Last updated on February 12th, 2024 at 07:31 am

In this article, you’re going to learn what is student loan and how student loan work.

For completing your higher education if you can’t afford the expenses then taking a student loan is a common option. It helps you not only cover your educational expenses but enables you to get financial aid.

In the US the total student loan debt is more than $1.73T as of 2021.

This means that it is a major source for students to finance their educational expenses.

But the problem is that it is a debt and can affect your financial future.

That’s why you should know the answer to how student loan work, how interest is calculated, and other important queries. And this article contains in-depth information which covers all necessary aspects of student loans.

So let’s get started.

What is a loan?

Before going to the explanation of student loans and their working, let’s first understand the term “LOAN”.

A loan is money you borrow from a lender on the promise to return it in the future with some additional amount called interest.

You borrow money to spend it on your needs. When the term of the loan or time period you promised will complete then you return that amount to the lender with additional charges called interest.

Interest is the money earned over money. It is a cost of borrowing that a debtor pays to the creditor. It is an expense for the borrower but income for the lender.

Basically, loans are taken by individuals and businesses. But the purpose is the same that is satisfying their financial need which they can’t pay with their pocket.

In the case of individuals, the loan is used for education, personal needs, any small business needs, trips and vacations, and buying automobiles or houses. But businesses use loans to finance their projects, making a mix of equity and debt, and other operational needs.

What are the types of loans?

There are two main types of loans which include secured loans and unsecured loans.

1. Secured Loans

These loans are the ones that have collateral in place. This means they are secured by some security like property, cash in a bank account, government securities, car, inventory, house, or any other valuable asset like gold.

The common types include mortgages, car loans, bonds, home equity loans, secured debentures to companies, etc. Their interest rates are lower because they’re secured and have risk is very low to zero.

2. Unsecured Loans

Unsecured loans do not have any collateral in place. They are given on the basis of credit reputation and trustworthiness. The most common examples include credit cards, student loans, personal loans, subordinated debentures to any company, etc.

Their interest rates are normally higher as compared to secured loans.

The secured and unsecured loans both are used by individuals and companies. The default chance in secured loans is less and if anyone defaults then the amount is recovered from collateral. While in the case of unsecured loans, the lender may face a loss in amount or may recover using legal procedures.

That’s why unsecured loans are riskier than secured loans.

Now let’s understand student loans, their types, and how student loan work.

What is a student loan?

Are you an undergraduate and decided to take admission to college? Do you want to continue your education after graduation?

It doesn’t matter at which stage of education you‘re in. In-country like the US you need to bear the educational expense which is increasing day by day.

According to historical data, the four-year college education cost in 1968-1969 was $329 for public colleges and $1,487 for private colleges. But in 2021 the same cost is $21,422 for public and $46,448 for private colleges.

The cost is huge and students can’t pay on their own or from their parents. So the only option they are left with is student loans.

Student loans are amounts students borrow from the government or any private lender to pay for their educational needs.

They are used to cover expenses like buying books and registers, going on trips and vacation plans, hostel fees, food, tuition fee, any laptop or equipment, and others.

Like all other loans such as personal loans, credit cards, and mortgage loans you’re liable to pay interest on a student loan. This means if you’re not financially intelligent then it can put your financial future at risk.

There are a number of different solutions that can help you avoid a student loan or pay it faster later in this article.

But for now, let’s jump to the next section.

What are the types of student loans?

There are two main types of student loans. One is called Federal student loans and the second is called Private student loans. In short either you can take a loan from the government or from private lenders.

1. Federal student loans

These loans are given by the US Department of Education to needy students and different loan servicers manage them on behalf of the government.

These loans make up the major portion of total US student loan debt.

According to EducationData.org, federal student loans make up 92.6% ($1.57 Trillion) of total student loan debt. And this amount is owed to 42.9 million Americans.

Why do students go for federal student loans instead of private ones?

