Last updated on February 26th, 2024 at 07:26 pm

In this article, you’re going to learn about 40 personal finance tips and tricks to help you to stay on top of your personal finances.

The single most important thing you need to deal with is personal finances. Their management is necessary to achieve financial and life goals.

But sadly the majority of people don’t know how to take control of their money.

Here I’m going to share 40 personal finance tips you can try to improve your finances and achieve your financial targets.

Let’s jump into it.

40 Personal Finance Tips To Easily Solve Your Financial Problems

Here is a brief explanation of each trick:

1. Spend less than you make

You heard this several times “Look at the sheet before spreading your feet”.

In personal finance, it simply means that you limit your spending according to your income. Avoid spending more than you make.

According to NGPF, 54% of Americans spend more than they earn.

When you spend more than your income then you have to use a credit card which creates debt and interest expenses. As a result, it becomes difficult to achieve important financial targets like retirement funds, emergency funds, and investments.

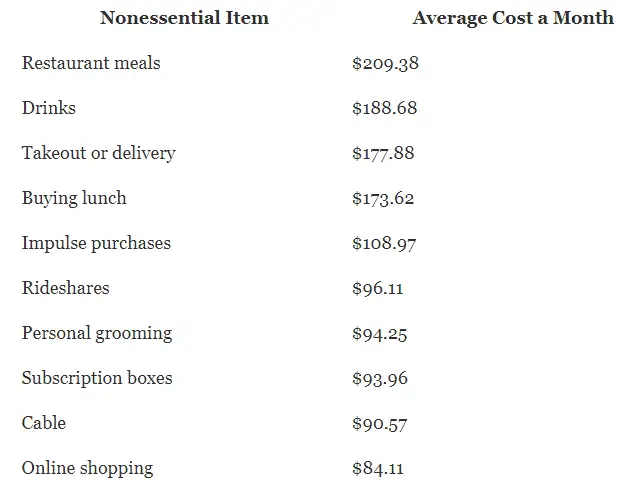

The main part of this financial tip is to avoid non-essential items.

Statistics from USA Today show that, on average, Americans spend $18,000 on non-essential items each year. Here is the exact breakdown:

Related Post:

157 Fun Things To Do With No Money In Your Free time (2024)

31 Budgeting Tips for Beginners to Easily Grow Your Savings

2. Stay on budget

The second most important of all these financial tips.

If you want to control your personal finances then it is important to know the inflow and outflow of money. Doing this becomes easy with having a proper budget.

But a majority of people don’t know the importance of making budgets for their household and personal expenses.

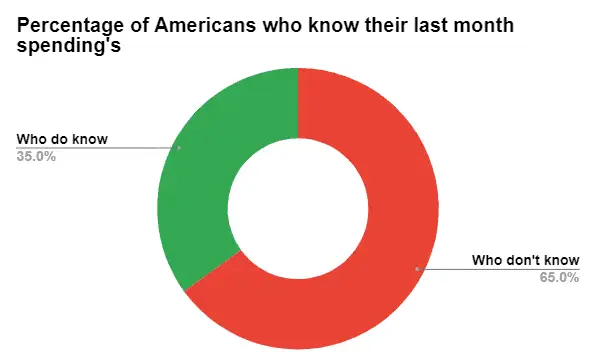

According to a survey, 65% of Americans don’t know how much they spent in the previous month.

Another statistic shows that 55% of people in Americans don’t use a budget to manage their money.

You can easily make a budget with apps including Mind, Goodbudget, Personal Capital, and Pocket Guard.

Related Post: How to Create a Personal Budget [ 6 Easy Steps]

3. Have a budgeting objective

The third financial advice is related to making a budget.

Having a clear budgeting purpose is key to making a successful budget. You exactly know how much you need to spend and how much to save towards achieving your goal.

A budgeting objective can be anything of financially meaningful to your life. For example, buying a car, getting a house, paying off debt, saving for a vacation, emergency funds, and covering child fees.

