Last updated on January 2nd, 2024 at 06:42 pm

Debt is an easy way of financing your spending.

And this is the reason why the public tends to use more and more debt in the form of credit card loans, student loans, mortgages, and other personal loans.

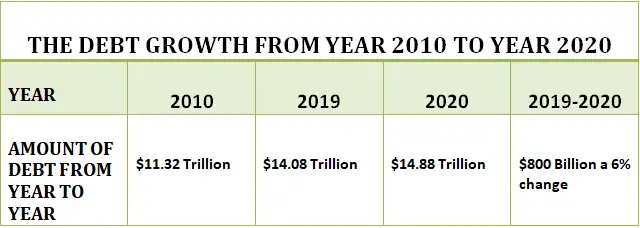

In fact, the data from Experian shows that the US consumer debt is climbing from 2010 to 2020. The amount of consumer debt in 2010 was $11.32 trillion while in 2020 it was recorded at $14.88 trillion. While from 2019 to 2020 the amount increased by $800 billion at a 6% annual rate.

But the debt is always not favorable for everyone. And drive many disasters like insolvency, stress, and poor financial future.

Because everyone doesn’t know proven strategies on how to pay off debt fast.

If you’ve got the same problem and want to get out of debt fast then you came to the right place.

In this guide, you’re going to learn 11 different strategies to pay off debt fast.

So let’s take a look at the exact breakdown of this post in the table of contents section.

Understanding the types of personal debt

Before diving into the details of how to pay off debt fast? Let’s first understand the types of personal debt and the main repayment methods.

1. Secured debt

The first type is secured debt. Here you take a loan from a bank or any other institution while keeping a pledge or property usually called collateral.

This type of debt is secured for the lender which is why he charges low-interest rates. Example of these types of debt is car loans and house loans. In the first one, the collateral is a car and in the second the collateral is a house.

2. Unsecured debt

The second type is unsecured debt. There is no collateral or security behind the amount borrowed. The common types include student loans, personal loans, credit cards, and medical bills. Due to no security, these debts have higher interest rates.

Debt comes in two major repayment methods. Which include revolving credit and installment credit.

1. Revolving credit

The first one is revolving credit. In this repayment system, the borrower does an agreement with the lender to borrow a certain amount of debt and pay it off within the due date and then borrow again if needed.

This means he borrows money, uses it, and then pays it off within the due date. Usually, this happens in credit card debt. Where you use it for different kinds of purchases and then pay back the amount you owe to the bank.

In this repayment system, the lender gives a credit limit to the borrower that he can’t exceed. And there is an annual fee for giving the facility and an interest rate charged. But you can avoid interest if you do repayments within a certain time frame.

There is a credit utilization ratio involved in revolving debt. Which is simply the used balance divided by the amount of the credit limit. The ratio impacts your credit score because in calculating the score it has a significant weightage. If your CUR is higher, it becomes more dangerous. So keep it as low as possible to less than 30%.

Revolving debt has also another drawback of higher interest. Because on credit cards the amount owed is unsecured so the lender charges more interest as compared with the secured debt. And you need to pay more money. And in case you can’t meet the minimum monthly payment then you bear a penalty.

2. Installment credit

The second one is called installment credit. In this method the borrower borrows the principal amount of the loan in bulk and upfront after that he pays a monthly installment. The monthly payment includes the interest as well as the principal amount.

The interest amount is higher in the beginning payments because the principal amount is large so interest is also. But later the interest gradually decreases in the amount due to payment of a portion of the debt principal amount.

Example of these loans includes mortgage and car loans. These are usually secured loans.

In this repayment system, the time frame to pay the whole debt is a lot longer like 5, 10, 15 years or even 20 years. Therefore the interest rate is lower.

But if you owe that kind of debt try to pay it fast. Because it is compulsory for meeting savings and retirement investment needs. Otherwise, you pay it for your whole life and can’t achieve other financial goals.

