Last updated on January 2nd, 2024 at 06:47 pm

Do you want to secure your financial future?

If yes! Then it is your responsibility to take it seriously because no one else is going to take care.

And, for a bright and secure financial future, it is important for you to start financial planning at the right time, which is now.

If you want to know that, what is financial planning? How can you create a good financial plan? If that helps you achieve your financial goals and objectives then this post is for you.

In this post, you will learn all of the nitty gritty’s of financial planning in a simple and clear way. After reading this post you’ll be able to clearly define your financial goals and make a strategy to achieve them at the desired time.

So let’s get started.

What is a financial plan?

A financial plan is a written document that includes information about your financial goals, current financial status (like income & expenses), and a clearly defined roadmap to achieve them in a specific time frame.

The goal can be single or multiple. Some common goals include retirement, investment, child education, emergency fund, and others.

A financial plan helps you clearly define the objectives and then tells you how you can achieve them. You can make this plan yourself or can take the help of a professional financial planner.

Having the right financial plan in place is important to be successful in the future regarding your financial goals. It keeps you on track so you stay focused on your end goal while achieving each individual milestone.

You can download the financial plan document template here.

What is financial planning?

It is a process of determining how you can achieve certain financial goals while taking into consideration your current financial information.

Financial planning covers different aspects like protecting your wealth, retirement goals, long-term investment, paying off debt, and children’s education. In simple words, its scope is vast and covers multiple financial objectives.

While doing financial planning you focus on your goals and develop strategies to deal with the risks and barriers.

It is used by individuals as well as businesses. When it is used by an individual then it is called personal financial planning, while in the case of a business, it is called business financial planning. But the purpose of both is the same which achieving certain financial goals.

Financial planning consists of several steps which you learn in the sections below. If you want to do proper financial planning then gathering and analyzing financial data is vital.

What is a financial planner?

Financial planners are professionals who analyze your financial information and advice you regarding your financial goals.

They take into consideration the current financial data including monthly income, savings, and expenses, and give you advice that helps you fulfill your financial needs.

These planners are of two types. One gives free financial advice and the second charges fees. But it is best to go with paid financial planners because they give fair advice and have no relation to any company or organization for commission.

Financial planners include both specialized and general. Specialized advice on specific areas like tax, budgeting, insurance, retirement, etc. While general advice on everything from budgeting to child education to retirement, paying off debt, etc.

It is good to go with specialized ones because they have more expertise and knowledge in a single area.

Getting advice from financial planners is not always needed. But if your situation is more complex and you don’t have enough knowledge then it is the best choice to go for an expert financial planner.

You also like: How to do Zero-Based Budgeting Using 5 Simple Steps?

What are the types of financial planning?

Financial planning falls into different categories. Here is a brief explanation:

1. Education planning

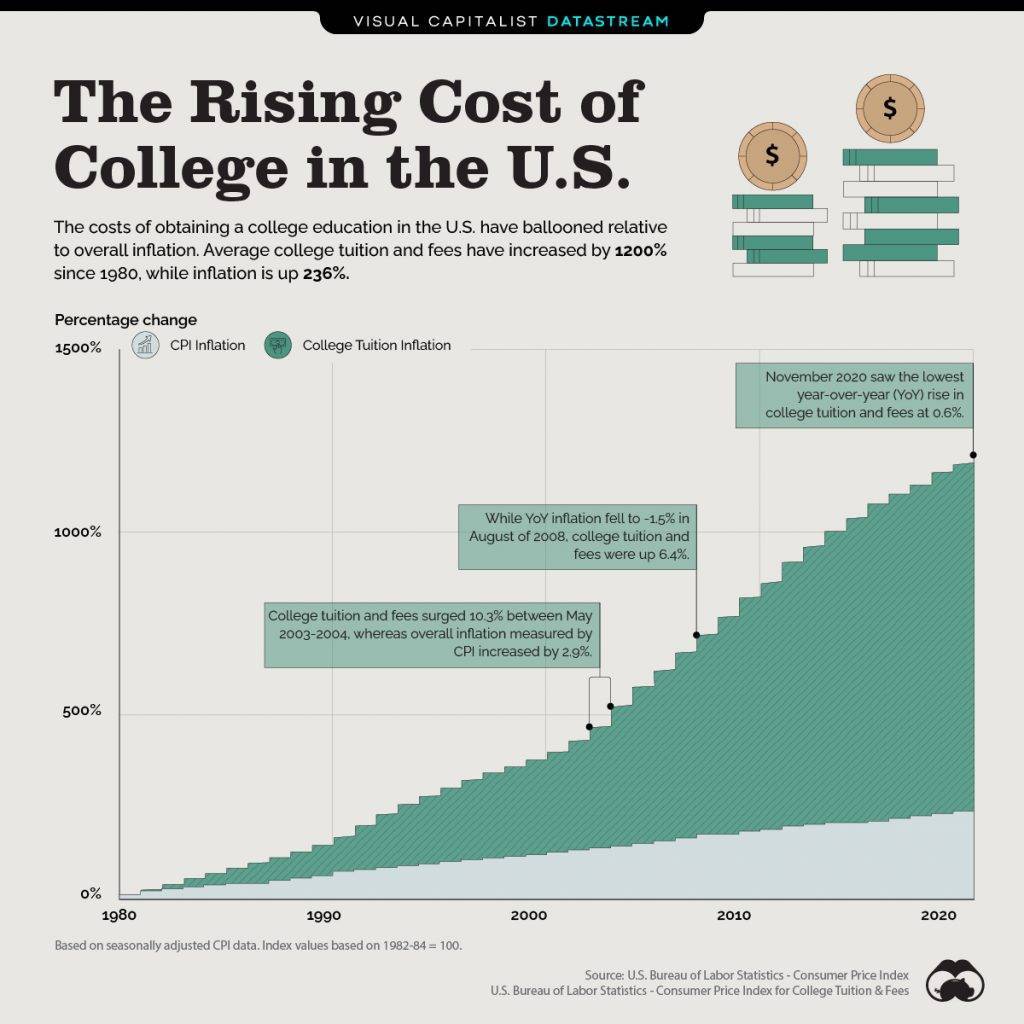

Education is one of the factors that all of us need in our life. It has become a life necessity. But at the same time, its cost is rising each year in the United States. And students are taking more and more loans from lending institutions including Fed, banks, credit unions, and online lenders.

According to statistics college fees and tuition have increased by 1200% since the 1980s as compared to inflation which increased just 236%.

The parents also need to start planning for their kid’s education when he came into the world. They need to start saving to cover the school and college expenses that they need to pay soon after the child starts going to school.

For managing all of the education-related finances and covering expenses financial planning comes in handy. And this type of planning is called education planning. It is a major category of financial planning in this century.

2. Investment planning

Inflation is eating money with each passing interval of time. The costs of goods and services are rising. Therefore tackling this problem is as much important and the only solution is to earn more and start using your spare money.

That’s why individuals need to invest money for earning more money to boost their income. And investing needs planning depending on whether you want to invest in a short-term or long-term opportunity.

Investment is made early in the 20s or 30s or after retirement for having enough income to live a better life. And all of this needs is investment planning.

3. Retirement savings & income planning

You need to retire one day from your job. It doesn’t matter whether you’re working in a private company or in a government position. After the 60s most people start retiring from their positions.

But after retirement, they need to have a sufficient amount of money to meet their needs.

Here are some shocking retirement savings statistics from the united states:

- Only 16% of women and 30% of men have more than $250,000 in retirement savings.

- On average women have $23,000 for retirement savings while men have $76,000 in total.

- 54% of women believe that they should save for retirement while 43% have no strategy for retirement savings.

Now retirement-related financial planning is used to deal with all these issues. This covers retirement saving opportunities like 401k, 403b, traditional IRA, Roth IRA, etc. It also helps you choose the right investment opportunity that provides a sufficient income to meet your expenses.

4. Tax planning

Tax is an important obligation all of us need to pay to the government. No one can run away from government taxation.

But it is possible to implement ways to minimize it and this is what tax planning does.

It takes into consideration multiple elements and factors including tax law to help you pay minimum tax or avoid tax on certain income sources. This way you can save more and lower your tax expense.

Tax planners advise you on different ways in which you can implement tax-related benefits and exemptions from taxation authorities. This helps you increase your tax efficiency and put more money toward your other financial goals.