It can also be to keep a record of your income and spending and cut down extra expenses. An important personal finance tip to consider before making a budget.

4. Try different budgeting methods

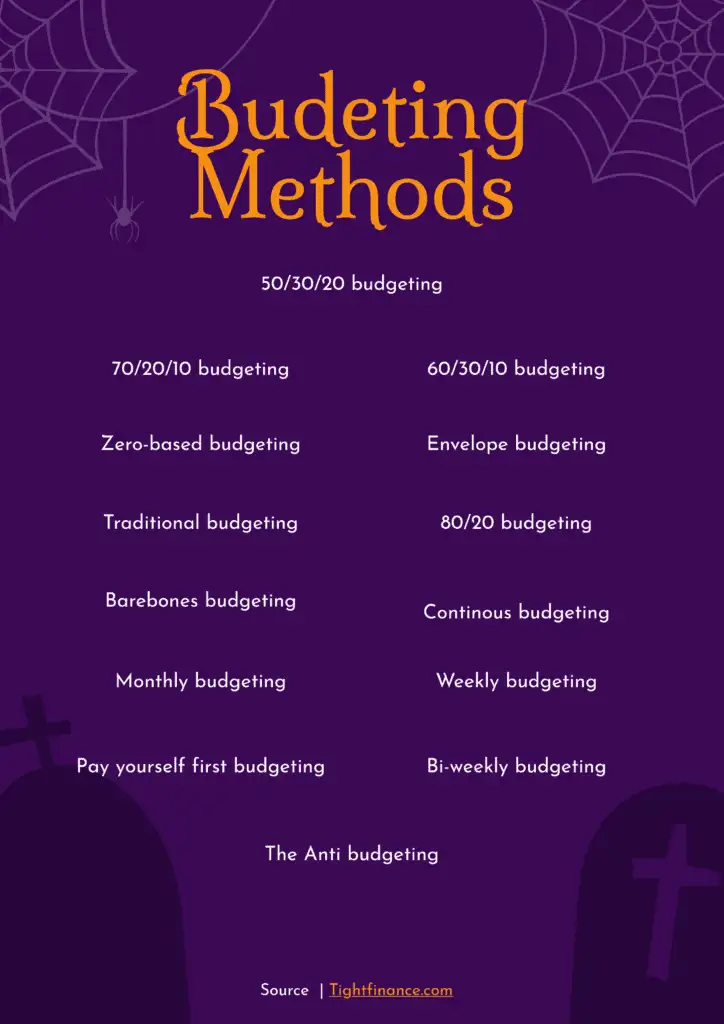

You may not be comfortable with a single budgeting method. That’s why you need to try multiple ones if anyone doesn’t fit your financial situation.

There are different budgeting methods including 50/30/20, 60/30/10, 70/20/10, zero-based budgeting, barebones budgeting, and weekly budgeting.

For example, if your financial condition is too worse you can’t afford to buy wants and just satisfy your monthly needs. Then you need to try barebone budgeting. On the other hand, if you earn weekly paychecks then having a weekly budget is better than making a monthly.

Likewise, if you have more family members then you should try the 70/20/10 instead of the 50/30/20 budgeting rule. Because more money out of income is needed to spend on needs and wants.

So that is how you try different budgeting methods if one doesn’t fit well to achieve your end goal. Trying this financial tip will help you in choosing the right budgeting method.

Related Post: 11 Downloadable Printable Monthly Budget Template (Excel + Pdf)

5. Update your budget regularly

Many variables change with time. For example, inflation rate, prices, child fees, and income. That’s why your budget needs to be adjusted.

It’s possible that you may have some seasonal expenses in the current month but not in the next month. Your income may change month to month if you’re doing jobs where you get paid a commission or are self-employed.

Regular updates help you get correct figures and avoid confusion.

6. Use budgeting apps

Budgeting apps make a lot of your work a cup of tea. The reason is that they have lots of cool and advanced features that do your work automatically. For example, importing transactions from a bank account, calculating values, keeping a record, and a lot more.

