Last updated on March 25th, 2024 at 04:48 pm

In this article, you’ll learn how to save money using 59 different strategies.

Saving money is important whether you are a business owner or doing a job.

Saving cures your financial need in emergencies, illness, vacation, and entertainment.

But most people can’t save enough money.

According to the survey conducted about US public savings here are some abnormal statistics:

- 69% of US adults have less than $1000 bucks in savings

- More than 50% of US women have no savings at all

- 38% of people can’t save money because of higher expenses

In this post, I will walk you through 59 different ways how to save money even if you find it difficult.

So let’s dive in.

Before going into the explanation of tips and tricks on how to save money, let’s first understand the basics.

What is Saving?

Savings are referred to money left out of disposable income after paying necessary expenses ( like household, utilities, food, and others). It is also called net Surplus of funds.

For example, you receive an after-tax salary of $5,000 each month. Now you spent $4,000 on personal and household expenses. You’re left with only $1,000 in your bank account. This means you’ve saved $1,000.

Savings are a bit different from investing. Here the money stays risk-free and can help you earn a little return or not at all. But in investing you need to put money at risk for earning higher returns and to grow it faster. The common investment opportunities include stocks, bonds, personal business, or real estate.

Savings can generate returns with savings accounts, high-yield savings accounts, certificates of deposits, treasury bonds, and retirement plans. But they all have a very low return rate so you need to go for a good investment opportunity to earn more.

Related Posts:

23 Easy Ways to Save $20000 In a Year From Your Salary (2024)

157 Fun Things To Do With No Money In Your Free time (2024)

Cheap Grocery List 150+ Items: 17 Tips to Save More Money

30 Money-Saving Charts To Track Your Savings And Debt Pay-Off

Why is it important to save money?

Now you are thinking about why you should save money while you’re covering your monthly expenses. So here are the reasons and benefits of saving money that make it crucial.

1. Emergency needs

You can easily build an emergency fund to meet an unexpected need. It helps you cover financial needs for illness, emergency traveling, incidents, funeral costs, and car maintenance.

2. Financial Freedom

If you’re able to accumulate a big sum of money then it provides you with some kind of financial freedom. You can travel anywhere, go on vacations, and live in a favorite apartment. Because the saved money continuously generates a return over time. It doesn’t matter whether it is in a savings account or treasury bonds.

3. Enjoyment and entertainment

Life becomes more joyful and entertaining. You can go on vacations, college trips, and parties, and enjoy amazing drinks and food.

4. Avoid debt

Helps you avoid debt because enough savings will allow you to swipe your debit card for the majority of purchases, not a credit card. Also, you can avoid taking personal loans, emergency loans, and other types of debt for meeting daily needs.

RELATED POST:

65000 A Year Is How Much An Hour? Is It A Good Salary?

10K in 100 Days Envelope Challenge: Build Your Savings In 2024

How to Avoid Debt to Make Yourself Financially Strong

5. Complete your dreams

One of the biggest reasons is to buy your dreams. Whether you want to buy your favorite bicycle, motorcycle, or car you can do that. And you don’t worry about taking any type of loan instead your pocket will pay.

6. Pay for large purchases

Sometimes you need to pay for large purchases like a refrigerator, iPhone, laptop, or your favorite furniture. If you have a good amount of saving then you can easily purchase them. The reason is that debt sometimes can’t cover that expense due to low credit limits or high credit usage ratios.

7. Financial security

You have financial security because if you lose your business or job then having 6 to 12 months of savings can provide security until you find the next job or start a venture. You don’t need to beg for a loan from a bank or a friend.

8. Pay for education

Education is a major cost that everyone can’t afford. Therefore if you’re a student then savings can help you pay for your education. It doesn’t matter whether you took a student loan or not. Savings will help you pay a large portion of the loan on time and the extra education expenses like hostel fees, food, and college trips.

9. Financial independence

Your true freedom is only when you’ve financial freedom. Having a good amount in a savings account or a high-yield savings account make you financially independent. And you don’t need to ask your parents and family members for money. Along with that if you’re married then you can easily cover child fees and house costs.

10. House and kitchen redesign

If you want to redesign your kitchen or want new distemper on house walls then savings can help you do that. Usually designing a kitchen, painting furniture or a house and other home decor costs a fortune. So taking debt for that is not a good decision because it takes years to repay. Therefore saving a portion of your income for that purpose can easily eliminate the expense and your purpose will also be fulfilled.

11. Get a dream house

Buying a house isn’t an easy task. You need to take a large mortgage that takes years to repay. So what can help you is your savings. If you have retirement savings then you can utilize them. Or you don’t need to take a full mortgage.

12. More options

You can become choosy. The reason is savings gives you options to buy your favorite items irrespective of worrying about price. So if you save money on the car then you can make a choice between different brands. Likewise, you get options to buy whatever clothes or shoe brand you want to wear.

13. Investing opportunities

A major advantage that savings provide is an investment. If you want to do business to generate higher returns on the extra money you can invest that in different opportunities. But this will be only possible if you have enough amount in savings.

14. Fulfill retirement needs

Everyone will retire one day and covering expenses after that isn’t easy. But timely savings in different retirement plans like 401k, IRA, and Roth IRA can help you cure. If you have a 401K plan, you should try to match employer contributions because that is free money and grows your retirement savings faster.

15. Life events

There are many life events you need to face. For example, newborn child, going to marriages, paying for birthday. So instead of paying with a credit card or getting sad due to not having enough money, you should start saving right now. Because it is the easiest method to pay for those events and fully enjoy them.

Related Post: 109 Cheap Foods To Buy When Broke or On a Tight Budget

16. Reduce risk

If you’re doing any kind of business then savings help you mitigate or lower your financial risk. For example, if you’ve $25,000 in savings and you invested $10,000 in a small business then you only risk 40% of your money. In case of failure, you’ve 60% to meet daily financial needs.

