Last updated on March 16th, 2023 at 07:08 pm

In this article, you’ll learn, what is debt consolidation and how debt consolidation works. Along with that how you can apply for a consolidation loan?

It is a headache to manage multiple debts and payments each month. Whether they are credit cards or student loans, personal loans, and auto loans.

This creates mental stress and a kind of tension to not getting late on payments. And if you’re payments, the creditors through dozens of calls to your phone. That’s why most people want to get out of these debts as soon as possible.

If you’re facing all these kinds of issues. Then came to the right place.

One of the solutions to multiple high-interest debts is called debt consolidation.

Here you learn all about it in detail. And you get answers to almost every query that hits your brain about consolidating debt.

Let’s get started.

What is debt consolidation?

Before diving into how debt consolidation work first, you need to understand what is debt consolidation.

Google defines consolidation like this:

Yes, something is in the case of debt consolidation.

It is the process of combining multiple debts and their payments into a single debt with a single payment. You convert the existing debts into one solid with one payment each month.

Whether you’re 2, 3, 4, or more debts outstanding, you convert them into one debt.

In simple words, you take a new loan to pay the existing ones, and then you’re only liable to make payments on a new loan. This method is commonly used in the case of multiple credit cards. And there are multiple reasons for doing this.

- It is difficult to manage multiple credit card debts and take care of their monthly payments. So the consumer goes for consolidation to get out of this tension.

- Consumers save money on existing debt payments. Because they take a new loan at a lower interest rate as compared to existing debts which helps save money.

- To pay the loan faster. Because multiple debts with higher interest rates take a long time as compared to a single lower-interest loan.

Now the thing is whether it is right for you or not. And how does debt consolidation work? And how to apply for a debt consolidation loan? All this stuff is explained in the sections below.

Related Post: What Is Debt Collection? How to Deal With Debt Collectors?

So let’s jump to the next section.

How does debt consolidation work?

The working of debt consolidation is simple.

If you’ve 2 or more debts due with high-interest rates, you take a new loan to pay them and make only a single payment on the new loan. This makes debt management easy for you and saves money if you did it right.

It is commonly used if you’ve multiple credit card loans outstanding.

Example solution:

Now let’s understand them with an example.

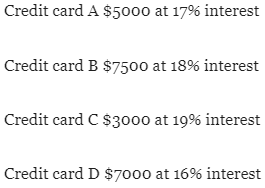

Let’s say you’ve 4 credit cards with the following amounts and interest rates.

If you analyze this scenario, the interest rate on all credit cards is high. Because this is an unsecured loan with no security or collateral. That’s why the interest rate is higher.

If you return this loan to creditors then you pay more interest and take a longer return. And it is more likely that you fail to make payments on time which results in a negative impact on your credit score.

For example, you go to a bank or any lending institution and take a loan of $22,500 ( excluding interest rate to make the calculation easier ) at 12%. And you use that to pay the above credit card.

What happened is that you got a loan at 12% as compared with the credit card loan with a 17.5% average interest rate.

The scenario changed and you don’t need to take care of multiple credit card payments on different dates with more money going out of your pocket. Instead, you combined it into a bigger loan of $22,500 with a single payment each month. And you save some money as well.

At this stage, you have a clear understanding of how debt consolidation works.

Related Post: How To Pay Off Debt Fast (11 Bullet Proof Tips )

Now let’s understand the ways you can use to consolidate your debt.

What are the ways to consolidate debt?

There are five ways you can consolidate your debt. Each method has its own pros and cons with specific requirements you need to fulfill. These methods include balance transfers, low-interest loans, debt management plans, home equity loans, and 401K loans. Below is the explanation of each method one by one.

1. Balance transfer method

The balance transfer method is used for credit card debt. In this method, if you’ve multiple credit cards with several thousand debts and with higher interest rates, you can transfer them to a new credit card with a low-interest rate ( even 0% APR for a limited time ).

In short, you use a new credit card with low-interest charges to pay off the existing credit cards with higher interest rates.

