Last updated on June 17th, 2023 at 06:29 pm

In this post, you’re going to learn what is debt avalanche method. And how you can use it to get out of debt fast?

Debt is the cheapest source to finance your needs. Whether you want to pay for college fees, medical bills, shopping, or personal needs, debt is the easiest option.

But there is a big problem with debt and that is you get into debt very easily but getting out of it is difficult.

In fact, on average Millennials (age 18-34) have $36,000 in debt, and 20% of Millennials expect that they die without paying their debt.

For this problem, there is a repayment plan called the debt avalanche method. Today I’m going to explain it to help you pay your debt fast and save money as well.

So let’s get started.

Debt avalanche method definition

It is a type of accelerated debt repayment plan which aims at paying a loan as fast as possible.

In this method, you make the minimum payments on all your debts (excluding the mortgage) and devote the remaining money to pay the debt with the highest interest rate.

When the highest interest rate debt gets paid you then use his payments to pay down the next highest interest debt and so on. The method applies to all the debt amounts until they get paid.

For a more detailed understanding of this method, let’s jump to the next section.

How does the debt avalanche method work?

The debt avalanche method works like a snow avalanche. Using this method you tackle the highest-interest debts first and spend all the extra money to pay them off while making minimum payments on the remaining loans.

When two to three debts with the highest interest rate get paid then the remaining amounts wipe out very fast and you become debt-free. This method is cost-effective and takes less time to pay the debt.

For understanding it in a practical way, let’s explain it with an example.

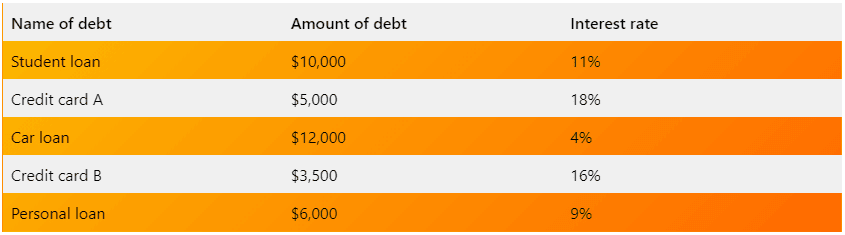

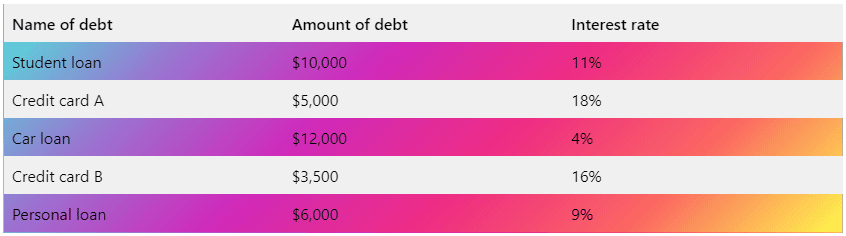

Let’s say you’ve five debts outstanding. For making it simple here are their name, amounts, and interest rates.

For example, this is your current scenario of debts and interest rates.

To make the calculation more simple let’s assume that you make $100 minimum payments on each debt every month. And you set aside $1,500 out of your income for paying off your debt each month.

How do you apply the debt avalanche method?

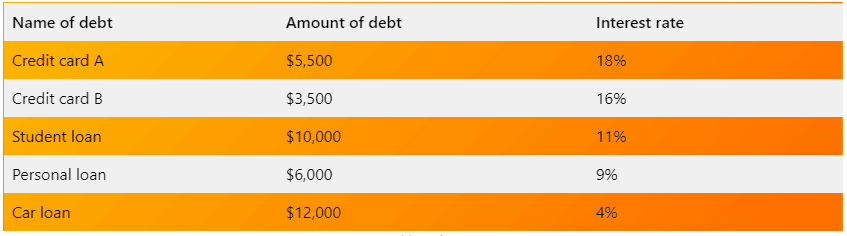

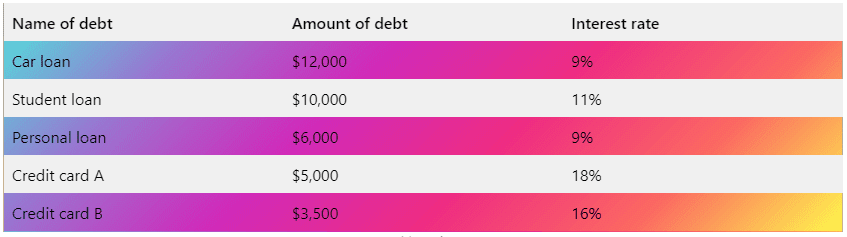

You first list down all the debts in descending order with respect to the interest rate. The highest interest debt comes on top then the next highest interest till the lowest one on the bottom.