17. Trust and confidence

It develops financial trust and confidence. You believe in your abilities and don’t hesitate to face financial hardships.

18. Get a compounding effect

You can easily compound your savings over time. This will help you grow your money faster in the long term. For example, if you save $1,000 each month for the next 10 years at a 5% annual interest rate. Then you’ll have $156,930 at the end of 10 years. If you stretch it even longer for 30 years then you’ll have $836,727 and for 40 years $1,533,379. But as earlier you start the more money you make.

19. Help others

You can give money to charity and help others. There are lots of charity organizations for the disabled, orphans, elders, poor and ill people that can’t live life on their own. So if you have savings you can give at least a tithe (or 10%) out of it to help them. There are animal rescue organizations so you can help them cover expenses. This also gives you blessings from God.

20. Develop financial habits

Saving money is a good financial habit. And it helps you develop other financial habits that are necessary for financial success. For example, when you save money then you stay on your budget and spend according to your needs. You can cut back on useless purchases, sell useless items, and educate yourself on money management.

RELATED POST: 8 Tips For Money Management To Achieve Financial Prosperity

21. Pay your debt

So you’ve debt in student loan, credit card loan, mortgage, personal loan, or any other emergency loan. Then you can devote your savings to paying your debt which helps you eliminate it faster. Also, you pay less in interest over time.

22. Better health

Most people get into stress and depression due to a lack of money. Because they can’t meet their financial needs and dreams. That’s why having money in your savings account eliminates unwanted financial or monetary stress.

23. Cover extra expenses

You can easily pay for any extra expenses. For example, you have a big tax bill than a normal one so you can pay extra tax with it. Likewise, if your child gets sick then you can meet medical expenses. Paying for a gift that you give to your friend on his next birthday.

24. Pay for marriage

Getting married isn’t easy. You need to have a large sum of money for booking a restaurant and paying for the dinner of guests. And here comes your savings in handy.

25. Leave a legacy

One day everyone will die. So leaving a legacy for your beloved ones is a must. Therefore if you save money early then you can help your family member especially if you’ve small children.

So you’ve got the importance of saving money for the above reasons. Let’s jump to the next section on tips and tricks for how to save money.

59 Ways How to save money

1. Budget your expenses

Budgeting is an easy way to keep an eye on where your money goes each month. And help you allocate a specific amount to each expense. It is the easiest way to save money as well because you know how much expense you incur on different things.

But the majority of people don’t give importance to budgeting that’s why they’ve no idea where their money is going. For example, in the USA 65% of people don’t know how much they spent last month.

So if you want to save money take the help of budgeting. Allocate a specific amount of money to each expense and find which ones you can cut down to control spending.

Along with that you stay organized and find a way to increase your net income to solve saving problems.

RELATED POST:

$45000 A Year Is How Much An Hour? Is It Enough To Live?

How to Create a Personal Budget [ 6 Easy Steps]

10 Best Budgeting Apps of 2022 (Free + Paid)

12 Best Money-Saving Apps for 2022

2. Cut down on digital subscriptions

Do you use online paid subscriptions on different sites and software? Then cut them down to reduce extra expenses.

Sometimes you subscribe to any online website for watching your favorite movies, or to any software for personal use. But most of the time you don’t use them much. While on the other hand your subscriptions and memberships auto-renew which cuts out money from your bank account.

So make a list of all of these subscriptions and cancel those which are unimportant or useless. Only keep the ones you find important or use frequently. For example, I personally cancel all the auto-renewal of my domains and hosting accounts. Along with that, I refund online purchases that I no longer use.

This helps you save lots of money that you normally don’t know about.

3. Avoid branded products

We all love to buy our favorite brands. It doesn’t matter whether it is a clothing brand, car brand, shoe brand, or food brand like KFC or Mcdonald’s. We buy.

But do you know buying branded products washes out our bank accounts or piles up a mountain of credit card debt?

I don’t discourage buying branded products but emphasize controlling these branded purchases to cure your savings.

Here are some simple tips:

- Shop branded products when the season is ending. Because at the start of each season whether summer, winter, or spring, prices hit the sky. When the season comes towards the end big brands offer huge sales like 20 to 70% off. And you get a chance to save huge on the same items.

- Don’t buy clothes that require a dry cleaning service to get washed and cleaned. This will create an extra repeatable expense that is a total waste of money. According to a Checkbook survey, dry cleaning costs for men’s two-piece shirt suits are between $2 to $49 in the USA. For example, we take it for $25 and you dry clean two times a month then it costs $600 annually. So you can save that money if you avoid these types of clothes.

- And the third tip that really helps you is to utilize coupons and discounts for paying less on your purchases. Regarding discounts companies’ policies vary so use them on time.

Last but not least if you want to buy electronics products then buy those with higher life and warranty to avoid frequent purchasing and repairing.

RELATED POST: 133 Frugal Living Tips to Save Money and Build Your Financial Future

4. Stop using cable service

You use cable for watching your favorite channels and programs. And it’s very good to throw off the tiredness from the whole day of work.

According to statistics, the average consumer watches TV for around 4 hours each day.

But do you know cable costs you big bucks if you calculate your bills for a whole year? Data shows the average monthly cable bill is higher than the combined expenses of water, garbage, electricity, and gas bills.

So what you can do is cut out these expenses to save more.

Here is how:

- Block premium channels like HBO if you don’t watch them

- Choose cable providers that charge a low fee

- Buy cable and internet as a bundle to save up to $500 each year

- Negotiate the cable prices with a company to get a discount

Apply them and you save big bucks each year.

5. Take discounts and coupons

Shopping is an important part of our life. I purchase groceries, fruits, and other food items around 3 to 4 times a week.

What I do is ask for a discount on whatever I purchase. Because my frequent purchases include groceries, fruits, and meat that’s why each time I purchase I try to get a discount.

