Last updated on February 5th, 2024 at 06:38 am

In this article, you’ll learn $29 an hour is how much a year.

Not only that you also get to know the tax you pay and how much disposable income you get left with.

And if you’re tired of doing your current job I’ll share jobs that pay more than $29 an hour.

Along with that help, you to create a budget while earning $29 an hour each month. So you can afford expenses and save more money.

So let’s dive deeper…

How many working hours in the year 2023?

Before getting on to calculating the total yearly income at 29 an hourly wage rate, first, you’ve to know three things.

- Total business days

- Total working days

- And total working hours

According to Leave Board.com, there are 260 business days (2,080 hours) in 2023 after excluding the weekends (that is 52 Saturdays and 53 Sundays). But throughout the whole year, there are federal- holidays like Christmas and others that account for 11 days.

So after deducting 11 holidays from 260 business days, you’re left with 249 working days throughout the year.

There is a total of 8 full-time working hours per day. So multiplying that by 249 working days, you get left with 1,992 working hours per year.

Now you may also work part-time in any job position so let’s count those hours as well.

According to Glassdoor the worker who works 20 to 29 hours per week is considered part-time. But the statistics vary and according to Flexjobs, this time is between 30 to 35 hours a week.

So let’s say you work 5 hours part-time per day then it’s 1,245 hours per year for 249 working days.

Now jump into the next section…

$29 an hour is how much a year

You know that there are 249 working days and 1,992 working hours in 2023.

You can now easily calculate the total earning at $29 an hour wage.

Here is a formula:

Yearly income = total working days * working hours per day * rate per hour

Or

Yearly income = total working hours in a year * rate per hour

So here is the actual calculation and the answer:

Yearly income = 249 * 8 * $29 = $57,768

Let’s say your employer pays you for holidays. Then the working days don’t count as 249 instead they’ll be 260. So for 260 days, your total yearly income before tax will be:

Yearly income = 260 * 8 * 29 = $60,320

So for 249 days, you earn $57,768 and for 260 days it’s $60,320 in gross income or income before tax.

$29 an hour is how much a year working part-time

Let’s calculate the income at 29 an hour if you work part-time as well.

So there are between 20 to 35 hours of part-time work per week which accounts for 4, 5, 6, or 7 hours per day for 5 days a week.

Here we are calculating the answer for all these four values.

If you work 4 hours per day part time then here is the total yearly earnings at 29 an hour:

Total part-time income = 260*4*29 = $30,160 before tax

Total part-time income = 249*4*29 = $2,8884

Working 5 hours per day gives you the following figures:

Total part-time income = 260*5*29 = $37,700

Total part-time income = 249*5*29 = $36,105

If you work for 6 hours part-time per day then here is your income:

Total part-time income = 260*6*29 = $45,240

Total part-time income = 249*6*29 = $43,326

If you work 7 hours per day part time then your yearly income at 29 an hour will be the maximum:

Total part-time income = 260*7*29 = $52,780

Total part-time income = 249*7*29 = $50,547

I have calculated values for both 260 days working part-time and 249 days working part-time. So if you skip working part-time on holidays then go with figures where 249 days are taken, while in another case 260 working days are counted.

All of the above incomes including full-time and part-time are gross incomes or income before tax. In the next section, you know how much income after tax you’re left with.

So let’s jump to the next section…

$29 an hour is how much a year after taxes?

It’s important to know how much taxes you pay on $29 an hour or $60,320 a year income.

There are four types of incomes taxes you have to pay while living in the USA:

- Federal income tax

- State income tax

- Social security

- Medicare tax

If you see the federal income tax brackets then the full-time income of 29 an hour falls in the category of $41,776 to $89,075. So here the marginal federal tax rate is 22%.

Here is the actual tax you pay if you earn $60,320 or $57,758:

Federal income tax = $60,320 * 22% = $13,270

Federal income tax = $57,768 * 22% = $12,709

The second is state income tax which is different depending on the state you live in. Some states have zero taxes as well.

For this calculation, let’s say you live in a state with a zero tax rate so you don’t have to pay state income tax.