This organizes multiple debts and payments into a single manageable payment each month.

How does the balance transfer to a new credit card?

You can follow the simple steps below to transfer the balance from an old credit card to a new one. Here is a short description of all the steps involved:

1. Analyze existing debt

Analyze your existing credit card debt and interest rates. And do a calculation of how- much you owe and how much interest you need to pay.

2. Compare the solution

Evaluate and pick the best balance transfer credit card. Compare different credit cards and evaluate them on the basis of introductory APR, how long the introductory APR goes, and how much interest they charge. This helps you to choose the one with the lowest interest rate and long APR period and low fees charges.

3. Readout terms and conditions

Get clear on their terms and conditions. This is important to get more out of debt consolidation. Calculate the fees, interest rate, and credit limit. Also, any restrictions if they have. These conditions are written at the bottom of your application form.

4. Submit the application

Fill out the application form and apply for the card. This can be done online which makes the process easier. Here you include your name, credit card numbers you want to transfer the balance from, date, payment address, etc. Make sure to include all the necessary information so you don’t face any rejection.

5. Wait for the response

You may need to wait for some time before hearing from the respective organization. Because there is strict inquiry is performed regarding your credit score and credit report. It may negatively impact your credit score and decrease it for a short time period.

6. Transfer your balance

If the company accepts your application you need to contact them for a balance transfer. You can do this using your phone or online. Provide the information of old credit card numbers, and the amount of balance you want to transfer.

You can transfer all of your old credit cards balance depending on the credit limit. And after that, you should wait for some time to hear back. During this period you need to make any payments that occur on the old credit cards.

7. Start paying your debt

When the balance is successfully transferred you can now make payments on the new credit card. Make sure to pay as much as possible during the 0 APR period. Becasue, it is possible that when it is completed then interest rate suddenly rise. Along with that do regular payments and don’t get late to avoid penalties.

Now you understand how debt consolidation works with the balance transfer method.

Related Post: How to Pay Off Credit Card Debt Fast (17 Quick Tips)

Let’s dive into some pros and cons of using this method.

Pros and Cons of the balance transfer method

The upsides of balance transfer include:

- Debt and payments are organized into a single one

- You save money by getting a low-interest credit card

- During the initial time frame, you can enjoy a 0% APR

- Your debt can be paid faster

- Improves your credit score over a longer period if you pay it on time.

But it is not always a good option because of some potential drawbacks which include:

- You may face difficulty in transferring your balance because all companies don’t accept it

- The strict inquiry decreased credit scores temporarily

- There is a balance transfer fee involved. Which is normally 3% to 5% of the total balance transferred.

- You need to control your spending on the new credit card. Because some balance transfer credit card companies offer discounts if you purchase from their card. This will pile up your debt and ultimately result in the same problem you faced before.

- Sometimes 0% APR is not available. And if it is then after the introductory period ends it increases very fast which can make the debt difficult to pay. So try to pay as much as in the introductory period. It also increases as a penalty if you miss the payment or get late on it.

- You may get rejected for availing of this opportunity if your credit score is low. So try to maintain it above 670.

Considering these pros and cons of the balance transfer method helps you make the right decision. Before going for this option you just need to first evaluate your debt and compare the companies you want to transfer to. This way the possibility of saving money will increase.

For more information, you can read this article from Credit Karma: How to do a balance transfer in 6 easy steps

Let’s jump to the next method.

2. Personal loan

In the case of a balance transfer, you may get rejected if your credit score is not enough. But in personal loans, the restrictions are less. If your credit score is not much higher, you can still take a loan.

Here you borrow a low-interest personal loan to pay all your existing debts and then make payments each month on this new loan. This is another best method to consolidate debt.

You can take personal loans from banks, non-banking institutions, credit unions, and online lenders. This is also an unsecured loan with no collateral. Their repayment time frame can go from 3 to 5 years depending on the lender’s policy.

The interest rate is calculated while considering your credit utilization ratio, credit score, income, credit mix, and other factors that affect it. Therefore to qualify for a low-interest rate, it is important to have a high credit score.