If you save only a few bucks each time then good.

The same is the case with shopping for apparel, clothes, shoes, and electronic products. Take advantage of discounts or simply ask for a discount because most retailers give.

Do the same for online purchases from sites like Amazon, eBay, Alibaba, or any other store. Don’t forget to use their coupon codes or discounts. Online discounts save big bucks as compared with any random store you purchase in your city. A few months before I purchased a domain for my website. And you know I used a coupon code to get the $15 hosting for just $1.

6. Utilize retirement plans

If you’re doing a job in any government position or private organization, utilizing retirement plans is a great way to save big money for the future. There are different plans like 401k, IRA, 403 b, 457 b, etc.

According to statistics retirement plans were available to 65% of private industry workers. Good news for people doing jobs in the private sector.

But in case your employer is offering 401 k then good to put some money out of your monthly salary into it. Because in a 401k plan usually, the employer contributes half of the amount and half the employee.

In case your employer isn’t offering 401k, go for an IRA. In the IRA you save money without getting taxed on growth. It also provides you with a range of opportunities to grow your savings as compared to employer-offered retirement plans like 401k.

Therefore if you want to have a big amount at the time of retirement then set aside some amount even $100 each month in your retirement plan.

One thing to keep in mind is that, start as early as possible. For example, if you start saving $500 each month at the age 20s then you will have more money compared to the one who starts saving at 35. The first one will get more money as compared to the second.

7. Plan out traveling for vacations

Going on expensive vacations for enjoyment is an all-time amazing thing to do.

But it wipes out your money if you spend it a blind way.

There are certain ways to cut those expenses to grow your savings. Here is how:

If you go on a day-long trip or picnic, try preparing food yourself. Because food is a much more costly element in a picnic trip. If you take to stay in any hotel then get a room with a microwave, refrigerator, stove, etc.

Do trips inside the city. There are lots of places that you don’t know actually exist inside your city like museums, parks, and beaches if any. So familiarize yourself with them. This way you not only save money but also get more knowledge about your own place of living.

Take cold drinks, water, snacks, juices, fruits, bread, etc with yourself so you don’t need to buy them at expensive prices at tourist places.

Implement these tips and you see how much extra money you will save at the end of a month, quarter or year.

8. Save money on groceries

On average people spend $314 to $500 on groceries in major cities of the USA. And it sums up to $3500 to $6000 at the end of the year. A major food expense.

Groceries are healthy and beneficial for your health but healthy food shouldn’t be expensive.

How to save money on groceries?

Following are some ways to save money on groceries:

- Purchase groceries from the wholesale market not from retailers. Or if not possible then from a big market where lots of farmers are selling them. Because here prices will be a lot less due to competition as compared to the area where only a single retailer is selling.

- Get discounts on bulk purchases or use coupons from grocery stores, so you don’t pay full price.

- Search out 3 to 5 stores to analyze prices and then select the one with low prices and fresh groceries.

You can use the same method to buy fruits to save additional money.

RELATED POST: 33 Tricks on How to Save Money on Groceries

9. Crackdown on useless items

Sell out useless items

There are many useless items that we purchase throughout the month. Sometimes they include buying clothes from the mall without any need, or beautiful expensive shoes.

These types of unwanted purchases and expenses wash away lots of the money that you can save.

Wherever you go shopping, make a prepared list of important items at home. And follow the list while you‘re buying. This will help you stop your instant excitement to buy unwanted stuff.

According to statistics, Americans spend $18,000 on nonessential items each year. You can analyze how much you can save.

More than that if you’ve extra useless or old items at home like a fridge, washer, oven, or furniture then sell them to finance your savings.

10. Pay off debt fast

Debt is a trap that catches financially illiterate ones.

It piles up in many forms including:

- Credit card purchases

- Student loan for college education

- Mortgage loans for buying a house

- Business loan for running operations

But if you want to save money fast and more then you need to throw debt off of your shoulders. As long as you take to pay the debt, saving becomes as difficult.

How to pay off debt fast?

Here are some tips on ways to pay off debt fast:

- Stop using credit cards or minimize the numbers: in case you’re using one credit card then stop it. But if using multiple then first minimize their numbers and then vanish them all.

- Decrease your spending on different items and use that savings to pay off more of your debt.

- If you’ve multiple debts then first pay back those with the highest interest rates and then with low ones. This will help you pay less if you do vice versa.

- Make more money. I will further expand on it later and tell you how you can do that.

When you manage to pay off all your debt then your savings will obviously increase.

RELATED POST: How To Pay Off Debt Fast (11 Bullet Proof Tips )

11. Do yourself what you can

There are many activities and tasks at home that you can do yourself without taking the help of anyone. For example, if your sewage is blocked you can open it yourself, or if you need to place light bulbs in holders then do it yourself.

And there are many small tasks that don’t require an outsider to do them for you. Like how to manage your financials and calculate tax payments. This will save a bunch of money that otherwise goes into a financial advisor’s pocket.

The DIY technique is the best way to save money on little tasks.

If you do launch outside then keep a launch bag with you. This will help you save paying premiums for eating outside restaurants. The same applies to coffee that you drink from a shop near your town. Buy a coffee maker and beans to prepare yourself. This will not only cost you less but also make you smarter at preparing some food items.

12. Read books for free

Are you a lover of book reading? Then you can’t wait to finish a book every two weeks. Normally you purchase books from nearby libraries or stationeries. According to statistics an average millionaire reads around 10 books a year.

But buying books each time isn’t an all-time smarter decision.

If you read a book only one time and then throw it on the shelf then it is better to search for a free library. If not possible, take books for a small fee and return them after reading.

There are tons of free online libraries that provide books. With tens of millions of free book databases, you can download them on your mobile, tablet, or laptop to read them. Some famous ones that I use include PDF Drive and Library Genesis. Simply search the title of your favorite book and 90% of the time you will get that book.