The third is the social security tax which is 6.2% for employees and 12.4% for self-employed on the first $160,000 of income. So here is a calculation for two-income values:

If you earn full-time income for 260 days then here is the social security tax amount:

Social security tax= $60,320 * 6.2% = $3,740 (for self-employed it’s $7,480)

But if you earn money for just 249 working days then here is your actual tax amount:

Social security tax = $57,768 * 6.2% = $3,582 (for self-employed it’s $7,164)

The fourth is Medicare tax which is 1.45% for employees and 2.9% for self-employed for upto $200,000 annual income. So here is the tax amount for both incomes:

Medicare tax = $60,320 * 1.45% = $875

But if you work only 249 days then here is the value:

Medicare tax = $57,768 * 1.45% = $838

In social security and Medicare taxes, the other half is paid by your employer if you do a job in any organization. Remember that if you’re self-employed then you’ve to pay double the rate that’s 12.4% for social security and 2.9% for Medicare.

Here is a table of federal tax, state income tax, social security, and Medicare tax amounts for two income levels:

| INCOME | FEDERAL TAX | STATE TAX | SOCIAL SECURITY | MEDICARE |

|---|---|---|---|---|

| $60,320 | $13,270 | $0 | $3,740 | $875 |

| $57,768 | $12,709 | $0 | $3,582 | $838 |

If you add up all of these taxes then here is how much percentage and amount of your income goes into taxes:

On earnings of $60,320 a year, you pay the following amount in all four types of taxes considering state income tax zero for this calculator:

Total tax = $13,270 + 0 + $3,740 + 875 = $17,785

Net income after taxes = $60,320 – $17,785 = $42,535

On earnings of $57,768 for 249 working days, you pay the following amount in taxes while considering state income tax zero:

Total tax = $12,709 + $0 + $3,583 + $838 = $17,129

Net income after tax = $57,768 – $17,129 = $40,639

So you pay $17,785 in taxes if you make $60,320 a year for working 260 days a year at 29 dollars an hour for 8 hours a day. Otherwise, for 249 working days with 11 holidays unpaid, you only pay $17,129 a year in taxes.

Here all the itemized and standard deductions are not applied and the amount is calculated using tax brackets. Otherwise, the effective federal tax rate of $60,320 is 10.01%. For more information on your income tax concerns, it’s recommended to take the help of a tax professional.

RELATED POSTS:

80000 A Year Is How Much An Hour? Is It A Good Salary?

60000 A Year Is How Much An Hour? Budget It With Example

$35 An Hour Is How Much A Year After Taxes Full And Part-Time

Cheap Eats Near Me: 29 Ways to Save Money Dining Out

Find the Best, Cheap, 24-Hour, And Coin Laundromat Near Me

Coin Machine Near Me: How to Find Coinstar Machines Near Me?

25 Dollars An Hour Is How Much A Year? Is It Enough To Live?

23 Dollars An Hour Is How Much A Year? Is Enough To Live Easily?

21 An Hour Is How Much A Year? How To Live On This Salary?

45 An Hour Is How Much A Year After Taxes In The US Full-Time

$32000 A Year Is How Much An Hour? Is It A Good Salary or Not?

$44000 a Year Is How Much an Hour? Is 44K Good And Liveable?

What is the income tax on $60,320 a year?

Using brackets and not considering standard deductions you have to pay $13,270 in federal income tax. The state income tax depends on which state you live in. While social security and Medicare tax or FICA applies 7.65% which is $4,615. So you pay a total of $17,785 as income tax on $60,320 a year income on a 29-an-hour wage rate.

How much is $29 an hour or $60,320 semiannually?

Dividing the yearly income by 2 gives you the semiannual income at 29 an hour. So whether you’ve earned $60,320 for the whole 260 business days or just $57,768 working for 249 days, you can calculate it easily. See here:

Semiannual income = $60,320/2 = $30,160 before tax

In other words, you’ll earn $30,160 a year semiannually at a 29-an-hour wage rate.

How much is $29 an hour or $60,320 quarterly?

There are four quarters in a year. Each quarter consists of 3 months and so dividing the amount of $60,320 by 4 gives you quarterly income at 29 an hourly wage rate:

Quarterly income = $60,320/4 = $15,080 before tax

You can use the same formula to calculate quarterly part-time income.

How much is $29 an hour or $60,320 monthly?

This part is a little tricky because you’ve to take into account the work in a month. Then you multiply those working days by working hours to calculate the total working hours in a particular month. Remember that number of days changes from month to month.

