Last updated on February 20th, 2024 at 05:19 pm

In this post, you’ll learn that 17 an hour is how much a year

I’ll also cover how much is 17 an hour monthly, biweekly, weekly, and daily.

You get to know the expected amount of tax you’ve got to pay to Uncle Sam each year on a $ 17-an-hour salary.

After the calculation, you’ll get an example budget for managing expenses and jobs that pay a 17-per-hour rate. In addition to this, important tools and tips are discussed to help you live on a seventeen-dollar-per-hour income.

So let’s jump to the next section for an explanation…

17 an hour is how much a year

As you know, a whole year consists of 260 working days. If you’re working full time for 8 hours per day, then your total working hours for a year are 2080. Now you can easily calculate your early earnings at the 17-hour wage rate.

What you have to do is multiply the $ 17-an-hour rate by 2080 working hours.

So here is a formula:

Annual Salary = Hourly Wage × Hours Worked per Year

You can also use the following formula:

Annual Salary = Hourly Wage × Hours Worked Per Week × Weeks Worked Per Year

Note: In this calculation, I am considering that you took no unpaid time off.

Annual Salary = $17/hour × 40 hours/week × 52 weeks/year = $35,360 per year

Hence, if you make $17 an hour, then you’ll earn $35,360 a year in gross salary.

Now if you choose to work part-time for 5 hours a day, your total part-time working hours for the year become 1,300. Now multiplying $17 per hour by 1,300 hours gives you $22,100 a year.

Part-time income = $17 per hour × 25 hours/week × 52 weeks/year = $22,100 per year

17 an hour is how much a year after taxes

If you’re earning money, then you’ve got to pay taxes as well.

So now let’s calculate the yearly tax on above-average 17-hour income, which is $35,360 a year.

So there are three main types of taxes you have to pay on your income. First is the federal tax; second is the state tax; and third is FICA, which includes Social Security and Medicare.

Here again, I am making some assumptions. First, you’re living in a state with zero tax, and second, you’re a single person. There are no eligible deductions included, and this is just an estimate of your annual tax; the actual amount can vary.

So here is how much tax applies to your income for each individual tax type:

- Federal tax = 12% because you’re falling in the $11,001 to $44,725 bracket.

- State tax = 0% considering that you live in Texas.

- FICA Tax = 7.65%, including 6.2% Social Security and 1.45% Medicare.

Here I’m using the SmartAssets tax calculator to find the expected amount of tax on my $17 an hour income. Here is the calculation:

| Tax Type | Marginal Tax Rate | Effective Tax Rate | 2022 Taxes |

| Federal | 12.00% | 7.02% | $2,484 |

| FICA | 7.65% | 7.65% | $2,705 |

| State | 0.00% | 0.00% | $0 |

| Local | 0.00% | 0.00% | $0 |

| Total Income Taxes | 14.67% | $5,189 | |

| Income After Taxes | $30,171 | ||

| Retirement Contributions | $0 | ||

| Take-Home Pay | $30,171 |

So your total tax amount becomes $5,189 a year, and you’re left with $31,171 after tax.

Hence, the answer to the question 17 an hour is how much a year after taxes is: $31,171.

If you want to calculate tax on part-time income, then the same procedure is used. Here again, I am taking help from the Smart Assets Tax Calculator. Here is a snapshot of your taxes, keeping in mind the above assumptions:

| Tax Type | Marginal Tax Rate | Effective Tax Rate | 2022 Taxes |

| Federal | 10.00% | 4.14% | $915 |

| FICA | 7.65% | 7.65% | $1,691 |

| State | 0.00% | 0.00% | $0 |

| Local | 0.00% | 0.00% | $0 |

| Total Income Taxes | 11.79% | $2,606 | |

| Income After Taxes | $19,494 | ||

| Retirement Contributions | $0 | ||

| Take-Home Pay | $19,494 |

Hence, you pay $2,606 in taxes and keep a take-home pay of $19,494 a year.