This way if you read 300 books a year then saving around $500 to $1000 dollars is not a bad idea at all.

In case you don’t find a specific book due to its copyrights then go for buying it.

13. Make more money with investment

My favorite way of making money is an investment. Currently, I’ve multiple businesses including beekeeping, cryptocurrency, freelancing, and blogging. And the reason includes my love for business and its huge return.

You can do the same. There are lots of opportunities around you that can make you enough money if you start doing business in them. It doesn’t matter whether you do small or medium business.

Investment is the best option to earn huge money. Some common investment opportunities that you can take on now include:

- Investing in cryptocurrency that is booming right now. And it is possible that a single coin can make you a millionaire.

- Forex trading, stocks, derivatives, and commodities if you’ve knowledge and love trading.

- Blogging and freelancing where little to no money is needed if you’ve any money-making skills or can learn a new one. Just an extra time of 2 to 4 hours daily work can help you make significant money.

Doing small business in your own city or town like opening a coffee or burger shop and/or a pizza point.

There are tons of other options other than the above. Some require money and time while just requiring skill and time. It all depends on how you like to choose.

RELATED POST:

What is Six Figure Salary? 25 Jobs That Pay You Six Figure

How To Make Money Without A Job (55 Lucrative Ways)

62 Best Jobs For Stay-At-Home Moms (Online And Offline)

How to Sell Feet Pics Online and Make Passive Income: 20 Best Platforms

52 Ways How to Make Money as a Teenager Working (Online and Offline)

14. Clean up an email account

Email customers spend $44 dollars as compared to every dollar a company spends on acquiring them.

If you’re an email subscriber of your favorite brands and online products then unsubscribing is a good option to avoid frequent purchases.

When you wake up in the morning mostly check out your inbox for any new email notifications. And if you see new products or sale notifications from your favorite brand then it becomes difficult to stop yourself from purchasing from your favorite brand.

That’s why consider unsubscribing and deleting all previous emails and doing the rest in your inbox.

15. Analyze your insurance

Insurance helps you get safety for unpleasant situations that may occur in the future. Usually, you buy insurance to help you cure disability, a death that can ruin the future of dependents, a car, home, business loss, etc.

With all these benefits there is a drawback of insurance from an expense point of view.

That’s why analyzing your insurance and choosing the right one is essential. While choosing an insurance policy see which one is most beneficial to you. For example, if you don’t have dependents then life insurance is a waste of money. If you have an expensive car or house and you want to protect them from any incident or theft then car insurance or house insurance is best.

This way you can make a good insurance decision. If you can’t do it yourself or have no idea then contact a fee-based advisor that doesn’t have any link to insurance companies to earn a commission. So that you get fair advice.

RELATED POST: 40 Personal Finance Tips To Effectively Manage Your Money

16. Checking to save method

This method is used to save money automatically. What it does is deduct a specific amount of money like 5% to 15% from your checking account and deposit it directly into your savings account. This will force you to save money even if you decide not to save the next month.

Along with that, this automatic saving method lets you organize your monthly amount in a spreadsheet or in any online saving app. So you know how much you’ve in an emergency fund.

17. Carefully spend extra earning

Did you get a bonus last month? Do you get an allowance next month?

If you get any extra money whether in form of a bonus, allowance, increment, or from doing any overtime job or freelancing then spend it wisely.

Don’t spend it foolishly on an expensive birthday party or vacation plan.

Here are some useful tricks that can help you:

- Pay your children’s school fees

- Deposit all of it into your savings account

- Invest it in any profitable opportunity

- Pay utility bills

Follow these tips and you can take huge benefits.

RELATED POST: How to Stop Wasting Money Using 12 Simple Financial Tricks

18. Lower energy costs

Energy is another regular and big expense that all of us need to pay.

Statistics show that in the USA consumers incur bills:

- $110.76 in electricity

- $72.10 in natural gas

- $70.39 in water

- $85 in cable TV

- $60 in internet

- $70 in cell phone

And they all compile up to more than $4700 in utility bills.

But how do you lower energy costs?

- Avoid taking long showers to save more water

- Buy energy-efficient appliances like washers and refrigerator

- Install energy savers that use less electricity

- Have an energy audit to reduce costs

- Get a free water connection

- Bundle Internet with a cable to save on package

If you use these tips for sure you can easily reduce 15% to 25% of your monthly bills.

RELATED POST: Find the Best, Cheap, 24-Hour, And Coin Laundromat Near Me

19. Lower electricity bill

Among six utility bills, the electricity bill is the larger one. In the US the average electricity bill is $114 which becomes over $1,400 a year.

If you can cut back on electricity expenses, you can easily save a sufficient amount of money each year.

So let’s dive into how to save money on electricity bills:

- Don’t use normal filament bulbs instead use energy savers which consume less energy and provide more light. You can also get them repaired if they fuse.

- Avoid using an electric blower to heat up living rooms in winter. Because it consumes lots of electricity very fast due to its large KWh.

- Don’t use electric heaters too much. It is just like an electric blower and uses a huge amount of energy.

- Set an alarm before you start the water motor so you don’t forget to switch it off when the tank is full.

- When you go out of home or in daylight you should turn off the bulbs. Also, turn off unnecessary bulbs at night and before sleeping.

- You should have a separate electric meter and don’t share your electricity with anyone else.

- If the electric meter has failed then contact the company to replace it.

- Sell out old electronic equipment and purchase new energy-efficient ones. For example, old fans, refrigerators, TV, and AC.

- Don’t forget to turn off your AC when you sit on a lawn or go out. Because it consumes 3.5 KW if it runs for one hour.

These are a few tips you can use. If you want more in-depth information then visit this article: 50 Super Simple Ways to Save on Energy Costs

20. Use money savings apps

Money savings apps help you track your savings so that you can easily hit your savings goal. This way it becomes a lot easier for you to save money and also manage other aspects of your personal finances. These apps come with multiple features like goal tracking, budgeting, charts and graphics, and automatic savings features.