Related Post: 40 Personal Finance Tips To Effectively Manage Your Money

Why pay off debt fast?

Debt is beneficial for meeting multiple needs. Whether it is buying a house on a mortgage or making a purchase with a credit card. But these upsides come with multiple downsides which you should make yourself aware of. So you can try your best to pay off your debt fast.

So let’s dive into some major ones:

1. Eat your income

It wipes out your income by paying principal, interest, and annual debt fees. So you can’t save enough for emergency requirements and for retirement. As a result, it makes you financially poor and hinders you from achieving other goals that are important for a prosperous life.

2. Lacking the ability to invest

You can’t invest your money because you don’t’ left enough. And paying off the debt faster you can easily invest towards different opportunities like rental properties, mutual funds, stocks, and many more to increase your monthly expenses.

3. Destroy credit score

It diminishes your credit score. Especially in the case of revolving debt if you utilize a maximum of your available credit limit or don’t make payments on time, ultimately your credit history will suffer. So you can face difficulty in getting into debt for any other important matter.

4. Physical and emotional stress

It affects your health in a bad way. Because as much as debt burdens, you have more emotional and physical stress you face. And it can make you depressed and anxious patient. You also distract from your daily job and other working tasks and face low productivity. According to an APA survey, 72% of Americans feel stressed about money in the prior months.

5. Waste of money

You pay extra for what you really cost. For example, if you buy with a credit card you pay more than what you need to. Because it involves interest and annual fees on what you spend. And a penalty if you‘re unable to pay on time.

6. False satisfaction

The minimum required payments put you into a false satisfaction which leads to paying more interest for a longer period of time.

7. Fraud and theft

You can face credit card fraud and theft. In that case, if the thief withdraws a large amount of cash you will be responsible for paying that. So in case your credit card is lost then suddenly contact your respective institution to block your card.

8. Difficult tracking

It is difficult to track spending on more than one credit card. Because you make multiple payments and it becomes difficult to find out how much you spent on each one.

9. Encourage overspending

Debt especially credit cards encourage you to spend more. And if you spend more than your income you’re in a dangerous mode to running your financial future. So stay in balance with what you earn. In fact, spend less than what you earn to help you have something in emergency savings.

10. Kill your enjoyment

Your normal life enjoyment and relaxation get stuck. And you either don’t’ spend money to enjoy life or you put all your time to earn more to pay debt faster.

11. Facing bankruptcy

You may face bankruptcy or become insolvent. As a result, you can’t be able to take any debt for your whole life.

So these are the serious drawbacks of owing a debt. Therefore try to avoid debt or if you need it then keep yourself in control and use minimum debt.

Related Post: How to Avoid Debt to Make Yourself Financially Strong

What are the benefits of paying off debt fast?

Let’s take a quick look at the benefits of paying your debt faster.

- You save more for your retirement and emergency needs.

- The credit score will improve and build trust with your lender

- Emotional, physical, and family relationship life will stay normal.

- You can avoid wasting your hard-earned money on paying interest and fees of debt.

- Easily avail different investment opportunities to make more money.

- The working life and productivity will stay at their peak because you don’t have any financial stress.

In the next section, you’re going to learn how to pay off debt fast so you can get the above benefits.

So let’s dive in.

How to pay off debt fast?

Before diving into the actual strategies for paying debt fast first you need to do some preparation. This will help you to easily plan the rest.

Calculate the amount of debt

Before diving into the ways to pay off debt faster. First, you need to prepare your math of how much debt you have. How much interest do you need to pay? And What is the principal amount you will pay?

To do all of this you need to follow the following steps.

- Take help from an excel sheet or for auto-saving you can use Google spreadsheet online. And make columns including the name of debt, principal amount, interest amount, and monthly payments.

- After that, list down all the amounts in each of the respective columns you made. And do the correct calculations of each debt principal amount and interest expense and then the repayment amount you pay each month.