The best budgeting apps you can use are YNAB, personal capital, Mint, Goodbudget, and Digit. Some of these are free to use while other costs a little amount of money each month. But it depends on your choice and needs.

So try this finance tip to save time and energy.

Related Post: 10 Best Budgeting Apps of 2022 (Free + Paid)

7. Earn what you are worth

How much you’re earning will ultimately determine how much you have for spending. There are some major earning methods like job and business. But the most dominant in the world is a job.

So if you’re doing a job to earn a living. Then it is important to know your worth and charge accordingly.

Most of the jobs in government positions and in companies are underpaid that don’t match your experience and qualifications. And you need to take it into consideration if facing.

Data reveals that 77% of Americans believe that they’re getting underpaid in their current job.

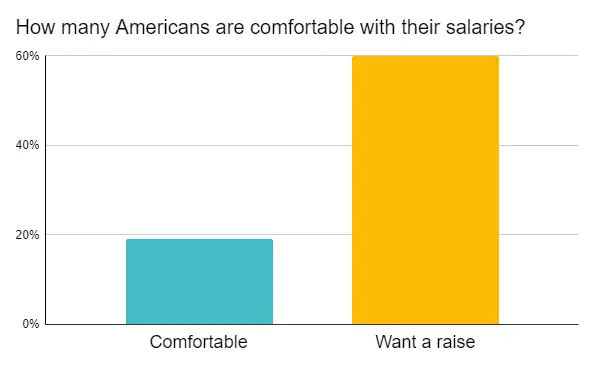

According to Indeed, only 19% of Americans are satisfied with their current salary while 60% say they need a raise of at least $6,000.

So what you can do is demand more for your work in the same job position. Otherwise, you can search for a better job position.

Related Post:

65000 A Year Is How Much An Hour? Is It A Good Salary?

What is Six Figure Salary? 25 Jobs That Pay You Six Figure

8. Through off-credit card

Every payment you make using your credit card will cost you interest. This means you’re paying lots more for your purchase as compared to making a cash payment.

For example, if you spend $5,000 with your credit card then you pay $5,250 to the bank if they’re charging a 5% interest rate. In case your credit score is low then the interest rate can climb up to 20% as well.

Credit card debt is one of the reasons for declaring bankruptcy in America.

So you can cut back on the existing number of credit cards and pay for most of the purchases with cash. Along with that try to pay the existing credit card debt quickly to avoid paying big interest amounts.

Related Post: How to Avoid Debt to Make Yourself Financially Strong

9. Save strategically

Pay yourself first. If you can’t save much money like 20%, 30%, or 50% of your monthly after-tax income then no problem. If you can save only 5% then that is also a good start. For example, you earn $5,000 each month and you save $250. If you earn a 1% monthly compounded rate of return then that savings grow to around $3,381 each year. You can see how much you have accumulated in saving.

But just saving isn’t enough. Having a good saving strategy is important.

You need to save in a way that will grow your savings faster or pay larger interest rates. Otherwise, inflation will eat up your money with every passing moment of time.

So for that purpose, you can find banks with high-yield saving accounts. Another good strategy is to buy bonds to earn a steady 8% to 10% return annually in the form of even payments.

Related Post: 59 Ways on How to Save Money Even If You Find it Difficult

10. Get rid of credit card loan

As I earlier mentioned credit cards are a trap that they want to stick you in. But if you’re using one then get rid of the debt.

The reason is as long you take to pay off your credit card loans as much interest compiles. And it is possible that you pay them throughout your whole life and the bank swallows all of your money.

So first of all if you have these loans try to not build them more and if ones exist, pay them as soon as possible. And when you get rid of them don’t further use the credit card and instead pay with a debit card or cash.

Related Post: How to Pay Off Credit Card Debt Fast (17 Quick Tips)

11. Start online freelancing

When it comes to making money online the number one method is freelancing. The majority of skilled labor uses it to make big bucks each month.

You may have expertise in any skill like web designing, content writing, photography, video editing, etc. So you can sell it as a service online through marketplaces like Upwork, and Fiverr, and/or contacting directly to clients.