There is a huge list of these applications and software. Here are some famous ones:

- YNAB

- Mint

- SavingStar

- Groupon

- DebtTracker Pro

RELATED POST: 12 Best Money-Saving Apps for 2022

21. Cut back on the gas bill

Gas is our daily need for cooking food and heating water. But irresponsible use can result in a huge bill. And especially in winter when you use the heater and geezer equipment.

So here are the tips on how to save money on gas bills:

- Check out your gas meter and pipeline. If there is a leakage then contact the gas company to fix it.

- Set an alarm when you turn the geezer button to full temperature. And when the water heats up then reverse it to the pilot. This will help you avoid wasting gas.

- Do not forget to turn off the gas heater when you go to sleep or when you don’t sit near it.

- Close the doors and windows in winter. Also properly fill any gaps so that the outside cold air doesn’t come inside and hot air doesn’t go outside.

- Use warm clothes as much as possible. Because they will not only save you from the cold but enables you to avoid heater.

- Turn off your stove when you’ve cooked your food. Also, don’t heat up water on it instead use your geezer.

- If you see your gas bill high and there are wrong units reading mentioned on the bill then go to the near office and tell them to reduce it.

Follow these tips and tricks to lower your gas bill.

22. Organize money in your wallet

This is another amazing trip. What you do is organize your money bills in your wallet. You put the small bills on the front and the bigger ones on the back.

It helps you have a clear idea of how much money you’ve in your wallet. And whenever you’re purchasing something you’ll remember the remaining amount in your wallet. You also have a clear idea that how much I’m going to spend today.

RELATED POST: Coin Machine Near Me: How to Find Coinstar Machines Near Me?

23. Pay down credit card debt

Everyone is using credit cards in the US. It is the easiest way to pay for your purchases. But on the other hand credit cards have higher interest rates. That’s why if you use it too much you need to pay as much interest.

So what do you do?

You should pay your credit card bills as faster as possible. Avoid buying too much with it and put every additional money towards its payments. This helps you pay less in interest.

RELATED POST: How to Pay Off Credit Card Debt Fast (17 Quick Tips)

24. Lower water bill

The water bill is the third most important utility bill. Water costs an average of $72.93 in the US each month. Which is over $850 a year.

So here is how to save money on water bills:

- The first step is to fix any leakage in the pipeline or faucets.

- If your water meter is not working properly then contact the authority to replace it.

- Lower the number of showers. Usually, in summer people go for more than 2 to 3 showers a day. But if you’re doing that then lowering these numbers stops you from wasting water. And take shorter showers and avoid sitting under them for hours.

- Use a dishwasher instead of handwashing. And if you’re manually washing the dishes and another crockery then place a tub filled with soap and water. This helps you avoid the water getting drained away.

- Give water to roses and other plants on your lawn and close the water supply. Don’t forget the water flows uselessly.

25. Think like rich people

Your thoughts have a serious impact on your success. If you want to become a millionaire then you need to think and act like one.

The same goes for saving money. Thinking that you can’t save money because you’re poor or have less income never enables you to come out of trouble. Instead, think about how you can afford things and which strategies you act on that help you save money. It can be increasing income or lowering unwanted expenses.

The difference between rich and poor is only because they think in a different ways. So start changing your thoughts today and you’ll see how it improves the rest.

26. Divide the rent

If you’re living in a hostel or apartment then divide the rent amount with your friend. This way if you’ve one two or three roommates then the same expense will cost you much lower instead of paying it yourself.

The costs of living in the USA are very high. In fact, in rural areas, a one-bedroom apartment costs over $600 while in Boston it costs over $3,000. So if you can’t afford that kind of cost then look for a roommate and divide these costs.

27. Save money on taxes

Tax is another huge expense you need to pay each year. In a country like the USA where tax goes from 10% to 37% a year, you pay a fortune. But using some tips ad tricks you can save big bucks easily.

So how to save money on taxes?

- Get dependent tax benefits of $2,000 for every child under 17 years.

- Make changes to your W-4 form.

- Contribute towards your retirement accounts like 401k, IRA, or Roth IRA.

- Get tax credits for whatever excellent work you did like charitable work.

- Invest in tax-free bonds.

For more tips and tricks you can visit this article: 12 Tips to Cut Your Tax Bill This Year

28. Save money on wedding

According to Business Insider in 2019 the average cost of a wedding was $28,000 out of which the venue costs $10,000 alone.

This means it is a huge expense and you should try to save money. And you can do that easily with some useful tricks.

Here are some major ones:

- Negotiate the price for printing wedding cards.

- Search for discounts on wedding dresses and order them in advance.

- Find a photographer who is new to the field because experts charge more.

- Don’t go overboard with the wedding party and stay inside what you can afford.

- Get a wedding gown on rent and then return it which saves you thousands.

- Find the restaurant with the lowest cost or negotiate the price.

For more helpful tips here is a comprehensive article: 53 Genius Ways to Save Money on Your Wedding.

29. Lower garbage bill

Garbage costs you more in two ways. The first is that it is a waste and as much you produce your pocket pays. Second, the garbage company charges per bag, and as more bags, you have the more garbage bill you need to pay.

Here are some simple tips you can use to lower it:

- Do a garbage inspection and find out which items produce the most garbage and then cut down on them.

- Go for reusable bags for shopping and other purposes. They live longer and are more cost-efficient.

- Recycle your garbage into useful things. For example, you can crush vegetables, fruits, bones, and leaves into fertilizer and throw them into your backyard. This works like a nutrient for your garden plants and also lowers garbage bags.

- Cook food of how much you needed so you don’t throw it off in a trash can.

- While cleaning the house floor throw the soil and dust in your garden.