5. Risk management and insurance planning

Creating and having wealth is not an easy task like a cup of tea. It requires years of effort and time. That’s why no one wants to lose it or see any risk of loss.

And here comes the type of financial planning which helps you protect your money and other important assets so your financial future stays secure.

Risk management and insurance planning deal with things like life and disability insurance, car insurance, house insurance, etc. In simple words, you manage risk so that it decreases and your important assets stay secure from fire, theft, and any other incident.

6. Estate planning

Last but not least comes estate planning. You understand by name that it deals with planning related to your assets if you die.

It is a major planning activity when it comes to financial planning. Here are some of the estate planning activity statistics of Americans:

In estate planning, you plan how your assets are distributed to your family members or any other individual or organization after you die. It is important because it documents your wishes and describes who will get your assets in your absence.

They can be your children, any charity organization, or a member of your family like your wife.

What are the benefits of financial planning?

Let’s discuss some important advantages of doing financial planning:

- You get a clear roadmap of how you can achieve a certain financial goal or objective. This makes it easy and less time-consuming for meeting that goal.

- The confusion is eliminated because having a written plan clearly tells you the situation and how to tackle it.

- Your money management problems minimize because you get a clear understanding of how to cut spending and invest toward your goals.

- It helps you know which choices and objectives are superior to others. Also which ones you should go to first, second, or third? So you can use your financial resources in an efficient way.

- Your financial risk gets managed whether it is protecting your money or hiding risk from your investment portfolio.

- Helps you monitor how much money you’re saving and if it is low then you can add more to meet emergency and retirement needs.

- The financial future becomes more secure and bright if you make a solid financial plan. Most of your financial problems get solved and you can live the life of your dreams.

- Your mental stress and worries minimize or eliminate that are caused by financial problems like low income, large debt, child education, etc.

- It covers different categories under one umbrella. So it is useful whether you want to do planning for education, retirement, investment, budgeting, or anything else. It always helps you.

- You can set SMART goals that are specific, measurable, attainable, realistic, and timely.

- It helps you set parameters to measure your financial performance toward what your needs are. So you can determine the outcome of your work.

- Your retirement, child’s education, money, and credit reputation become more secure than if you don’t properly plan things.

- This helps you meet different financial planners who are experts in their fields. That way you absorb more and more knowledge about personal finance management.

So these are the reasons and benefits that make financial planning crucial for you.

You also love: 20 Budget Templates To Confidently Track Your Money

How to do financial planning?

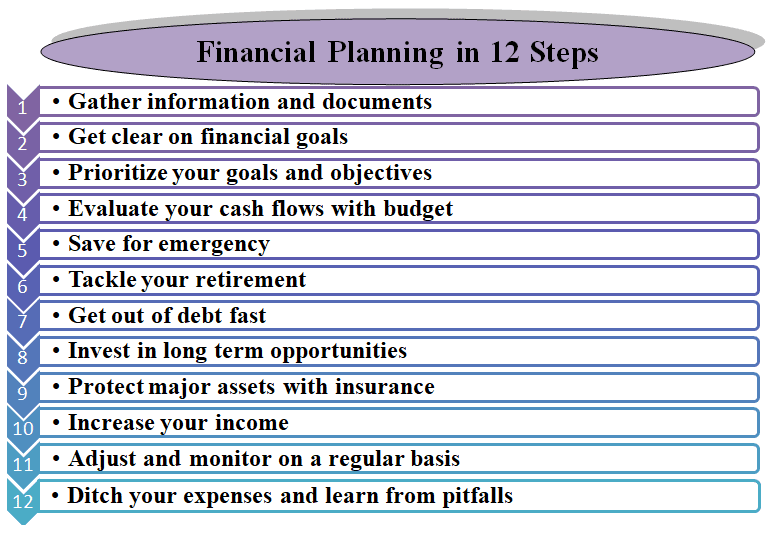

Making a good financial plan is a mixture of different steps. If you follow them in proper order and with complete information then you can create a useful financial plan with ease.

Here we list out 12 simple steps with a brief explanation.

1. Gather information and documents

If you want to make a plan for yourself or for your clients as a financial planner, the first step is gathering important information. You’ll need to have some documents that give you all the information.

Here is the list:

- Income statement that describes how much you earn each month from your job or business.