17 an hour is how much semiannually

Here is a formula for calculating semiannual earnings at $17 per hour:

Semiannual Earnings = Hourly Wage × Hours Worked per Week × Weeks Worked per Semiannual Period

Assuming a typical workweek of 40 hours and a semiannual period of 26 weeks (half of a year), you can calculate your semiannual earnings as follows:

Semiannual Earnings = $17/hour × 40 hours/week × 26 weeks/semiannual period

Now, calculate it:

Semiannual Earnings = $17 × 1,040

Semiannual Earnings = $17,680

So, if you earn $17 per hour and work a standard 40-hour workweek for 26 weeks (half of the year), your semiannual earnings would be $17,680.

As a part-time worker, you’ll earn $11050 a year working 650 hours.

17 an hour is how much quarterly?

There are three quarters in a year and two in a semiannum. A quarter consists of 13 weeks or 65 working days. The total full-time working hours in a quarter are 520, and multiplying them by $17 gives $8840.

While working part-time for 5 hours per day, your total working hours become 325. Multiplying 325 working hours with 17 an hour gives $5,525.

So you earn $8840 per quarter working full-time and $5525 per quarter working part-time.

RELATED POSTS:

$11 an Hour Is How Much a Year, a Week, a Month, and a Day?

22 An Hour Is How Much A Year After Taxes? Is It Enough To Live?

23 Dollars An Hour Is How Much A Year? Is Enough To Live Easily?

25 Dollars An Hour Is How Much A Year? Is It Enough To Live?

21 An Hour Is How Much A Year? How To Live On This Salary?

45 An Hour Is How Much A Year After Taxes In The US Full-Time

$35 An Hour Is How Much A Year After Taxes Full And Part-Time

27 An Hour Is How Much A Year? How To Budget It [With Example]

$28 an Hour is How Much a Year? Is It a Good Salary?

$44000 a Year Is How Much an Hour? Is 44K Good And Liveable?

17 an hour is how much a month

Each month consists of 21.66 working days on average. This value is obtained by dividing the 260 working days by 12 months. This does not mean that the exact value is the same each month, but it does vary. Some months have 21 working days; some have 20 and 22. All of these account for 260 per year.

As a full-time worker, if you multiply 21.66 by 8, you get 173.33 working hours per month. Now let’s calculate the monthly income:

Working days per month = 260 working days per year. 12 months in a year = 21.66.

Now, calculating the working days per month:

Working hours per month = 21.66 work days per month × 8 hours per day = 173.33 hours

Now let’s calculate the monthly gross income:

Monthly income = 173.33 working hours × $17 per hour = $2946.61

If you’re working part-time for 5 hours per day, then your total working hours per month are here:

Part-time working hours = 21.66 working days × 5 work hours per day = 108.3 working hours

To calculate the total part-time earnings, multiply the monthly working hours by the hourly rate of $17.

Monthly Earnings = 108.3 working hours × $17 per hour = $1,841.1

Hence, as a full-time worker at 17 an hour, you’ll make $2946.61 as a full-time worker and $1,841 a month as a part-time employee.

17 an hour is how much biweekly

To calculate your earnings on a biweekly basis (every two weeks) at a full-time rate of $17 per hour, you can use the following formula:

Biweekly Earnings = Hourly Wage × Hours Worked per Week × Number of Weeks in a Biweekly Period

Assuming a full-time workweek of 40 hours and a biweekly period of 2 weeks, you can calculate your biweekly earnings as follows:

Biweekly Earnings = $17/hour × 40 hours/week × 2 weeks/biweekly period

Now, calculate it:

Biweekly Earnings = $17 × 80

Biweekly Earnings = $1,360

So, if you earn $17 per hour and work full-time (40 hours per week) on a biweekly basis, your biweekly earnings would be $1,360.

Let’s assume you work 5 hours a day, 5 days a week (part-time) for a total of 2 weeks in a biweekly period:

Biweekly Earnings = $17/hour × 5 hours/day × 10 days/week

Now, calculate it:

Biweekly Earnings = $17 × 50

Biweekly Earnings = $850

So, if you earn $17 per hour and work part-time for 5 hours a day, 5 days a week, your biweekly earnings would be $850.

17 an hour is how much you pay biweekly after taxes.

17 an hour is how much weekly?

To calculate your weekly earnings at a rate of $17 per hour, you can use the following formula:

Weekly Earnings = Hourly Wage × Hours Worked per Week

Assuming you work a standard 40-hour workweek:

Weekly Earnings = $17/hour x 40 hours/week

Now, calculate it:

Weekly Earnings = $680

So, if you earn $17 per hour and work 40 hours per week, your weekly earnings would be $680.