- When all of the above is done. You will have a clear picture of how much you owe. And how much interest amount and the percentage do you pay on each of the debts? Now you’re able to analyze the situation.

- At this stage, you need to decide on a repayment plan. Whether you pay using the snowball method or debt avalanche method. It is up to you but also depends on the situation. You will learn in more detail in the later section about both of these methods.

- And finally, you also need to dive deep into the details of how much time period you have to pay. What type of debt do you owe whether it is a credit card, mortgage, student loan, or any other? Because it does matter and affects the repayment plan also.

So now you are prepared. Let’s dive into the strategies and tips on how to pay off debt fast.

11 Simple Strategies to pay off debt fast

In this section, there is a list of 12 tips and strategies you can implement to throw off the burden of debt. Some of these are repayment methods and others are simple saving and income strategies. If you become successful in following some or all of them you can pay off debt faster.

Let’s explain them in more detail.

1. Avoid paying with a credit card

In today’s money predators, the credit card is number one. The reason is it seems to be the easiest and most flexible way of paying for your day-to-day purchases. Whether you need to buy a grocery, branded clothes and shoes, or any other small purchases credit card is at the front.

It is true that credit cards solve lots of your problems regarding financial transactions. But at the same time if you’re not financially intelligent then it can throw your financial future into a disaster.

The reason is that with credit cards there are a number of extra penalties included. Interest, annual fees, and late payment charges are the major ones. And if you’ll not meet the payment requirements on time your credit score will ultimately suffer.

Here are some of the most dangerous factors connected with your credit card:

- Allows you to spend blindly while having no balance of how much you earn to pay back the credit amount. This results in overspending and your financial conditions get stuck.

- Multiple credit card transactions are very difficult to manage. And this leads to financial problems.

- Not meeting the minimum monthly payment, your credit score will ultimately suffer and you’ll not be able to get into more debt.

- It eats up your income and you’ll not be able to invest or save for emergencies and retirement.

- If your debt exceeds 50% of your income then you may lead to insolvency or bankruptcy.

- If you don’t pay the amount on time you’ll face penalties from the lender.

Here is how to avoid it.

There are a number of other ways you can avoid the tragedy of getting into credit card debt. Here are some simple tricks:

1. Use a debit card or cash

At this time if you don’t have a credit card then only use your debit card or cash for transactions. Whether it is an online transaction while purchasing something from Amazon or it is an offline transaction at a local grocery store. This will deduct the amount directly from your bank account or from your pocket and you pay the actual.

2. Get a card with a low rate

If you want a credit card then analyze the different credit card provider banks and institutions. See what interest rates they charge and what is the annual fee. What is the late payment fee? And go with the one which has all of this at the lowest amount.

3. Avoid multiple credit cards

If you have a credit card already then don’t go for multiple credit cards. Why because it will give you more credit limit to spend. And if you blindly start using your credit limit then it not only builds a mountain of debt but also impacts your credit score because of the high utilization ratio. It can also ruin your financial future and hinders you from achieving other goals in life.

4. Think before impulse purchase

Before making any impulse purchase you should think about it. And put a credit card aside for some time. It is possible that you may not need those things which you want to purchase due to instant gratification. This way you can avoid spending on non-essential items. It’s reported that adult Americans spend $1,497 a month on nonessential items.

5. Don’t share your card

Don’t hand over your card to any of your colleagues, friends, or any others in your close relationship. Because what he will spend with your card, you’ll be responsible for repayment. And in case he lost it anywhere and any financial mishap happens you’ll be considered responsible.

6. Keep an emergency fund

Have an emergency fund so you don’t pay with your card in case of sudden monetary needs.

If you follow this tip you can not only avoid debt to compile but also save more money.

2. Make more money

After avoiding credit cards, this is the number#2 that I stress the most.

When you have a debt this means you need money to pay it back. For debt easily if you make more than what you owe, then it will be easy for you to make monthly repayments. You can put something towards savings as well.

