Last updated on January 2nd, 2024 at 06:58 pm

In this article, you’re going to learn how student loan interest is calculated in 3 simple and easy steps.

But the problem is that they’re a type of debt. Like any other debt, there is an interest cost on student loans that you need to repay when you complete your education.

That’s why it is important to know the process of calculating interest on student loans. This will help you know how much interest you pay in each individual payment and as a whole.

Before going on to how student loan interest is calculated first we need to understand what is interest and its types.

So let’s dive right in.

What is interest?

It is the amount of money a borrower pays to the lender for obtaining and using his money.

In economics and finance, it is considered as the cost of borrowing funds whether it is taken from any individual person, institution, or government.

Interest is extra money upon the principal amount or original amount borrowed. Basically, it is the income of the lender on his money.

But why do lenders charge interest?

Here are the four main reasons behind charging interest for the lending amount.

- First, the lender can’t use the money for his own needs and so he can’t benefit from his money.

- Second, the lender wants to cover inflation. Because due to time value of money affects the amount of money today worth more than the same amount tomorrow.

- Third, there is a chance of default or risk that the borrower may not be able to repay the amount. That’s why the lender wants him to pay interest so that in case he defaults the lender suffers minimum monetary loss. Normally higher the risk higher the interest rate.

- Fourth because the borrower can’t use that money, therefore, he wants to generate income for himself. The interest is the income of the lender while covering the inflation so he can fulfill his own monetary needs.

The normal formula that determines how much interest rate a lender charges is:

Interest rate = risk-free rate + inflation premium + default risk premium + liquidity premium + market risk premium

This means lenders set interest rates while taking into account their own profit, inflation rate, risk of default, and in the case of bonds liquidity risk and market risk as well. This formula is used for setting interest on bonds and other government debt securities.

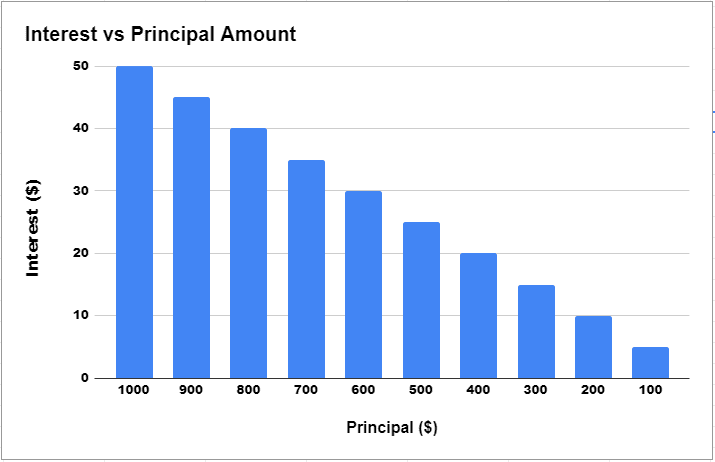

Remember that as time passes on the interest amount in the loan payment decreases. The reason is that the borrowed amount decrease as the borrower makes payments.

Now let’s jump on to the next section.

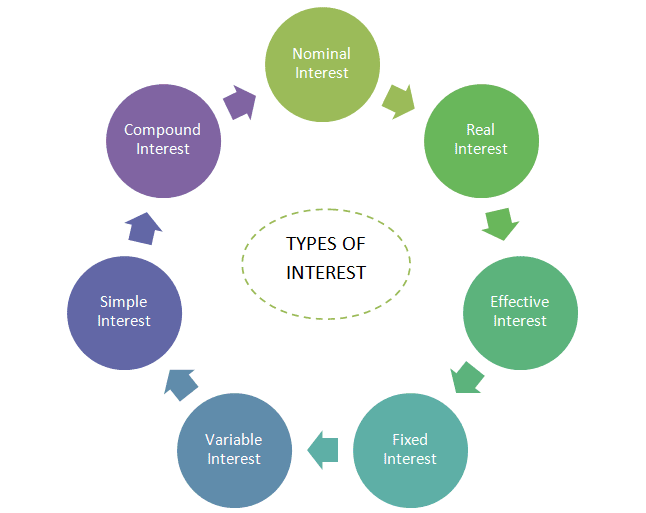

What are the types of interest?

Interest falls into different categories and types. That’s why their rates also vary among each type and also the calculation method.