The reason is that federal student loans offer more benefits as compared to private ones. Along with that, they are easy to borrow and have flexibility in repayments.

Federal student loans are divided into four major categories. They include direct subsidized loans, direct unsubsidized loans, direct parent plus loans, and direct consolidation loans.

Let’s briefly explain each one of them in detail:

1. Direct Subsidized Stafford Loans

These loans are given to undergraduate students with financial needs. But they need to fulfill the eligibility criteria. These loans are also called Stafford subsidized loans.

There are certain benefits associated with these loans. You don’t need to make interest payments during college, after 6 months of passing out from college and dropping out before halftime. During this time the government will pay the interest. You can save a bunch of money this way.

2. Direct Unsubsidized Stafford Loans

These loans are given to undergraduate, graduate, or professional students if they meet the eligibility criteria. Unsubsidized loans don’t require any demonstrated financial need. But you need to pay interest during college and if not then it is capitalized or added to your principal amount.

3. Direct PLUS loans

These loans are issued to undergraduates, graduates, and parents of undergraduate students who are dependent but without any financial need demonstration. Here your credit history is checked up and if you’ve poor repayment history on one or more loans then you need to fulfill another necessary requirement.

On a direct plus loan, you start accruing interest as soon as the whole amount is disbursed to you between 2 weeks to 2 months time frame. You can make repayments while you’re in college time or extend them up to six months after you leave college.

Direct PLUS loans are subdivided into two types. The one is called Parent PLUS loans and the second is called Grad PLUS loans.

The Parent PLUS loans enable parents if the student financial aid doesn’t cover the whole amount of fee or education cost. But for repaying the loan only parents will be responsible not their child.

The Grad PLUS loans enable graduate and professional students to borrow money for financing their education costs. They help them cover the full cost of grants and scholarships don’t.

For more information and eligibility criteria you can visit this article from CFPB: What is a Direct PLUS Loan?

4. Direct consolidation loan

The fourth type of Federal Stafford loan is called the Direct Consolidation loan. It is used to combine multiple federal loans a student has into one single loan to a single loan servicer.

Here you take a loan from the US Department of Education to pay the existing loans and then make a single payment on this new loan. The direct consolidation loan helps you save money in interest if you get the loan at a lower interest rate.

For more information about Direct Consolidation loans, you can visit this article from Investopedia: What is a Direct Consolidation Loan? Advantages and Disadvantages.

2. Private student loans

The second major type of student loan is called Private student loan. Private student loans are taken from banks, credit unions, colleges, or individuals. These are different from federal student loans in terms of interest rate, lending agreement, loan terms, and the amount you can borrow.

Along with that, there is a credit score check and the terms and conditions may be difficult as compared with federal loans. They have higher interest rates as compared with federal student loans.

Let’s jump to the next section on how student loan work.

Related: How Does Debt Consolidation Work? Is It a Good Idea?

How do student loans work?

Student loans are amounts students borrow to cover their educational expenses. They are given by the US Department of Education and other private lenders. Students borrow these amounts and use them for fulfilling their educational needs and then return them back to the lender.

