Last updated on February 5th, 2024 at 06:36 am

In this post, you’ll learn 23 dollars an hour is how much a year.

Here you get the calculations related to gross income and after-tax income.

Along with that how much is 23 dollars an hour for daily, weekly, bi-weekly, and monthly time frames?

You get to know whether you can live on a $23-an-hour income and make a budget with example.

In the end, you get tips to live on $23 per hour and jobs that pay this rate or more.

So let’s dive deeper into the explanation…

How many working days in a year?

In 2023, there will be a total of 260 working days if you live in the US.

Here’s how the calculation is done:

365 days in a year – 105 weekends = 260 working days

According to Calendar.com, there are 11 federal holidays so if you subtract them from the total working days then:

260 working days – 11 federal holidays = 249 working days

So only 249 working days in total.

How many working hours in a year?

There is a total of 8 full-time working hours in a day. And multiplying this with a total of 260 working days then here are the total working hours in a year:

260 working days X 8 hours = 2080 hours

So there are 2080 working hours in the year 2023.

But if you subtract the 11 federal days and take 249 working days then here is the actual calculation:

249 working days x 8 hours per day = 1,992 working hours

You stand with 1992 working hours at 249 working days per year.

23 dollars an hour is how much a year

To calculate how much $23 an hour is per year, you need to know how many hours a year a full-time employee typically works.

Assuming a full-time employee works 40 hours a week for 52 weeks a year, they would work a total of 2,080 hours in a year. As calculated in the previous section above.

To calculate the annual salary at a rate of $23 per hour:

Annual salary = hourly rate x number of hours worked per year

Annual salary = $23 x 2,080 = $47,840

Therefore, a person earning $23 an hour would earn approximately $47,840 per year.

If you work 249 days at a rate of $23 per hour, your total gross income before taxes would be:

$23 per hour x 8 hours per day x 249 days = $45,816

Note that this calculation assumes you worked a full 8-hour day for each of the 249 days. Actual earnings may vary depending on factors such as overtime pay and taxes.

23 dollars an hour is how much a year working part-time

If you choose to work a $23 per hour job as part-time or if you work for additional 5 hours a day part-time other than a full-time job, then here are your earnings:

260 working days X 5 hours X $23 per hour = $29,900

You earn $29,900 per year working part-time on 23 dollars an hour rate.

23 dollars an hour is how much a year after taxes

To calculate how much $23 an hour is per year in the US after federal, state, and FICA taxes, you can make the following assumptions:

- The employee is single with no dependents and claims the standard deduction on their federal income tax return

- The employee lives and works in California, which has a state income tax

- The employee’s FICA tax rate is 7.65% (the Social Security tax rate is 6.2% and the Medicare tax rate is 1.45%)

Based on these assumptions, here’s how to calculate the employee’s after-tax annual salary:

Calculate federal income tax:

- Use the IRS tax brackets for 2023 to determine the employee’s marginal tax rate based on their taxable income (which is their total income minus the standard deduction of $12,900 for a single filer in 2023)

- Apply the marginal tax rate to their taxable income to calculate the federal income tax owed

- For simplicity, we will assume the employee falls into the 22% marginal tax bracket for all of their income

Taxable income = ($23 x 2,080) – $12,900 = $35,540

Federal income tax = $35,540 x 22% = $7,818.80

Calculate state income tax:

- California has a progressive income tax system with nine tax brackets

- We will assume the employee falls into the 9.3% marginal tax bracket for all of their income

State income tax = ($23 x 2,080) x 9.3% = $4,739.04

Calculate FICA taxes:

Multiplying your gross income with the FICA tax rate provides the total FICA tax amount you pay. Here it’s:

FICA taxes = ($23 x 2,080) x 7.65% = $3,579.96

- Calculate total taxes owed:

Total taxes owed = federal income tax + state income tax + FICA taxes = $7,818.80 + $4,739.04 + $3,579.96 = $16,137.80

Calculate total after-tax annual salary:

After-tax annual salary = gross income – total taxes owed

After-tax annual salary = ($23 x 2,080) – $16,137.80 = $30,702.20

Therefore, in the US in 2023, a person earning $23 an hour would earn approximately $30,702.20 per year after federal, state, and FICA taxes, assuming they are single with no dependents and claim the standard deduction, and live and work in California.

Remember that the actual after-tax salary may vary based on the employee’s individual circumstances and the state and local taxes in their area.

23 dollars an hour is how much semiannually

If you divide the yearly income at 23 dollars an hour by 2 then you get a semiannual or 6-months salary figure.

Here is how:

Semiannual salary = $47,840/2 = $23,920 semiannually

You earn $23,920 in gross or income before tax semiannually at a $23 per hour wage rate.