- Bank statement to get an overview of your savings and withdrawals each month.

- Any other source of income if you have and how much you earn from it.

- If you’ve any debt outstanding then that information is also important. This includes the type of debt (mortgage, car loan, student loan, or personal loan), its amount, and the monthly payments or installments you make including any interest.

- Your monthly budget to get an idea of cash inflow and outflow.

- Information about your social security and current retirement investment including 401k or IRA.

- Details and statements about the insurance policy ( one or more ) if you’ve. This helps to understand how much of your income goes to insurance and which insurance policy you’ve in current.

- Any trust fund details including stocks, bonds, or business.

- Tax information including tax expenses and tax returns. Also, the tax benefits you’ve so that the tax efficiency will increase.

If you’re going to a financial planner for getting advice then he may require you to submit more information. So you should give as much as information possible, especially about your income and expenses to get fair advice.

2. Get clear on financial goals

These are the financial targets you want to achieve in a specific time frame. They are the milestones and hopes or wishes you want to fulfill in your life with money. It can be savings goals, retirement goals, child education at Harvard University, or buying a big house that matches your lifestyle, etc.

These are all things that require money to be achieved. So defining them is an important step to start making a strategy to achieve them.

These goals can be ones like buying a car after one year or multiple. But remember these goals should be SMART. It stands for specific, measurable, attainable, realistic, and timely.

Defining these goals gives a picture of how much money you need, how much time it takes, and what steps to take action. For example, if you want to buy a car that is worth $24,000 then if you want to buy it in 12 months then you need to save $2,000 each month. This means your goal needs 12 months to fulfill if you save $2,000 each month.

Here is a list of some common goals that most people want to achieve.

- Getting out of debt whether it is a mortgage, credit card debt, or a student loan.

- Cover retirement because it is important and exciting to build a portfolio that pays after the 60s and covers after-retirement income goals.

- Building a sum to meet education needs. This can include your own education or your child’s or grandchild’s education at the school, college, and university levels.

- Saving enough to cover your emergency needs. It is called an emergency fund.

- Making a useful budget that cuts back the spending and living on what you earn.

- Buying a dream car or house that matches your lifestyle.

There are many more like these which need money to get fulfilled. But it is important that you should clearly define them and make them realistic.

3. Prioritize your goals and objectives

Defining your goals and objectives is not enough. There are some goals that are more important than others. Therefore they need more attention and money so they are achieved on time.

So what you do is prioritize your goals according to the importance each of them exhibits.

You know which goal is more important and you want to achieve it first by spending more money on it. That’s why you rank them according to your choice.

Here is a general prioritization:

- Building an emergency fund

- Saving for retirement

- Paying off credit card debt

- Child’s education

- Buying a car

- Purchasing a house

This is just an example, your ranking and order can be different depending on the situation.

4. Evaluate your cash flows with budget

Financial goals have different requirements and one of them is money. That’s why you need to analyze your cash flows with the help of your budget.

Cashflows include both inflows and outflows. Cash inflow means money coming into your pocket. It can be salary from a job, profit from the business, interest from bonds or saving accounts, and others like that. In simple words, this is what you earn.

While the cash outflows are your expenses like medical bills, utility bills, food and rent, picnic, and monthly interest payments on debt. This is what goes out of your pocket.

If you have a proper budget then you can easily identify your income and expenses.

This is important because you need to get a transparent picture of how much you left for spending on other important goals.

You also like: How to Create a Personal Budget [ 6 Easy Steps]

5. Save for an emergency

An emergency fund is an important goal that you must cover first. There is nothing worse than having low to no cash in your bank account for any unexpected event. For example, a serious injury, illness, job loss, business loss, and more.

You don’t need to compile a huge sum of money but at least that covers months of your living expenses.

If you don’t have an emergency fund yet or a small one then starts saving as little as $500 a month. First, make it enough to cover one month of expenses and then two months and that can go up to six months or a year.

6. Tackle your retirement

When you retire from a job then your salary stops. And you’ve only left with what you invested for retirement. Which you can use to build up an income stream through savings accounts or investing in any opportunity.

Therefore you should start investing for retirement as early as possible.

If your employer is giving a 401k plan then devote a matching amount to that plan. This helps you get free money of equal amounts that build up your retirement fund fast.