The per hour on average is $20 in the United States for online freelancers. This is just an average from research data. If you’ve expertise and built a successful rating you can charge hundreds of dollars per hour.

12. Start a part-time job

Are you a student or employee who isn’t running up with monthly expenses?

Then starting a part-time job to earn extra bucks is the best option. For example, delivery boys, cashiers at the theater, security, and receptionist. These types of jobs pay a handsome hourly rate of more than $13.

Even working 3 to 4 hours part-time can accumulate $1,000 to $2,000 each month

Related Post: 109 Cheap Foods To Buy When Broke or On a Tight Budget

13. Open a YouTube channel

These days YouTubers are making big bucks. And it doesn’t need much capital to start a successful youtube channel. You can do it with a mobile phone with a high-resolution camera.

If you have a budget then buying a camera isn’t much expensive. And you can start making videos to upload.

Youtube pays between $5 to $18 per thousand views on a video in top-tier countries. You can also try other ways like sponsorship and affiliate marketing. It’s not only a fun way to earn income but also helps you interact with the audience.

14. Run a small business

Small businesses not only need less capital but are also easy to start. For example, an auto repair shop, gym, fitness trainer, per services, babysitting, fast food stall, and a coffee shop.

It depends on your choice and skill. According to statistics, small business owners are earning an average of $71,813 per year. That is a good amount of income to cover personal and household expenses.

15. Run an online blog

Online blogs and websites are very dominant and popular ways of making money through the internet. They simply publish quality content related to a specific topic like health, finance, money, and games or news which brings traffic. The bloggers convert that traffic to money using ads, affiliate marketing, and selling their own products.

You can easily earn between $1,000 and $10,000 per month if you do it properly. Some top-tier bloggers are making hundreds of thousands or even millions per month.

And starting a blog is not difficult. You only need a domain, hosting, and content management software like WordPress. After setting up start publishing quality content and do its SEO to bring traffic and earn decent money.

16. Open an online store

E-commerce stores are thriving when it comes to selling physical products. And there are many platforms available for opening e-commerce stores like Shopify, Wix, Woocommerce, Amazon, etc.

Here you can either sell your own physical products or you can use other dealers’ and companies’ products. It can be health products, clothes, fashion and design, bags, electronics, jewelry, and sports.

17. Avail investment opportunities

One of the best ways to earn extra income and build your financial future is possible through investing. It is the best way to spend today so you can make your coming financial future bright.

The reason is investing provides you with more return and income as compared with other options like saving and a job while covering inflation.

So what you can do is search for investment opportunities and use your extra money saving to do a side business that can earn you a fair amount for your efforts. For example, you can start a small business part-time, you can invest in stocks, bonds, government securities, etc.

But keep in mind if you’re investing then you first gain some knowledge about it and in which type of opportunity you’re investing your money. Because some investment opportunities are riskier than others and you can get your money wiped out.

Last but not least think long-term in investing to achieve better results and growth.

18. Keep track of records

Throughout the year from January to December or whatever format you like, you must maintain a track record of your earnings and spending and whatever is left.

Records are so helpful to analyze your financial position. They help you improve your personal financial management to achieve better prosperity. So record all the income streams and expenses from the beginning to the end of the year so you can keep an eye on your money.

Robert Kiyosaki says in his book Rich Dad Poor Dad, that if you don’t know how to manage your money then the money will manage you until you die.

This means money is so powerful.

That’s why keeping a track record is important.

You can do this easily using an Excel sheet or any accounting software online like Quickbooks, Freshbooks, Xero, and more.

This will also help you to prepare taxes at the end of the year. You don’t need to get into the headache of compiling records for the whole year at the time of paying income tax.

Related Post: 8 Tips For Money Management To Achieve Financial Prosperity

19. Analyze your insurance

Insurance is a great way to make yourself safe from any unpleasant event that can occur in the future. But it is important when choosing your insurance policy. Because a wrong insurance policy only costs you.