Let’s assume you work 5 hours a day, 5 days a week (part-time):

Weekly Earnings = $17/hour × 5 hours/day × 5 days/week

Now, calculate it:

Weekly Earnings = $17 × 25

Weekly Earnings = $425

So, if you earn $17 per hour and work part-time for 5 hours a day, 5 days a week, your weekly earnings would be $425.

Let’s assume you work 5 hours a day, 5 days a week (part-time):

Weekly Earnings = $17/hour × 5 hours/day × 5 days/week

Now, calculate it:

Weekly Earnings = $17 × 25

Weekly Earnings = $425

So, if you earn $17 per hour and work part-time for 5 hours a day, 5 days a week, your weekly earnings would be $425.

17 an hour is how much daily

There are 8 working hours in a day. So you can multiply them by $17 an hour to get the daily full-time wage estimate. Here is the calculation:

Daily full-time wage = $17 hourly rate × 8 working hours per day = $136 per day

If you work part-time for 5 hours a day, your total part-time earnings are:

Part-time wage = $17 per day x 5 hours worked = $85

Hence, if you work full-time for 8 hours per day, you’ll earn $136 as full-time earnings. On the other hand, working part-time for 5 hours per day will help you earn $85 per day at the $17 an-hour wage rate.

RELATED POSTS:

Hourly salary to annual calculator

You can use this calculator to convert any hourly wage to an annual salary. Just insert your hourly rate and click calculate. The answers are shown below for different timeframes including yearly, semiannually, quarterly, monthly, bi-weekly, weekly, and daily.

17-hour salary with paid and unpaid time off

Including 11 holidays, sickness, and other important circumstances, the workers on average take leave of 2 to 4 weeks per year. That means if you get paid for a vacation or leave throughout the year, you’ll earn the same amount as calculated above. That’s $35,360 a year with 2 or 4 weeks of paid vacation.

If your vacation is unpaid, then your total earnings will drop. Let’s say you take three weeks of vacation throughout the year. Now there are 120 working hours in 3 weeks. Multiplying 17 hours by 120 gives you $2040. That means your annual income decreases to $33,320. Hence, if you take paid vacation, you’ll earn the same amount; otherwise, on 3 weeks of unpaid vacation, you’ll earn $33,320 a year in gross salary. This means your hourly rate drops from $17 to $16.01.

17-hour monthly budget example

Here is a monthly budget example for a 17-hour income. It’s based on average percentages of expense categories. Your actual budget can be different depending on factors such as your spending, lifestyle choices, and obligations.

So let’s see the following budgeting example:

| Category | Budgeted Amount ($) |

|---|---|

| Income | $2,598 |

| Housing | $800 |

| Utilities (electricity, water, gas) | $150 |

| Groceries | $300 |

| Transportation (gas, public transit) | $150 |

| Insurance (car, health, etc.) | $200 |

| Debt Payments (credit cards, loans) | $200 |

| Entertainment | $100 |

| Dining Out | $100 |

| Personal Care (toiletries, cosmetics) | $50 |

| Clothing | $50 |

| Health (prescriptions, co-pays) | $50 |

| Miscellaneous | $48 |

| Total Expenses | $2,198 |

| Savings and Investments | $400 |

The $2598 is a take-home pay or disposable income. Keep in mind that the income is low, which is why your savings will be small and sometimes zero due to additional expenses. That’s why staying frugal and always finding opportunities to earn more is important.

RELATED POSTS:

Example Of A Monthly Budget? How To Cut Back Extra Expenses

How To Make a Budget Binder In 4-Simple Steps (Free Templates)

