Last updated on January 2nd, 2024 at 06:43 pm

In this article, you’re going to learn: what is a debt snowball method? And how to use it to actually pay off multiple debt obligations.

Having multiple debts is a financial burden.

Whether it is in the form of credit cards, student loans, car loans, or any other debt obligation. Paying it off is more important to stay financially strong and maintain a good credit score.

But the main problem most debtors face is, they don’t know the effective way to pay multiple debts. Which makes them confused about different debt pay-offs methods like consolidation, settlement, and many others.

As a result, they get more and more into debt and file for bankruptcy. Their credit score and reputation get ruined.

If you’re in debt then knowing the methods to pay it off is the bible. And one of these methods is called the debt snowball method.

So here is the exact breakdown of what you’ll learn about this method.

What is a Debt Snowball method?

It is a do-it-yourself debt payment method.

If you have multiple debts then according to this method you first pay off the debt with the smallest amount.

You list down all the debts by the amount and start paying from the lowest one until all is get paid. On all the other debt amounts you’re required to make the minimum payment which is usually around 1% to 2%.

The financial expert Dave Ramsey is a famous proponent of this method.

Basically, the main purpose of using a debt snowball is the motivation factor. Because a person will be more motivated to pay off all of his debts when he sees his small debts being paid off one by one each time. He gets a sense of achievement.

Let’s dive into the working of this method.

Related Post: How to Pay Off Credit Card Debt Fast (17 Quick Tips)

How does the debt snowball method work?

Applying this method is so simple. You just need to follow the simple steps and you become ready to get to go with it. Here are the steps:

- List down all the debts with the exact amount. You can use a spreadsheet or a pen and paper. It is important that you know the correct amount of each debt to avoid any mistakes.

- Next, rank all the amounts in ascending order from the lowest to the largest. The lowest will be below and the next lowest and it goes on to the largest one like 1,2,3.

- From here you analyze your minimum payment on each of the debts. Along with that how much monthly income you can dedicate to pay the debt?

- Now you start paying off every single debt while paying the minimum payment of all the others.

- When one debt is paid off you will devote the payment to the next debt. This is where the snowball effect came to play. And it builds up like a rolling snowball down the hill accumulating more snow and becoming larger and larger.

- When all the debts are paid off you can then save all that amount for future purposes.

Here is a practical example to explain each of the steps above.

Example of debt snowball method

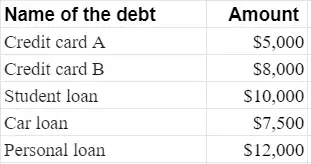

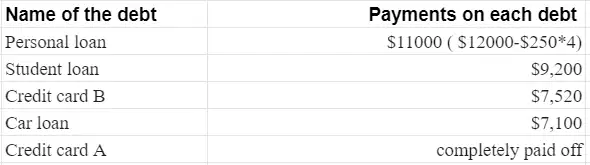

Let’s say, you’ve five debts currently. And the scenario looks like this while ignoring any additional debt amount:

The amounts are not ranked by the interest rate in the debt snowball method. That’s why I only use the amounts here.

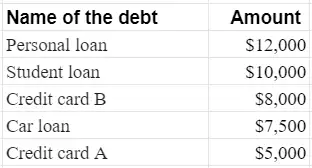

Now, the next step is so simple. List them in ascending order like this:

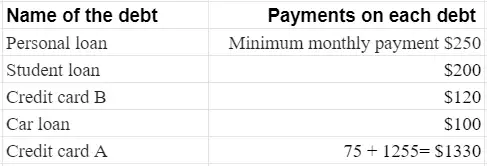

The next step is to list down the minimum payments on each debt. Here is it.

Let’s say, the amount you can dedicate each month to paying your debt obligation is $2000.

When you apply the debt snowball then the scenario looks like the below one. Where you make the minimum payment on the other debts while devoting all the remaining amount to a single smaller one. Here is it.

Now you do it for a period of four months until credit card B gets paid with the fourth-month payment of $1010. And the remaining $220 will is used in the payment of the car loan whose payment in the fourth month will be $100 + $220 = $320.

After four months the scenario will look like this:

Now you repeat this process and each of the lowest debts will get paid off. This may take a longer time period but staying consistent will lay off all the debt burden.

Related Post: How to Pay Off Debt Fast? 11 Bullet Proof Tips

What is the advantage of using the debt snowball method?

There are several benefits of using the debt snowball method which make it a suitable method for you. Here are some of them:

- This method doesn’t need to have much complex calculation and analysis. You just need the amounts of each debt and you’re good to go. But one thing to remember here is that the interest amount on the debts will be adjusted to have updated amounts. Likewise, if there is any other fee or penalty then that is also included.

- It gives you motivation with each small debt you pay. You get a sense of achievement and get more spirit to pay off the remaining debt. After Dave Ramsey popularized this technique many people successfully paid their debt obligation using this.