According to CNBC, the majority of the American public doesn’t have much information about health insurance that as a result only costs them.

There are different insurance policies. Some of them are more beneficial compared to others. And you need to choose an optimal insurance policy that provides you with more benefits in the future.

Here are two main things that matter the most:

- Which insurance policy is right?

- How much does it cost you?

Sometimes people choose the wrong policy. Like if the car insurance is right for them but they tend to buy life and disability insurance.

If you don’t have dependents then it’s not an optimal decision to choose life insurance. Because that only accounts for an expense.

Along with that, there is no need to buy too many insurance policies. Only choose the ones that are important and through others in the dustbin.

20. Consume employee benefits

If you’re one who does a job to earn a living. It’s important to keep in mind that there are many employee benefits that can help you cover lots of expenses free of cost and save you money. Along with that sometimes they provide you with extra bonuses or allowances that increase your income.

Whether you’re a government employee or of any private company. In both cases certain employee benefits are amazing. For example, money for a vacation, travel allowance, and health and medical care allowances which in fact major expenses if you go to the hospital on your own.

There are some other benefits like 401k that can help you reduce your tax and save more money. Otherwise, it will be a major expense.

21. Care about your retirement plan

Obviously, everyone will retire when they reach 60.

If your employer is offering 401K then don’t hesitate to invest in it. Sometimes the employer contributes half the amount and the other half will be yours. And the interest is accumulated on these amounts and at the time of retirement, they are given to you as a lump sum.

In case the employer has no retirement plan offer then go for an individual retirement account. This is because IRAs are tax-free and your money will grow for years in a tax-free way and in the end, you get big bucks. So try to save at least $100 in these accounts monthly. Otherwise, as much as you save in them is ultimately beneficial.

But invest in these plans as early as possible.

For example, if you save $300 from age 20 onwards and in comparison to you another person saves $300 from 35 onward then this makes a big difference in the amount of money both get in the 60s. Let’s say if the interest is 5% annually compounded monthly then the first one gets $258,604 while the second one will get $161,627 at age 60.

You can see how much difference it makes for those who invest early in their employee retirement plans.

Related Post: How To Invest In Retirement To Live A Comfortable Life [7 Simple Strategies]

22. Dip sudden gratifications

Learn self-control. Learning how to control your instant wishes and gratifications is the best way to save yourself from financial troubles and get better at finances.

For example, if you are purchasing something in a store then avoid credit cards. It is an easy way to pay but puts you to pay more if you use a cash or debit card instead.

Similarly, keep a hold on avoiding purchasing new technologies. Like new car models, new houses, and expensive vacation plans or birthday parties.

We are humans and it is difficult to stop these instant and impulse gratifications but controlling them really helps you save more. Instead of wasting your money on these unnecessary things invest them and grow your income so you can cover them in the future with ease and peace of mind without worrying.

23. Financially educate yourself

The most important among all the personal finance tips.

You got a degree in academics and educated yourself for working in a professional environment including how to behave and how to manage different tasks. But what the majority of the people in the world fail at is when it comes to managing their financial conditions.

They don’t know how money works. And what are the right rules of finance and money that can guard and protect them against financial disasters?

They avoid financial education. They don’t know how to grow their incomes, or how to deal with different pleasant and unpleasant financial conditions.

And all the reasons for these problems people face are due to not having financial knowledge and IQ.

Rich people and those who have no financial troubles are usually the ones who have deep financial knowledge. They know how money works and how we can make more while minimizing expenses. They took optimal financial decisions that can help them avoid financial mismanagement.

Most people don’t understand the difference between assets and liabilities. What they consider an asset is usually a liability and what they consider a liability is usually an asset. Along with that they don’t know accounting at all and are hesitant to take risks that can change their financial future in their entirety.

So what you can do is learn basic finance and accounting. Get knowledge on basic money management and investing principles as well as rich psychology to analyze how they go through their journey to become financially free.

The best books I can recommend include Rich Dad Poor Dad by Robert Kiyosaki. He is a famous millionaire who has written great books on increasing financial intelligence and IQ to solve financial problems.