For example, you need $3000 monthly to satisfy your debt payments and save for emergencies and other investment needs. And you’re currently making only $1800 monthly in salary. This means the simple trick is to make $1200 more to meet that need.

Related Posts:

How To Make Money Without A Job (55 Lucrative Ways)

62 Best Jobs For Stay-At-Home Moms (Online And Offline)

There are multiple ways to build up your income. Some are offline and tons of available online. Here you’re going to learn about some easy and simple tricks.

1. Part-time job

Do a part-time job at the existing company or at a local business where you find it easy. But first, find out the one that pays a good hourly wage and helps you meet the required financial goal.

2. Start a business

Start a small business in your local area. Like a fruit shop, grocery store, coffee shop, and or a small franchise. These types of small businesses don’t make you rich but help you earn a decent profit to cover your needs.

3. Give assets on rent

If you’ve any car, house, apartment, or warehouse then give it at rent. It is a good source of passive income.

4. Online freelancing

Do part-time online work as a freelancer. If you’ve any skill which you’re interested in and can easily learn to sell it online. Freelancing can help you earn a decent amount because lots of people are doing it already.

5. Sell extra items

If you’ve any spare items or old things present in your house like furniture, a car, a refrigerator, or any other, sell them. And put it into paying debt amounts.

Use the above income-generating techniques and spend that money on paying off your debt. And don’t swear by large payments because it ultimately throws the debt burden off your shoulders.

For more information visit this article: How to Make More Money: 21 Ways to Start Earning More Money

3. Minimize your monthly spending

One bad thing that a poor person does is spend more than what he earns. He does it either to show off or due to his bad habit.

If you’re doing this then stop.

If you don’t have any debt still this is a bad thing. Because it not only wipes out all of your earnings but also makes you financially weak to save for other important purposes. If you do overspend you will not be able to invest in insurance, retirement, saving, and other investment opportunities.

In case you have a large amount of debt whether student loan, credit card, or mortgage, this habit can lead you into disaster. So you should spend your money carefully.

There are multiple ways you can tackle this:

Prepare a monthly budget. List down all of your income sources and expenses. After that, analyze the budget deeply and find out the essential expenses and non-essentials. When you do all of that from next month, cancel out all the non-essentials because they are just a waste of money.

Whatever the money left from canceling nonessentials, spend that to pay your debt. This will allow you to make larger payments and save more on interest and avoid late payment penalties.

Adjust your budget after a certain period of time for any new income source, debt that you paid off completely, and any other new expense.

If you follow these tips you will stay on track with your expenses and income. Now let’s jump to the next section.

Related Posts:

How to Create a Personal Budget [ 6 Easy Steps]

23 Money-Saving Challenge Ideas To Build A Big Saving Fund

4. Spend extra income on debt payments

In case you get extra income in any month then don’t swear to spend it on paying a debt. Usually, this is hard to do because lots of people want to spend it on enjoyment, like going on vacations and doing a long drive.

But it can really help you in getting some of your debt settled. And you know paying a portion of debt can benefit in the long run.

So if you get any tax refund, bonus from your company, or allowances then don’t hesitate to use them in paying the debt.

Or if you don’t need debt payments then utilize them in any other productive opportunity like insurance, child school fee, and savings.

5. Use the debt avalanche method

There are two main and famous methods how to pay off debt fast.

And one of them is called the debt avalanche method.

What you do in this method is to list down all of your debt with respect to the interest rate. Meaning the one with a higher interest rate will be at the top and first priority for you to pay, then the next biggest in regard to interest rate, then the next, and so on. And you start by paying first the debt with the largest rate of interest then the next largest until you paid off all of the debt.

When one debt is paid you use the repayment amount of that debt to pay the next one. Then the third one. This means you add up all the repayment amount of previously paid debt to pay the next one.