Related Post: 13 Easy Tips on How to Improve Credit Score Fast

How to get a personal loan?

Here are some easy-to-follow steps:

- First, evaluate your existing debts and their interest rates

- Second, evaluate the personal loan options with the lowest interest rates

- Analyze your qualification requirements

- Review the terms and submit the application to one or more lenders

- If accepted take the loan and pay your debt

Pros and Cons of personal loans

There are some pros of using personal loans to pay off credit card debt:

- Can save you money due to the low-interest rate

- You need to make only a single payment each month

- Normally the credit score requirements are low for approval

- Improve your credit score by decreasing the credit utilization ratio

- Your credit mix is improved if only credit cards were their before

- No need of using collateral it is an unsecured loan

- You can get fast access to pay existing debt

But some downsides are there that you need to consider in mind:

- You may get rejected if your credit score is too low

- Can damage your credit score

- There are some fees and penalties included

- If the credit score is not good you need to put some collateral

- If you still use the existing credit cards then more debt can compile

- You need to evaluate more alternatives because the interest rates may climb

This is how debt consolidation work with a personal loan. But as compared with the balance transfer method it is a good option. You not only get a low-interest rate but also avoid headaches. Just follow the guidelines and compare different alternatives to go with the one that is best.

For more information read out this article from Bankrate: Best debt consolidation loans

3. Debt management plan (DMP) with ACCC

This is an alternative option to debt consolidation. Here you make all the payments on existing debts like credit cards to the ACCC organization. And they make payments to your creditors on your behalf.

ACCC stands for American Consumer Credit Counseling.

ACCC is a nonprofit organization that provides free counseling to consumers in debt. They also teach about bankruptcy, debt management, money management, etc. This is all free and their counselors don’t charge any money for their services.

The benefit of using ACCC is that you don’t need to borrow money to pay off an existing loan. This also simplifies your payments system and you don’t need to worry about making payments each month instead, ACCC distributes them to the creditors.

They also negotiate with your creditors to eliminate financial charges, late payment fees, and over-limit charges. And also get you a reduction in monthly payments. This will help you lower the burden of how much money you owe.

For learning more about ACCC visit the Consumer Credit.

4. Home equity loan ( HEL )

If you’re looking for the lowest-interest loans for paying debts then a home equity loan is one of them. For taking this loan you place your home as collateral or guarantee and the lender gives you a loan at a lower interest rate. It is a secured loan and if you fail to pay it back then your lender will sell your property to recover it.

It is also referred to as an equity loan, home equity installment loan, and second mortgage. You need to pay it in installments.

You pay it back like a mortgage. The payment includes interest as well as a portion of the principal amount.

Pros and Cons of home equity loan

There are some pros and cons of getting a home equity loan for debt consolidation.

Pros:

- Has low-interest-rate due to security

- It is easy to avail

- The tax is reduced because of the interest paid

- A credit score doesn’t need to be higher

- The borrowing cost is low

- You can use the money for any purpose

Cons:

- If you default on payments then your home is used to recover that amount

- The interest doesn’t change with the market and you need to pay fixed interest over the lifetime of the loan.

- Different types of closing costs are involved like an appraisal fee, loan origination fee, notary fee, title search, documents preparation fee, attorney fee, and credit report fee. Some are fixed but others can vary.

- You may face a decrease in your after-tax income because you’re making two mortgage payments.

A home equity loan is the best option to go with if you have a property in your ownership. It can save you money on the existing high-interest loan. But at the same time, you must have a payment plan in place so you don’t lose your house.

Related Post: What Is a Debt Settlement? A Simple Technique to Negotiate

5. Obtain a 401K loan

This is the most beneficial option for obtaining a debt consolidation loan. Here you’re a borrower and also you’re a lender.

Most of the drawbacks of previous debt consolidation options are eliminated in this option.

You borrow money from your 401K retirement saving plan and use it for consolidation. After that to cure the retirement account you pay back this money with the interest rate included.