Here is the scenario of the above-mentioned debts.

After listing them down in descending order now you make payments on each one. Here you make pay a minimum of $100 on credit card B, student loan, personal loan, and car loan. While spending all the remaining money to pay the credit card A.

That means out of $1500 just $400 is used as minimum payment on the remaining 4 debt amounts while $1100 is used to pay credit card A which has the highest interest rate.

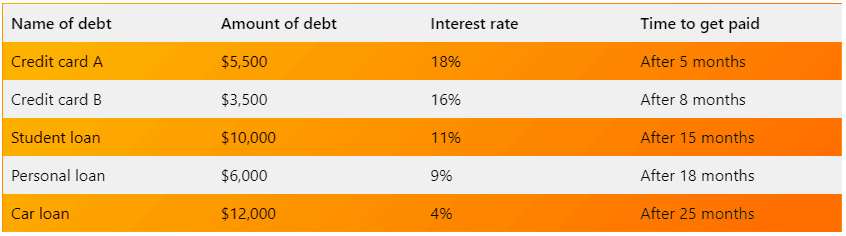

Now after five months the credit card A debt gets paid and you then use this $1100 to pay the credit card B. After 3 months it gets paid with the last payment of $600. Then you devote its payment to pay the student loan.

Here is the scenario of months each debt takes to totally get paid.

So after 25 months all of your debts get paid and congratulations you become debt-free.

Now you can see that when credit card A is paid then the $1100 is used to pay credit card B ( $1100 + $100 ). When it is paid then his $1,200 is added to the student loan minimum payment of $100 ( $1200 + $100 = $1300 ). This way the monthly payments for each incoming debt become bigger to pay debt fast.

This is how the debt avalanche method actually works and helps you get out of debt fast while saving money.

You also like: Why I Chose the Debt Avalanche to Pay $81,000 in Student Loans

Difference: debt avalanche vs. debt snowball method

Debt avalanche and debt snowball both methods are both types of accelerated debt repayment plans.

But there is a bit of difference in how both methods are used. Also the time, it takes to pay the whole debt and how much interest you pay.

So let’s explain the difference between them.

1. Debt avalanche method

Using the debt avalanche method you pay the debt with the highest interest rate first while making the minimum payment on the remaining debts.

It is used for paying debt fast and saving money in interest amounts.

From the above example and explanation, you have a better understanding of how to use this method.

So now let’s explain the debt snowball method so you understand the differences between both methods.

2. Debt snowball method

This method is another type of accelerated debt repayment plan.

Using this method you pay the debt with the lowest amount first while making minimum payments on all the other debts.

Here you pay the minimum amount on each debt and what extra remains is all devoted to paying down the debt which has a minimum balance. You don’t consider the interest rates here. You just take into account the minimum balance.

When one balance is paid you move to the next minimum all the way to the highest one until the debt is abolished.

Let’s understand it with the help of debt amounts from the previous example.

Now you list them down in ascending order from lowest to highest in terms of their amounts.

Now assume the minimum payment of $100 you make on each debt and then spend the extra $1100 to pay the credit card B (lowest amount). When it is finished you transfer that payment to pay credit card A and so on.

Each debt gets paid one by one until you get out of it. This is a simple method of using a debt snowball repayment plan.

Key differences in both methods

Here is a table listing the key differences between both methods.

| Debt avalanche method | Debt snowball method |

| Aims at paying the high-interest debt first. | Aims at paying the lowest balance first. |

| It is faster than the snowball method. | Take longer compared to a debt avalanche. |

| Cheap because it saves money in interest. | Expensive because it ignores the interest rate. |

| Based on consistency and patience. | Based on the psychology of small wins and motivation. |

These are the key differences between both methods. Now, let’s jump to the next section.

Pros and cons of the debt avalanche method

This method comes with certain advantages that make it different from other methods.

