.

In all cases, the card number is the primary identifier for your card and is necessary for making online or phone-based purchases, as well as certain in-person transactions.

Please note that it is important to keep your card number secure and avoid sharing it with unauthorized individuals to protect against fraud or misuse.

How can I tell if a card number is valid?

Validating a card number typically involves performing a series of checks to ensure it follows the proper format and has a valid structure. The specific validation method can vary depending on the type of card (debit, credit, or prepaid) and the card issuer. Here are some common techniques for checking card number validity:

Luhn Algorithm: The Luhn algorithm, also known as the mod 10 algorithm, is widely used to validate card numbers. It verifies the integrity of the card number by performing a mathematical calculation. The algorithm checks the digits of the card number and ensures they comply with a specific formula. If the resulting calculation matches a predefined pattern, the card number is likely valid.

Issuer Identification Number (IIN): The first few digits of a card number represent the issuer identification number (IIN) or bank identification number (BIN). Each card issuer, such as Visa, Mastercard, or American Express, has a specific range of IINs. By checking the IIN against the known ranges of valid issuer numbers, you can verify if the card number is potentially valid.

Length and Format: Different types of cards have specific length and format requirements. For example, Visa and Mastercard numbers are typically 16 digits long, while American Express numbers are 15 digits long. Additionally, card numbers may have specific patterns or combinations of digits based on the card issuer. Checking if the card number matches the expected length and format can help identify potential validity.

Checksum Validation: Some card issuers use additional checksum validation techniques to verify card numbers. These techniques involve performing specific calculations or applying validation algorithms on certain digits of the card number. By checking the calculated checksum against the expected value, you can determine if the card number is valid.

It’s important to note that while these methods can help identify potential validity, they do not guarantee that a card number is active or that the associated account has sufficient funds. To verify the status and legitimacy of a card, it’s best to contact the card issuer or perform a transaction using the card through authorized channels.

Is the debit or credit card account number the same as the card number?

No, the debit or credit card account number is not the same as the card number.

In summary, the card number is the identifier for the physical card itself, while the account number is associated with the bank account linked to the card. They serve different purposes and are used in different contexts when performing transactions or managing your finances.

What is a bank account number used for?

A bank account number is used for various purposes related to managing your finances and conducting transactions. Here are some common uses of a bank account number:

Identification: Your bank account number serves as a unique identifier for your specific bank account. It distinguishes your account from others held at the same bank or financial institution.

Deposits: Your bank account number is used to receive deposits into your account. It allows others, such as your employer or individuals making payments to you, to transfer funds directly into your account.

Withdrawals: When you need to make withdrawals from your account, your bank account number is used to authorize and process the transaction. It ensures that the funds are debited from the correct account.

Electronic Fund Transfers: Bank account numbers are required for electronic fund transfers, such as online payments, bill payments, and money transfers between accounts. It enables the seamless transfer of funds between different accounts and financial institutions.

Direct Debits: If you set up automatic bill payments or authorize organizations to directly debit funds from your account, your bank account number is used for this purpose. It ensures that the correct account is charged for the authorized payments.

Statements and Notifications: Your bank account number is used by the bank to identify your account when generating statements, providing transaction history, and sending account-related notifications or updates.

Account Management: When you interact with your bank, whether through online banking, mobile banking, or in-person transactions, your bank account number is used to access and manage your account information, including balance inquiries, account settings, and account-specific services.

How many digits is a bank account number?

The number of digits in a bank account number can vary depending on the country and the financial institution. However, in many countries, including the United States, Canada, and most European countries, bank account numbers are typically between 8 and 12 digits long.

In the United States, for example, bank account numbers are generally 9 digits long, but they can vary in length depending on the bank. In Canada, bank account numbers can be up to 12 digits long, while in the United Kingdom, they are usually 8 digits long.

Where is the bank routing number located on a check?

The bank routing number is typically located at the bottom left corner of a check. It is a nine-digit number that identifies the financial institution where the account is held. To find the bank routing number on a check, follow these steps:

Look at the bottom left corner of the check. You will see a series of numbers printed in a specific order.

The first set of numbers on the bottom left is the routing number. It is usually nine digits long and may be surrounded by symbols, such as vertical lines or colons, to separate it from the other numbers.

The routing number is typically followed by the account number, which is the second set of numbers on the bottom of the check.

branch or region of your bank. Therefore, ensuring you have the correct routing number for your specific account and transaction needs is essential.

HELPFUL POST: What is Credit Card? How Does it Work?

What do I need my routing number for?

You may need your routing number for various financial transactions and activities. Here are some common situations where your routing number is required:

Setting up Direct Deposit: When you want to receive your salary, government benefits, or other recurring payments directly into your bank account, you typically need to provide your routing number to the payer. The routing number helps ensure that the funds are correctly directed to your bank and account.

Electronic Fund Transfers: When initiating electronic transfers, such as online bill payments or transferring funds between bank accounts, you generally need to provide the routing number of the recipient’s bank. This ensures that the funds are properly routed to the intended financial institution.

ACH Payments: Automated Clearing House (ACH) payments are commonly used for various transactions, including direct debits for bills, online purchases, or transferring funds between accounts. Your routing number is required to authorize and process these ACH transactions.

Wire Transfers: If you need to send or receive funds through a wire transfer, both the sender and recipient typically need to provide their respective bank’s routing number. This helps facilitate the secure and accurate transfer of funds between financial institutions.

Receiving Payments: When receiving payments from individuals or organizations, such as clients or customers, they may require your routing number to set up direct payments or wire transfers to your bank account.

Verifying Account Ownership: In some cases, financial institutions or service providers may request your routing number as a means to verify ownership of your bank account. It helps confirm that you have authority over the specified bank account.

It’s important to note that the specific situations where you might need your routing number can vary based on your location, banking system, and the type of transaction you’re conducting. Suppose you’re unsure whether you need to provide your routing number for a particular transaction. In that case, it’s best to consult with the relevant party, such as your employer, financial institution, or service provider.

Conclusion

So you’ve learned where is the account number on a debit card along with other information including:

What is a sort code?

What is a security code?

Wow to protect your debit card?

What is written on the debit card?

What is the difference between an account number and a routing number?

Now I hope you have a clear understanding and knowledge about your debit card and you can use this to your benefit in the future.

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024