This depends on the policy of your employer whether you can borrow or not. And if yes then how much you can borrow? Usually, it is 50% of total assets or $50,000 whichever is less. On 27 March 2020, the American president signed a bill that includes a $2 trillion coronavirus emergency relief package. And now the 401K borrowing amount is doubled to $100,000.

But here no lender, creditor, or debt collector is involved. This is the money that you’re deducting from your retirement plan and using for your needs. Therefore you’re taking it from one of your pockets and putting it into another pocket. Now you’re clear on how debt consolidation works in the case of a 401K loan.

Upsides and downsides of 401K loan

Here are the benefits of borrowing a 401K loan:

- No interest cost. Because the interest charged finally goes into your retirement account to rebalance it

- It is easy to access because no collateral and credit score requirements matter

- This is fast and convenient to obtain

- The time period for returning it back is long. Usually, a 5 years amortization schedule

- You can pay it back with no prepayment penalty

- There is no other cost just some loan origination fees and charges

- Increase your retirement savings account

- No application is required and no taxes are paid

But there are certain downsides as well:

- This depends on employer rules. Some of them don’t allow these loans.

- The limit of how much you borrow sometimes can’t cover all the debt you want to consolidate.

- Your retirement savings growth is stuck when you borrow the amount.

- In the event of bankruptcy, the remaining fund may be seized.

But among all the other options it is one of the best. You just need to pay it back over the time period allowed. And you don’t incur any extra costs which makes it the cheapest option.

Related Post: What Is a Debt Snowball Method? How Does It Really Work?

Now let’s jump to the next section on how to apply for debt consolidation loans.

How to apply for a debt consolidation loan?

You need to follow a simple step-by-step process to apply for a debt consolidation loan. Different types of loans have their own application process. But here I list down the general steps you normally follow:

1. Check your credit score

The first step is to check out your credit score. It must be higher because otherwise, you don’t qualify for a loan. It must be more than 670 or more ( FICO score ).

2. Define your goals

Get clear on the goals you want to achieve. Whether you want to pay the debt sooner, save money, or want lower payments each month. So you can choose the consolidation loan provider that is right for you.

3. Compare different solutions

Compare the different lenders and credit unions to see which one is best for you. If you want to save money then go for the lowest interest rate and if you want lower payments then go for a long-term consolidation loan provider. Also read out and understand their terms and conditions so you don’t make any mistakes.

4. Apply for a loan

When all three steps above are completed. Now you apply for the loan. Try to apply to more than one lender so you’ve more chances of success. You can apply online by filling out a form with the necessary details. When you submit that application then wait for approval. It is possible that you undergo a strict credit evaluation process.

5. Pay your debt

Once you’re approved for the loan then pay the previous debts. And make regular payments on the new loan. You must have a repayment system in place so you don’t get late on your payments because it ultimately has a negative effect on your credit score. You also cut down on your spending and avoid using credit cards to not build more debt.

So these are the simple steps you generally follow for getting a debt consolidation loan. It is not the exact you may need to follow any other step depending on the lending institution guidelines.

Now let’s jump to the next section.

What are the pros and cons of debt consolidation?

There are some upsides and downsides to using debt consolidation. If you’re going towards using this option then you should make yourself aware of it.

Pros:

- You don’t need to manage multiple debts with multiple payments. All are organized into a single debt and payment which is easy to manage and the risk of late payment also decreases

- If you want to save money then a low-interest consolidation loan helps you. It pays off old high-interest debt and now you pay less in interest amount on new debt.

- Sometimes your credit cards are taken down if you’re using a balance transfer method. This helps you cut down on extra spending so you don’t face more debt.

- It takes out monetary tension and stress and provides peace of mind.

- Paying debt sooner will improve your credit score which is the most important factor. So you can easily take out a loan in the future.

Cons:

- There are different costs involved in this process. Some common ones include closing costs, appraisal fees, origination fees, and others.

- It is possible that you fail to make payments. Which increases the risk of default. And also negatively impact your credit report.