- If your income is low and you can’t devote a larger amount of money to pay debt fast like in the debt avalanche method. Then the snowball method gets handy there. Because you only make minimum payments on the other debt and put all extra money like allowances, bonuses, extra income, and others into paying a single debt.

- It is a do-it-yourself technique. And you don’t need to hire any professional advisor or manager because of its simplicity. So it helps you save that money.

Taking into account these advantages this method has its own worth when it comes to paying the debt. It is a reliable method for low-income and high-income people.

Related Post: What Is a Debt Settlement? A Simple Technique to Negotiate

What is the disadvantage of using the debt snowball method?

There are some disadvantages that you should make yourself aware of. Here comes the one by one:

- Your debt accumulates instead of paying down fast. The reason is you pay the debt by the amount of money and choose the one with the lowest one. That’s why the interest amount on all the other debts amounts accumulate over time and you face that problem. In case you have a large mortgage debt then the problem becomes even worse.

- It takes so long to pay off debt if the interest on all the other debts is larger. And in the case of credit cards, the interest is usually more than 15%. Therefore debt snowball may prove ineffective in that case. And you pay more amount than what you accumulate.

- This method can stop you from using other effective methods of eliminating debt like debt consolidation, debt relief, or balance transfer methods. So it is compulsory to analyze the situation. Because it is possible that other methods are more effective for your situation and save you more money.

- You still need to meet the minimum payment requirement therefore you can’t use all the money to pay off a single debt.

If you have a proper plan and analysis and you still find the snowball method effective on all the other methods. Then go for it. In case your interest rate on all debts is low and amounts are also then this method is a good choice.

Let’s differentiate it from the debt avalanche method.

Related Post: How Does Debt Consolidation Work? Is It a Good Idea?

Which is better? Debt avalanche vs debt snowball.

There are two main repayment methods for debt. They are both very famous but how they apply makes them a little different. Here in this section, you will learn the difference between the debt snowball and the debt avalanche method.

So let’s explain them.

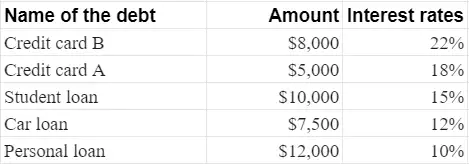

The debt avalanche method is a little bit opposite of the debt snowball. In this method, you pay off the debts with the highest interest rate first and then the second-highest interest debt, and so on until all are paid off.

You list down all the debts in descending order by the amount of interest rate. Then start paying the highest interest rate debt first while paying the minimum amount on all the other debts.

This method is best if you want to pay down your debt fast. Because it works as a snow avalanche. When you pay off one debt you transfer his payment to the next one therefore it combines one by one to create a snow avalanche effect.

You may not see any sudden change in the beginning but when 2 to 3 debts are paid off then you will clearly analyze the debt going down.

Let’s explain it with an example for more understanding.

Example of debt avalanche method

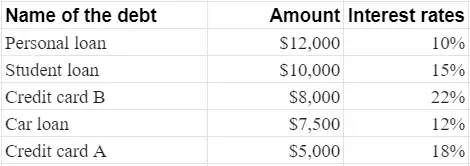

For example, you have debt amounts from the previous example with the following interest rates.

Now you order them in ascending order by their interest rate. Here is it.

All other factors will remain the same like paying the minimum on each debt. But the only exception is that you pay the credit card B debt first because it has the highest interest rate. Then credit card B and so on until your personal loan will be paid off.

Pros and cons of the debt avalanche method

There are some pros and cons of the debt avalanche method.

Coming towards the pros include:

- You can pay a debt a faster way because you’re making big payments. Also tackling the highest rate of debt first which helps you avoid compiling more interest.

- It takes less time compared with the debt snowball method. So you can pay debt faster.

While the cons include:

- May get you into the trouble of compiling huge interest on large principal amounts of debt. Along with that lenders use compound interest which can also prove to be bad.

- You must need to maintain emergency savings to cover unexpected needs. Because in a debt avalanches you are required to make bigger payments so it eats up all your income.

- You still need to pay the minimum payments.

Both methods the debt snowball and debt avalanche have their own importance. Because if you have a large amount of income and can afford to pay big amounts in debt payments. Then debt avalanche is the best option.

But for some people, this is not the right option. They need a psychological and motivational push to pay off debt. So the snowball method is right for that type of people. Another thing is that the snowball method costs you more interest over time and takes longer to pay.

Related Post: How to Avoid Debt to Make Yourself Financially Strong

Frequently asked questions about the debt snowball technique

In this section, there are some common questions and answers you may find important in terms of information. So let’s answer them one by one to help you increase your knowledge about the debt snowball method.

Which is fastest between the debt snowball and debt avalanche?