In case of the absence of a 401k plan, you can open your own retirement investment account like a traditional IRA or Roth IRA. Here you can save up to a certain amount of money before tax or after tax to cover retirement needs. Other options include 403b, high-interest saving accounts, and mutual funds.

7. Get out of debt fast

In a country like the US, everyone has a certain type of debt outstanding. It can be in the form of student loans, credit cards, medical bills, mortgages, car loans, personal loans, or others. And paying it back to lenders is a burden you need to get out.

So when your emergency fund and retirement become secure then it is important to get out of debt fast. This will help you save more money for investing and insurance.

You can choose a repayment plan for paying your debt. There are two most famous repayment methods including the debt snowball method and the debt avalanche method. But you need to devote as much as extra money towards repayment with each plan. The reason is these are accelerated debt repayment plans.

Along with that paying, debt with a high balance or high interest is important. Because this lets you stop compiling your debt so fast and pay it out in a specific time frame.

You also like: How To Pay Off Debt Fast (11 Bullet Proof Tips )

8. Invest in long-term opportunities

After the debt is covered the next important step is an investment. The investment gives you an opportunity to efficiently use your money and earn a return on it.

Investment is the only option that helps you earn more to cover inflation. So your money doesn’t lose purchasing power.

There are different investment opportunities which include both short-term and long-term. Short-term opportunities are less than one year while long term starts from a year to more than 10 years. For example, in most bond investing opportunities the length of maturity is 3, 4, 5, or 10 years. Over that time span, the company or government pays you interest, and after maturity returns the principal amount.

How do you want to invest? This depends on the option you want to choose like high-risk high return opportunity, low-risk low return, or any short-term opportunity.

Usually investing in stocks, real estate, derivatives, and commodities is high risk. But they also give fair returns that cover inflation. While investing in saving accounts, mutual funds, and government securities or well-rated bonds are low return opportunity with low risk.

9. Protect major assets with insurance

Building wealth takes time and effort. And no one likes to lose it. That’s why making a plan to protect your wealth is as important as the others.

You need to protect yourself from financial fraud, theft, fire, and accident. Here, the assets that are most important and valuable are included. For example, your house, car, land, life, etc.

To protect things like a house, car, machinery, or getting secure in the event of disability needs insurance. You need to take the right insurance policy so if you face any loss it will be easily recovered.

10. Increase your income

Income is what makes you able to satisfy your financial goals. It determines whether you can achieve a certain financial objective or not and how much time it takes to achieve that.

This is an option if you don’t want to cut back on your expenses and lower your lifestyle.

There are multiple methods that can help you increase your income:

- Doing a part-time job

- Starting a side business

- Investing in financial assets

- Online freelancing

And many others depending on which one best suits you. If you can increase your income then it will definitely make your financial plan stronger and actionable.

11. Adjust and monitor on a regular basis

The situation changes with time. Therefore you need to take care of your financial plan on a regular basis.

The financial environment is changing rapidly with time. Along with that the factors like interest rates on debt, changes in income level, variation in your wishes and goals, and ups and downs in your expenses occur frequently. So you need to adjust your financial plan according to that.

This will help you stay updated and monitor any change that can affect your financial goals.

Therefore monitor your plan regularly after a specific time frame. Insert any information that is missing and delete that isn’t required.

12. Ditch your expenses and learn from pitfalls

Last but not least is to control your expenses and spending. Avoid spending on those things which are useless and just cost you a fortune. This helps you devote your money to words that are valuable to you. Along with that, learn from your financial mistakes and constantly improve your knowledge.

Final Thoughts

Financial planning is a great way to build your financial future. It is not complicated and you need to follow some simple steps.

If your financial situation is complex and you aren’t great at finance then you can hire a financial planner. You just need to provide your financial information and discuss your goals.

But remember you should have clear goals that are specific, measurable, attainable, and timely.

Now tell me in your comments below which of the tricks you like most in this post.

You also like:

How Does Debt Consolidation Work? Is It a Good Idea?

How to Avoid Debt to Make Yourself Financially Strong

How Student Loan Interest Is Calculated? 3 Easy Steps

How Does Student Loan Work? The Ultimate Guide!

31 Budgeting Tips for Beginners to Easily Grow Your Savings

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024