If you can apply these tips then it will be a lot easier for you to lower the garbage bill. And you can easily save an extra $300 to $400.

30. Go for low-interest debt

The main cost of any debt whether it is a student loan, mortgage, personal loan, commercial loan, or credit card is interesting. Interest is money that you pay the over-borrowed amount to the lender.

Usually, for unsecured debt like credit cards, personal loans, and student loans there is a very high-interest rate. Because there is a higher risk.

So what you can do?

- If you’re borrowing for education then don’t go for private student loans. Instead, apply for federal student loans. They have lower interest rates and other amazing benefits like forgiveness, forbearance, and refinance.

- Do you love using credit cards? Then first compare the banks and go for the ones with lower interest rates.

- In the case of home equity loans and mortgages, there is a security or collateral. So there is no way that you pay higher interest. So choose your lender with the lowest interest.

- Make a down payment because this reduces the principal amount and so interest over time.

If you are successful at getting low-interest debt then you can save thousands of dollars in interest payments. And use that money to finance your retirement and other investing needs.

But what if you already have a higher-interest debt? Then jump to consolidation.

31. Consolidate your debt

When you already have high-interest debt in form of multiple credit cards, student loans, and personal loans then consolidation is the best option. What it does is combine two or more high-interest debts into one single low-interest debt.

In simple words, you take a new low-interest debt and pay the existing high-interest debt. And then you only need to make one single monthly payment to a single lender.

This way the interest rate decrease and so does the overall lifetime interest also. There are five different methods for consolidating your debt. You can learn about them here in our comprehensive post on debt consolidation.

For student loans consolidation is named refinancing. Where you take a low-interest loan and pay an existing student loan.

RELATED POST: How Does Debt Consolidation Work? Is It a Good Idea?

32. Avoid purchasing online

We all love to buy our favorite items from Amazon, eBay, and other eCommerce sites and stores. And why not? There is a huge variety of items available that local stores don’t offer.

But there is a big flaw with these e-commerce sites.

When you buy items online then there is an intermediary involved between the retailer and the customer. For example, Amazon, eBay, and Ali express are intermediaries that provide selling platforms to companies.

Now, these platforms charge fees that are usually 5% to 10%. And this is added to the product price which increases the expense. So whenever you purchase online they charge you more.

From my experience a few months ago I purchased a new laptop. And it cost me $341 but the original price in a local store for the same laptop was $281. This means I paid an extra $60 for shipping, handling, and the intermediary platform.

When I asked my local retailer about this he told me that online stores charge a fee. That’s why the customer needs to face an extra burden.

So I recommend that if you want to purchase these kinds of items like mobiles, laptops, refrigerators, and furniture then directly go to the required brand physical store. Because here you only pay the original price and save more money. You can also get amazing discounts.

33. Give yourself a saving challenge

Do you want to develop and build your money-saving habits? The money savings challenge is an amazing practice exercise.

What you can do is give yourself a money-saving challenge of one month, two, or three months at the start. And focus on cutting back expenses on useless things and implementing the savings strategies in this article.

There are a variety of money savings challenges that you can use. Here are a few of them:

- No useless spending challenge

- Holiday money-saving challenge

- 52 weeks money savings challenge

- Identifying and cutting back on expense challenge

There are lots more you can search on Google. They seem to be hard at first but when you practice them then it becomes flexible for you to do them.

RELATED POST: What is a No-Spend Challenge? 7 Simple Tricks to Do It Yourself

34. Decrease groceries expense

The average US household grocery spending is between $314 and $516. It costs around $2,641 each year to a person with an average of 2.5 members in the family.

Therefore cutting back on groceries each month will save you a significant amount of money. But how do you do that?

Here are proven tips on how to save money on groceries:

- Try to buy from the wholesale grocery market. Here the farmers sell their groceries and the retail competition is also high. That’s why the prices are significantly lower and you can save up to 20% or 30%.

- Don’t buy from big superstores with brand recognition because branded stores charge a premium.

- If there is a sale going on in the grocery market then you can buy items like onions, ginger, and garlic in bulk. Sales usually happen when the supply of a grocery is higher and the demand is less.

- Avoid buying out-of-season groceries. Because they are tasteless as well as 2 to 3 times higher in price. The same is the case with fruits.

- Don’t buy them with a credit card instead use cash or debit cards.

RELATED POST: What is a No-Spend Challenge? 7 Simple Tricks to Do It Yourself

35. Save money on food

We all need food to live our life on this earth. And that’s why it is a major expense among all the other ones. The data shows that Americans on average spend $7,700 a year on food. A significant amount of their primary disposable income ($47,673 a year in the US). Means 16.2% of their disposable income.

So how to save money on food?

- There are some food items that have short expiries like yogurt, meat, cheese, and others like that. So purchase these according to how much you require. Otherwise, after expiry, you need to through them in the trash which is a waste of food and money.

- Get a discount from superstores when you buy items like flour, rice, spices, milk packets, detergents, and other items.

- Make a list of required items before you go for shopping groceries, so you don’t go overboard. This will help you avoid buying unnecessary food items.

- Avail of coupons, discounts, and cashback rewards on your shopping.

- Try to purchase local brands’ food items and avoid national or international big brands. Also, avoid purchasing from branded stores instead go for a local retailer or if possible then wholesalers.

- Avail discounts and buy in bulk to freeze up the items that are usable for several weeks.

So you can use these tips and tricks to save money on food items. If you want more ways here is a comprehensive post: 55 Ways to Save Money on Food.

36. Save money on Amazon

Are you an Amazon shopping enthusiast?

Then you may frequently buy items like mobile phones, laptops, shoes, bags, kitchen utensils, or any other stuff. But there are certain ways that you can utilize to avoid paying full price and getting other benefits. Here are some of them:

- Utilize daily deals on different products.