But keep in mind that you should pay the minimum required amount each month on all the debts to avoid penalties. This is usually 2% of the whole payment depending on the lender’s policy.

At the start, this method will scare you. Because you don’t see any sudden change in the debt. But as time goes on your debt will fall out very fast until all will be paid off. So if you decide on this method then don’t be confused or hesitate.

Let’s understand this with an example. Let’s say you have 5 debts currently that you need to pay back. And they are like this: credit card $5000 with 18% interest, student loan $15000 with 10% interest, personal loan $12,000 with 13% interest, mortgage $25,000 with 8%, and car loan $20,000 with 15% interest rate.

How to put it into action?

Now here are the steps you will take to apply the debt avalanche method.

- List down all of these debts in a spreadsheet.

- Now order them one by one in descending order with the one with the highest interest rate at the top then the next high-interest rate, then the next. In the above case first is a credit card, car loan, personal loan, student loan, and last mortgage debt.

- In this step, you first tackle the credit card loan to pay first. Because it is with the highest interest rate. After that, you pay car loans then personal loans, student loans, and at last mortgage loans. But while making the minimum payment on each of the other debt amount each month.

In the beginning, you don’t see much change but when you pay 2 to 3 debts your speed will increase, and ultimately all of the debt will vanish.

Now you have a good understanding of what is the debt avalanche method. And how does it work?

Let’s uncover its advantages and disadvantages to make it more clear to you.

Advantages

- Helps you pay less in interest. Because you’re paying the ones with the highest interest rate first.

- Takes less time to pay the whole debt. Because you are making the maximum payment each month.

Disadvantages

- You don’t see any change at first which can lead you to demotivation.

- The interest rate on other debt compiles because the lenders use compounding. They can compound monthly, daily or semi-annually, or even annually.

- You need to stick to the plan for smooth payment of debt. Because some people can’t follow this discipline. So it becomes hard for them.

- You still need to make a minimum payment on all the other debts.

Emergency savings are important. Ultimately you’re spending all of your income on making big debt payments.

If you can afford to make big payments and have enough income as well as savings to meet unexpected events. Then the debt avalanche method is the best for paying off debt fast.

Related Post: How to Use Debt Avalanche Method to Quickly Pay Your Debt?

6. Utilize debt consolidation

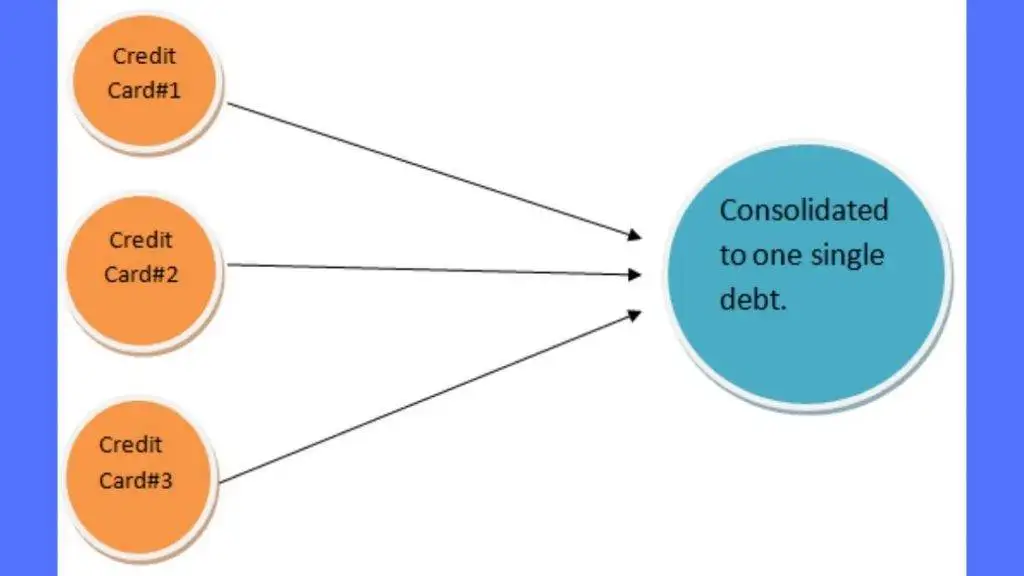

It is a method in which instead of paying multiple payments each month you combine all of them into a single payment. In simple words you take a new loan and pay the existing one, as a result, you only pay monthly payments on the new loan, and all other loans are settled down.