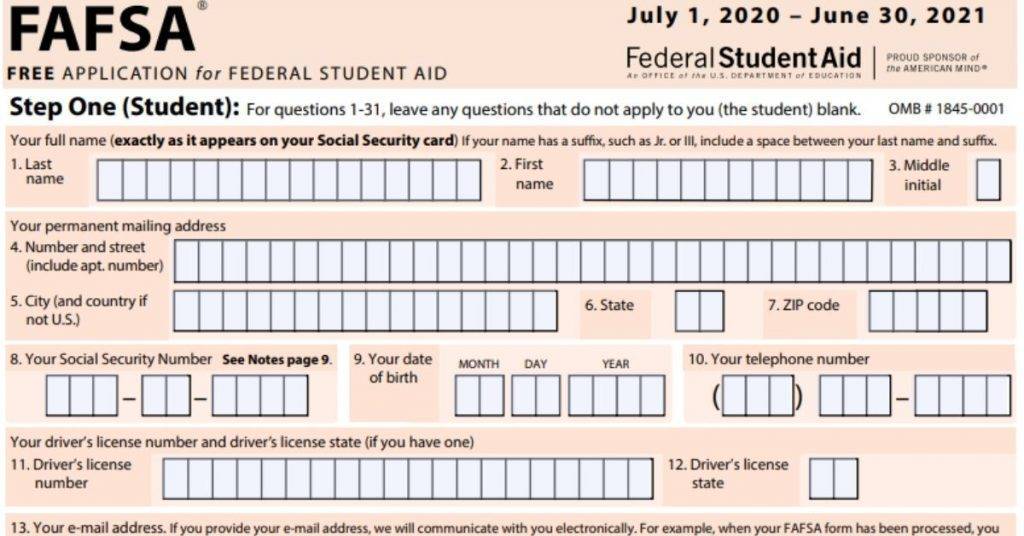

The students apply through a free application called FAFSA (free application for federal student aid). This includes the information from the student and his parents and family. After processing your FAFSA application the student aid report (SAR) is sent to the college you mentioned on the application form.

Your college then determines the amount of financial aid you qualify for based on the information on your SAR. It is sent to you in the form of an award letter and this aid may include the federal student loan amount.

When you get qualified for the amount of loan you then sign a promissory note which is a legal document. A promissory note ensures that you repay the whole amount of your student loan including interest and fees to the US Department of Education.

For obtaining private student loans, you contact any individual lender whether a bank, credit union, or online lender. The lender checks your credit history and score to examine how much you qualify.

It is possible that if your credit score and income level aren’t good or your credit history is thin then you might need a cosigner. You then sign a promissory note. The loan amount is disbursed to you within 2 weeks to 2 months time period.

You then start using that loan for your educational expenses. The interest starts accruing on federal and private student loans as soon as the whole amount is disbursed to you except for direct subsidized loans. So you can either choose to make interest payments while in college or it will be capitalized into the principal amount.

Now you understand how student loans work. Let’s jump to the next section.

How does student loan interest work?

Like all other loans, you need to pay interest on student loans as well. Both federal and private student loans charge a specific interest rate. But federal student loans charge less as compared with private student loans. And there are different interest benefits of federal student loans that private lenders don’t offer.

Now how the interest on student loans works is a simple phenomenon.

In the case of direct subsidized loans, you don’t pay interest during college time and 6 months after leaving college. And if you drop before half-time in college you don’t need to pay. But the question is that who will actually pay the interest? The answer is the government.

In direct unsubsidized federal loans, you start accruing interest as soon as the whole amount is disbursed to you. But if you can’t pay the interest then it is capitalized which means added to your principal amount. And later you need to pay all that amount.

And when it comes to direct PLUS loans then their interest terms and conditions work like the direct unsubsidized loans. You become liable to make interest payments as soon as the total amount is disbursed to you within 60 days.

While in private loans you are required to start making payments when the loan is handed over to you. And interest starts accruing irrespective of whether you’re in college or drop out or completed the degree.

If you can’t make the interest payments and you’re facing hard financial days then you can negotiate with the lender. Here either he can give you a deferment for some time or forbearance but the interest still continues to accrue.

How student loan interest is calculated?

Student loan interest is an important factor to consider. Ultimately your overall cost of borrowing depends on how much interest you paid over the term of the loan.

But how do you know how much interest you pay?

It is simple you can use a simple formula for calculating the interest amount on student loans. Here it is:

Student loan interest = principal amount * interest rate factor * number of days from last interest payment

For example, you have a $10,000 student loan at a 6% interest rate for 10 years. Now you divide the 6% by 365 to calculate the interest rate factor which is 0.016438% which is daily interest. Now you multiply it by the whole principal amount to determine how much interest you accrue in one day and that is $10,000(0.00016438) = $1.64 dollars daily.