- Get special coupons and discounts like Black Friday and Cyber Monday.

- Make purchases during special events like Christmas.

- Get subscribed to Amazon Prime memberships.

- Buy stuff for more than $25 worth and save dollars on free shipping.

There are many other ways. So if you want more in-depth knowledge then read this post: 20 Best Ways to Save at Amazon Every Time You Shop.

37. Lower internet expense

In the US the average monthly internet bill is $64 but in some areas, it is more than $100.

So if you implement some tactics then you can significantly lower this bill. The common ways how to save money on the internet include:

- Cut back on the internet bundle if you’re not using TV or any other entertainment.

- Compare the company’s prices and switch to a good internet service with less subscription cost.

- Don’t go for a separate cable from any other provider instead bundle it with an existing internet provider and save an extra $15 a month.

- Use internet 4G devices and mobile hotspots.

- Negotiate rates and get discounts.

Using these strategies can save you up to $300 to $600 a year.

38. Don’t stick to one retailer

It is possible that you like a specific retail shop for buying household items or for personal shopping. This can be due to their brand quality or emotional attachment.

But sometimes this isn’t a good idea. Because you miss out on amazing deals other retailers have on the same types of products.

Therefore frequently change your retailers and explore products and deals in other retail shops. Whether you’re buying clothes, shoes, food items, or electronics this will help you get more variety and better prices.

When I go for shopping small or big items I usually search out 3 to 5 retailers. And most of the time I’m able to save 20% to 30% on big items. A month ago I needed a water tank. So I visited 5 retail stores and you know two tanks in 1st retail store costing me $216 but I purchased the same tanks for $186 from the fourth retailer. This means 14% savings straight.

39. Cut traveling budget

We all need to travel frequently throughout the month. It can be if you’re working at a job which is away from your house. Or you need to travel to another city or country for any project or honeymoon.

These traveling costs are increasing over time. In fact, the one-week vacation cost for a single person in the US is $1,579.

So how do you cut back on it and save big bucks:

- If you’re traveling by air then go for economy class.

- Cook your food items and take water and cool drink bottles with you if you’re going to vacation in your local area. Because at picnic places items are significantly higher in price.

- Drive the engine on CNG and avoid petrol and diesel.

- Travel on vacations in off-seasons because prices at that time are significantly lower.

- If you love adventures do your own camping instead of buying a hotel room.

For more helpful tips visit this article: 24 Ways How to Save Money While Traveling.

40. Avoid bad habits

There are lots of bad habits that cost you not only money but your health. The most common ones include gambling, drinking, smoking, costly parties with friends, and going to night dancing clubs.

In the USA data shows a pack of cigarettes a day costs $6.28 and $2,292 a year.

While on the other hand, men spend $66 and women spend $50 on beer each month which is over $700 a year.

These are not only damaging to your lungs and liver but also cost you a fortune. So if you cut down on these types of habits then you can save a significant amount of money.

41. Separate needs from wants

While making the budget you should separate needs and wants. The money needed to cover your monthly needs should be set aside.

This helps you avoid spending money in an impulsive way. You have a clear idea of which thing is necessary and which you don’t need at the time. Wants are usually not your basic need and some wants are just useless to buy. So you can save money by avoiding them.

42. Save regularly

Saving a lot of money in a single month is difficult. That’s why you should save a small amount of money each month to build enough funds. There is an easier way to do that, which is an automatic transfer from a checking account to a saving account.

A specific amount is automatically deducted and added to your saving account. So before the money comes into your hands to spend on needs and wants your savings responsibility is completed in advance.

43. Carefully spend money on periodic purchases

Aside from your monthly needs and wants that come each month, the periodic purchases are different. They come one to two times a year including birthdays, car registration fees, vacations, wedding parties, Christmas gifts, or any other function.

You set aside money for this list of expenses each month. And spend money out of that fund at the time of purchase. This helps you avoid overspending and stay within the limits of your income when the budget is tight.

Another reason to be careful is that while spending money on these expenses seems very amazing but can put you in a difficult situation. And you may need money later for any other emergency, so you should have that in hand.

44. Claim tax credits

These are provisions that directly lower your tax bill. According to FoxBusiness, you can save up to $2,000 a year in tax credits. Imagine saving that money to fund your emergency needs and cover other wants.

45. Start a business

All the other ways to save money are amazing but have limitations. But if you can increase your income then saving a larger amount of money is not a difficult problem. And one way to increase your income is to start a business online or offline which can build your savings and can cover investment needs as well. When you have more money you can save more money.

46. Invest in treasury and municipal bonds

It’s important for your savings to earn a return on them. If the money stays idle in the saving account or earns lower interest which most of the banks are paying then savings doesn’t grow fast. The corporate bonds, US treasury, and municipal bonds offer a greater return of more than 1.5% and go up to 5% plus.

So earning that much return is a good way to increase savings automatically and generate some income.

47. Contribute to 401k

If you’re working for a company type of business then opening a 401k retirement account is the best option. The reason is that along with your contributions, your employer may contribute a matching amount to the account. Which is totally free money for you to grow your retirement account.

There are two main options lying in the 401k that is traditional 401k and Roth 401k. In traditional 401k the contributions are deducted from taxable income while in Roth 401k contributions are deducted from after-tax income.

RELATED POST: How To Invest In Retirement To Live A Comfortable Life [7 Simple Strategies]

48. Go for 403b account

This plan is for employees of public schools, churches, and code 501(c)(3) tax-exempt organizations. It’s like a 401k account and money is deducted from pretax income and grows tax-deferred unless you make any transactions. These accounts are for non-profit organizations and government agencies.

49. Open an IRA account

IRA accounts stand for individual retirement accounts and they can be opened by self-employed and those employees whose organizations don’t offer 401k. There are two types of IRAs that are traditional IRA and Roth IRA. In traditional IRA contributions are deducted from pretax income while in Roth IRA contributions are deducted from after-tax income.