Here are the monthly working days and hours in 2023:

| Month | Workday | Weekend | Holiday | Total |

|---|---|---|---|---|

| January 1-31 | 20 | 9 | 2 | 31 |

| February 1-28 | 19 | 8 | 1 | 28 |

| March 1-31 | 23 | 8 | 0 | 31 |

| April 1-30 | 20 | 10 | 0 | 30 |

| May 1-31 | 22 | 8 | 1 | 31 |

| June 1-30 | 21 | 8 | 1 | 30 |

| July 1-31 | 20 | 10 | 1 | 31 |

| August 1-31 | 23 | 8 | 0 | 31 |

| September 1-30 | 20 | 9 | 1 | 30 |

| October 1-31 | 21 | 9 | 1 | 31 |

| November 1-30 | 20 | 8 | 2 | 30 |

| December 1-31 | 20 | 10 | 1 | 31 |

| Total | 249 | 105 | 11 | 365 |

For example, there are 31 days in January 2023 while only 28 in February 2023. So January has 20 working days with 160 working hours, while February has 19 working days with 152 working hours.

So now you’ll earn a monthly income of $4,640 at 29 an hour in January 2023 while only $4,418 in February 2023. Here is a monthly income for all of the months of 2023 including working days and hours:

How much is $29 an hour or $60,320 biweekly?

It’s so simple because biweekly means two weeks and there are 5 working days in a single week with 10 working days in two weeks. Now multiply your working days by working hours and calculate the total working hours. After that multiply working hours by the hourly rate to get the total biweekly paycheck amount. Here it’s:

$60,320 biweekly = 10 working days * 8 working hours per day * $29 = $2,320

So you earn $2,320 every two weeks at a $29-an-hour wage rate.

How much is $29 an hour or $60,320 weekly?

There are only 5 working days in a week with 40 working hours. Multiplying these working hours with 29 an hourly rate gives you the following figures:

Total weekly income = 5 working days * 8 working hours * $29 = $1,160

You make $1,160 per week at a $29-an-hour wage rate.

How much is $29 an hour or $60,320 daily?

Each day there are 8 full working hours from 9 AM to 5 PM. With a $29 an-hour wage rate you earn a total of $232 per day. While if you work 5 extra hours part-time then your total part-time earnings will become $145 a day. Here is the calculation:

$60,320 daily = 8 hours * $29 = $232

Daily part time = 5 hours * $29 = $145

It’s an income before tax or gross income at the end of the year you’ve to pay taxes including federal income tax, state income tax, and FICA.

Hourly Salary to Annual Salary Calculator

What is the average salary in the US?

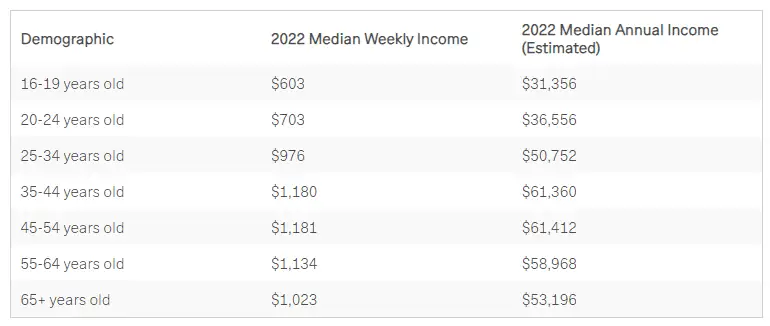

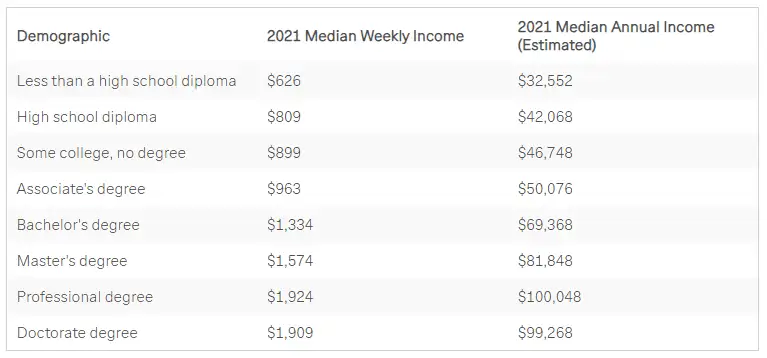

The average salary in the US greatly varies depending on age, profession, education level, social & economic conditions, industry, experience, and region. The national average also varies depending on the same factors. But the average personal income of an individual American is $63, 214 a year.

Here are some other related statistics about American’s income levels including age, industry, and profession from the First Republic:

American’s average income by age:

Average American’s income by occupation:

Americans’ average Income by education:

What is the hourly rate for $60,320 a year?

The hourly rate for making $60,320 a year is $29 per hour. And you’ve to make $232 per day full time which accumulates to $1,160 per week and $2,320 biweekly.

How do you calculate the hourly rate for annual salary?