24. Increase your tax knowledge

Tax is a major expense that every business and employee needs to pay before getting money into their pockets.

And if you get your hands strong on tax-related policies and calculations then you can save yourself money as well as avoid different tax payments simply in a legal way. Get to know how to apply different tax rules, how much rates on how much money, and how to calculate the yearly tax.

You must know how much tax you incur if you leave one job for another. For example, if you earn $50,000 in your first job then you should know how much tax you will pay if you get another job that pays $60,000 a year. Because as the number of salaries increases different tax rates apply to them.

Knowing and calculating taxes on your own will help you save money. Because otherwise, you need to hire a professional accountant or tax consultant that charges you big bucks. And if you’re in a country like the USA then this will be an added expense.

There is much online software like Quickbooks, Xero, Freshbooks, and more that help you easily calculate your tax in a few clicks. So learn them and try to calculate for yourself.

25. Protect your wealth

The most important of all personal finance tips on this list.

Protecting your precious wealth is important. Because you accumulate it with so much effort but if you don’t protect then this can result in a big pitfall.

So what steps can you take?

Here are some simple tips that can help you guard your precious wealth:

- Make sure to have insurance for your car and house against fire, accident, or thieves.

- Instead of making your extra money rest in a bank account that is eaten up by inflation and making the bank rich, you should invest it somewhere to earn a big return. This way you not only cover inflation but make premium profits.

- Likewise, if you have dependents then it’s best to go for life insurance to protect their future.

So these are some of the tips that can help you protect your most precious items that contribute to the major portion of your hard-earned wealth.

26. Have a personal financial calendar

Keeping your monthly and yearly financial activity on track is important for effective management. But managing all personal financial activities isn’t easy.

You need a schedule and record of what you already did and going to do in the future.

Here comes the use of a financial calendar. It is a record of all the personal financial tasks and an overview of how you are going to complete them. It includes tasks related to tax, interest payments, paying bills, making mortgage payments, and different other tasks.

The dates are also assigned to each task or month in which it is going to be completed. So this makes sure that tasks are completed on time.

For more information visit this article: Tips For Creating Personal Financial Calendar

27. Regularly watch interest rates

Interest rates are an important factor if you want to determine:

- Your cost of borrowing on a student loan, mortgage loan, or credit card.

- Return on savings accounts by comparing different bank saving rates.

- Total return you can get on investment and percentage of profit.

- What happens to the economy in the future?

That’s why you should analyze it on a regular basis. This will help you make the best financial decision regarding debt, and loans, open a saving account, make investments, and examine economic conditions.

28. Save first and separate it

There is an old saying, save money after spending. But this is the wrong approach.

You should save a percentage of your income each month first and spend what is left on your day-to-day needs and personal expenses. It is the pay-yourself-first approach.

When you do this then savings will grow and you don’t need to worry about any emergency needs. Also if there come bad days like losing a job, business losses, illness, or any other undesirable event then you’ve enough balance to meet that condition.

Also, make your saving account separate from the checking account. Or another thing you can do is to open a savings account in any other bank. This helps you avoid spending savings on regular needs. For depositing a percentage of money into a saving account you can use an automatic transfer from a checking account to a saving account.

Related Post: 12 Best Money-Saving Apps for 2022

29. Change your lifestyle

Lifestyle is an important factor in our daily life. We don’t want to compromise on it.

But if you’re a student or a low-income person then it is necessary to stay within your limits regarding your lifestyle. Most people do the mistake that they spend money with their credit cards to buy luxury items just to show other people that they are rich. They go beyond what they can afford.

Buying luxury items, traveling inexpensive private vehicles, eating at 5-star hotels, and regularly purchasing branded items are all non-serious attitudes if you aren’t able to afford them. People think that they can afford a credit card but remember that is not your money. Instead, you’ll have to pay it later. So don’t build a mountain of debt burden.