Here is a brief description of each one:

1. Nominal interest

Nominal interest is the stated interest rate which doesn’t include any fees, inflation, or any compounding of interest. You can calculate it using the simple formula:

N.I = m × [ ( 1 + e)^1/m – 1 ]

where n= nominal interest while m= numbers of compounding periods and e= effective rate of interest. It is also called the stated rate of interest.

2. Real interest

As the name suggests it is the actual rate of interest a lender receives. As opposed to the nominal interest rate it takes into consideration the inflation rate as well. Because inflation is not known so it is taken in expected value to adjust into the interest rate until the maturity of the loan.

You can calculate the real interest rate using the formula: real interest rate = nominal interest rate – inflation rate.

3. Effective interest

It is the same as the nominal interest rate but with the one difference which is compounding. The effective interest rate takes into account the compounding effect that’s why it is always greater in value than the nominal interest rate.

For example, you purchased bonds at a 10% interest rate with a $1,000 investment. Now the nominal interest rate will give you $50 after each six months time frame. But if the interest compound semiannually then after the first six months, you receive $50 but after the second half, you receive $52.5. The effective rate per annum compounded semiannually becomes 10.25%. Which is more than the nominal interest rate which is 10%.

As the number of compounding periods increases then the effective interest rate increases. For example, the interest rate from the above example will be 10.38% if compounded quarterly while 10.43% if compounded monthly. So you should know it in case of lending.

4. Fixed interest

It doesn’t change over the life of borrowed amount or for a specific time frame. You need to pay a fixed amount each month including interest and principal amount.

Normally this applies to mortgages, student loans, auto loans, some credit cards for a specific time frame, and saving accounts. For calculating it you need to divide your interest by 12 and multiply it by the amount of the outstanding loan.

For example, you took a $10,000 mortgage at 4% for 10 years. Your payments are monthly so you divide 4% by 12 which gives 0.25% and multiply it with $10,000 which gives $25 a month interest.

4. Variable interest

A variable interest is one that changes over the life of a loan. There is no guarantee because it all depends on the economic and market situation as well as the policy of your lender.

It is also called floating interest or adjustable interest rate. It depends on the reference rate which is out of the control of the borrower and lender. Normally it is like a LIBOR rate and can be in the form of an unemployment index or consumer price index or current market interest rate.

Borrowers take loans with a variable interest rate in the hope of saving more money. But it depends on the market and economic situation. It is possible that in one month the interest rate is lower but in the second month, it climbs upward.

5. Simple interest rate

In simple interest, the lender only receives the interest on the principal amount. The interest is not accrued or compounded. To calculate the simple interest you can use this formula:

Simple Interest = Principal amount * Interest rate* Time period

For example, you took a loan of $10,000 at a 5% interest rate for 5 years. Now you can calculate simple interest as:

S.I = $10,000*0.05*5 = $2500

This means you need to pay $2,500 over 5 years time period.

6. Compounded interest

This interest is the opposite of simple interest. Here the interest earned compounds until the maturity of the borrowed loan. Here the interest of previous months will add to the next months or year and then compound. This means earning interest over interest.

But if you pay the previous interest then it will exclude and you only pay the interest on the remaining principal amount. If the interest compounds daily then you need to face the effect of compounding.

For calculating compounded interest you can use the formula below:

A = P (1 + r/n)^(nt)

Here, A is the interest amount, P is the principal amount, R is the interest rate, N is the number of times the value compounds and T is the number of years.

Because interest earns over the interest that’s why the lender earns more interest in the compounding method as compared to the simple interest formula.

You also like: How To Pay Off Debt Fast (11 Bullet Proof Tips )

How student loan interest is calculated?

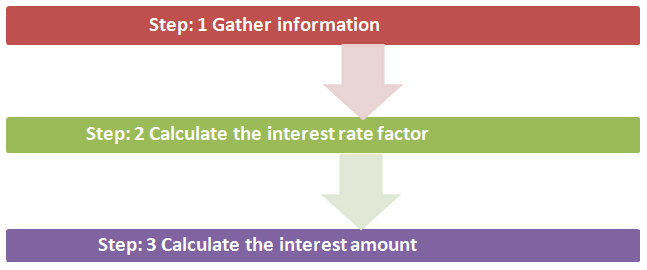

For calculating interest on the student loan you need to follow three easy steps.