Some most important ones include the:

- It helps you pay debt faster. When two to three debt balances are paid off then the remaining ones wash out very fast.

- This method targets the highest interest debts first. This is the reason why it is a viable method for saving money. When you’ve paid down the high-interest debt, the interest amount can’t compile quickly.

- Your mental and physical health will stay normal because the debt burden will lay off quickly. According to Aspen Institute, financial problems lead to 16% of suicides in the United States.

But at the same time, there are some downsides so it may not be a reliable method:

- It needs commitment and patience. If you’re not the kind of person with strong consistency it will not work for you. The reason is you lose motivation after not seeing any sudden results in the beginning.

- You need to stop spending money with your current credit cards. Along with that, you need to avoid taking any further loans like personal or auto loans. Because if you don’t follow these precautions then more and more debt will compile and this method will fail.

- If you skip any month or two and don’t make payments then this method will not work for you. And it is possible that it takes longer and more interest to pay down debt.

Keeping its upsides and downsides in mind helps you make the best decision of whether to use this method or not.

You also like: What Is a Debt Snowball Method? How Does It Really Work?

Debt avalanche method calculator

The debt avalanche calculator is a tool that makes the calculation easier for you.

Here you put the details and it will help you get information on:

- How much interest do you pay on your debt?

- What time does it take to pay your debt?

- How much do you save using the method?

- What scenario becomes if you use the snowball method?

- How much extra money you can add to payments?

So you get a clear understanding of the debt payment scenario. There are two best calculators available online one is available on Omni calculators and the second is available on Nerdwallet.

These calculators are very easy to use, you need to follow some simple steps mentioned below. Here I go with the Nerdwallet calculator because it is so simple with enough details.

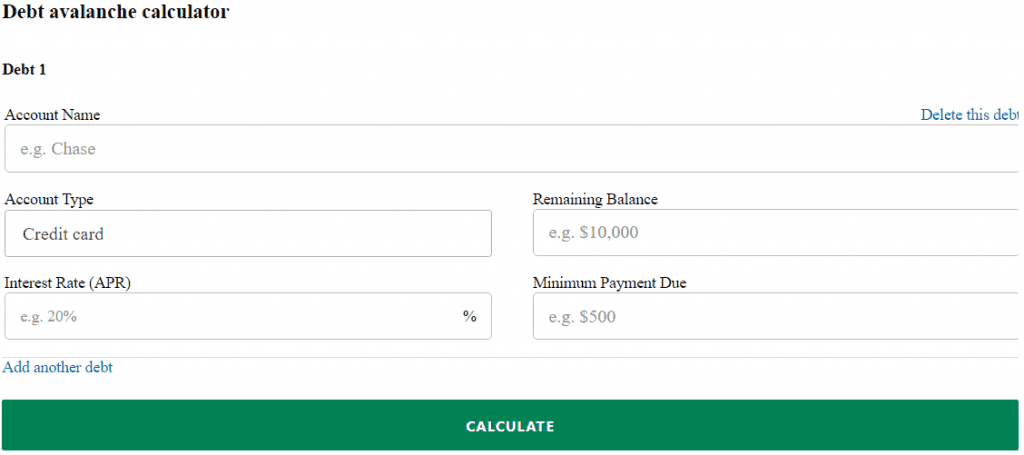

Step:1 Enter values

Enter debt values including the name of the account, name of debt for the downward list, amount of debt, interest rate, and minimum payments. You can add a minimum of two debts and for adding more debts you need to click “Add another debt”.

Step:2 Calculate

When you fill in these details and add all your debt amounts then click the “calculate” button at the bottom.