So live within your limits. If you’re low income then travel by public transport, avoid giving expensive treats to friends and avoid frequent expensive shopping. You’ll see these habits will not only saves you huge money but also eliminates tension regarding money.

30. Calculate your net worth

Net worth determines how much you really have in your pocket. It is calculated by subtracting your debt from the assets.

It will tell you the real financial position you’re standing at. And you can then analyze and compare it with the financial goals you want to achieve. Also, you can make strategies to increase your net worth.

It doesn’t matter how much you really earn but how much you keep. If a person earns more than $100K a year but didn’t able to keep anything out of it. He spends all of his needs and wants. So his financial situation is poor.

On the other hand, if a person earns $50,000 a year but saves $10,000 out of it, he is in good financial condition. Because he can meet his financial goals more than the first person who spends all the bucks.

31. Use the 50/30/20 budget rule

This rule is a famous budgeting rule. The main crux is that you spend 50% of after-tax income or disposable income on needs, 30% on wants, and 20% on savings.

Your needs include food, water, shelter, mortgage payments, groceries, health care, and medical payments. Because they’re necessary for living on Earth.

The wants include buying branded clothes, a car, branded shoes, insurance, eating at five stars, and studying at an expensive university. They’re not normally a need and just what you wish you should have in your life.

While in savings you put money into emergency funds for meeting unexpected events, investing in mutual funds and the stock market. This also includes meeting retirement saving plans like 401K, IRA, and Roth IRA.

32. Pay off your debt fast

Debt is a useful way to meet your sudden needs. You take it in the form of student loans to meet educational needs, mortgages for buying a house, credit cards for daily payments, and more.

But you need to pay interest on it which is a cost for you. And it also impacts your credit score and trustworthiness in the eyes of lending institutions.

If you’ve one or more debts in the form of credit cards, student loans, or a mix of all these, then paying them early is critical for your future. You should devote enough of your income to paying down your debt to lower interest costs and save more money.

Also, increase your income to help you make frequent debt payments and avoid building more debt either through credit cards or personal loans.

Related Post: How to Pay Off Debt Fast ( 11 Bullet Proof Tips )

33. Stay below on credit usage

Do you use debt? Whether it is a credit card, personal loan, student loan, or any other unsecured debt, you need to have a good credit score.

One of the factors that seriously impacts your credit score is called credit usage or utilization ratio. It refers to how much credit you have used out of the total limit.

For example, you got a credit card with a credit limit of $5,000 and you’ve spent $1,000 out of it and not yet paid it back. Now your credit utilization is $1,000 divided by $5,000 which equals 0.2 or 20%. It means you’ve used 20% of your credit limit.

In simple words higher the credit utilization ratio the worse impact it has on your credit score. Because the lender sees you as a riskier borrower than the one with low credit usage. Your default rate gets increased.

So if you want to avoid that, you should keep your utilization ratio below 30%. It is a normal and good percentage that financial and other credit experts recommend. And if it crosses 30% then make a repayment to balance it.

Related Post: 13 Easy Tips on How to Improve Credit Score Fast.

34. Check your credit report

A credit report contains information about your credit activity, loan payment history, personal information, and credit accounts. It is a database of all credit-related financial activity. It covers all loans including credit cards, personal loans, student loans, car loans, and mortgages.

You get your credit report from credit bureaus like Experian, Equifax, and Transunion.

Why should you check it? This is because there is a possibility of any missing information or mistake that is badly impacting your credit score. So you can correct it by contacting your lender and credit bureau.

35. Do financial planning

It is a process of examining your current financial situation and future goals and making strategies to achieve them. The document which lists all the information is called a financial plan.

Warren Buffet once said that “An idiot with a plan can beat a genius without a plan.” And it is true because a plan provides you with a concrete track for achieving your desired objective.

Likewise in personal finance, it is important for you to document a plan for your future. This helps you clearly devise your future goals like achieving enough emergency funds, buying a car, buying a house, having enough retirement funds, etc. Also, you get to know your current financial situation including your income, assets, and liabilities you have.