1. Gather information

Collect information on necessary variables that are important in the calculation. Here is the information you need:

- The amount of debt you borrowed is the principal amount

- Rate of interest on the principal amount which is usually fixed

- Days of the year which is 365

- Information about when you make the last interest payment. From that date to the current one you need to have an exact number of days.

Let’s say you borrowed a $20,000 student loan with a 5% annual interest rate. And you make the last payment 30 days before.

Now we go to the next step.

2. Calculate the interest rate factor

In this step, you calculate the IRF or the daily interest rate on a loan. It is important because the interest on student loans accrues on a daily basis. So what you do is take the annual interest rate and divide it by 365 and you get the number.

From the above example, we can calculate the interest rate factor as IRF = 5%/365 = 0.0137% daily rate.

3. Calculate the interest amount

After finding out the interest rate factor now we calculate the amount of daily interest we accrue. This is by multiplying the above daily rate with the principal amount and then by how many days passed after making the last payment. This is 30 days from the above example.

Here is the formula:

Student Loan Interest = Principal amount * Daily interest * Days From Last Payment

Student loan interest = $20,000 * 0.000137 * 30 = $82

This is a simple way on how student loan interest is calculated.

You need to pay $1.37 daily interest on a $20,000 student loan and if your payment is monthly then after 30 days you need to pay $41 as interest.

Considering the statistics let’s assume that the above debt is taken at 10 years plan and the average monthly installment on a student loan is $193. So out of this $193, the amount of interest is $82 and $111 is the principal amount.

You can interpret from these results that there is a significant impact of interest on your monthly payments. And that’s why it highly affects your ability to pay on time or become delinquent. According to statistics, 20% of student loan borrowers were delinquent on their payments before the COVID-19 pandemic.

Frequently asked questions

Now you understand how student loan interest is calculated. There are some important questions that student loan borrowers ask online. I have compiled a list of all these questions here that I’m going to answer briefly one by one. So let’s take a look at them.

How does a student loan work?

Student loans are a type of debt that students use to pay for their college fees and other education-related expenses. These loans have an interest rate like all other loans. You can take student loans from the federal government or from a private lender but they have a higher interest as compared to the federal government.

You fill out a free application form and apply for federal student loans. The parents also insert their information and then send the form to the respective school or college. Here the student gets a loan according to how much he qualifies for.

Along with that whether the loan is federal or private the student needs to sign a promissory note. This is a promise that the student will repay the loan when he completes his education. All the terms and conditions are present:

- Payment schedule or timetable

- Disbursement date when the loan will issue

- Interest rate whether fixed or variable

- How interest capitalizes

- The date you make the first payment.

- The interest accruing policy is either daily or monthly.

You need to carefully read out all these terms before signing because they will highly affect your cost of borrowing and payment ability.

How to calculate the total cost of a student loan?

The true cost of a student loan is what you paid off in actuality. So for calculating that if your monthly payments are even like $550 a month for 10 years then you need to multiply all of them by 120 and you get the answer.

What are the COVID-19 student loan interest benefits?

There are a number of student loan-related benefits announced by the US government. Here is a list of a few of them.

- The final extension of the loan is announced by the US Department of Education on August 6, 2021, applicable until January 31, 2022.

- US Department of Education will automatically set your interest rate to 0% after March 13, 2021, if you are eligible.

- They automatically suspend your payments from March 13, 2021, till Jan 31, 2022, if you’re eligible.

- The department also announced the benefits for total and permanent disabled on March 29, 2021.

- The defaulted loans also get different relief benefits like a tax refund, no wage garnish, and no collection calls.

For more information on these benefits, you can visit this article Coronavirus Info for Students, Borrowers, and Parents.

How Does Student Loan Interest Work?

The interest you pay on student loans whether federal or private is student loan interest. They are either at fix rate that doesn’t change over the life of the loan or variable interest which fluctuates with the time either up or down.

Your total cost depends on how much interest you pay over time. The larger the interest rate the more cost you’ll have to pay.

- The total cost of a student loan depends on four factors which include:

- The interest rate (If higher the more cost you’ll pay)

- The principal amount (The original amount you borrowed)

- The payment term (longer it will be more interest you pay).

- Whether your interest will capitalize or not ( if interest is capitalized, the compounding effect will be higher so the cost of borrowing).

For more information on how student loan interest work, you can visit this article: How Do Student Loan Interest Work?

What is the rate of interest on federal and private student loans?