Cash Envelope System: 9-Simple Steps To Do Envelope Budgeting

31 Downloadable Printable Monthly Budget Template (Excel + Pdf)

10 Best Budgeting Apps of 2022 (Free + Paid)

30 Money-Saving Charts To Track Your Savings And Debt Pay-Off

59 Ways on How to Save Money Even If You Find it Difficult

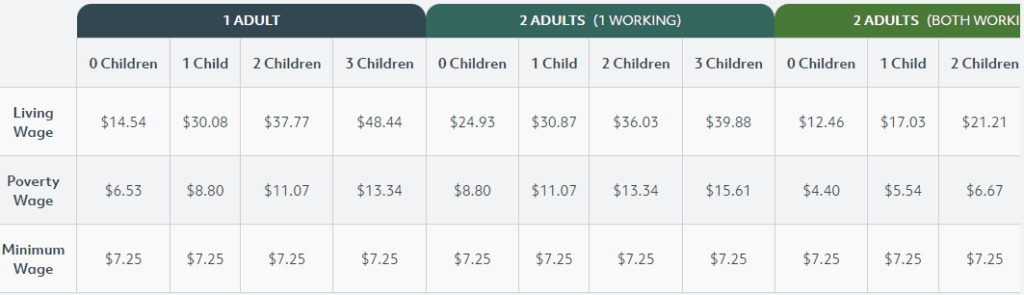

Is $17 an hour a livable wage?

Whether you can live on a $17-an-hour income or not totally depends on factors such as your location, family size, and financial needs. In areas with lower costs of living, a wage of $17 an hour can help a single individual cover their basic needs. However, in higher-cost regions, especially if you have dependents, it is not sufficient. Obviously, you’ve got to pay for rent, food, child care, and other expenses.

The MIT Living Wage Calculator is a useful tool for calculating the minimum income you require to meet basic needs in different locations across the USA. The calculator takes into account local cost-of-living data and family size.

The federal minimum wage in the US is $7.25 per hour, and $17 is much higher than that. You can live easily as a single individual, especially if you’re a fresh graduate.

So here are some factors you should consider:

Location: The cost of living can vary greatly from one region to another. For example, $17 an hour may go much further in a rural area than in New York or San Francisco.

Family Size: The number of dependents you have will significantly impact whether this wage is livable or not. As the family size increases, you require a higher income to cover expenses.

Debt and Expenses: Existing debts and financial obligations, such as student loans or high medical expenses, can make it more challenging to make ends meet on $17 an hour.

Quality of life: A livable wage is not just about covering basic needs. It helps you enjoy some quality of life, save for the future, and handle unexpected expenses.

Government Assistance: Eligibility for government programs like Medicaid, SNAP (food stamps), and housing assistance can also affect the sufficiency of a wage.

Is 17 an hour good pay?

It totally depends on the factors that make a payment good or bad. These factors include:

- Cost of living in your area

- Your financial obligations and needs

- The benefits attached to your job

- Responsibilities you have to handle on the job

- Family size and lifestyle requirements

- The average wage in your area

- Career growth and advancement opportunities

- Your financial goals, like a car, savings, investment, and house

If you see that all or some of these factors are satisfied, then $17 an hour is a good wage. For example, if your employer offers higher benefits along with the wage, then it adds significant value to the job. Likewise, if the career advancement opportunities are higher and you can grow more in the future, including earnings and career, then that is amazing.

If these factors are not satisfied, then you should make an alternative decision to earn more.

How much rent can I afford at $17 an hour?

According to the 30% rule, you should not spend more than 30% of your before-tax income on rent. But after deducting the tax from your before-tax income, you’re left with take-home pay that is less than your gross income. So at $17 an hour, your monthly take-home pay will be around $2600 after deducting the tax amount.

Applying the 30% rule to $2600 means that you can spend $780 or $800 per month on rent. And the remaining amount can be allocated to other necessities and savings.

In short, you can afford to spend around $800 on rent if you’re getting paid a 17-hour wage.

What is a time and a half for $17 an hour?

“Time and a half” refers to a pay rate that is 1.5 times an employee’s regular hourly wage. This rate is typically applied to hours worked beyond the standard 40 hours in a workweek and is a common practice for overtime pay in many employment situations.

To calculate time and a half for an hourly wage of $17, you would follow these steps:

- Determine the regular hourly rate: In this case, it’s $17 per hour.

- Calculate the overtime rate: multiply the regular hourly rate by 1.5 (or 150%) to find the time-and-a-half rate.

- $17/hour * 1.5 = $25.50/hour

So, if you work overtime hours, which are typically any hours beyond 40 hours in a workweek, you would be paid at a rate of $25.50 per hour for each of those overtime hours. This higher rate is intended to provide extra compensation for employees who work more than the standard 40-hour workweek.

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024