For example, you’ve 3 credit cards with $5000 debt on each combined equals $15,000. You are being charged a 20% annual compounding rate of return. Now if you have a 12 months period to pay it completely then you will be charged around $1,250 in principal and $250 in interest the first month. And over the course of 12 months, you pay an extra $1,620 in interest.

Now if you take a personal loan or consult any lending institution to give you a loan at a low-interest rate like 12%. Then you pay the credit card loan with that money and then you pay only one payment each month instead of 3 credit card payments. In this case, you save money on the interest that is paying 12% instead of 20% on the same amount of loan. Along with that, you pay the new loan in the same time frame with a low-interest rate.

This whole process of combining or paying multiple debts with a single new loan is called debt consolidation. It is usually used to get economic benefits by saving money on interest expenses.

In the above example if you pay $1620 on 3 credit cards but if you divert to debt consolidation you only pay $975 on the same amount of loan. So this is a major benefit.

Now let’s dig into more of the upsides and downsides of debt consolidation.

Advantages

- Saves your interest over time.

- You can pay the debt faster by taking a new loan.

- You’ll not face any late payment issues because all debts are paid at a time.

- No need to manage multiple payments, just one single one each month.

- Improves your credit score because you paid multiple debts.

- Less stress will be on you. So better health and relaxation.

Disadvantages

- If your income is low and you can’t make the payments on time then your interest will accumulate into a big amount.

- If you pledge certain property or collateral for taking consolidation loans then you’re putting that asset at risk.

- In case the period is long enough to pay back then the amount of interest may be greater than the high-interest credit card debt.

- You may spend more in satisfaction with a single debt. That can lead you to more debt.

Overall if you become successful in raising a low-interest-rate debt then it is good to go for debt consolidation. But contact your financial advisor before going for it. Because there are certainly other factors involved like repayment period, overall interest amount, and fees. So a professional financial advisor can better guide you.

Related Post: What Is Debt Consolidation? How to Consolidate Your Debt?

7. Use the debt snowball method

If you can’t follow the debt avalanche method then the next best one is called the debt snowball method. In this method, you pay the smallest balance debt first then the next smallest one, and so on until all the debt is paid off.

For example, you’ve five different debts taking the above example used in the debt avalanche method. And they are like this: credit card $5000 with 18% interest, student loan $15,000 with 10% interest, personal loan $12,000 with 13% interest, mortgage $25,000 with 8%, and car loan $20,000 with 15% interest rate.

Now you rank them one by one from smallest to largest. In the above amount, the smallest one is 5000 credit card debt. So you first pay the credit card debt, then the next one is a personal loan, student loan, car loan, and finally the mortgage.

But you still pay the minimum amount each month on all the other debt amounts. And focus majorly on the smallest one. When you paid off the smallest then move that payment to pay the next smallest until all debt is gone.

This will provide you with motivation because the smallest debt is paid off very quickly.

Advantages

- The positive emotional impact on your brain is that you achieved something.

- You don’t need to do much analysis. It’s just simple to pay off the smallest one first.

Disadvantages

- You may pay high interest on the bigger amounts in the long run as well as the short run. For example, if you have a credit card debt of 20,000 at 18% interest and you spend all the money on paying a car loan of 15,000 at 12% then it makes no sense to pay a huge amount in credit card interest.

- It can hurt your credit score if you don’t meet the expected requirement.