Now if you want a monthly interest amount then you can multiply it with days from the last loan payment. Let’s say it is 30 days and when you multiply it by 30 it gives you $49. For calculating the yearly interest you multiply the same daily interest by 365 and you get $600 annually.

To make this process more easy and sophisticated you can use the online student loan interest calculator. Here you only need to insert your values and it will automatically give you all the answers.

Why should you take out federal student loans?

If you can afford your education expenses then I don’t recommend you to take student loans. But if you can’t then there are multiple benefits that other types of loans don’t provide.

- If you go for federal student loans then interest rates are lower which saves you money.

- In the case of federal direct subsidized loans, your interest is paid by the government during college and after six months of passing out. This saves you big bucks and lowers the cost of borrowing.

- You can take forbearance, deferment, and temporary suspension for making interest payments. So during that time, you can make your financial position strong.

- They give you enough time to repay. In fact, the normal term for federal student loans is 10 years but it can be extended beyond 10 years to up to 25 years.

- If you qualify for forgiveness then a portion of your student loan will be forgiven and saves you money.

- When you apply for a student loan then filing the FAFSA application form provides you an opportunity to take financial aid for college or university. This financial aid is in the form of grants and scholarships which are free money that you don’t need to repay. It also lowers your loans to cover educational costs.

- If you maintain a good credit history and make on-time payments then it will help you build your credit reputation. So in the future, you can easily obtain low-interest rate loans in the form of credit cards and personal loans.

These benefits are great that other types of loans don’t offer. Here you can easily cover the educational expenses and then repay the loan in the future.

What are the downsides of student loans?

With many sweet benefits, there are some downsides that you should take into account before going for student loans. Because it is a debt, not free money and so can highly affect your financial future.

- You can default on making payments and this will seriously affect your credit history and score. So it becomes difficult for you to take a loan in the future.

- If you don’t make payments and file bankruptcy then it will stay on your credit report for 7 to 10 years. You can also get sued for not paying the loan and face difficulty in obtaining any other loan in the future.

- If your loan is huge and you don’t have an excellent level of income then it is possible that your financial future gets seriously damaged. You may possibly make payments for 20 to 25 years and be unable to invest for retirement.

- In case you apply for forgiveness then according to statistics, only 1.3% of applicants became eligible. It seems that your chances of forgiveness are less to no and if you get approved then only a portion of your student loan will be forgiven. And forgiveness also requires you to make 120 months of payments before actual forgiveness happens. Which makes it not a good option.

- Student loan provides serious stress and bad health effects if you become unable to cope with the situation. So it is good to build a strong income stream so you can easily pay back the loan.

- Interest continues to accrue in unsubsidized federal loans, direct PLUS loans, and private student loans. It doesn’t matter whether you have taken forbearance or deferment. And if you don’t make payments the interest will capitalize and builds even more debt due to the compounding effect. Which increases your cost of borrowing.

So before going into the student loan trap, you should first consider these side effects in mind. Ultimately your financial future is the most important of all.

You understand what is a student loan, what are the types, how does student loan work, and the upsides and downsides.

Now let’s understand how to get a student loan and other answers to other important questions.

How to apply for a student loan?

Applying for student loans is simple but remember methods are different for federal and private student loans. So let’s discuss how to apply for each loan.

For federal student loans, you need to apply using a free application form called FAFSA. It stands for Free Application For Student Aid. Here you mention your details and your parent’s details. Then the SAR is sent to the college where you want to take admitted.

After that, the college will determine how much you qualify for student aid. This aid comes in the form of grants and scholarships which may include student loans. But the grant or scholarship is free money so don’t miss out.

When you qualify for a student loan then you need to sign a promissory note. It is proof that where you promise to pay the loan including interest in the future. Now the loan servicers working on behalf of the US Department of Education start disbursing the loan. Usually, the whole amount is disbursed to you within 60 days of qualifying.