Step:3 Analyze results

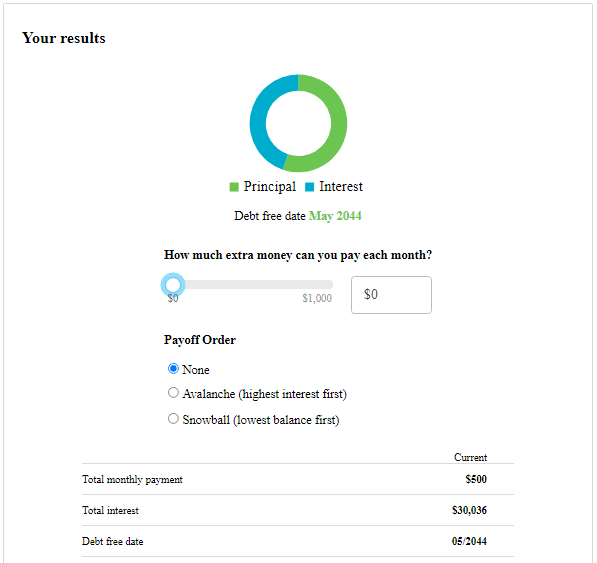

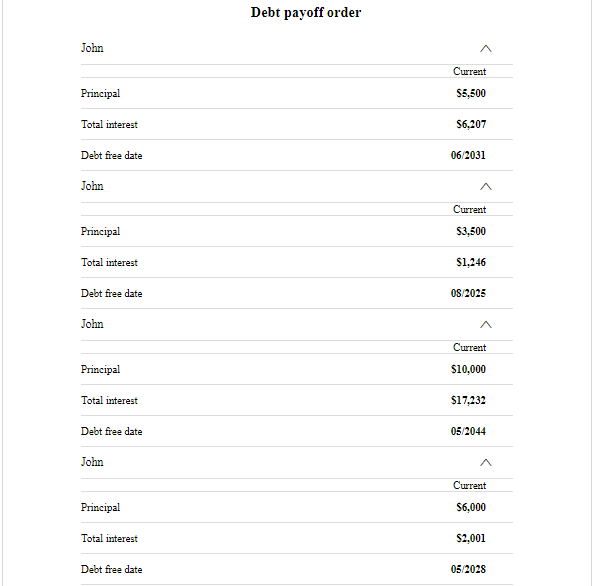

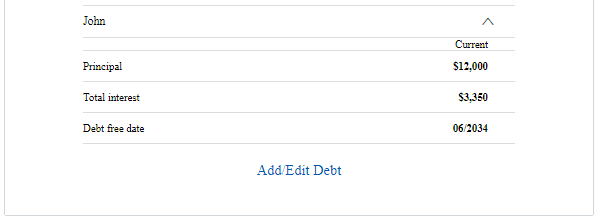

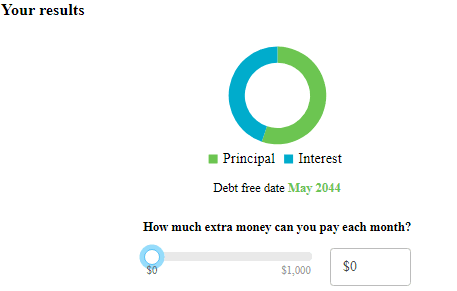

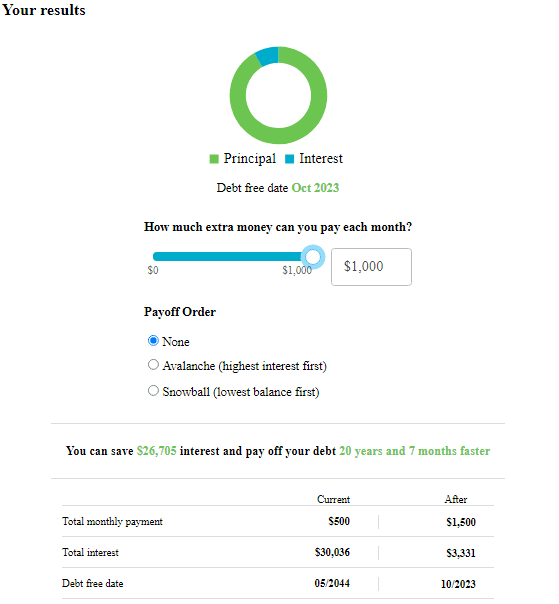

At this stage, you get a donat chart showing principal and interest percentages. Below is the debt-free date if you make only the minimum payment on each debt. In our example, this date is April 2044.

The calculation also shows the total monthly payment, the total interest you pay over time, and the debt-free date. The debt payoff order shows the principal amount of each debt, the interest you pay on each debt, and its debt-free date.

Step:4 Use slider

In this step, you need to use the option “How much extra money can you pay each month”. Below is the graph on top of the calculator data.