- In case your introductory APR period ends then the interest rate goes up suddenly. So you will pay more in interest expense.

- Debt consolidation loans are very difficult to take if your income is low or your credit score is down. You may face lots of rejections or need to pledge your property as collateral for taking a loan.

- In the case of a long-term consolidation loan, you pay more interest amount.

- If you don’t cut down your spending and continuously use credit cards then you may not get out of debt fast. And you may don’t achieve the goal you took out the loan for.

- The problem of getting out of debt still remains. And you need to make payments on the new loan regularly.

Considering these pros and cons in mind is important. Because it is a matter of your financial future. Debt is a trap. One bad decision can ruin your savings, retirement, and other dreams you want to achieve through money. So keep them in mind while going for debt consolidation.

What is a debt consolidation calculator?

A debt consolidation calculator is an online financial tool that helps you figure out whether debt consolidation is right for you or not. You insert the necessary values and click calculate and it will show all the details.

There are many calculators available online for free like the Bankrate calculator and Nerdwallet calculator. I liked the Nerdwallet calculator because it is easy to use and has enough details to understand the results.

So I’m going to discuss the Nerdwallet debt consolidation calculator. Here are the steps for using it in a proper way.

1. Insert amounts

You enter your debt balance value in the given box. Also the interest rate and monthly payments you make. If you have more than 2 debts outstanding then click the “add another balance” button to include more values.

When you’re done with inserting values. Then click “I’m done” and then it will show you the green “calculate” which you click on to see the solution.

3. Analyze the solution

Now the first thing it will show you is the “total balance”, combined interest rate, total monthly payments you make, and how much time it takes to get out of debt. Here the total balance represents the total amount of debt you owe, the combined interest rate is the average interest rate you pay on all loans, and the time you need to pay it all.

4. More options

Below are the options for credit scores. You can select the right option depending on how much credit score you currently have to see which debt consolidation method is right for you. You also see the APR ranges lenders are offering and additional options for bad credit scores.

5. Use the slider

There is a slider available with two options the interest rate and loan terms in years. As you drag the slider it will show your new monthly payment, new total amount, and how much you save on interest.

6. Compare your results

Now you can compare the old debts and new consolidated debt options. Whether you want to stay with old debts and payment options or the consolidation option is right. If you save more and pay faster than relying on previous debt options then choose debt consolidation.

So you get an understanding of how to use this calculator. You can go to the website Nerdwallet and use it if you want to consolidate your debt. It will make your calculations easy and clear.

How to stay on track with debt consolidation?

There are some tips and tricks that will help you to successfully achieve your goals with debt consolidation. You will easily stay on track with it.

Here are the tips:

- Avoid building more debt in form of credit cards until you really need it

- Minimize your spending especially buying branded products to avoid wasting money

- Make payments on time and automate other payments like utility bills to save time.

- Focus on the goal for which you consolidated the debt. And avoid any financial decision which affects it and also your credit report.

If you follow these tips along the way you will really succeed in getting out of debt.

Related Post: How to Avoid Debt to Make Yourself Financially Strong

Frequently asked questions (FAQ) about debt consolidation

After learning how debt consolidation work and the ways you can consolidate debt, now it’s time to answer some important questions.

So let’s get started.

Does debt consolidation hurt credit scores?

Yes, it hurt your credit score in two ways. First, when you apply for a debt consolidation loan, you need to face a strict credit valuation. This lowers your credit score for a temporary time period. Second, if you fail to make the payments on your consolidated loan or go late on it then it decreases your credit score. And if you file bankruptcy then this remains on a credit report for 7 to 10 years according to chapters 7 and 13.

When debt consolidation isn’t worth it?

There are certain requirements if you can satisfy then debt consolidation worth it for you.

- You’ve debt which is no more than 40% of your disposable income

- The credit score is higher so you can get 0% APR and a low-interest loan

- You can control your spending to avoid an increase in debt

- If your cash flow is enough to cover monthly payments

- In the given time period you’re able to pay back the whole debt

If you meet these criteria then going for debt consolidation loans is right for you.