In the case of private student loans, you don’t need to file FAFSA. Here you can contact any of the random lenders whether it is a bank, credit union, or anyone else, and discuss your situation with them.

After that, they check your credit history and credit score to determine the risk level and how much amount you qualify for. If you qualify then you need to sign a promissory note and have a cosigner ( in case of poor credit history and low income).

When all obligations are completed the loan amount is disbursed to you and interest starts accruing.

But remember that private student loans come with higher interest rates as compared with federal student loans. There are no repayment benefits like in the case of federal student loans. Therefore you need to stay cautious when taking private student loans.

How are student loans different from grants and scholarships?

Student loans are a kind of debt that you need to pay back later. You pay back including principal and interest amount. Students get loans on the basis of need and if private then credit history as well along with satisfying other requirements as well.

Grants and scholarships are free money you get as a gift for covering educational expenses. You can get them if you’ve excellent education records including marks and grades or are just need-based. You don’t require to return this money.

How can you pay off your student loan fast?

Paying off a student loan is a headache like any other kind of debt. Normally there are 10 years to pay it back. But if your student loan is higher in amount (like more than $30k) then you can take an extension up to 20 or 25 years.

Here are some excellent strategies you can implement not only to pay the loan faster but also to avoid taking further student loans.

1. Do a side job as a student

If you only set aside 3 to 4 hours a day and do a side job gig then you can easily earn a good amount of income. It becomes 20 to 28 hours a week and 140 to 200 hours a month.

For example, if you charge $10 an hour then you can easily earn $2,000 plus a month which is a sizable income. You can use it to pay the loan interest and save for the future to grow it and eventually use it to pay the remaining debt.

This way you can pay a big amount of loan and you may not need to take more debt. You can earn this by doing a job at a local market or you can do a part-time job at a university or college you’re currently studying at. Because lots of these educational institutions have programs that help you earn.

2. Utilize grants and scholarships

This strategy is another best one. When you apply for a student loan then don’t go for private but federal. Because federal student loans help you file FAFSA and the college may give you financial aid in the form of grants and scholarships. This helps you replace a big size of student loans with free money.

For more information here is a good article: Finding and Applying for Scholarships

3. Do a side business

If you have a money-making skill or investment then you’ve got a good opportunity. Starting your own business as a side hustle whether it is online or offline can help you earn big and avoid student loans in the future. You can do business as a freelancer online or offline if you have a skill like writing, designing, computer, software, or any other in-demand skill. You can start a coffee shop or a hardware shop in a local city. And there are plenty of other opportunities like stock market trading. But it is up to you how you tackle them.

4. Change your lifestyle

If you’re living in a five-star bedroom, eating at five-star hotels, wearing expensive brands, and traveling in private expensive cars then you should change it. In short words “Do not stretch your feet beyond the sheet”. This will help you avoid wasting money and spending it responsibly.

5. Ask your parents for financial help

If your father or any other member of the family has a good income then ask him for financial help. This works like grants and scholarships but they may require you to pay back. So be careful.

6. Search for colleges with low fee

You may want to get an education from top colleges in your town or city with huge fees. But remember this will put you into a mountain of debt if you go for a student loan. So the solution is to take admission to college with the lowest fees. There are many universities and colleges with excellent educational standards while having low fees. So don’t worry about standards just become financially smart.

If you follow one or all of these tips then you can not only get out of a student loan faster but also helps you avoid taking a student loan. Yes, I’m not kidding. This all depends on your financial intelligence.

Bonus tip: Use the debt snowball or debt avalanche method. For more information read these guides:

What Is a Debt Snowball Method? How Does It Really Work?

How to Use Debt Avalanche Method to Quickly Pay Your Debt?

How much student loan can you borrow?

Why federal student loans are more favorable than private student loans?