- You may accumulate more debt over the long-term period.

It is up to you which debt repayment method you like. It finally depends on your financial condition. If you can afford then debt avalanche is a good option but if you feel flexible with snowballs then it is also good.

Related Post: What Is a Debt Snowball Method? How Does It Really Work?

8. Go for a debt relief

When your debt is too large and you’re unable to pay it in the full amount then you can negotiate a lump sum amount with the creditor to settle the whole debt. This is called debt relief or debt settlement.

In this process, the amount you pay to a creditor as a settlement is considered the full payment. Therefore you pay less than what was actually due.

You can either consult your creditor personally to settle the debt or you can contact a debt settlement firm to do it for you. Usually, these firms charge you a fee of around 20% to 25% for the adjustment of your debt.

For example, you owe 7500 debt on a credit card to a certain bank or lending institution. You need to pay 1500 each month for 5 months. But due to some reason like job loss, illness, or any other emergency, you can’t afford that. In this situation, you contact a debt settlement company.

Let’s say you can currently pay only 1000. When you contact the settlement firm they stop you from paying that amount to the creditor and instead tell you to pay to the settlement firm. After that, the settlement firm saves the money for the 5-month s period. Now you paid $5000 to the firm. After that, the firm will contact your lender to negotiate the debt amount. For example, they close the creditor to $4,000. Now the creditor will write off your debt and consider that amount s full. The remaining $1000 will be charged as a fee by the settlement firm.

That is it. A simple process for people who can’t pay the whole amount.

Advantages

- Other financial goals can be met timely.

- There is an opportunity to pay debt fast.

- You pay less than what you owe and avoid the chances of bankruptcy.

Disadvantages

- A creditor can take legal action if you don’t pay the amount to him.

- Along with that, it is not guaranteed that the debt settlement company will be successful. The success rate in debt settlement is less than 10% according to FTC.

- You also accumulate more interest so more debt and pay all of them if not settled.

- Your chances of declaring insolvency will also rise if settlement is unsuccessful.

- Finally, the credit score also suffers due lack of debt repayment ability.

Considering the upsides and downsides of debt relief if you’re successful in it then good. But instead of going for settlement find ways to make more income like discussed in the above section and pay the whole amount this will retain your credit score and trust with the lender so you can easily take loans in the future. Go for debt settlement when your debt scenario becomes so worse.