To calculate the hourly rate from the annual salary you’ve to divide the total annual salary by the total number of working hours per year. For example, if you make $60,320 per year and there are $2,080 working hours in a year then you’ll earn $29 per day for 8 hours of work. So the formula (total income/total working hours) gives you per hour wage rate.

How much is the $29.50 an hour wage?

The $29.50 an hour income is a little more than $29 an hour but adds a bigger effect when compounds for a whole year. If you get paid for 260 days of the year full time then your income before tax will be $61,360. You earn $1,040 more as compared with $60,320 at $29 an hourly income.

How much rent can you afford on a $60,320-a-year income?

Your rent affordability depends on different factors, not just your income. Here are the 3 main factors:

- Location: Do you live in New York, Los Angeles, San Francisco, or Springfield? The more expensive city you live in the more rent you pay. In NYC the average rent is more than 2000 as compared with 662 in Springfield.

- House and Apartment: If you choose to live in a big and more luxurious house or apartment then more rent is charged. While living in an average apartment with enough space to fulfill your requirement is less costly.

- Money Management: Doing proper expense management and avoiding non-essential spending and wastage of money increases your affordability. While not doing a budget and lavishly spending money only wipes out your savings fund for paying rent.

At $29 an hour income or 60,320 a year, a good benchmark is not to spend more than 30% of income on the rent. Because if you follow the 50/30/20 budgeting method then your rent comes in 50% of the money you set aside for necessities. While the other 30% is for wants and 20% is for paying debt plus savings.

Here is your rent equals 20% of your income that’s 12,000 per year then it’s outstanding. If you spend 30% that is 18,000 on rent then it’s considered a sweet spot. While spending 40% or more is a splurge which is not recommended.

So you can afford upto 30% rent easily. For more information on how much rent affordability you can use the link below to calculate your, rent based on income, living location, and outstanding debt.

Comparison of $29 an hour with the median US salary?

According to the BLS 2022 report, 118.8 million US workers including both salary and full-time workers earn a median salary of $1085 per week. Multiplying this with 52 weeks gives an annual salary of $56,420. And dividing it by 12 gives a monthly salary of $4,702.

Comparing it with $29 an hour shows that US median salary is less than earning 29 an hour or 60320 a year. Because 29 an hour gives 1160 dollars a week and $5027 a month. At $29 an hour, you earn 6.87% more than the US median salary.

Here is a comparison of 29-an-hour income with the average salary of US states:

| Alabama: $48,110 | Nebraska: $52,110 |

|---|---|

| Alaska: $63,480 | Nevada: $51,080 |

| Arizona: $55,170 | New Hampshire: $59,270 |

| Arkansas: $46,500 | New Jersey: $67,120 |

| California: $68,510 | New Mexico: $51,860 |

| Colorado: $62, 900 | New York: $70,460 |

| Connecticut: $66,130 | North Carolina: $53,100 |

| Delaware: $59,820 | North Dakota: $53,380 |

| Florida: $51,950 | Ohio: $53,170 |

| Georgia: $53.940 | Oklahoma: $48,360 |

| Hawaii: $59,760 | Oregon: $59,070 |

| Idaho: $47,940 | Pennsylvania: $55,490 |

| Illinois: $59,650 | Rhode Island: $62,120 |

| Indiana: $50,440 | South Carolina: $ 47,490 |

| Iowa: $51,140 | South Dakota: $46,810 |

| Kansas: $49,680 | Tennessee: $49,330 |

| Kentucky: $48,170 | Texas: $54,230 |

| Louisiana: $47,740 | Utah: $53,400 |

| Maine: $53,230 | Vermont: $55,450 |

| Maryland: $65,900 | Virginia: $62,330 |

| Massachusetts: $72,940 | Washington: $68,740 |

| Michigan: $55,160 | West Virginia: $46,490 |

| Minnesota: $60,480 | Wisconsin: $53,120 |

| Mississippi: $42,700 | Wyoming: $52,110 |

| Missouri: $51,390 | |

| Montana: $49,340 |

$29 an hour is how much a year with paid and unpaid off time?

There are 11 federal holidays and including any other sick leave days, you may get off from your job for 2 to 3 weeks every year. So if your employer pays for those off times during the year then you earn a full income for 260 business days. And your total yearly gross income will be a total of $60,320.

But in case the employer doesn’t compensate those days with money, that means you don’t earn anything for those days. So if you take just the eleven holidays then you work for only 249 days instead of 260 days. That’s why you earn a total of $57,768 in a year.

If you take 2 weeks off that means your income drops to $57,072. While 3 weeks or 18 working days off means you earn only $55,448 a year before tax income.