What types of debt can be consolidated?

Normally, the debts are not secure. That’s why you can consolidate student loans, medical bills, credit cards, personal loans, and payday loans.

Is it a good idea to consolidate credit cards?

Yes, if you’ve multiple credit card debts at higher interest rates. There are three benefits that are savings on interest, faster payment, and you don’t need to manage multiple payments.

How do lenders set the interest rates on debt consolidation loans?

This depends on your credit history and score, length of payment terms, and security. These loans are not secure that’s why if your credit history is not good then you face higher interest rates. Likewise, if you take a long-term loan then the interest will be lower but you pay more amount over a longer period. In case you use security or collateral to take a loan then your credit score doesn’t matter. The lender gives you a lower interest range because his money is secure.

What is a debt consolidation program?

A debt consolidation program is a method where you don’t need to take a further loan to consolidate existing debt. Instead, you combine all the payments and pay the lump sum to the company providing this program. And then it disburses those payments to a different lender to whom you owe money on your behalf of you.

There are certain benefits of these programs because they do arrangements with the lenders and eliminate extra charges and late payment fees. Along with that, your payments reduce, and your interest rate declines which help you save money.

These are nonprofit organizations usually, so they provide free credit counseling and you don’t need to worry about paying different lenders on different dates. They manage those payments for you. The best example is ACCC ( American Consumer Credit Counseling ). They only cover the highest-interest credit card bills.

Who offers a debt consolidation program?

These are the separate non-profit organizations for debt management that offer consolidation programs. They can or cannot charge you money for delivering their services. If they are debt settlement companies then they charge fees. But if simple payments management company like ACCC then the service is free of cost.

What types of debt are not in DMP?

The debt management plans only cover unsecured debts. These include credit cards, student loans, medical bills, and other personal loans.

How to get a loan for debt consolidation?

There are only five ways you can get a debt consolidation loan. They include:

- Credit card balance transfer

- Home equity loan

- Personal loan

- Debt management plan

- 401K loan

Some of them are dependent on credit score, some require collateral and 401k loan require no collateral because you’re withdrawing personal savings.

Can I consolidate all my debts into one payment?

Yes. you can combine all your debt payments into a single management payment. It can be with the low-interest rate or not if the credit score is down.

What is the difference between debt consolidation and debt settlement?

Debt consolidation combines several debts into one single debt with a single payment. While debt settlement is a process where an intermediary company settles your debt with a lender for a less amount than the actual amount. For example, if you have a $10,000 debt then you can settle it for a $5000 lumpsum amount. This amount is considered full and the creditor writes off your debt.

How to get a debt consolidation loan with bad credit?

Having bad credit is a problem for getting an unsecured loan for consolidation. But still, there are some strategies that do work:

- Take a secured loan because you pledge a property and so the credit score does matter much. But your property like a car, house, land, or anything else must have enough value to cover the debt if you default.

- Wait and improve your credit score if you don’t have a property to take a secured loan. Pay the existing debt and make your credit score above 630.

- Search for different lenders including commercial banks, national banks, credit unions, and online lenders. It is possible that someone will give you a loan while having bad credit.

If your credit score is below 600 it is a major problem for getting a loan and if you get then still the interest rates are very high.

You also like:

8 Tips For Money Management To Achieve Financial Prosperity

How Does Student Loan Work? The Ultimate Guide!

How to Get Student Loan Forgiveness? Who Will Qualify?

Money Can’t Buy Happiness But It Can Buy You What? 9 Ways to Find Happiness

Final thoughts

Debt consolidation is a good strategy to come out of debt quickly. It is reliable for paying less interest.

But keep in mind this is not a magic bullet that gives you sudden relief from debt.

You must have a good understanding of how debt consolidation work to take effective decision.

After reading this guide I’m sure you have a clear picture of what is debt consolidation and how to determine whether it is for you or not. If you implement this knowledge then you can come up with the right solution for eliminating your debt.

Now tell me in your comments whether you use debt consolidation or not.

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024