Related Post: What Is a Debt Settlement? A Simple Technique to Negotiate

9. Use balance transfer

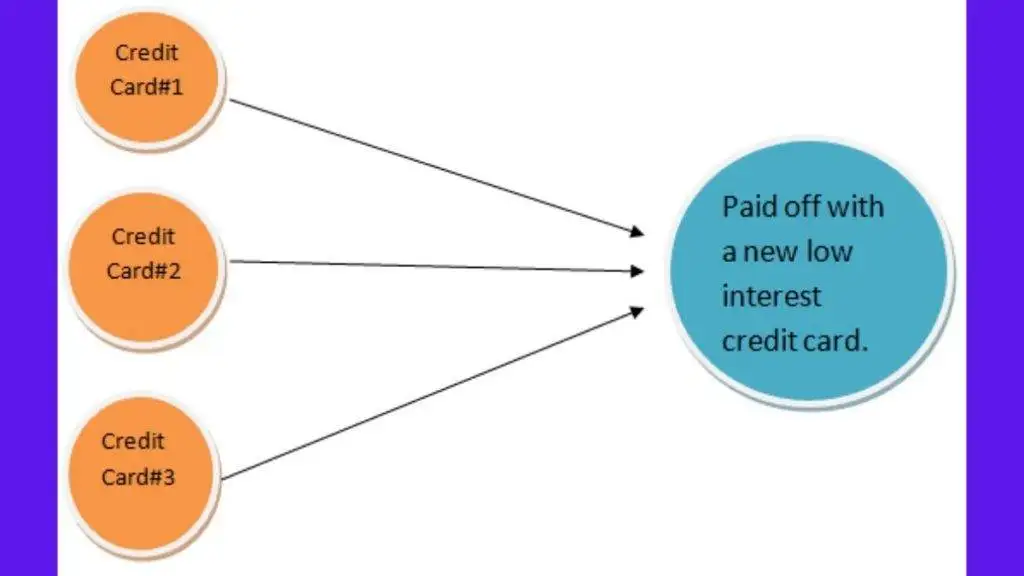

If you’ve got multiple credit cards with a high-interest rate then you can use the method of a balance transfer to pay them off.

What is a Balance Transfer method?

It simply refers to the payment of an old high-interest credit card balance with the new low-interest credit card. For example, you have a credit card with a 20% interest rate with 5000 debt. And you obtain a new car with 15% interest and pay the old one with this new card. What happens is that you save 5% interest amount at the rate of 5%.

This is an effective way to pay off if you have a good credit history. And also there are low-interest credit card lenders available.

But there are certain downsides to using this strategy. For example, if you don’t pay on-time installments you may incur a late fee. Along with that if the interest rate on a new credit card rises you get no benefit. Your credit limit also impacts. If it is low than your previous debt then you can’t pay and need to get another credit card.

For more information visit this article: How to Pay Off Debt Fast With Balance Transfer

10. Use your savings

This tip is so simple. If you have a large amount of savings in your bank account then utilizing them for paying your high-interest rate debt is a good strategy.

This means if you continuously save a fixed amount of money from your income each month then it is good to use some portion of existing savings to pay off debt. For example, you’ve $5,000 credit card debt with 20% interest. At the same time, you’ve $7,500 in savings while also having a continuous 500 deposit to savings each month.

Now instead of paying a 20% return on a credit card, you can withdraw $5,000 from your savings to pay off a credit card. This will allow you to through off debt while still having the amount of $2,500 in savings which grows each month fast after paying the debt. Because your existing monthly savings plus what you pay on debt payments will accumulate to help you save more.

Related Post: 59 Ways on How to Save Money Even If You Find it Difficult

11. Declare bankruptcy

There is a possibility that you can’t pay your debt due to over-accumulation. Your property and income can’t satisfy the debt repayments.

In that case, the final option is to file bankruptcy so your debt is written off.

There are several steps involved in this process. Usually, you need to find the right attorney and submit all your information about debt, income, and property. After that, he examines all of the situations and according to Chapter 7 or Chapter 13 of bankruptcy law, he completes the process.

Following chapter 7 a portion of your property is taken away while in chapter 13 you can keep all of it.

But remember filing bankruptcy is a serious issue. You should first examine your situation and then take any decision regarding it. Because if you go bankrupt then the following results you need to face.

- You lose your credit score.

- The bankruptcy stays on your credit report for 7 to 10 years.

- Difficulty in obtaining a mortgage, loan, or any other type of credit.

- The court may surrender some of your property to pay creditors.

So be cautious about these dangers after taking that kind of decision. But if all of the options are blocked then you can go for bankruptcy to vanish your debt. Because for some people it remains the last option.

For more information visit this article: How to File Bankruptcy in 2021 for Free: A 10-Step Guide

Conclusion

For a green financial future, it is important to know how to pay off debt fast. Because if you don’t take this seriously then the debt will accumulate too much that you can’t repay it.

Paying off debt is not a difficult task if you have little financial knowledge about the strategies to vanish it.

You’ve learned 11 strategies in this guide. It is not compulsory that you follow all of them. But whatever you go with, you must stay consistent to see great results.

If you’ve any other strategy in mind please share it in the comments section below.

Other helpful posts:

13 Easy Tips on How to Improve Credit Scores Fast

How Student Loan Interest Is Calculated? 3 Easy Steps

What Is Financial Planning? How to Do It In 12 Easy Steps?

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024