In the traditional IRA, savings grow tax deferred, and tax is deducted at the time of withdrawal. While in a Roth IRA savings grow freely while having no tax deductions at the time of transaction.

50. Use a health savings account

Individuals who are qualified under high deductible health plans to save for specific medical expenses as stated by IRS. Here you can take tax advantage where the contributions of your employer and your income are tax-free. Except for the direct contributions which are tax deductible.

51. Hold assets for long-term

If you buy stocks of companies, real estate, or invest in gold then these types of assets grow in their market value which provides a sizable gain over time. You can also cure an inflation rate to stop devaluing your money. The stocks also pay dividends which is an extra income.

52. Minimize ordering food

Ordering food from outside is 5 times more expensive than cooking it at home. Here you have to pay two types of costs that’s food costs and delivery service charges. And if you purchase the food ingredients from the market and cook them yourself at home then the cost will be much lower. You also enjoy that as fun.

53. Keep a launch box

Eating outside has the same case as ordering food. The cost of eating outside for a single meal is $13 while home-cooked meals cost only $4 which gives you $9 savings per meal. So it’s the best option to keep a launch box with yourself while going to a job to save more.

54. Lower your cell phone bill

According to CNBC, the average cell phone bill in the US costs $127.37 per month. There is a lot of room to lower this bill. You just need to follow some tips and tricks like using auto-pay, cutting down phone insurance, eliminating extra services, and taking advantage of discounts.

55. Skip impulse buying

Impulse buying is when you don’t need a product but still, buy it or you spend more than your limits. You can’t stop your sudden gratification which leads you to overspend or buy useless things.

Here are some quick tips from Clever Girl Finance blog to stop impulse buying: create a budget and stick to it, think before buying, avoid temptation, and remind your goals. Another good tip is to have a shopping list.

56. Use cashback sites and apps

As the name suggests these websites and apps pay back money out of the commission they receive from retailers when you make a purchase through them. They support thousands of retail stores inside the US and outside.

Here are some prominent and reliable cashback sites and apps: Rakuten, Ibotta, Coupons, Befrugal, Fetch Rewards, Get Upside, and Receipt Hog. You can find even more apps through a simple Google search.

57. Use the cash envelope system

A cash envelope system is the most traditional type of method for making a budget. Using this method you have a separate envelope for each expense and put cash inside. After that you spend from that envelope throughout the month and when the cash ends you spend no more money on that expense.

This way you can control overspending and exactly know how much you spend on each specific expense. As a result, you will save more money.

58. Don’t use bottled water

According to data, bottled water cost $1.08 to $1.38 per gallon which is 1,000 to 2,000 times more expensive than tap water which only costs $0.004 a gallon. Usually, tap waters are better than bottled water in comparison to natural minerals. So if you use 4 to 6 bottles of water per day then you can save $180 to $270 per month.

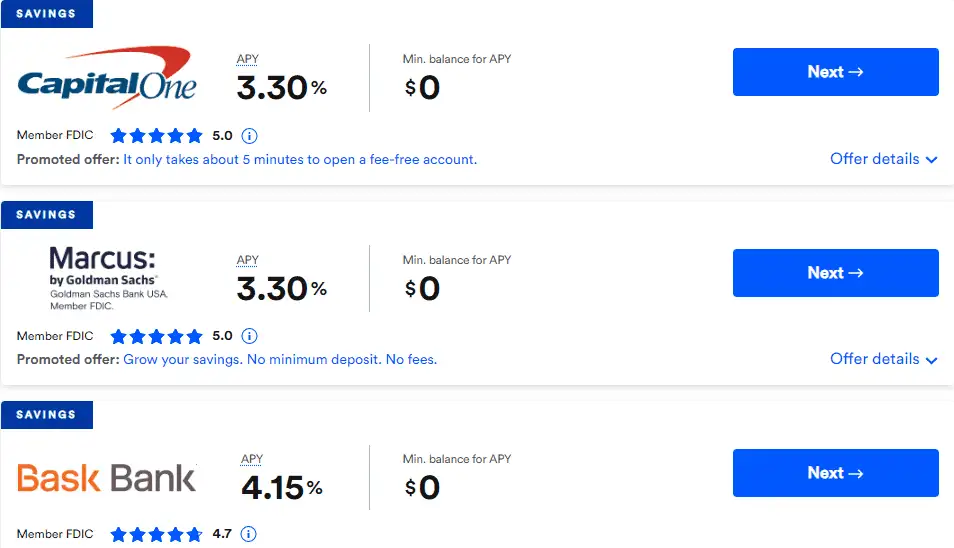

59. Open a high-yield saving account

High-yield saving accounts help you earn more interest as compared with normal saving accounts. As a result, your saving grows faster than normal saving accounts. You earn 0,5% on normal savings account the high yield will earn you more than 1% per annum.

Here is a list of the best high-yield saving accounts banks from the Bankrate blog:

You can find more by visiting the above link.

Related Post: 23 Money-Saving Challenge Ideas To Build A Big-Saving Fund

Conclusion

Saving money is helpful for meeting emergency needs and living a comfortable life. But due to large expenses, some people find it difficult.

But knowing how to save money is important if you want to solve your saving problems.

Implementing some of the above tips that apply to you will help you save more even if your current situation is not giving you that option. You don’t see immediate results but with time you can easily overcome saving problems.

So tell me in the comments which trick you like.

Related Post:

How to save $5000 in 6 months? Proven Tips And Breakdowns

Cheap Eats Near Me: 29 Ways to Save Money Dining Out

- $11.50 An Hour Is How Much A Year In Gross And After Tax - April 7, 2024

- Does Amazon Deliver on Saturday and Sunday? (2024 Updates) - April 3, 2024

- How to save $5000 in 6 months? Proven Tips And Breakdowns - March 25, 2024