When you have a clear picture in front of you then you can establish strategies to achieve future financial goals. And it becomes a lot easier to achieve those goals.

36. Set personal financial goals

Goals are what you want to achieve and mean the same in personal finance. What do you want to achieve regarding your personal financial future?

It can be a saving goal for retirement, an emergency fund, paying your debt faster, purchasing a house or car, and graduating from a top college in your city.

These goals can be short-term, mid-term, or long-term. This depends on the time frame.

Short Term goals are what you want to achieve in a few months. Like an emergency fund, monthly budgets, meeting insurance, etc.

Mid Term financial goals are what you want to achieve in a few years from 1 to 5. This can be graduating from college, paying off unsecured debt, starting a small business, buying a house, buying a car, etc.

While long-term financial goals are what take more than 5 years up to 10, 15, or 25 years. Saving for retirement, paying the mortgage, getting out of student loans, etc are some examples of longer-term financial goals.

But remember you should have SMART financial goals which stand for specific, measurable, attainable, realistic, and timely.

For more information visit this article: How to Set Financial Goals?

37. Stay positive and relaxed

For achieving anything in life whether it is financial success, educational success, or business success, staying positive and optimistic is important. It helps you motivate yourself and stay focused on your end goal. Also, provides energy to do hard work for achieving the desired objective.

According to Henry Ford “Whether you think you can or you think you can’t- you’re right.” So stay optimistic about future goals and show commitment then it becomes so easy to achieve your financial goal.

38. Use tools and software

There are a number of free and paid personal finance tools, apps, and software online. They include budgeting tools, bookkeeping software, saving apps, loan calculators, and much more.

You can use them to regularly store financial data and they give you a clear overview of what is your current financial position. How much of your goal has been achieved? Along with that the proper financial statements to analyze your income, expenses, and net worth.

They provide you with efficiency and save you time. You can easily keep track of your records with these tools.

Related Post: The Best Personal Finance Tools To Get You On Track

39. Give to charity

When you give in the name of God he will return back more. Also, it promotes feelings of happiness and mercifulness.

Donating money to charity organizations, disabled people, and the poor in your society is common. It is up to you how much you can spend on charity. But giving away 10% is a good choice.

According to research, 3% to 5% of American income on average goes to charity. This money goes to help child protection, visually impaired people, humanitarian response programs, and help disabled ones.

40. Implement what you learn

Last but not least.

The best tips, tricks, and plans don’t work if you won’t take any action. Putting knowledge into practice is important for personal financial success.

What you learn about saving, investing, paying off debt, goal setting, and retirement plans, you need to take action. Start implementing the strategies while keeping patience and consistency.

Now you’ve read 40 personal finance tips so let’s summarize the whole discussion.

Conclusion

Personal finance management is an important skill to have for living a prosperous life. And it is not rocket science. If you follow all or some of these personal finance tips you can solve all your personal finance problems very easily.

It is possible that you may not fall under some of the tips in this list. But consider applying those that you can.

So let’s summarize what we’ve covered above:

- Spend less than you make to have a budget surplus, not a deficit.

- Stay on a budget to know where your money is going.

- Know what you are worth to earn a fair salary and easily cover expenses.

- Through off credit cards to avoid getting stuck in the dirt of a loan.

- Save strategically to earn more interest and grow it fast.

- Pay credit card loans as soon as possible to avoid getting income washed.

- Invest in different opportunities to put money to work for you and grow fast.

- Keep your finances in the record for easy management and tax calculation.

- Analyze your insurance to make it a benefit, not just an extra expense.

- Take full advantage of employee-related benefits to cut out some big expenses.

- Take care of your retirement plans to get big sums at the time of retirement.

- Avoid satisfying instant gratifications but instead, act rationally.

- Get financial education to make your future bright and financially free.

- Know the ins and outs of tax and calculate it yourself to avoid tax advisor expenses.

- Protect your wealth to avoid it from running because it’s hard-earned.

If you’ve any other personal finance tips then share them in the comments and also tell me which trick you like from the above list.

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024