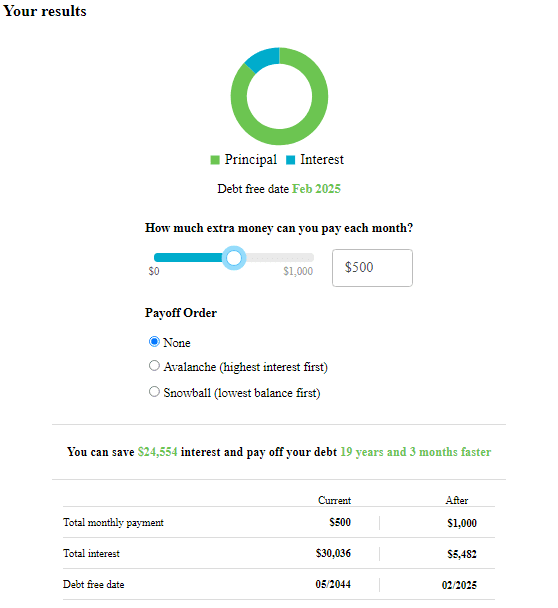

Here you slide the button from zero onwards and you can select a maximum of $1,000. As you select the amount the whole calculation changes including how much interest you pay over time and the time it takes to get out of debt.

In our example, if we select $500 extra money then our debt-free date decrease from April 2044 to July 2026, and the interest amount decreases from $30,036 to $750.

And if we select the maximum of $1000 then we can pay the debt 20 years and 7 months faster by paying only $3,331 in interest and get free from debt in September 2023 instead of April 2044.

So as you increase the extra amount of money the interest and debt-free date decrease. And you save more money as compared with if you only make the minimum payment. This way you can start saving for retirement early.

You can also switch the methods from avalanche to snowball. This gives you a changed scenario of how much interest you pay, how much savings, and the debt-free date. In our example with the snowball method, the debt-free date is the same, but we pay $3453 in interest which is a bit higher than if we use the avalanche method. And we pay $122 more in interest.

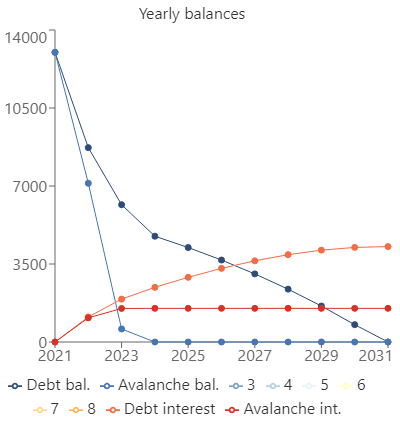

Use Omni calculator

The Nerdwallet calculator only shows you the data and a little principal and interest graph at the top. If you use the Omini calculator then it will also show you a graph at the bottom with dot points and lines.

This chart shows you how your yearly balance decrease using the debt avalanche method.

You also like: How To Make Money Without A Job (55 Lucrative Ways)

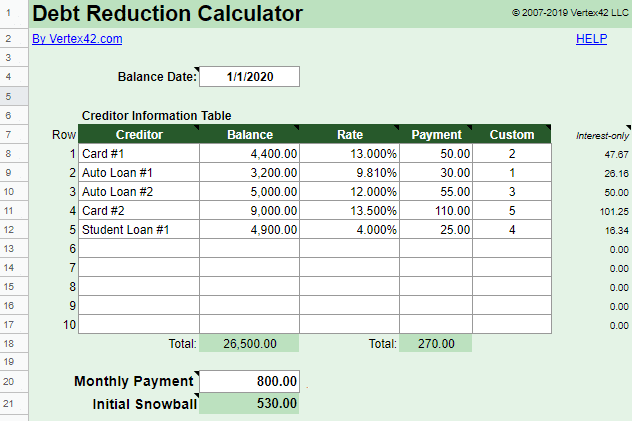

Debt avalanche method spreadsheet

It is similar to the debt avalanche calculator. The spreadsheet helps you mathematically calculate the values including interest rate, debt-free date, principal amount, and minimum payments.

It has more functionality as compared with a debt reduction calculator. You can make charts and graphs in an Excel sheet to better interpret the scenario.

These spreadsheets are available online for free. Whether you want it in Google Sheets or on your computer as an Excel sheet. You just need to enter values in it and it will do all the necessary calculations itself.

If you want to get these spreadsheet calculators for free then here is the place: 7 Best Free Debt Snowball Spreadsheets.

The same spreadsheet works for both debt snowball and debt avalanche. There are separate calculators available in them.