23 dollars an hour is how much quarterly

There are four quarters in a year and each quarter consists of 3 months. If you divide the yearly income by 4 then you can get answers for quarterly salary at a $23 an-hour rate:

Here is the calculation:

Quarterly salary = $47,840/4 = $11,960

So you earn $11,960 each quarter at a $23 per hour rate.

23 dollars an hour is how much a month

There are 12 months in a year and dividing the $47,840 by 12 gives you monthly earnings at $23 an hour income. On the other hand on average, a full-time worker works 173.33 hours each month.

Here is how much you make each month at a $23 per hour wage rate:

Monthly salary = $47,840/12 = $3,987

Or

Monthly salary = $23 X 173.33 hours = $3,987

You make $3,987 each month at 23 dollars an hour income.

Choosing to work part-time for 5 hours per day on a $23-an-hour rate for 21 days per month helps you earn $2,415 per month. Here is how:

Part-time monthly income = 21 working days X 5 hours per day X $23 per hour = $2,415

23 dollars an hour is how much bi-weekly

It’s so straightforward. There are 80 working hours in two weeks if you have a full-time 9 to 5 job. That means if you multiply 80 hours by 23 dollars, you get bi-weekly income figures.

Bi-weekly salary = $23 X 80 hours = $1,840

So if you receive a paycheck every two weeks then you receive $1840 for working 80 hours at $23 per hour.

You may work part-time at a $23/hour rate. In that case, you’ll make $1,150 bi-weekly. Here is how:

Part-time income = $23 X 50 hours = $1,150 bi-weekly

23 dollars an hour is how much weekly

As a full-time worker, you work 40 hours a week for 5 days with 8 hours each.

So multiplying 40 hours by $23 per hour gives you $920 per week. Here is how to calculate:

Weekly salary = 40 hours X $23 per hour = $920

In case you choose to work part-time for 5 hours per day, then you’ll earn $575 a week. Here is how:

Part-time salary = 25 hours X $23 per hour = $575 a week

23 dollars an hour is how much daily

There are 8 working hours per day and multiplying them by $23 per hour helps you earn $184 per day.

If you work part-time for 5 hours per day, then you can earn $115 per day working part-time.

Hourly Salary to Annual Salary Calculator

RELATED ARTICLES:

40 an Hour is How Much a Year? Is $40K a Good Income?

18 An Hour Is How Much A Year? Can You Afford the Expenses?

55000 A Year Is How Much An Hour? Is It Enough?

$50000 A Year Is How Much An Hour? Can You Live On It?

30 Dollars An Hour Is How Much A Year? Is It A Good Salary?

25 Dollars An Hour Is How Much A Year? Is It Enough To Live?

21 An Hour Is How Much A Year? How To Live On This Salary?

20 Dollars an Hour is How Much a Year? Is it Enough to Live?

How Much a Year is 15 Dollars an Hour? How to Easily Live on It?

$80 An Hour Is How Much a Year? Is It a Good And Livable Wage?

$32000 A Year Is How Much An Hour? Is It A Good Salary or Not?

Can you live on 23 dollars an hour income?

Yes, you can live on a $ 23-an-hour income in the US. However, the cost of living and the ability to make ends meet will vary depending on where you live and your lifestyle.

In some parts of the country, $23 an hour may be enough to cover basic expenses like rent, utilities, groceries, and transportation. However, in other areas with higher costs of living, more than this may be needed to cover all expenses, especially if you have dependents or a high level of debt.

To live on a $ 23-an-hour income in the US, it’s important to budget and manages your money effectively. This may involve cutting back on expenses, finding ways to save money, and looking for additional sources of income if needed. With discipline and planning, it is possible to live comfortably on a $23-an-hour income in the US.

Tips to live on a $23-an-hour income in the US

Living on a $ 23-an-hour income in the US can be challenging, but it is possible if your budget and manage your finances well. Here are some tips to help you live on a $23-an-hour income:

1. Create a budget

The first step to managing your money effectively is to create a budget. List all your expenses, including rent, utilities, food, transportation, and other monthly bills, and allocate your income accordingly. Make sure to include a portion for savings.

2. Cut back on expenses

Consider ways to reduce your expenses by cutting back on things like dining out, entertainment, and unnecessary subscriptions. Consider shopping at discount stores, buying generic brands, and buying items on sale.

3. Save for emergencies

Create an emergency fund to cover unexpected expenses, such as car repairs or medical bills. Aim to save at least three to six months’ worth of expenses.

4. Consider living with roommates

If you’re single, living with roommates can help reduce your expenses by splitting rent and utilities.