Using the debt snowball method you pay the smallest debt by amount first while in debt avalanche you pay the largest interest debt first. If you want motivation to pay off all of your debt then the snowball method is best. Because with each small win, you’ll feel more powered to pay the rest.

But if you’re a savvy one and hate big numbers then debt avalanche is best. Using this method you’ll be able to save some money. Not as much but to some extent, it is financially savvier than the snowball.

When it comes to how fast you pay with each one of these methods. Then remember there is not a significant difference in the time period between both techniques. However, the debt avalanche method is one month faster than the debt snowball.

Here another factor is called the success rate of paying the whole debt. So the snowball method is more successful than the debt avalanche. Because human beings are more emotional creatures and less logical.

Related post: How to Use Debt Avalanche Method to Quickly Pay Your Debt?

Is the debt snowball method reliable?

Yes, it is a reliable method. And it is basically developed while considering the human psyche in mind. That’s why it is an emotional program.

But remember not always it is the best option. Its reliability depends on the situation. For example, if you have a large number of multiple debts with large interest rates then this method not only cost you more but also takes much longer to finally pay off the balance.

And this is one of the big drawbacks of this method. Due to this reason, other methods like debt consolidation, balance transfer, debt settlement, and/or debt avalanche may prove more reliable.

Related Post: What Is Debt Collection? How to Deal With Debt Collectors?

Is the debt snowball psychologically logical?

According to Harvard Business Review, we usually imagine bigger achievements that are great but the problem is the success rate is low. But the amazing thing is if we achieve small wins and milestones, then they also boost our inner self and provide motivation to do more.

Therefore, the snowball method is developed while considering this thing in mind. And people who used Snowball have successfully paid off their debts. Simply its success rate is higher.

And the answer is yes. It is psychologically more logical and fits the human emotional side of the brain.

Did Dave Ramsey invent the debt snowball?

No, he is just a big proponent of what say advocate of the debt snowball method. He didn’t invent it. Basically, this method is based on the psychological concept of small achievements that provide motivation for achieving more.

What is a debt snowball calculator?

A debt snowball calculator is a tool that helps you calculate the different variables related to paying off debt using the snowball method. It takes out the burden of calculation off your shoulders.

The most popular snowball calculator which also has the debt avalanche option is available on Nerdwallet. It allows you to calculate how much amount of interest you pay over a time period of paying debt and by which date you’ll be debt-free using the method.

Here is what are the components of this calculator:

- The name of the account.

- Type of account whether it is a credit card, student loan, mortgage, car loan, medical bills, or other.

- The principal amount remaining in debt.

- The rate of interest on a given debt.

- The minimum payment you need to make each month.

After including these payment details you need to press calculate and you’ll get the results.

Here you get the option of how much extra you can devote to debt payment. Which range from 0 to $1000. Along with that below these options, there is an option to choose debt snowball and debt avalanche. For both of these methods, the calculation will be different. In this case, you need to select the debt snowball method.

After that, it will tell you how much interest you save and how fast you pay off all the debt.

You also get the debt pay-off order where all the information of your accounts including principal, interest, and date are present.

All this calculation clearly tells you how faster you pay the debt, how much you save, and the date you will become debt-free. You can read the details for the interpretation of your calculations.

Is the debt snowball payoff method superior to paying off debt on the highest interest accounts?

No. this method is good for paying off the debt with the smallest amounts first. The interest rate doesn’t matter in this method, which is a major flaw. If you want to pay high-interest debt first then debt avalanche is the best.

How long does Dave Ramsey’s Debt Snowball take?

It depends on different aspects. The most compulsory include:

- How much debt do you’ve?

- What is the interest rate ( low or high )?

- How much income do you set aside for making monthly payments?

But normally both methods take longer to pay like over 40 months depending on the above factors.

Is it mathematically logical?

It is based on the psychological concept. And that’s why provides a motivational benefit. If you see it from a mathematical point of view then this method is not the best, but the avalanche method is right.

What should one know before starting with this method?

It is the simplest method. You just need to know the correct amount of debt and need to make the necessary adjustments of interest each month. And start paying from the smallest amount while paying the minimum repayment amount on all the other debt. And when one is paid off then devote all his repayment amount to the next one.

Final thoughts

The debt snowball method is best if you’re a more motivation-oriented person.

In the beginning, you might see little to no change in the debt but if you stay consistent with this method you can successfully pay off your debt. It may take longer depending on the amount of your debt and the interest rate.

If you get any additional income like allowance, bonuses, extra savings, and extra income then spend all of that on paying your debt. This will enhance the process and get you there faster.

I hope you got clear on how to use this method to actually pay off debt.

Now please tell in the comments which method you really liked: debt snowball vs debt avalanche?

Related posts:

How Student Loan Interest Is Calculated? 3 Easy Steps

What Is Financial Planning? How to Do It In 12 Easy Steps?

13 Easy Tips on How to Improve Credit Scores Fast

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024