You also like:

How To Pay Off Debt Fast (11 Bullet Proof Tips )

What Is Debt Collection? How to Deal With Debt Collectors?

How Does Debt Consolidation Work? Is It a Good Idea?

How Does Student Loan Work? The Ultimate Guide!

Money Can’t Buy Happiness But It Can Buy You What? 9 Ways to Find Happiness

Debt avalanche FAQs

Is it better to put money in savings or pay off debt?

This depends on the situation. If you are able to generate a good rate of return that is more than the interest rate you pay on your debt and give enough profit then go for saving or investing.

Because here paying debt with money is just a waste where you can earn an additional amount.

This will help you earn more money which you can use for retirement savings as well as paying your existing debt.

But if the savings opportunity is not good enough to give you a fair return. In that case, you should use your money to pay the debt. Because if you don’t do that the interest will continuously make your debt burden larger and larger. As a result, it becomes difficult to pay back.

You also like: 59 Ways on How to Save Money Even If You Find it Difficult

Does the Dave Ramsey debt snowball method work for the average person?

Yes. The debt snowball method works for the average person. Basically, it is based on human psychology, not on a mathematical calculator.

It reflects the behavior of humans where they feel motivated when they achieve a small win or objective. After that, he is more likely to complete the whole challenge.

The same theory applies to the debt snowball. When a person starts paying his smaller debts then he feels motivated each time he eliminates a debt. So he becomes motivated to pay off all the remains.

According to Ramsey Solutions, more than 5 million people used the debt snowball method to pay off their debts.

How to decide between the debt snowball and the debt avalanche method?

Your decision depends on two factors. If you’re more towards either of them then you need to go with the respective repayment method.

- Consistency, savings, and patience

- Motivation, small wins, and behavior

If you want to save money and show commitment and patience then go with the debt avalanche method. You need to make regular payments for each debt on time and need to wait for results.

On the other hand, if you are the type of person who wants motivation and has the behavior of doing small tasks, then choose the snowball method. Whey? Because with each small debt you pay, the chances become higher that you’ll pay the whole debt. You feel motivated and get a sense of achievement.

You also like: What is Six Figure Salary? 25 Jobs That Pay You Six Figure

What’s the fastest way to get out of debt: the debt snowball or the debt avalanche?

The difference between both methods in terms of time is not significant. In some cases as in the example above the time period, it takes to eliminate debt is the same for both methods.

But in some cases, the debt avalanche method is one month faster than the snowball method.

The main difference between both is how much money you save. And using debt avalanches you can save more money as compared with the debt snowball. For example, $122 in the above example.

But snowball and avalanche methods both are too faster and savvier as compared to just making the minimum payments on all debts. If you rely only on making minimum payments on all debt to eliminate then it takes decades to eliminate all the debt.

You also pay thousands of dollars in interest which otherwise can be invested for retirement. So both avalanche and snowball are too effective as compared to the minimum payment method.

You also like: 62 Best Jobs For Stay-At-Home Moms (Online And Offline)

What is the best way to pay off a credit card debt, the snowball or the avalanche method?

If you are motivated by small wins then use the snowball method. It takes more money to pay the debt but finally, your debt gets eliminated.

But for credit card types of debts, the interest rates are very high. The reason is they’re unsecured loans and involve credit scores. So your debt burden rises very faster.

It is good to go with the debt avalanche method for these types of debts. Especially, if you’ve multiple credit cards. This will allow you to pay down high-interest balances one by one and ultimately you pay less in interest amount.

Finally, the choice is yours. Whichever method you feel flexible with. But keep in mind to stay away from minimum payment methods and avoid spending money with credit cards to see the results fast.

You also like: How to Pay Off Credit Card Debt Fast (17 Quick Tips)

Conclusion

The debt avalanche method is the best option to accelerate your debt repayment process.

But you need to stay consistent while keeping strong patience. You didn’t see greater results in the beginning but when two to three balances are paid, the remaining will wipe out rapidly.

This method is the best option to save money. You need to devote as much as extra money you can toward debt repayments.

Keep in mind that you need to stop spending money with credit cards and avoid taking loans. If you didn’t hold on to it then whether it is a debt avalanche or debt snowball they don’t work at all.

Tell me in your comments which method did you go with (debt avalanche or debt snowball)?

You also like: How to Avoid Debt to Make Yourself Financially Strong

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024