Interest on student loans varies. Federal student loans have a lower interest rate as compared to private student loans from banks and other credit unions. Below are the tables that list the student loan interest rates including year by year, for undergraduates, graduates, and parent plus.

They include interest rates for both subsidized and unsubsidized federal loans. Subsidized student loans are those which are given to undergraduates by the US Department of Education. While unsubsidized student loans are given to both undergraduates and graduates.

Below is a list of tables that include the latest and historical interest rates by specific category.

Federal Student Loan Rates For Direct Subsidized, Direct Unsubsidized, And Direct PLUS

| Loan Category | Disbursed July 1, 2021- June 30, 2022 | Disbursed July 1, 2020- June 30, 2021 |

|---|---|---|

| Direct Subsidized Loans (Undergraduate Students) | 3.73% | 2.75% |

| Direct Unsubsidized Loan (Undergraduate Students) | 3.73% | 2.75% |

| Direct Loan - Unsubsidized (Graduate/Professional Students) | 5.28% | 4.30% |

| Direct Parent PLUS Loan | 6.28% | 5.30% |

| Direct Graduate/Professional PLUS Loan | 6.28% | 5.30% |

| Health Professions Loan | 5% | 5% |

How to calculate the repayment of a student loan?

You can calculate your student loan monthly payment using a formula in manual way or using an online repayment calculator. If you want to calculate it using the loan repayment formula then it is given below:

A = P (r (1+r)^n) / ( (1+r)^n -1 )

Where A is the monthly payment, P is the original or principal amount, R is the interest rate, and N is the total number of periods.

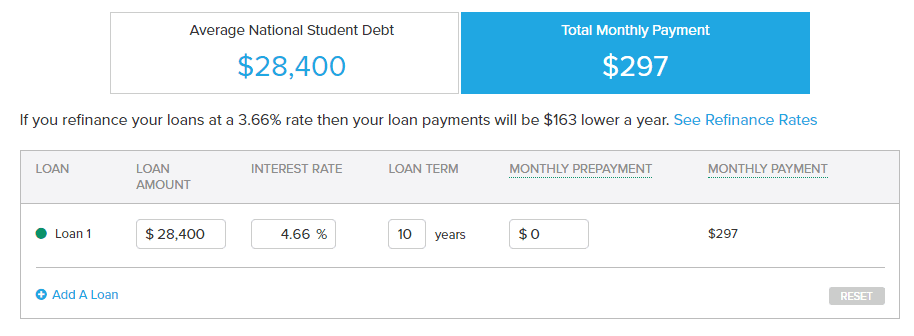

But this is a hectic method. You need to use a scientific calculator or pen and paper. The more advanced and reliable method is the online repayment calculator. Here you just need to put values and click calculate button.

You can find one at Smart Assets.

Here you need to insert your principal amount, interest rate, time period, or term of the loan and if any advance or prepayment you made before the due date. The calculator will automatically give you the required value. And if you want to reset it then click the “RESET” button and for adding more loans you can click the “ADD A LOAN” button.

When does interest start accruing on student loans?

Whether it is a federal student loan or private student loan the interest starts accruing as the loan amount is disbursed to you. But on federal loans, payments are not required until you complete your education.

The same principle applies to PLUS loans. That’s why if possible you should make payments during education to lower the loan cost.

Is interest accruing on students loan during COVID?

On federal students loan, there is no interest accruing during the forbearance period. This period starts on 6 Aug 2021 and ends on 31 Jan 2022.

During this period if you can afford then make as many as payments so when the period ends your overall loan amount accrue less interest.

But on the other hand on private student loans, the interest doesn’t stop and continues to accrue. You can avail forbearance time frame from your private lender but the interest continues to accrue.

You also like:

10 Best Budgeting Apps of 2022 (Free + Paid)

What Is Financial Planning? How to Do It In 12 Easy Steps?

What Is a Debt Snowball Method? How Does It Really Work?

Conclusion

Student loan interest is a major factor that is responsible for your ability to make payments and avoid delinquency.

But the pitfall of going into default can only be avoided if you know how student loan interest is calculated. Because this will show you the exact picture of how much you are going to pay and how much income you need to meet your payments.

For calculating student loan interest I recommend you use the online calculators and tools mentioned above. They not only make the job easy but give accurate answers and also save you time.

Now tell me in your comments below which method of calculation you prefer either manual or online.

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024