5. Use public transportation

If you live in a city with good public transportation, consider using it instead of owning a car. This can help save money on car payments, insurance, and gas.

6. Take advantage of discounts

Many companies offer discounts for their employees on products and services such as cell phone plans, gym memberships, and insurance. Check with your employer to see what discounts are available.

7. Cook meals at home

Cooking meals at home can be more cost-effective than eating out. Consider meal prepping and buying groceries in bulk to save money.

8. Look for additional sources of income

Consider taking on a side job or selling items you no longer need to earn extra money.

9. Avoid debt

Try to avoid using credit cards or obtaining new credit cards. It increases your interest expense and lowers your savings. On the other hand, avoiding it helps you become more financially intelligent and put money towards other goals.

Remember, living on a $ 23-an-hour income in the US requires discipline and planning, but it is possible to live comfortably within your means with a little effort.

Budget example for $23 an hour income in the US

Here’s an example of a monthly budget for a single person earning $23 an hour, assuming they work 40 hours a week and are paid twice a month:

Income:

- Assuming 260 working days or 2080 working hours per year your monthly working hours become 173.33

- Gross income per month: $3,987 ($23 x 173.33 hours per month)

- Net income per month (after taxes and deductions): $3,100 (estimated)

Expenses:

Here are the important monthly expenses you have to pay:

Housing:

- Rent/mortgage: $1,000 (assuming a one-bedroom apartment outside of the city center)

- Utilities: $150 (electricity, water, gas, internet)

Transportation:

- Car payment or public transportation pass: $150 (assuming a car payment of $200 per month including insurance and gas or a monthly public transportation pass)

Food:

- Groceries: $400 (assuming $75 per week for groceries)

- Eating out: $150 (assuming eating out twice a week at $15 per meal)

Personal Care:

- Health insurance: $300 (assuming employer contribution of $200 per month)

- Personal care items: $50 (toiletries, haircuts, etc.)

Entertainment:

- Streaming services: $50 (Netflix, Hulu, etc.)

- Gym membership: $50 (assuming a basic membership)

Savings:

- Emergency fund: $150 (aiming to save at least 5% of net income each month)

Total expenses: $2,400

Remaining payment: $700

Note: This is just an example and the actual expenses and income may vary based on individual circumstances and location. It’s essential to create a personalized budget based on your own needs and priorities.

There are three possible budgeting methods you can use. That is 50/30/20, 60/40, and 70/20/10 method.

In 50/30/20 you spend 50% on needs, 30% on wants, and 20% on savings or paying off debt.

- 50% on needs = $1,550

- 30% on wants = $930

- 20% on savings = $620

Using the 60/40 method you spend 60% on needs and 40% on savings, paying debt, and other wants.

- 60% on needs = $1,860

- 40% on wants, savings, and debt = $1,240

While if you use the 70/20/10 budgeting method then you spend 70% on needs, 20% on paying debt and savings, and 10% on fun money.

- 70% on needs = $2,170

- 20% savings & debt = $620

- 10% fun money = $310

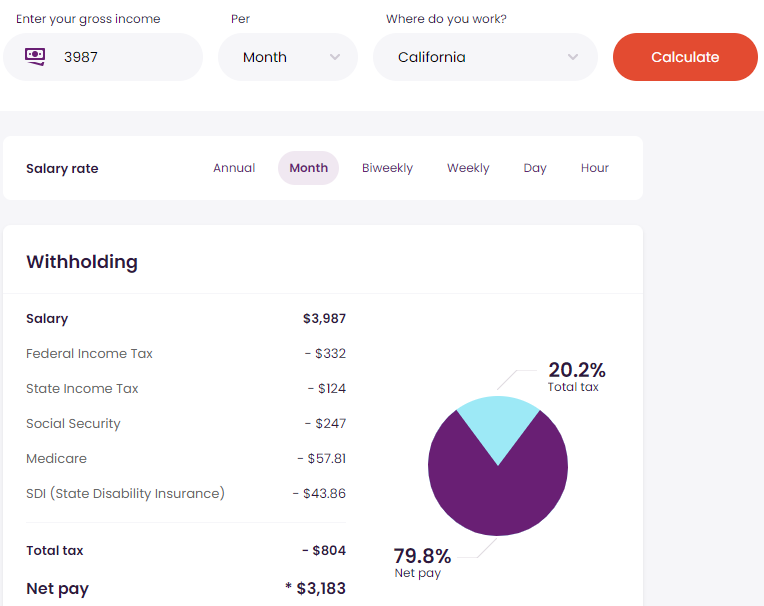

Here is a comprehensive budget using average budgeting percentages. The after-tax income is calculated considering that you live in California where you left with $3,183 net income out of $3,987 gross pay. Here is a screenshot from Talent.com:

Now let’s make an expected budget based on this income. The budgeting percentages are taken from TheBalanceMoney.com:

| MONTHLY EXPENSES | PERCENTAGES | EXPECTED AMOUNTS |

|---|---|---|

| Housing | 25% to 35% | $796 |

| Food | 10% to 15% | $477 |

| Transportation | 10% to 15% | $318 |

| Utilities | 5% to 10% | $159 |

| Fun & Entertainment | 5% to 10% | $159 |

| Clothing | 5% | $159 |

| Personal Care | 5% to 10% | $159 |

| Insurance | 10% to 20% | $318 |

| Debt Payments | 10% | $318 |

| Savings | 10% to 15% | 320 |

RELATED ARTICLES:

How Many Working Days In The Year? [2023-2050]

How to Create a Personal Budget [6 Easy Steps] PLUS Template

10 Best Budgeting Apps of 2022 (Free + Paid)

31 Budgeting Tips for Beginners to Easily Grow Your Savings

31 Downloadable Printable Monthly Budget Template (Excel + Pdf)

Budget by Paycheck Workbook: 6 Steps for Making a Paycheck Budget

Cash Envelope System: 9-Simple Steps To Do Envelope Budgeting

How To Make a Budget Binder In 4-Simple Steps (Free Templates)

$55 An Hour Is How Much A Year Full-Time And Part-Time

Tips on how to increase income from $23 an hour

Here are some tips on how to increase your income from $23 an hour:

- Negotiate a raise: If you’ve been working for your employer for some time and have proven yourself to be a valuable employee, consider asking for a raise. Prepare a list of your accomplishments and contributions to the company and present it to your manager during a performance review or meeting.

- Look for a higher-paying job: If you’re unable to get a raise from your current employer, consider looking for a higher-paying job with another company. Research job opportunities in your field and consider upgrading your skills or education to qualify for higher-paying positions.

- Take on side jobs: Consider taking on a side job to earn extra income. This could be anything from freelance work to part-time jobs in your area of expertise.

- Invest in education or training: Consider investing in education or training to increase your skills and qualify for higher-paying jobs. This could be anything from taking online courses to earning a degree or certification in your field.

- Start a business: If you have an entrepreneurial spirit, consider starting a business. This could be anything from selling products online to starting a consulting business in your area of expertise.

- Ask for overtime: If you’re currently employed, ask your employer if there are opportunities to work overtime. This could help you earn extra income without having to take on a second job.

Remember, increasing your income from $23 an hour may take time and effort, but with persistence and hard work, you can achieve your financial goals.

20 jobs that pay $23 an hour income in the US

Here are 20 jobs in the US that pay around $23 an hour or more:

- Electrician: Install and maintain electrical systems – Median hourly wage is $26.00.

- Carpenter: Build and install structures made of wood – Median hourly wage is $24.45.

- Plumber: Install and repair water and drainage systems – Median hourly wage is $25.00.

- Heavy Equipment Operator: Operates large machinery such as bulldozers and cranes – Median hourly wage is $23.43.

- Welder: Join and cut metal parts – Median hourly wage is $22.80.

- HVAC Technician: Install and repair heating, ventilation, and air conditioning systems – Median hourly wage is $23.00.

- Registered Nurse: Provide medical care to patients – Median hourly wage is $35.36.

- Dental Hygienist: Clean teeth and provide preventive care – Median hourly wage is $36.00.

- Physical Therapist Assistant: Assist patients with physical therapy exercises – Median hourly wage is $25.00.

- Software Developer: Create and maintain software programs – Median hourly wage is $50.00.

- Marketing Manager: Plan and implement marketing strategies – Median hourly wage is $62.00.

- Financial Analyst: Analyze financial data and make investment recommendations – Median hourly wage is $41.00.

- Web Developer: Build and maintain websites – Median hourly wage is $31.00.

- Court Reporter: Record and transcribe legal proceedings – Median hourly wage is $25.00.

- Paralegal: Assist lawyers with legal work – Median hourly wage is $25.00.

- Human Resources Specialist: Recruit and manage employees – Median hourly wage is $28.00.

- Executive Assistant: Provide administrative support to high-level executives – Median hourly wage is $30.00.

- Insurance Sales Agent: Sell insurance policies to clients – Median hourly wage is $25.00.

- Real Estate Agent: Sell and rent properties to clients – Median hourly wage is $25.00.

- Architect: Design and plan buildings and other structures – Median hourly wage is $38.00.

Note that the actual hourly wage may vary based on factors such as experience, education, and location.

Helpful Article: 21 Jobs That Pay $20 An Hour With Little Or No Experience/Degree

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024