Federal student loans have different benefits associated with them. Some of them include:

- Low-interest rate

- Flexibility in payment

- Forgiveness programs

- No interest accrues on subsidized loans during college

- Variety of repayment plans

- Grants and financial aids opportunity

- Easily available without any credit score checking

But on the other hand, private student loans don’t offer such benefits. They’ve higher interest rates and if you get a forbearance from a private lender then still the interest continues to accrue.

They also check your credit history and if it is not good then they may reject you or need a cosigner. You also can’t avail of grants and financial aid. If get delinquent on payments then you need to face calls from debt collection agencies.

When did the student loan repayments start?

The repayments on federal student loans start when you leave out college, drop below half-time, or complete your graduation. Here you also get a six months grace period so that you can find a job or any other income source. During this period you don’t accrue interest.

When your grace period ends the repayments will start including principal amount and interest. The loan servicer will calculate fixed monthly payments and the time period for which you need to pay. It is normally 10 years.

The private student loans accrue interest as soon as you receive the full amount. Your repayments also start soon after. Now there is a deferment option if you can’t pay a loan while in college. Therefore you can choose to repay it after you complete your study but interest continues to accrue. The repayment includes both interest and principal amounts.

What are the current student loan interest rates?

Here are the student loan interest rates for the years 2020 to 2021. They include rates for both federal subsidized, unsubsidized, and Direct PLUS loans as well as for private student loans.

- Direct unsubsidized loans have 3.73% for undergraduate students and 5.28% for graduate students.

- Direct subsidized loans have a 3.73% interest rate because they are only for undergraduate students.

- Direct PLUS loans have a 6.28% interest rate for both graduate and their parents.

While the private student loan varies in interest rates and their range starts from 0.99% and ends at 12.99%. This includes parents, undergraduates, and graduates.

What are the student loan repayment options available?

There are six types of repayment plans that are available for students. Here is a short explanation of each repayment plan:

1. Standard repayment plan

In this plan, you need to make a fixed amount of payment each month for a specific time frame to the loan servicer. It includes the principal and interest amount. For example, if you have a $10,000 loan at a 5% interest rate for 10 years, then you will have to make 120 payments of $106. The minimum payment under this plan is $50 a month.

2. Graduate repayment plan

Here you start with low repayment but it increases with time after every 2 years. In short, when you’re starting out the repayments will be low but they increase as time passes on. It increases with income and has a loan term of 10 years.

3. Extended repayment plan

This repayment plan allows you to extend loan repayments beyond 10 years up to 25 years. Usually, if you’ve $30,000 or more in student loan debt with a standard or graduate repayment plan then you can use this plan.

4. Income-driven repayment plan

An income-driven repayment plan allows you to make payments that are affordable while considering your income and family size and expenses. Normally, it is 10% to 15% of your discretionary income and it adjusts each year.

5. Income-contingent repayment plan

It is just like the income-driven repayment plan but with the one exception that it charges 20% of your discretionary income to loan repayment. It adjusts each year.

6. Income-sensitive repayment plan

As the name suggests, this repayment plan is sensitive to your annual income before tax. And only low-income borrowers with FFEL ( Federal Family Education Loan) program are eligible. The repayments amount may up and down with a change in the income of the borrower. It adjusts each year with changes in your income.

How much amount you repay can vary under each plan. So be careful when you decide to choose any one of these plans.

You also like: How to Avoid Debt to Make Yourself Financially Strong

Final thoughts

Student loans are a good option for paying your educational expenses. They are not only easy to get but the payment terms are also flexible.

But before taking a student loan first you should examine your situation. If you have enough money that you can finance the college costs then avoid taking student loans. If not then go for federal student loans because of several benefits.

When you get a student loan then you should have a plan for repaying it. If possible then start making payments during college so that you pay less interest and avoid it from compiling into big.

If you deal with debt in a financially intelligent way then it will become an investment for you and benefits in the future.

I hope you understand what is student loan and how a student loan works. You have also got answers to other queries as well.

If you like this post then share your opinion in the comments section below.

Related Post: How to Get Student Loan Forgiveness? Who Will Qualify?

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024