$29 an hour budget example

The monthly budget is made out of disposable income. The income you receive after federal, state, and FICA deductions.

In this case, you receive a total of $42,535 per year, and dividing it by 12 gives around $3,545 per month. Here the standard deductions aren’t applied and it’s just to give you an idea o making a budget at this wage rate. You have to use real after-tax income amounts to budget for household expenses.

Now here is how your standard monthly budget looks:

- 50% on needs ($1773)

- 30% on wants ($1063)

- 20% on savings and paying debt ($709)

Let’s dive deeper to make a detailed budget while keeping in mind the standard percentages of making a household budget:

| Expense | Monthly cost |

|---|---|

| Housing | $1,050 |

| Transportation | $913 |

| Utilities | $290 |

| Groceries | $400 |

| Medical | $431 |

| Entertainment | $100 |

| Debt payment | $110 |

| Entertainment | $66 |

| Personal care | $54 |

| Savings | $185 |

RELATED POSTS:

48000 A Year Is How Much An Hour? Can You Live?

$40000 A Year Is How Much An Hour After Taxes? Can You Live?

How to Create a Personal Budget [6 Easy Steps] PLUS Template

10 Best Budgeting Apps of 2022 (Free + Paid)

How to do Zero-Based Budgeting Using 5 Simple Steps?

31 Budgeting Tips for Beginners to Easily Grow Your Savings

31 Downloadable Printable Monthly Budget Template (Excel + Pdf)

Budget by Paycheck Workbook: 6 Steps for Making a Paycheck Budget

Cash Envelope System: 9-Simple Steps To Do Envelope Budgeting

How To Make a Budget Binder In 4-Simple Steps (Free Templates)

Can I live off a $29-an-hour income?

As you see above that $29 an-hour income is more than the median salary in the whole US. So it’s surely possible to live on that much income.

But there are certain things to keep in mind so that you don’t struggle with paying off your expenses and saving more money.

You have to give priority to important expenses plus savings and need to cut down on the entertainment budget. Because if you live in a higher cost of living areas like NYC, Los Angeles, and San Francisco then you face difficulty.

Use budgeting and stay focused on your goals to achieve maximum value from 29 an hour’s income. You get more tips below that can help you live on a $29-an-hour income.

Tips for living on a $29-an-hour income

Here are a few tips to live on a $29-an-hour income:

- Create a budget and stick to it

- Avoid living in a state with an income tax

- Avoid living in high-cost areas and cities

- Avoid debt and pay off existing debt fast

- Increase your income with part-time work, business, and side hustles

- Switch your job and get an even better opportunity with high payment

- Ask for a pay raise and get paid what you deserve

These tips make your life so easier and help you become frugal as well as efficiently utilize your income.

What are the ways to increase your income from $29 an hour?

Here are some quick tips on increasing your income from 29 an hour and earning more each month:

- Switch your current job with a high-paying job

- Ask for a raise from the existing boss

- Start a side hustle

- Start a side business

- Do part-time work for 4 to 6 hours a day

- Learn a high-paying skill and sell it online

RELATED POSTS TO INCREASE YOUR INCOME:

62 Best Jobs For Stay-At-Home Moms (Online And Offline)

What is Six Figure Salary? 25 Jobs That Pay You Six Figure

How To Make Money Without A Job (55 Lucrative Ways)

How to Sell Feet Pics Online and Make Passive Income: 20 Best Platforms

52 Ways How to Make Money as a Teenager Working (Online and Offline)

33 Best Making Money Apps for Instantly Earning Money

13 Jobs that pay $29 an hour

There are jobs that pay $29 an hour and more both online and offline.

Here are some of them:

- Bank tellers

- Virtual assistants

- Production Coordinators

- Entry-level marketing jobs

- Data entry clerks

- Safety specialists

- Maintenance Workers

- Administrative Assistants

- Freight brokers

- Medical Equipment delivery technicians

- Registered Nurse CI

- Lawn Movers

- Event planners

You can find more jobs online through online job websites and Google searches. Type in “jobs that pay $29 an hour in the US”.

Conclusion

In this post, you’ve learned $29 an hour is how much a year.

Plus you get an idea of how much after-tax income you’re left with at 29 an hour and how to calculate monthly, weekly, and daily income.

You learned how to make a budget and increase your income.

Finally, you got a list of jobs that pay $29 and more an hour.

Now it’s your turn to apply all this information to make your budget, manage money, and earn more.

If you go value from this post then don’t forget to share it on social media.

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024